What is TrueFi (TRU)?

TrueFi it is an unsecured loan protocol.

TrueFi’s target is to carry DeFi to decentralized lending. This aids cryptocurrency lenders appreciate desirable and sustainable charges of return, even though offering cryptocurrency borrowers with predictable lending disorders devoid of collateral.

All loans and loans on TrueFi are absolutely transparent, permitting lenders to thoroughly realize the borrowers concerned and the funds flows interacting with TrueFi.

How does TrueFi do the job?

Lenders deposit TrueUSD into the TrueFi pool which is applied for agricultural loans, curiosity and TRU tokens. Any unused capital is deposited in the Curve protocol to maximize earnings.

Borrowers (this kind of as exchanges and other protocols) submit loan proposals from the pool. They send the capital they want and the Ethereum handle will obtain the loan if the proposal is accredited.

Borrowers will borrow money from TrueFi Pool by submitting a request, which will be accredited by TRU Staker to vote on these proposals by pointing their TRU as a “Yes” or “No” alternative for the money. individual loan. Each vote signifies that participating TRU holders will improve or lower based on no matter whether the closing loan is repaid efficiently and, as this kind of, TRU Staker is encouraged to vote with caution.

The Smart Contract Pool approves or rejects the loan primarily based on the Pool’s threat parameters and TRU Staker’s Yes / No rating.

The borrower have to repay the principal and curiosity prior to or prior to the due date. Borrowers who are previous due will encounter legal action in accordance to the signed loan agreement

Who are the TrueFi end users?

Lenders deposit TUSD, and perhaps other cryptocurrencies, into TrueFi Pool for use in decentralized lending to accredited borrowers. They earn substantial returns on their TUSD loans. Lenders whose principal is lent on TrueFi will obtain ERC20 tradable pool tokens representing their demand for principal and curiosity due on repayment of all loans to the loan pool. These tokens can have their very own liquidity on Uniswap and other DEXs. In the potential, the task hopes that a number of TrueFi Pools can exist at the very same time (perhaps with distinct lending methods, this kind of as lending-only to exchanges).

Borrowers will borrow money from the TrueFi Pool by submitting applications based on the credit score rating of the TRU stakers and approval of the Pool. Borrowers have to repay the loan sum and curiosity prior to the loan matures or encounter reputational and legal threat that is payable in court, underneath the terms described in their binding loan agreement. At the outset, borrowers will consist of a whitelist of money thoroughly chosen and vetted by the Believe inToken workforce. Over time, TrueFi could open to any borrower with an Ethereum handle, such as other DeFi sensible contracts.

TRU Stakers vote “Yes” or “No” to loan requests from borrowers to signal their assistance. In the potential, TRU could be applied to approve new borrowers or lead the advancement of TrueFi.

Off-platform liquidity suppliers who assistance TRU liquidity on Uniswap or Balancer, have the chance to farm their LP tokens with TrueFi.

Basic data about the TRU token

- Token title: TrueFi

- Ticker: Significantly less

- Blockchain: Ethereum

- Token regular: ERC-twenty

- To contract: 0x4c19596f5aaff459fa38b0f7ed92f11ae6543784

- Token sort: Utility

- Total present: one.441.129.426 Small children

- Circulating provide: 343.296.907 Small children

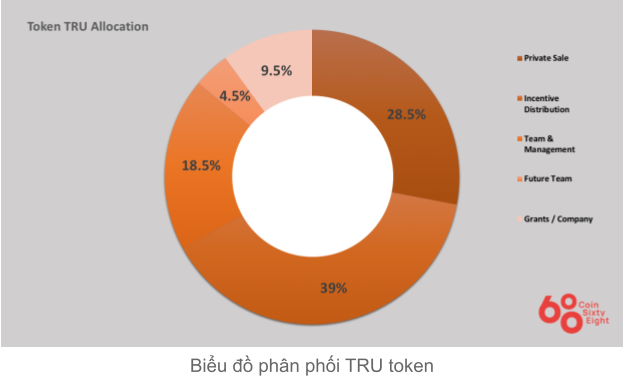

Token allocation

- Private sale: 28.five%

- Distribution of prizes: 39%

- Team and Manager: 18.five%

- Team in the potential: four.five%

- Subsidies / firm: 9.five%

What is the TRU token for?

The TRU staker will participate in the voting procedure irrespective of no matter whether the loan is accredited or not.

TRU token storage wallet

TRU is an ERC20 token, so you will have numerous wallet alternatives to keep this token. You can opt for from the following wallets:

- Floor wallet

- Popular ETH wallets: Metamask, Myetherwallet, Mycrypto, Coin98 wallet

- Cool wallets: Ledger, Trezor

How to earn and very own TRU tokens

- Buy right on the stock exchange.

- Become a loan provider in the TrueFi protocol.

- Become a drill bar supplier for ETH / TRU and TUSD / tfTUSD pools.

Where to invest in and promote TRU tokens?

Currently, TRU is traded on numerous unique exchanges with a complete each day trading volume of roughly $ six.six million. Exchanges listing this token involve: Binance, Gate.io, MEXC, FTX, MEXC, Uniswap …

What is the potential of the TrueFi task, really should I invest in TRU tokens or not?

TrueFi is a DeFi task that enables end users to borrow devoid of collateral. TrueFi selects borrowers primarily based on the whitelist and consent of TRU stakers. Overall, this is a wonderful DeFi task when it owns a TVL of up to $ 258 million. However, for tasks that permit end users to farm like TrueFi, the worth of TRU tokens will not have a sturdy development in the potential simply because end users soon after getting TRU tokens from farming will generally have a tendency to promote now, rather of holding them at. prolonged phrase. Through this short article, you have to have by some means grasped the primary data about the task to make your investment choices. Coinlive is not accountable for any of your investment choices. I want you accomplishment and earn a whole lot from this prospective market place.