- Ripple opts against IPO, focusing on private growth.

- $500 million funding reinforces strategic choices.

- XRP and RLUSD stablecoin spotlighted in strategy.

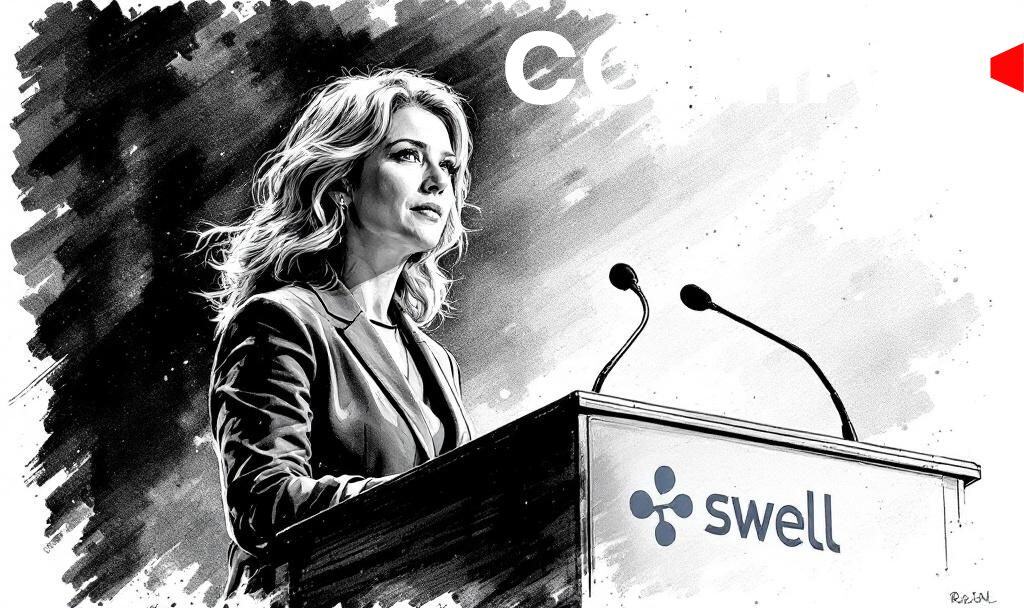

Ripple President Monica Long announced at the Swell conference in New York that Ripple has no plans for an IPO, opting to grow organically after securing $500 million in funding.

This decision emphasizes Ripple’s strategy to maintain private control while bolstering its market positioning, encouraging a stable operational focus amid an enthusiastic institutional investment landscape.

At the Swell conference in New York, Ripple President Monica Long confirmed the company has no plans for an IPO. Ripple intends to fund its growth through the recent $500 million round from prominent institutional investors.

Ripple will remain private and use the recent funding to expand into areas like crypto custody and prime brokerage services. Monica Long cited their strong capital position from a $40 billion valuation.

The decision impacts Ripple’s market strategy, particularly its focus on strengthening partnerships with financial institutions. The company’s network has reported processing over $95 billion in transactions, highlighting its extensive market involvement.

Ripple’s strategy could shape industry norms, with competitors like Kraken preparing IPOs. The decision underscores Ripple’s emphasis on building infrastructure and maintaining operational control rather than public market exposure.

Ripple’s inclination towards private growth contrasts with broader industry trends, as seen in IPOs from Circle and Gemini. This approach reflects the company’s confidence in its existing liquidity and market presence.

Capital from the funding round is earmarked for enhancing Ripple’s RLUSD stablecoin, already valued over $1 billion. Monica Long also mentioned customer growth, with new funding supporting Ripple’s expanding reach globally. As Monica Long stated, “We do not have an IPO timeline. No plan, no timeline.”