Tonight (December sixteen), numerous tasks that pool liquidity on Raydium are continuously urging consumers to withdraw LPs. According to preliminary facts, the pooling technique on this DEX has encountered a vulnerability that triggers a massive sum of assets to be misplaced.

According to facts shared on the social network Twitter, an electronic wallet swiftly withdrew cash from Raydium’s liquidity pool inside of minutes.

It seems that an account at Solana is draining numerous pools of income at Raydium.

The account has acquired 1000’s of SOLs in the final couple of minutes.

We advocate withdrawing any liquidity to Raydium until eventually even more observe. https://t.co/gcEePNQw4y pic.twitter.com/FaX4wfhsOP

— Arkham | Cryptocurrencies (@ArkhamIntel) December 16, 2022

Specifically, the wallet of the aforementioned attacker made use of the administrator’s signature, creating withdrawals devoid of obtaining to deposit or cancel the LP Token.

🚨🚨🚨🚨🚨

There seems to be a wallet that is draining LP pools from Raydium liquidity pools applying the admin wallet as a signatory devoid of obtaining/burning LP tokens.Excellent Protocol supplied PRISM/USDC liquidity from Raydium

WITHDRAW YOUR PRISM/USDC LIQUIDITY FROM RAYDIUM

— PRISM (@prisma_ag) December 16, 2022

Raydium also acknowledged the vulnerability, but the precise bring about has not been confirmed. Preliminary assessments are even now ongoing as to irrespective of whether the admin vital will be exposed.

An exploit on Raydium affecting liquidity pools is staying evaluated. Details to comply with as you know additional

⁰The preliminary concept is that the owner’s authority has been overtaken by the attacker, but for now the authority has been broken on the AMM and farm plans

Attacker’s accounthttps://t.co/ZnEgL1KSwz—Raydium (@RaydiumProtocol) December 16, 2022

“A Raydium exploit has occurred and we are investigating the impacted liquidity pools. The specifics have nevertheless to be established. Initial speculation revolved close to that manage of the vital had been stolen by the attacker. This manage has been suspended on AMM and the liquidity farming plan has also been suspended for the time staying.

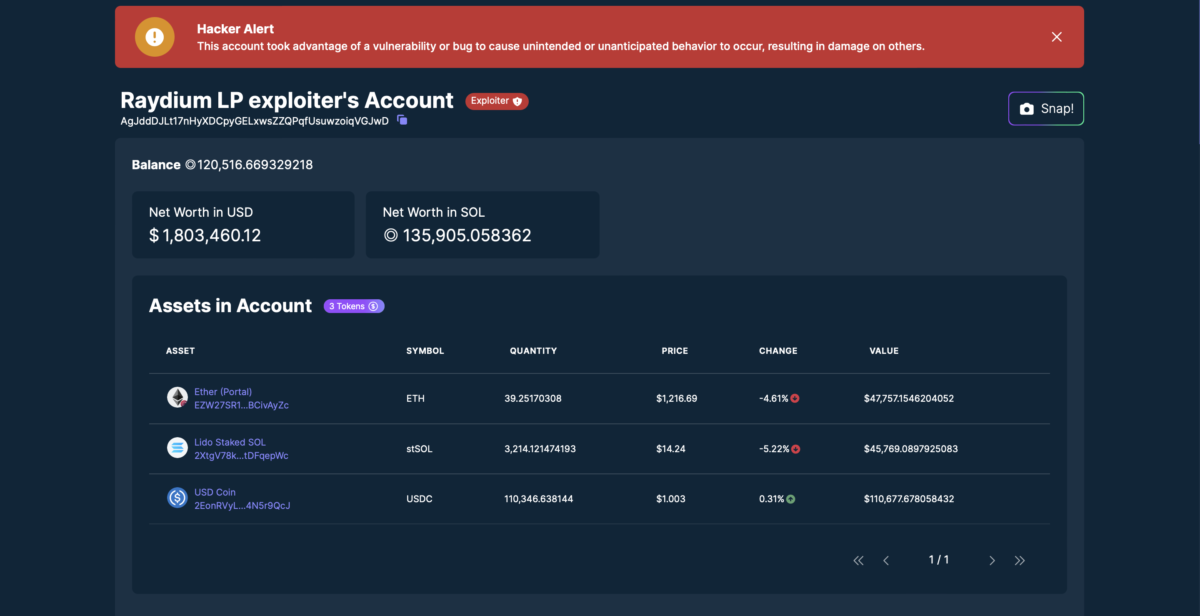

At the time of creating, the over hacker’s account has a stability of around $two.two million, of which $one.eight billion is in the kind of SOLs.

This facts is as soon as yet again a shock to the Solana ecosystem. After the collapse of FTX and Alameda, the liquidity of this ecosystem dried up, along with the “surrender” moves of Serum, Solana’s basic liquidity pool.

Previously, Solana was not quite well-known with consumers when it abruptly “turned off” for fairly a lengthy time.

Synthetic currency68

Maybe you are interested: