What is ReSource Finance (Supply)?

ReSource Finance is a venture that supplies a detailed instrument to generate distributed credit score methods that assist participants accessibility reasonably priced credit score at incredibly aggressive terms, cooperative trading and generate a new sort of stablecoin that derives its stability and worth from the organic supply of industry forces.

At the heart of ReSource is a lending method that permits corporations to give every other credit score in the type of products supplied and companies rendered. In terms of efficiency, this signifies that method participants can accessibility every other’s products and companies in exchange for the assure of supplying products and companies of equal worth to people of the method by other network participants.

The abilities of the ReSource protocol can be tailored to distinctive use scenarios and can meet the demands of closed trading communities as effectively as lively unlicensed for-revenue open industry applications.

How does ReSource Finance get the job done?

ReSource permits firms to give credit score to every other, with no fiat cash.

The ReSource protocol permits merchants to monetize what they by now have: unused stock, cost-free get the job done time, and all the assets that make up their enterprise.

Participating merchants lend these unused sources to colleagues who will need them, and in return, they get what they will need to broaden their enterprise.

This home loan credit score method is backed by a distributed network of underwriters who assist safe lines of credit score and get rewards in return.

Highlights of ReSource Finance

Change the idea of cash

The ReSource protocol produces a new sort of stablecoin, attaining autonomous stability. ReSource stablecoins are not pegged to fiat or other assets, but consider the steady worth of the products and companies traded towards them.

Change the economic sector

The ReSource protocol not only ignores the middleman and custodian, it efficiently removes the creditor from the equation.

No ensures, safe and decentralized

A distributed underwriting network that permits decentralized credit score issuance with no compromising decentralization and safety.

Smart coverage

Instead of relying on credit score rating companies, participants can use their very own share capital, help every other, or use a wide variety of track record mechanisms to show their creditworthiness. Not only is it fairer than a standard credit score score, it is also smarter and a lot more trusted.

Basic data about the Supply token

- Token identify: economic sources

- Ticker: Supply

- Blockchain: Ethereum

- Token regular: ERC-twenty

- To contract: Updating

- Token sort: Utility, Governance

- Total present: Updating

- Circulating provide: Updating

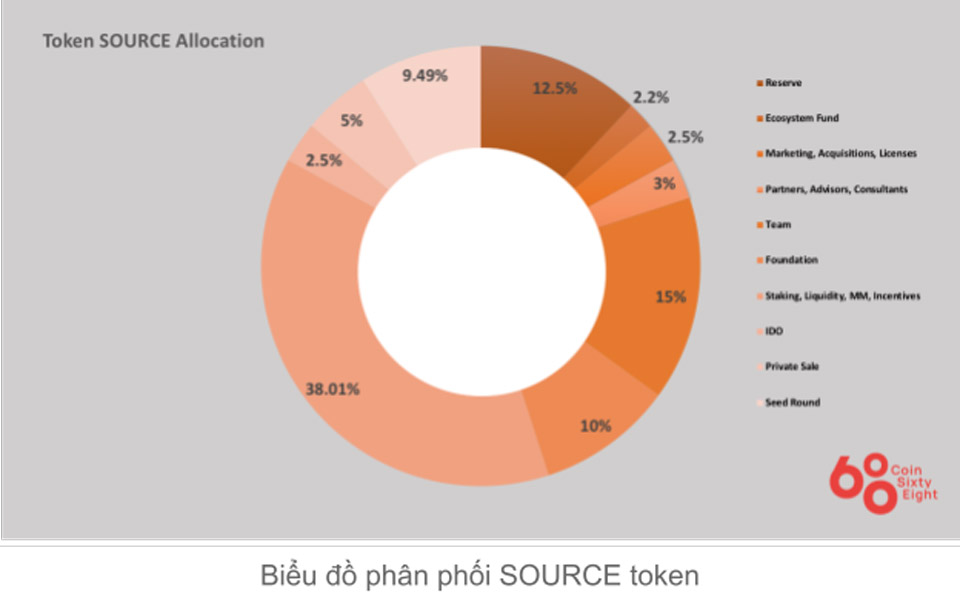

Token allocation

Reserve: twelve.five%

Ecosystem Development Fund: two.two%

Marketing, mergers, licensing: two.five%

Partners and consultants: three%

Squad: 15%

Sponsorship fund: 10%

Staking, liquidity, MM, incentives: 38.01%

I DO: two.five%

Private sale: five%

round seed: 9.49%

What is the Supply token utilised for?

Administration.

Payment of transaction costs on the net.

Supply Token Storage Wallet

Updating

How to earn and very own the Supply token

Updating

Where to invest in and promote Supply tokens?

Join SHO on the Dao Maker fundraising platform.

Roadmap

Updating

Partner

What is the long term of the ReSource Finance venture, must I invest in Supply tokens or not?

ReSource Finance was produced to generate a distributed credit score network, making it possible for participating firms to lend to every other. Through this post, you should have by some means grasped the standard data about the venture to make your investment choices. Coinlive is not accountable for any of your investment choices. I want you achievement and earn a great deal from this likely industry.