The initial two days of the trial of former FTX CEO Sam Bankman-Fried ended with no any surprises.

Recap of the initial two days of the Sam Bankman-Fried trial. Photo: Inner City Press

Recap of the initial two days of the Sam Bankman-Fried trial. Photo: Inner City Press

As reported by Coinlive, the trial of former FTX CEO Sam Bankman-Fried started on October three (US time) on 7 costs of fraud and deception associated to the collapse of this exchange.

– See far more: five points to know in advance of the Sam Bankman-Fried trial

The post is based mostly on the procedure summary from the account City center print on X (Twitter).

First day of trial October 3rd

On the initial day of the trial, the court invested all its time pick a jury serve the trial procedure. However, Sam Bankman-Fried nonetheless showed up to court with a new seem, with shorter hair than the “Curly Sam” nickname all people nonetheless is aware of.

Some of the initial courtroom sketches of Jane Rosenberg’s new SBF haircut for Reuters: pic.twitter.com/n0FqW71PWD

—Luc Cohen (@cohenluc) October 3, 2023

The court permitted Sam Bankman-Fried to use a laptop with no an net connection to consider notes.

However, given that US law prohibits filming in court, the written content of the trial was only narrated via notes and drawings from social network consumers.

Monday four October is the day of the check

On the 2nd day of the trial, October four, each the U.S. Department of Justice prosecutor and Sam Bankman-Fried’s defense lawyer gave opening speeches in the trial, then questioned the initial witnesses.

The prosecutor’s opening statement

The prosecutor prosecuting Sam Bankman-Fried, Thane Rehn, chronicled the rise and fall of FTX, accusing it all of currently being a fraudulent demonstrate organized by the former CEO, leading to billions of bucks in losses to 1000’s of people today who use the ‘exchange.

Sam Bankman-Fried has convinced ordinary consumers, investment organizations participating in capital injections, and even lots of politicians in Washington that FTX is a authentic trading platform, with authentic income and compliant with the law. But behind the scenes, the CEO applied consumer income for his very own functions, permitted the investment fund he managed, Alameda Research, to entry FTX consumer income, and then lied about all the things about the separation of these two organizations.

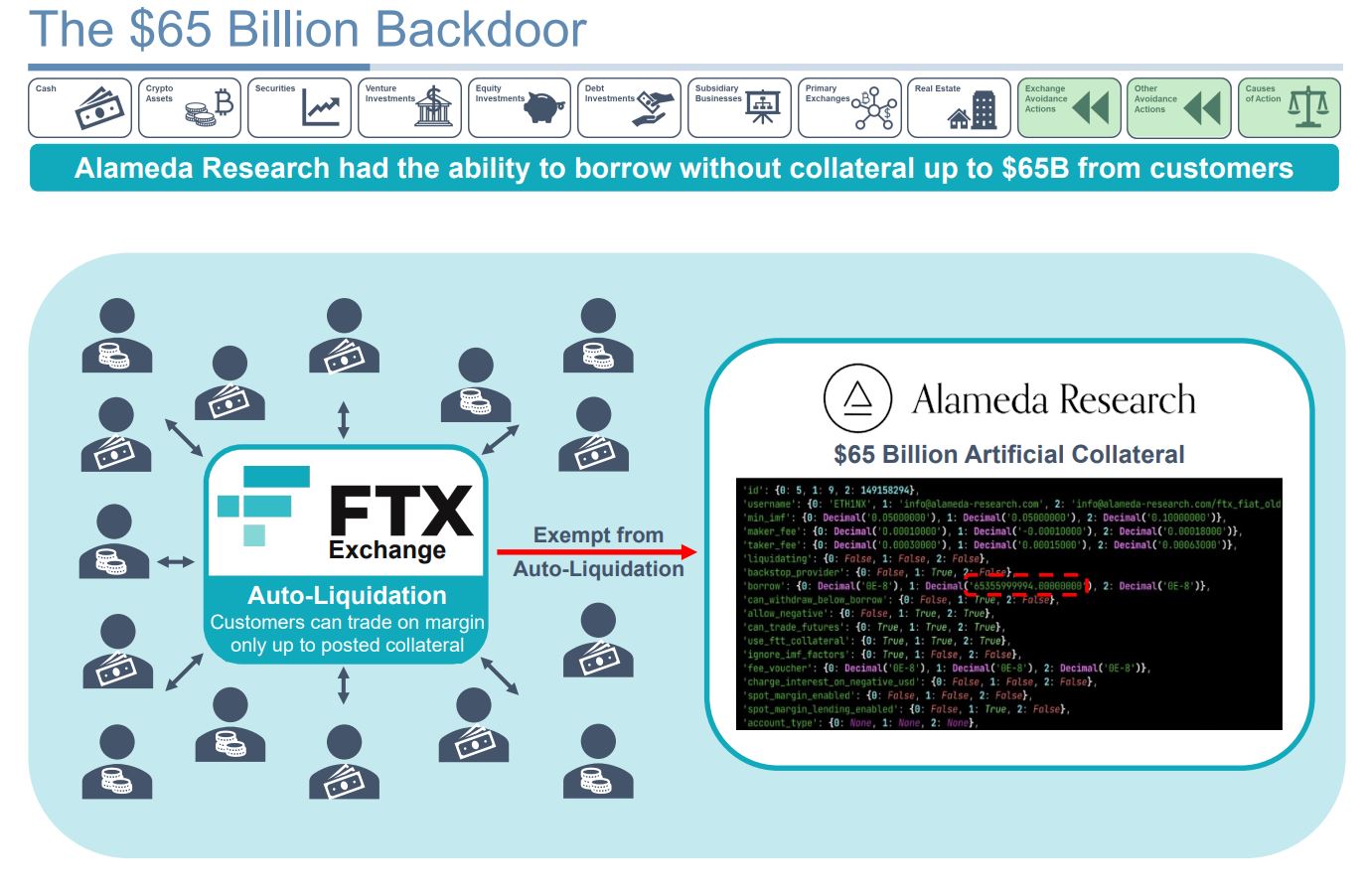

Prosecutors allege Sam Bankman-Fried defrauded shoppers in two methods. First, for the reason that FTX did not have a financial institution account, the CEO redirected fiat income deposited on the exchange to Alameda Research’s financial institution account, and then did not carry on to track that income. Secondly, FTX has a “backdoor” that makes it possible for Alameda Research to withdraw cryptocurrency stored by consumers on the exchange. As a outcome, the exchange knowledgeable each a fiat asset deficit and a crypto asset drain, leaving a hole of far more than $eight billion.

Evidence of a “back door” for Alameda Research to withdraw money from FTX, published January 2023

Evidence of a “back door” for Alameda Research to withdraw money from FTX, published January 2023

Sam Bankman-Fried also falsified FTX’s monetary statements to defraud traders, therefore mobilizing billions of bucks of capital for the exchange at a valuation of up to various tens of billions. However, he did not enable traders to participate in FTX’s board of directors, maintaining all the exchange’s pursuits below a veil of secrecy.

The sum of income raised by FTX was applied by Sam Bankman-Fried for the most various functions, from private expenditures, to the charitable fund managed by his younger brother, to the creation of huge sponsorships to encourage the picture of FTX, to political donations to exert legal stress. for the exchange. However, when Alameda Research encountered losses, Sam Bankman-Fried agreed to allow the fund withdraw FTX users’ income to hide the reduction, then continued to lie to all people to appeal to new deposits to the marketplace.

Sam Bankman-Fried repeatedly stated in advance of the media and also in advance of the US Congress all through his testimony, that FTX does not use customers’ income for the incorrect functions. However, the CEO admitted this to Alameda Research director Caroline Ellison and a amount of other figures in her inner circle, plainly demonstrating his awareness of the crime.

In November 2022, when Alameda’s monetary statements have been leaked, all of Sam Bankman-Fried’s frauds have been exposed and all of his two businesses collapsed quickly, collapsing just a number of days later on.

During this time period, Sam Bankman-Fried has nonetheless issued reassuring statements to consumers on social networks. But behind the scenes, he ordered workers to do all the things they could to increase far more income and set up car-delete messages to hide all traces of him.

The prosecutor explained that in the following days, when the plaintiff would cross-examine witnesses, together with Caroline Ellison, the court and jury would plainly see Sam Bankman-Fried’s fraud and be convicted of the crime charged by the Ministry of Justice .

Defense attorney’s opening statement

Sam Bankman-Fried’s defense lawyer is Mr. Mark Cohen of the Cohen & Gresser law company, a very well-identified New York enterprise attorney with practical experience litigating and winning lots of situations suing the U.S. government. United States, together with the Securities and Exchange Commission. (SEC).

From his initial phrases, Mr. Cohen stated that his consumer did not defraud any individual, but normally acted for a typical function. Sam Bankman-Fried believed that lending income to Alameda Research was a legal choice, identified to workers of each businesses. Sam Bankman-Fried did not steal income from any individual.

Mr. Cohen then argued that Sam Bankman-Fried was a educated, challenging-operating individual for 1 of Wall Street’s biggest hedge money. Both businesses he founded, Alameda Research and FTX, have sustainable and rewarding enterprise versions thanks to the application of new developments.

However, for the reason that each have been increasing so immediately, it was not possible for Sam Bankman-Fried to continue to keep track of the large image of FTX and Alameda Research, specially given that neither enterprise had workers.

Mr Cohen explained there is practically nothing incorrect with FTX conducting billion-dollar capital raising operations, for the reason that investment money see excellent probable in the exchange and the cryptocurrency marketplace. Likewise, actions this kind of as Alameda borrowing income from FTX, Alameda participating in the marketplace maker on FTX, FTX working with Alameda’s financial institution account to acquire fiat income from shoppers, and so on., are also not unlawful acts.

SBF’s Cohen: Alameda took huge margin loans from FTX. There’s practically nothing incorrect with that. Alameda was a marketplace maker. There’s practically nothing incorrect with that. FTX at first did not have a financial institution account to accept bucks, which in the cryptocurrency planet are referred to as fiat. So they applied an Alameda account

— Inner City Press (@innercitypress) October 4, 2023

Sam Bankman-Fried knew FTX was working with the Alameda financial institution account, but believed the income normally stayed in that account with no moving anyplace, so there was no threat of theft.

In late 2021, Sam Bankman-Fried stepped down as CEO of Alameda Research and passed the place to Caroline Ellison. In 2022, when the cryptocurrency marketplace had knowledgeable damaging developments, she suggested Ellison to make hedge positions for Alameda, but she did not do so, major Alameda Research to endure hefty losses due to the collapse of the cryptocurrency marketplace.

SBF’s Cohen: But what would have occurred if rates had fallen? Sam spoke to Mrs. Ellison and urged her to place up a hedge. He did not do it. In 2022, from May to November they flew into the best storm. Market shock: Bitcoin plunged 70%. Many businesses failed. Alameda was injured

— Inner City Press (@innercitypress) October 4, 2023

Sam so far nonetheless believes that his two businesses are nonetheless accomplishing very well, and this is what he conveys to the public and traders. However, offensive moves by the CEO of rival exchange Binance forced consumers to withdraw income from FTX en masse, leading to the exchange to fail in time and will need to file for bankruptcy.

Mr. Mark Cohen explained that by listening to queries from Sam Bankman-Fried’s former managers and confidantes this kind of as Caroline Ellison, Gary Wang and Nishad Singh, they will definitely make arguments towards his consumer, only for the reason that these 3 people today have all pleaded guilty in advance of the United States. Department of Justice.

At the finish of his opening statement, the defense lawyer stated that Sam Bankman-Fried was not guilty.

Comment by Coinlive

It can be noticed that although the prosecutor created robust allegations towards Sam Bankman-Fried based mostly on what occurred at FTX and Alameda Research, the attorney defending the former CEO argued that the situation is that Sam Bankman-Fried did its very best, denying the fraud and progressively shifting the blame to the bad threat management abilities of Caroline Ellison, CEO of Alameda Research.

The initial witnesses

The prosecutor then referred to as the initial witness, a single FTX investor named Marc-Antoine Julliard.

This individual responded that he was acquainted with FTX via introductions from mates, as very well as FTX’s promoting pictures all through the collaboration with the Mercedes-AMG Formula one racing crew, supermodel Gisele Bundchen, and promoting at the 2022 Super Bowl occasion.

Juilliard explained that at 1 level he applied the FTX app each day to invest in cryptocurrencies, generally holding Bitcoin and Dogecoin. The witness stated that he did not know that FTX could consider his assets and lend them to other folks.

When FTX collapsed, this individual was nonetheless following Sam Bankman-Fried on Twitter and studying a reassuring message from the CEO. However, when he attempted to withdraw income, his transaction was not processed and so far he has not been ready to acquire the four Bitcoins back on the exchange.

The upcoming witness referred to as was Adam Yedidia, a mutual undergraduate good friend of Sam Bankman-Fried at MIT, who later on worked as a colleague at Alameda and FTX. This individual remained on the exchange until eventually its collapse on November eleven, 2022.

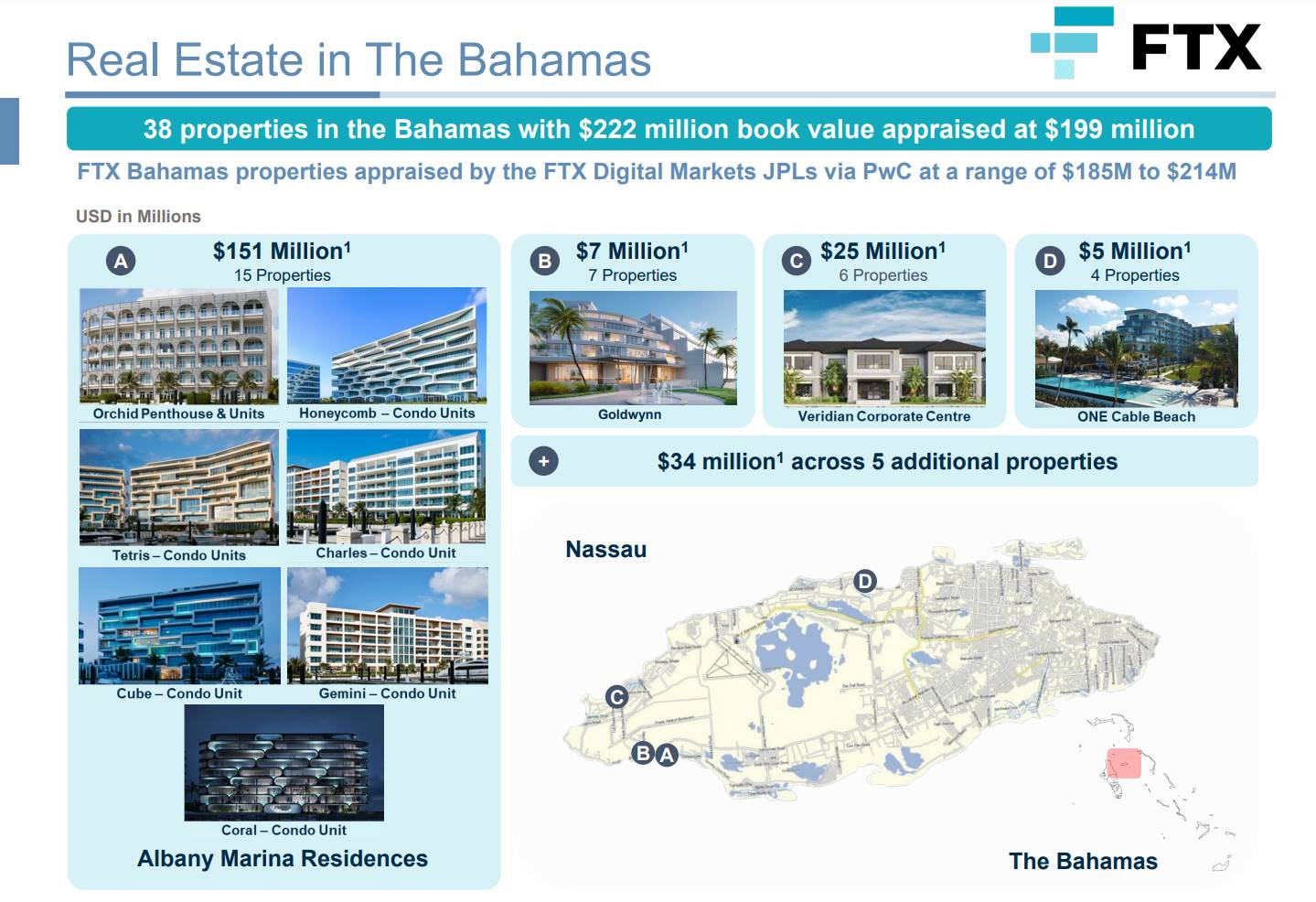

This individual explained he did not know about Alameda Research’s loan of income from FTX, but confirmed that he knew that Sam Bankman-Fried invested $35 million to acquire a luxury villa in the Bahamas, the place FTX’s headquarters are situated. Sam Bankman-Fried, Yedidia and eight other essential confidants of the FTX CEO reside right here.

The residence…

The residence…