Network of piti enthusiastic to announce the very best DAI assistance for decentralized stablecoin in the most current DAI / USD selling price feed.

Cooperation agreement

In partnership with MakerDAO, the Pyth DAI / USD feed enables any one to borrow, lend or trade on the key decentralized stablecoin on any EVM incompatible chain, this kind of as Solana. Pyth Network is seeking forward to partnering with primary Solana applications this kind of as Solend, Mango Markets, Bonfida, Drift Protocol, Jet Protocol and PsyOptions, moving in the direction of unlocking the upcoming generation of DeFi as a result of the world’s primary stablecoin.

Niklas Kunkel, representative of MakerDAO, explained:

“As DeFi’s applications and usability proceed to develop, oracles come to be more and more significant in their purpose of delivering trusted details at a speed steady with this regular development. As collaborations like these come to be extra frequent, the bridge among off-chain information and DeFi protocols strengthens, ushering in a new era of finance. Collaboration with Pyth facilitates the use of this bridge, bringing the oldest stablecoin into the serious planet of finance. “

Michael Cahill, Director of the Pyth Data Association, commented:

“As Pyth’s community of publishers and consumers of Pyth data continues to grow, the Pyth Network Oracle will continuously feed more accurate and popular pricing data to drive growth across the ecosystem. DeFi. Finance is changing, and that is. is evident with the popularity of MakerDAO’s DAI stablecoin. Pyth Network is thrilled to bring its user file closer to a new price feed and is equally thrilled with the overall industry impact where the real world of traditional finance is brought closer to DeFi and Oracle “.

MakerDAO and DAI

MakerDAO is a decentralized organization devoted to bringing stability to the cryptocurrency economic system. Maker Protocol employs a two-token process. The very first is Tricky – above-collateralized stablecoins supply stability. The MakerDAO neighborhood believes that a decentralized stablecoin is vital for any organization or personal to consider benefit of digital currency. The 2nd token is MKR, the governance token applied by stakeholders to keep the process and handle DAI. MKR token holders are determination makers for the Maker protocol, supported by a massive neighborhood and quite a few other events. Maker is unlocking the energy of decentralized finance for all by building a extensive platform for financial empowerment, enabling absolutely everyone to have equal entry to worldwide fiscal markets.

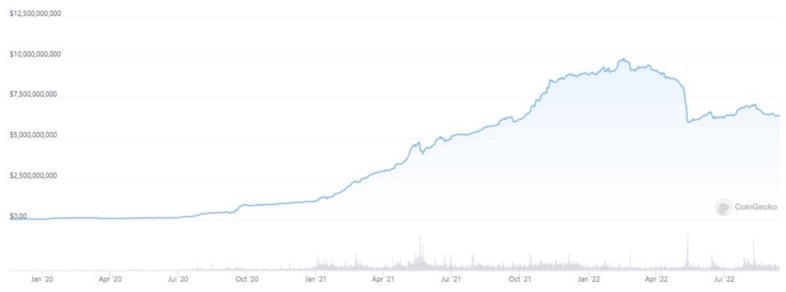

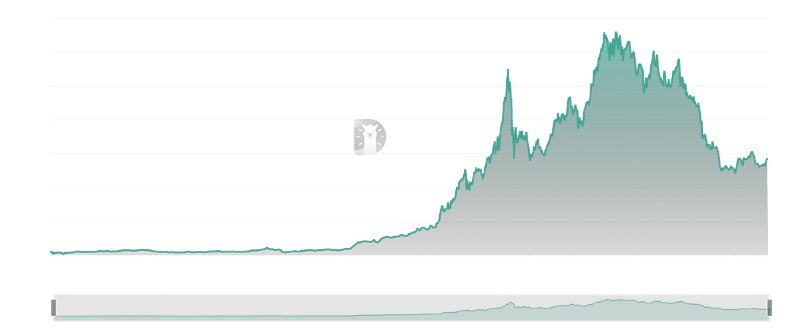

Launched in 2019, there are now virtually $ seven billion well worth of DAI in circulation, building it the most decentralized stablecoin nowadays, valued at close to $ ten billion locked in the Maker protocol. More a short while ago, MakerDAO has targeted on introducing serious planet assets (RWAs) to diversify the protocol’s basket of collateral, cut down total chance, and carry new income to the protocol. seven/seven/2022 marks the release of the 7th RWA Vault, produced for Huntingdon Valley Bank, with a $ a hundred million DAI debt ceiling.

The Pyth DAI / USD selling price feed is an significant phase in the direction of enabling new use situations of ERC-twenty tokens in the Solana ecosystem. With Pyth information going cross-chain by way of Wormhole, developers on any blockchain are empowered by way of Pyth’s DAI and stablecoin.

Anyone can conveniently deploy Pyth contracts on any chain and request updates by way of Wormhole for DAI / USD or any pair of Pyth’s in depth offerings on cryptocurrencies, FX, stocks and commodities.

Learn about the Python network

Pyth Network is an Oracle task that has attracted extra than 50 key partners around the world, delivering important information sources, integrating a number of protocols, AMMs, derivatives, and a broad array of other dApps with information reliably delivered with a latency much less than one 2nd.

Learn extra about the Pyth network: Website | Twitter | Telegram | Discord

Maybe you are interested:

Note: This is sponsored content material, Coinlive does not straight endorse any details from the over report and does not ensure the veracity of the report. Readers really should carry out their very own analysis just before building choices that influence themselves or their organization and be ready to consider accountability for their very own possibilities. The over report is not to be noticed as investment information.