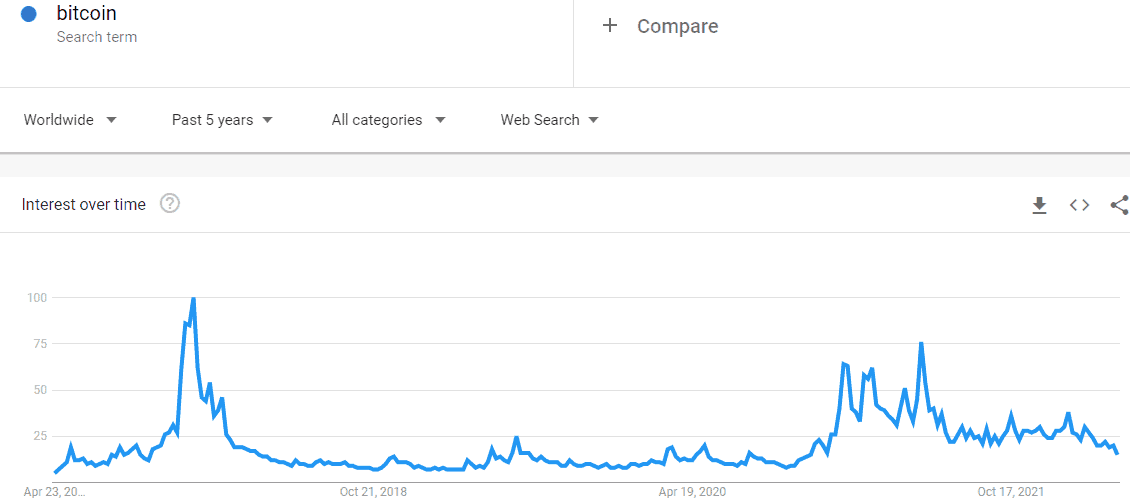

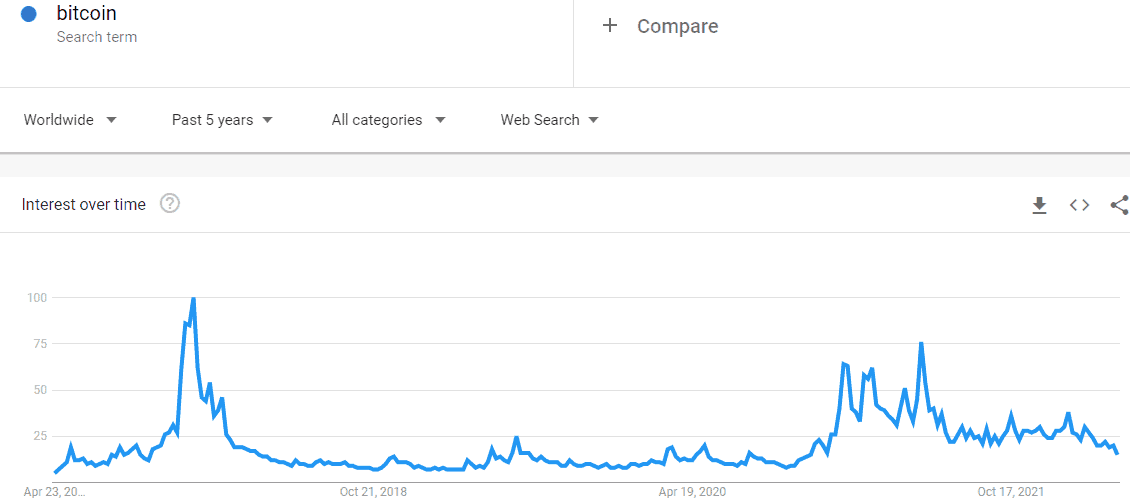

Retail investor curiosity in Bitcoin (BTC) seems to be dwindling as Google’s search volume plummets to lows not witnessed in more than a 12 months.

Accompanied by a rather damaging selling price motion on the portion of Bitcoin that has lasted considering that the starting of 2022, the frequency of Google searches for the greatest cryptocurrency on the industry has also plummeted, reaching its lowest degree considering that late 2020. BTC whale efforts, skyrocketing Bitcoin trading volume, BTC provide on the exchange continues to hit a new “bottom”.

The quantity of queries on the world’s greatest search engine generally reveals the certain habits of retail traders, which tends to drive amid the most major selling price hikes in background. The most notable situation was in late 2017 when BTC had a excellent 12 months when it skyrocketed to ATH at $ twenty,000.

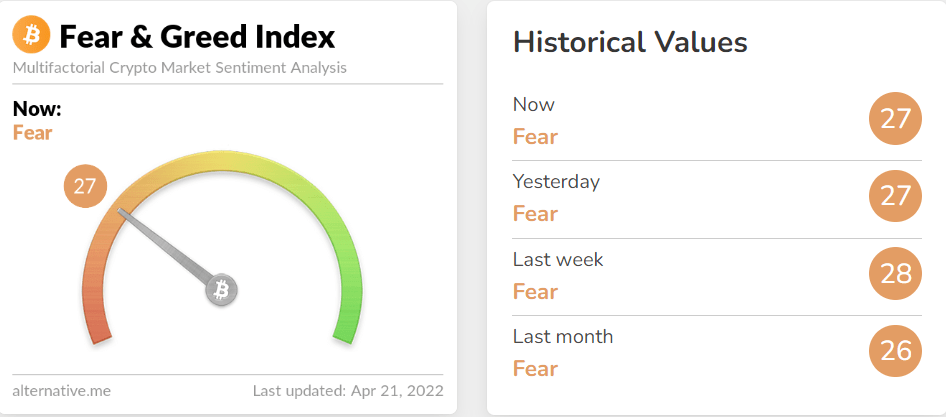

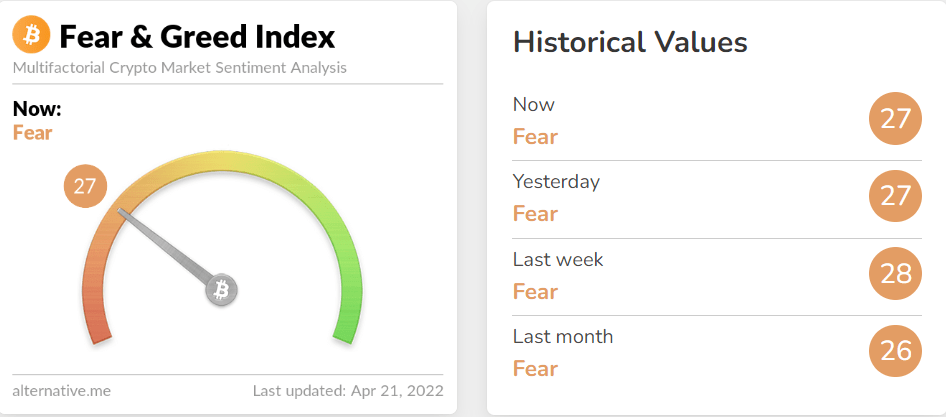

On the other hand, Bitcoin’s Greed and Fear Index has not steadily enhanced and stays in the “Fear” array, even though BTC’s recovery at press time is relatively favourable, approaching the $ 42,000 mark following the crash. It fell under the $ 39,000 mark beneath stress from miners earlier in the week.

The Bitcoin Fear and Greed Index is a information scale that measures basic sentiment in the cryptocurrency neighborhood by examining a variety of aspects, this kind of as selling price movements, polls, BTC industry share, trading volume, social interactions. media, and so on. The ultimate index consequence is displayed on a basis from to a hundred, wherever represents “extreme fear” and a hundred is “greed”.

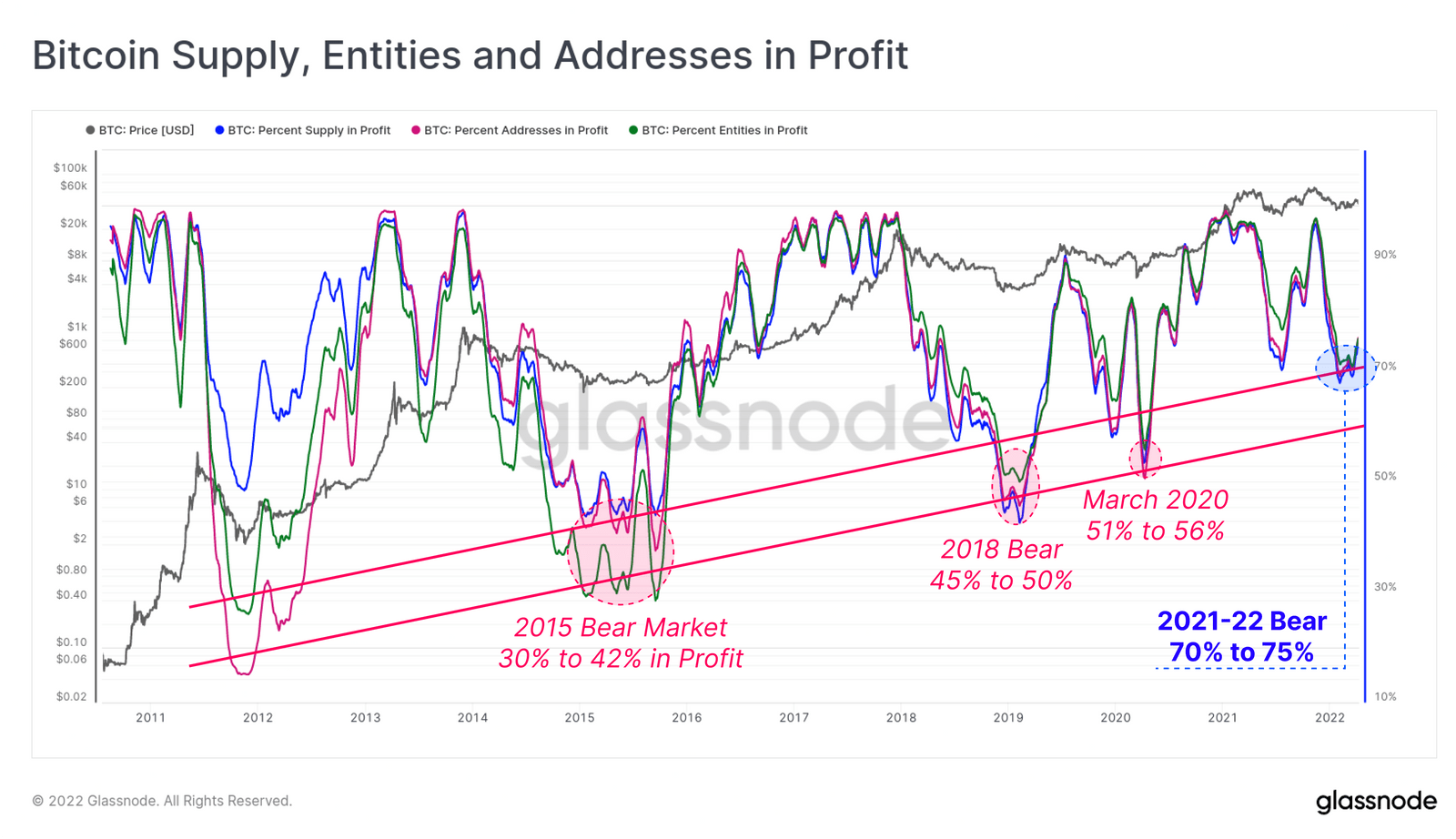

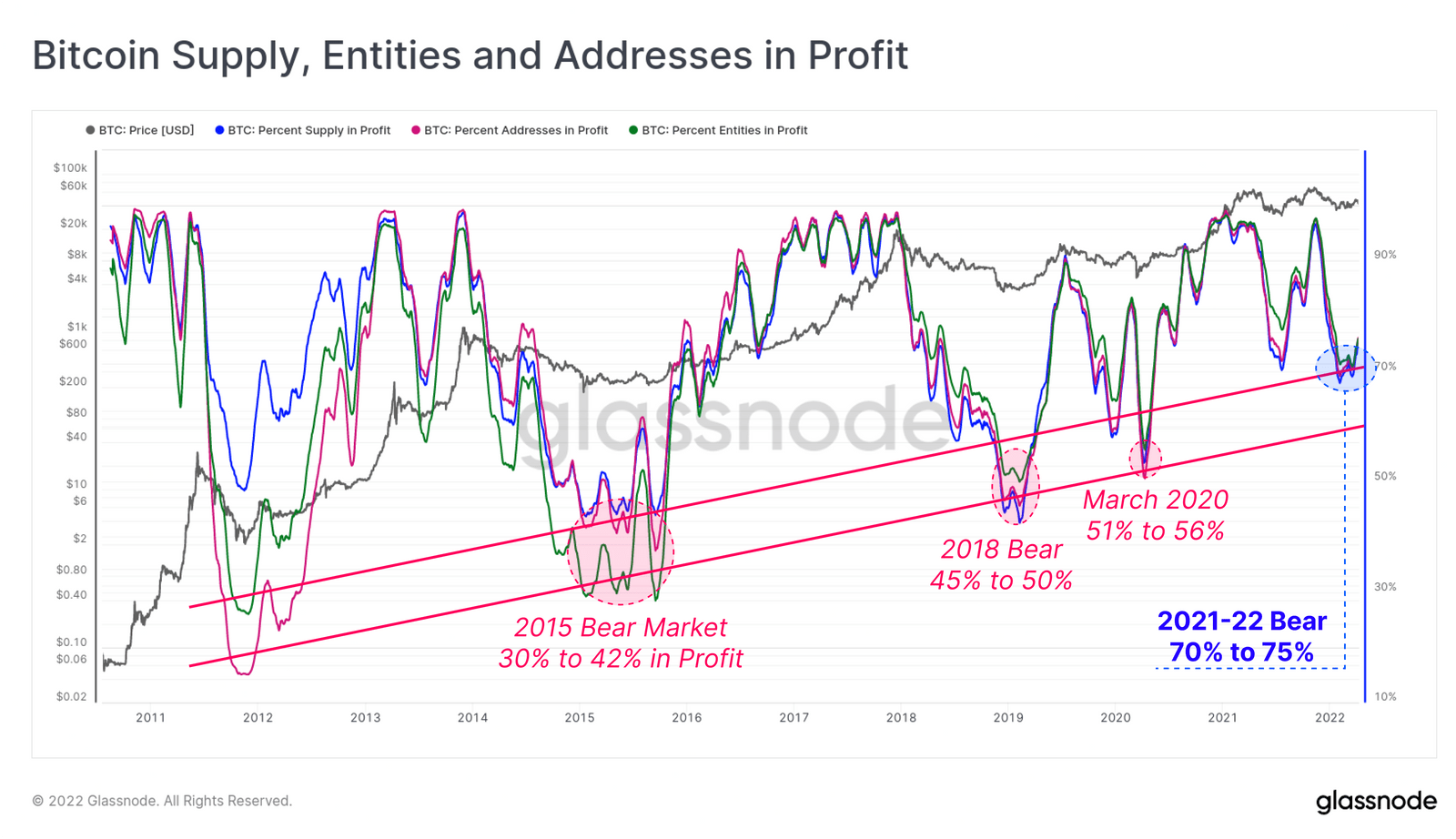

In reality, nonetheless, in its weekly report published on April twelve, Glassnode analyzed the quantity of Bitcoin wallets that are rewarding and discovered that concerning 70% and 75% of addresses are nonetheless unfulfilled. Currently, a lot additional than 45 % to 50% in the prolonged-phrase bear industry in 2018. Therefore, we can see that the recent correction is not as extreme as the worst intervals in contrast to all prior cycles.

Synthetic currency 68

Maybe you are interested:

Retail investor curiosity in Bitcoin (BTC) seems to be dwindling as Google’s search volume plummets to lows not witnessed in more than a 12 months.

Accompanied by a rather damaging selling price motion on the portion of Bitcoin that has lasted considering that the starting of 2022, the frequency of Google searches for the greatest cryptocurrency on the industry has also plummeted, reaching its lowest degree considering that late 2020. BTC whale efforts, skyrocketing Bitcoin trading volume, BTC provide on the exchange continues to hit a new “bottom”.

The quantity of queries on the world’s greatest search engine generally reveals the certain habits of retail traders, which tends to drive amid the most major selling price hikes in background. The most notable situation was in late 2017 when BTC had a excellent 12 months when it skyrocketed to ATH at $ twenty,000.

On the other hand, Bitcoin’s Greed and Fear Index has not steadily enhanced and stays in the “Fear” array, even though BTC’s recovery at press time is relatively favourable, approaching the $ 42,000 mark following the crash. It fell under the $ 39,000 mark beneath stress from miners earlier in the week.

The Bitcoin Fear and Greed Index is a information scale that measures basic sentiment in the cryptocurrency neighborhood by examining a variety of aspects, this kind of as selling price movements, polls, BTC industry share, trading volume, social interactions. media, and so on. The ultimate index consequence is displayed on a basis from to a hundred, wherever represents “extreme fear” and a hundred is “greed”.

In reality, nonetheless, in its weekly report published on April twelve, Glassnode analyzed the quantity of Bitcoin wallets that are rewarding and discovered that concerning 70% and 75% of addresses are nonetheless unfulfilled. Currently, a lot additional than 45 % to 50% in the prolonged-phrase bear industry in 2018. Therefore, we can see that the recent correction is not as extreme as the worst intervals in contrast to all prior cycles.

Synthetic currency 68

Maybe you are interested: