As funds flows are pouring into the Close to method suitable now, as degree two of Close to and the EVM engine utilized as a bridge for Ethereum, AURORA can act as an intermediary of the funds movement concerning Ethereum and Close to, therefore investment capital for AURORA in the long term it can develop even extra.

RoseFi undertaking the two a DEX exchange mixed with the Loan and Loan functions and entered the area of Stable Coin. When you mix three significant locations in DEFI collectively, maybe RoseFi will be a probable undertaking in the long term. So let us study Coinlive collectively RoseFi undertaking for a far better overview of this undertaking.

RoseFi undertaking overview

What is the RoseFi undertaking?

Rose.fi is a liquidity protocol on Aurora which consists of an exchange of stablecoins and asset wrapping and a collateralized stablecoin (CDP) that utilizes curiosity-bearing tokens as collateral.

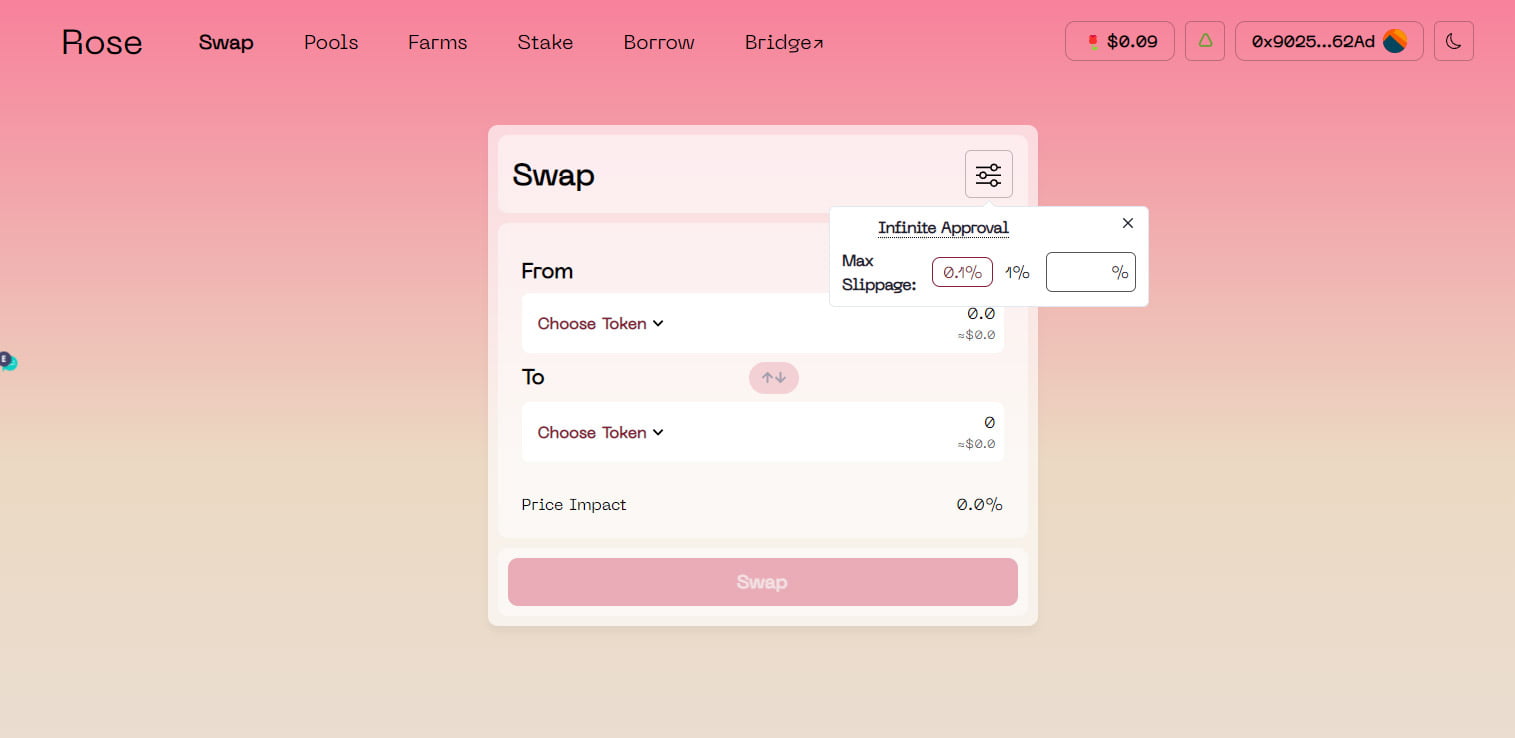

Rose’s to start with merchandise, which is also a vital merchandise, is Stablecoin swap, which makes it possible for you to trade steady coins with extremely lower slippage, followed by Farms and Stake.

Particularities of the RoseFi undertaking

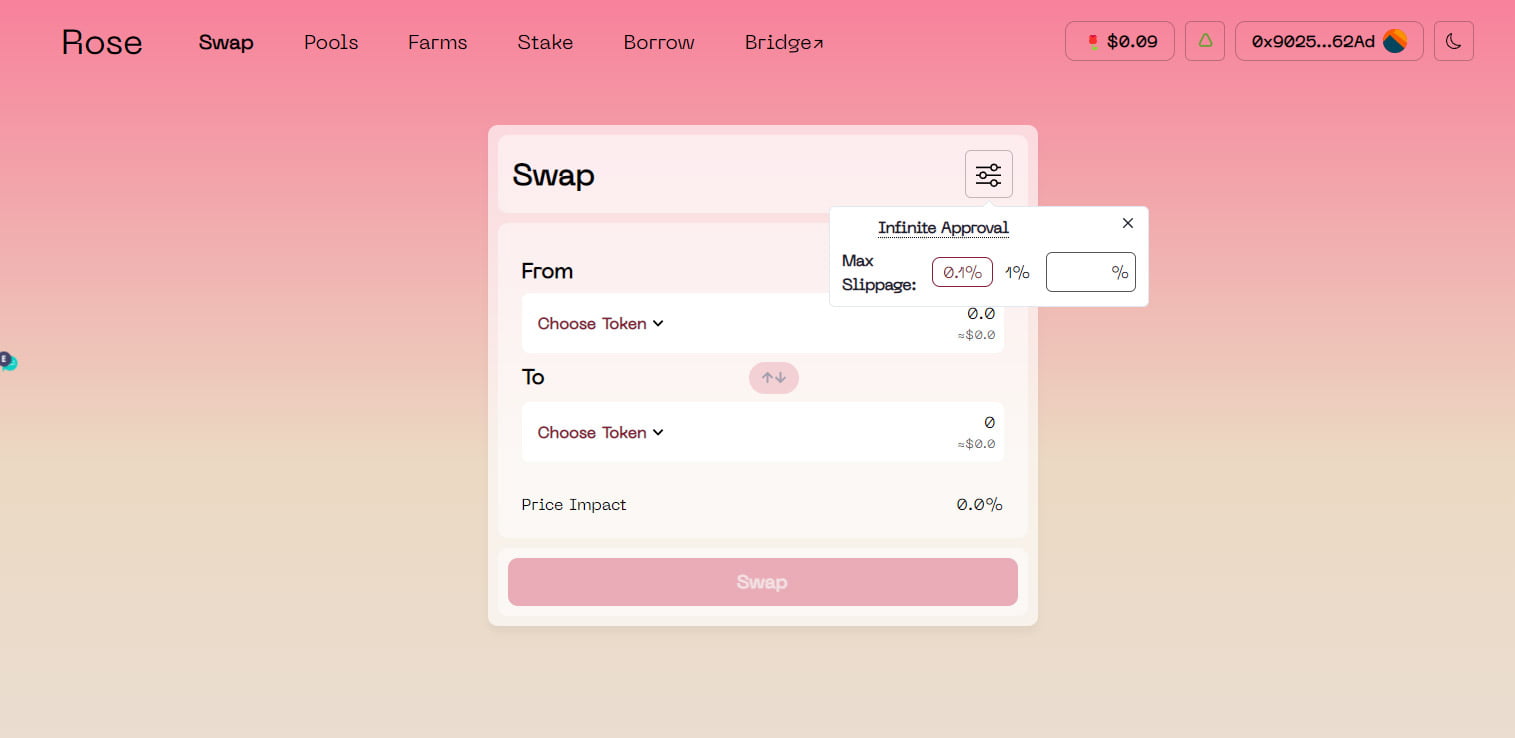

Stablecoin Exchange – Exchange steady coins with super lower slippage

The to start with merchandise is stables wap, the to start with decentralized Automated Market Maker (AMM) exchange on Aurora to trade fixed assets this kind of as stablecoins and assets with slip restrict and lower transaction charges.

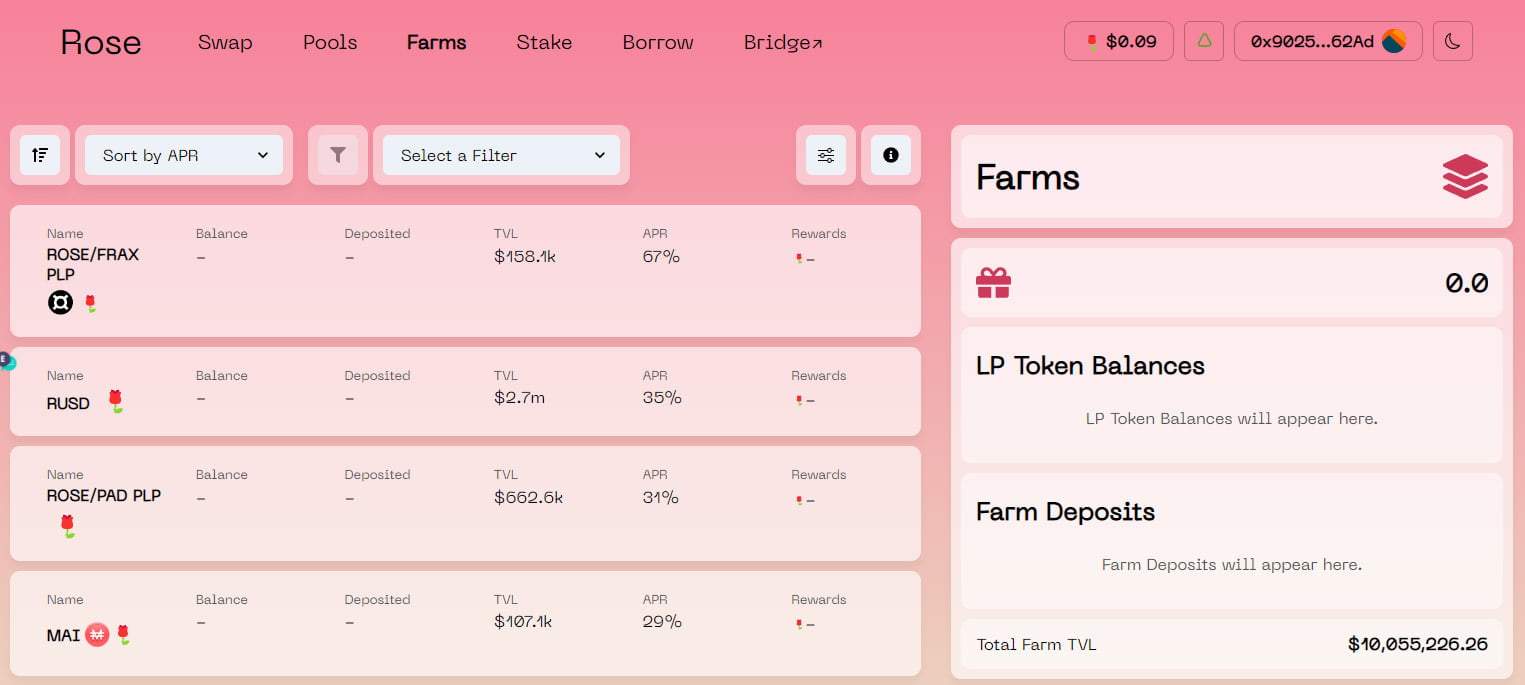

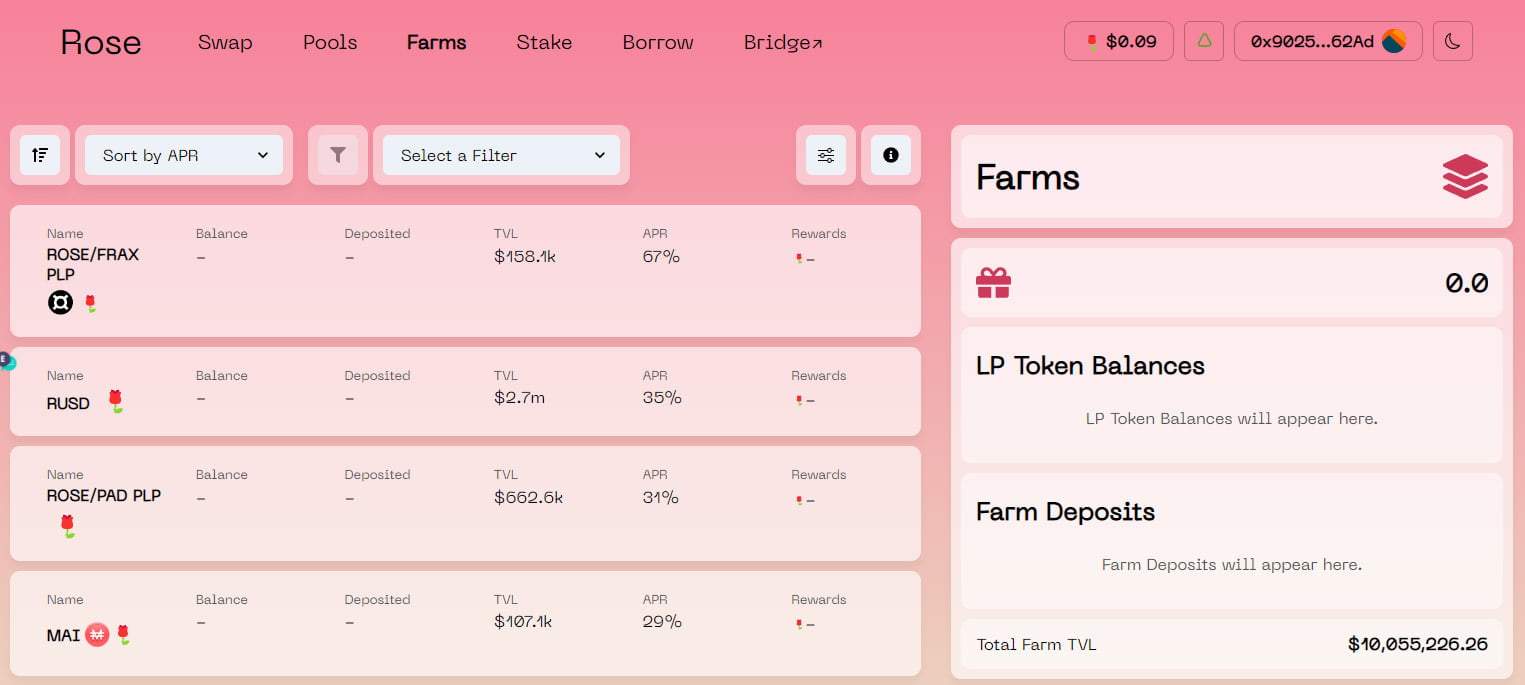

Farm

Similar to other DEXs, you can leverage liquidity for revenue, to start with you will need to include assets

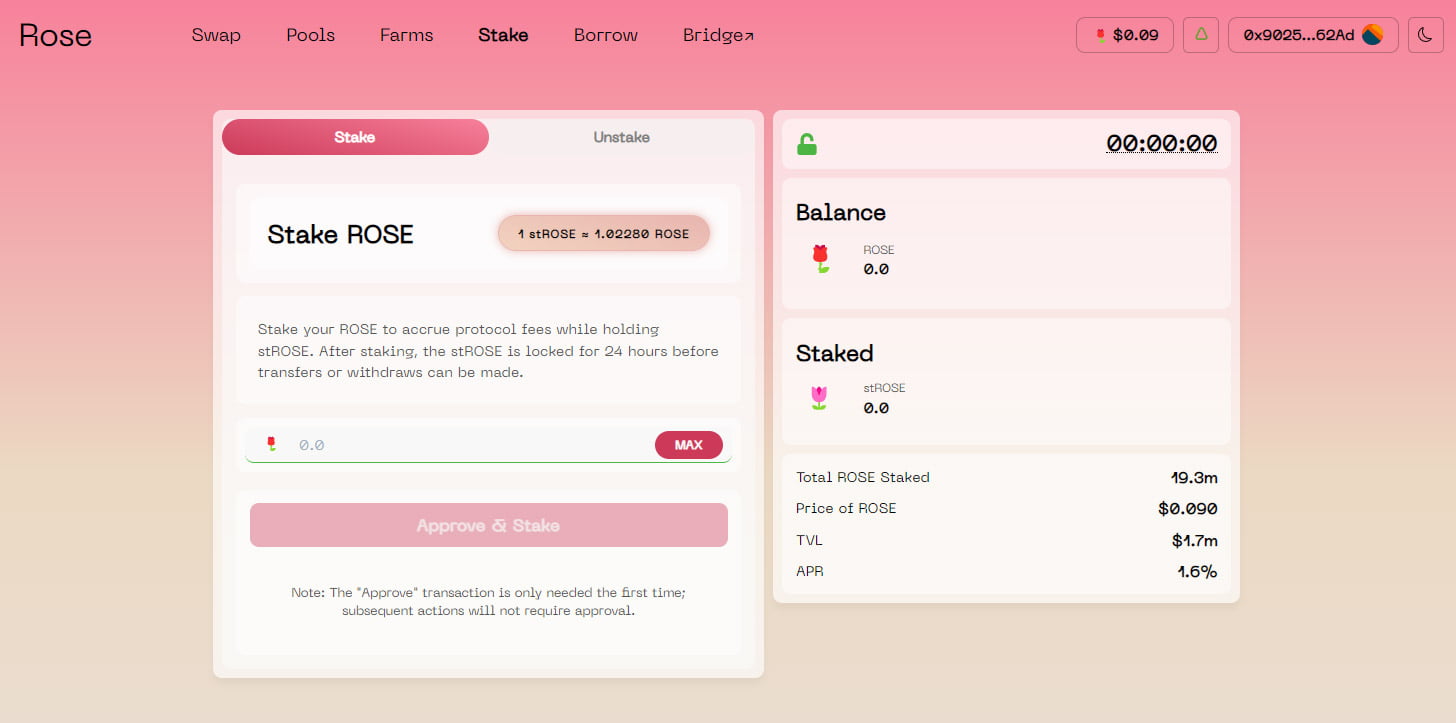

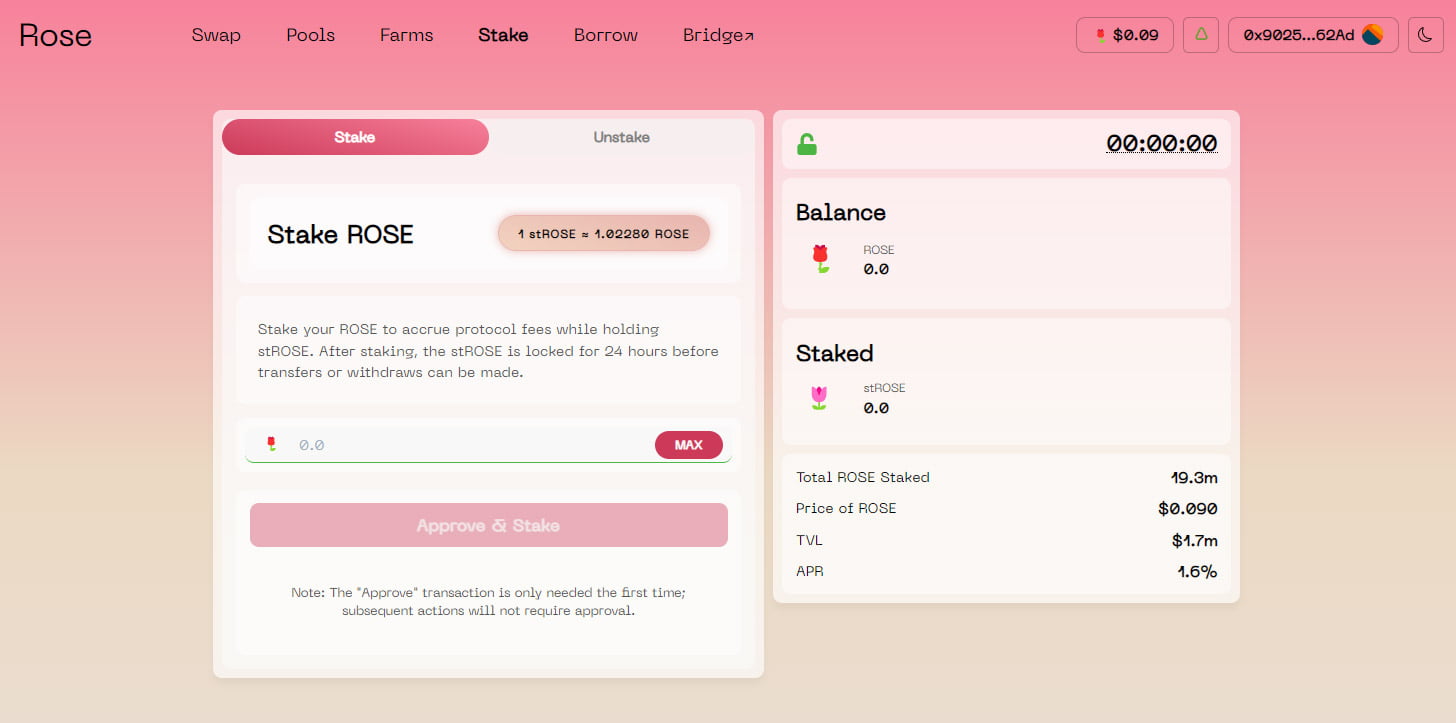

Pole

stRose will be utilized as collateral or as a share of the swap income. You can bet Rose tokens to get stRose

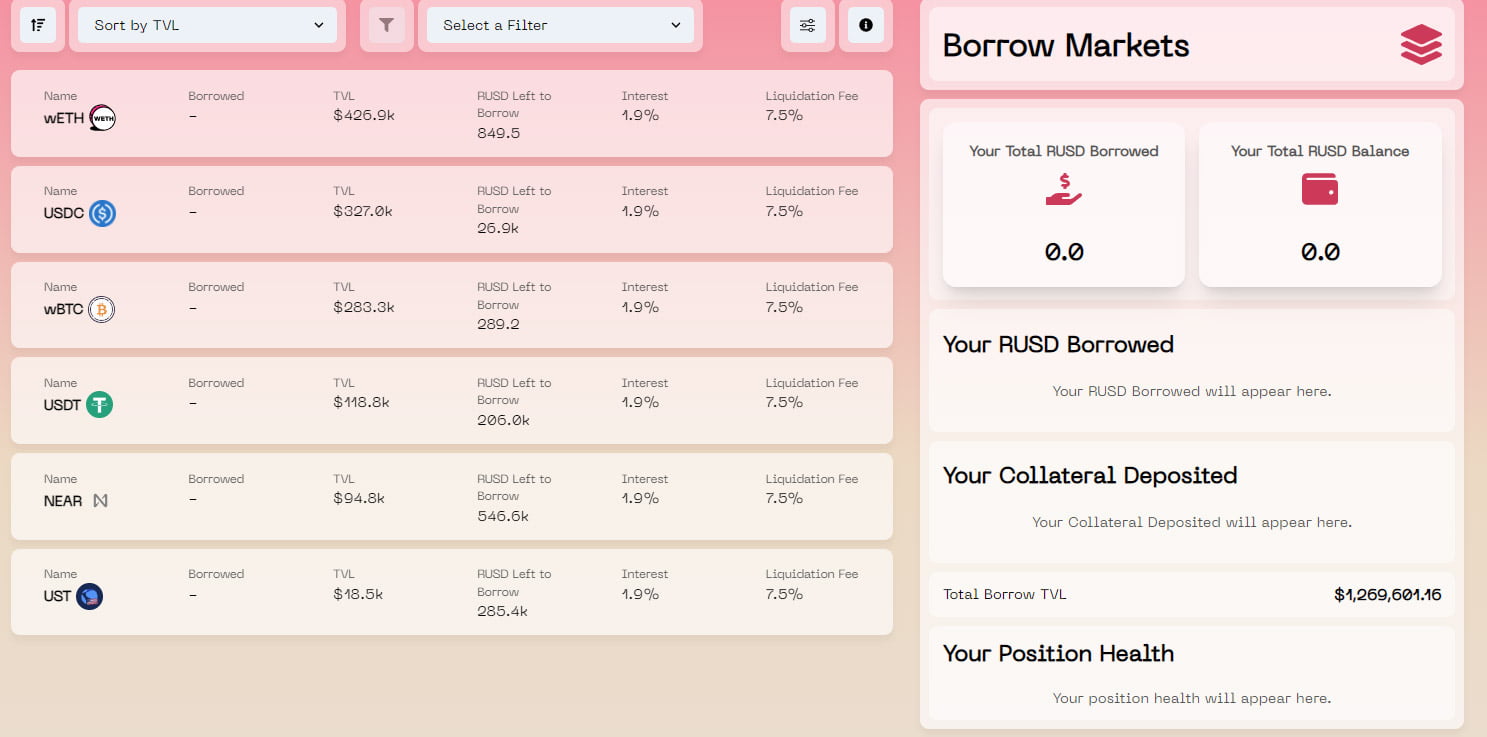

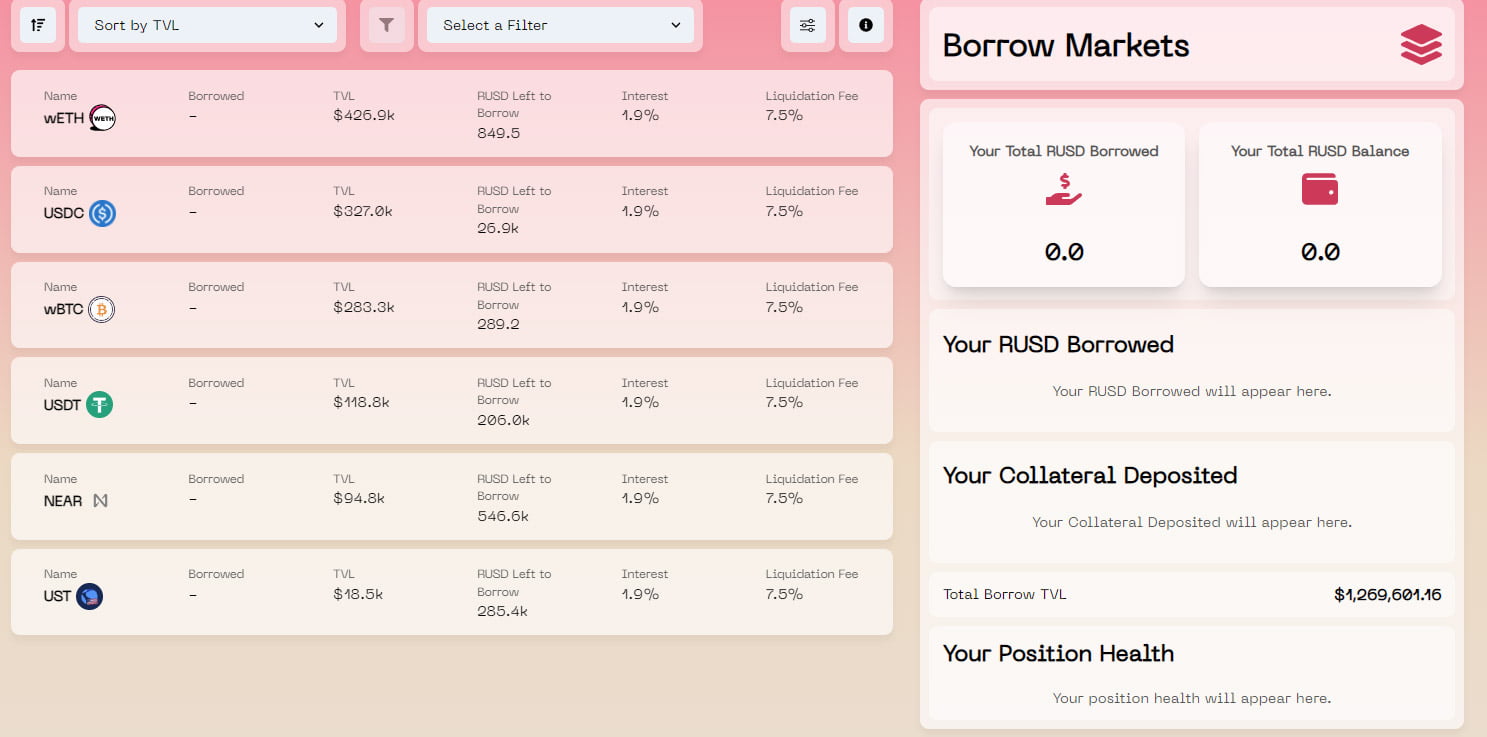

Vay – Borrow

Users can bet with Altcoins or other steady assets to borrow RUSD

Earn funds from RoseFi

Rose earns protocol charges in two approaches: swap charges and curiosity on borrowed RUSDs.

The Rose DAO decides this commission.

As liquidity companies will be heavily subsidized by incentive schemes, the income produced from the swap / gross charges and curiosity from borrowed RUSD will be distributed to stroSE and protocol holders in the following part. :

- 63% of the protocol income will be utilized to obtain ROSEs on the secondary marketplace for distribution to strOSE holders.

- 37% of the protocol income will go to the treasury and the group

- After the token is distributed, thirty% of the income will go to the Rose group, which will serve as a developer fund to incentivize development and extended-phrase financing following two many years of vesting.

- seven% of the income will go to the treasury managed by the DAO

Basic information and facts about the ROSE token of the RoseFi undertaking

The RoseFi undertaking has three styles of tokens

- PINK: use to inspire customers

- Solid: governance token, income share earned by staking ROSE and can be utilized to borrow RUSD

- USD: stablecoin, priced at one USD

Key metrics of the ROSE token

- Token title: Pink

- Ticker: PINK

- Blockchain: AURORA

- Token normal: AURORA

- Contract: 0xdcd6d4e2b3e1d1e1e6fa8c21c8a323dcbecff970

- Token kind: Government

- Total provide: 408.665.849

- Maximum provide: one,000,000,000

- Circulating provide: 48.725.779

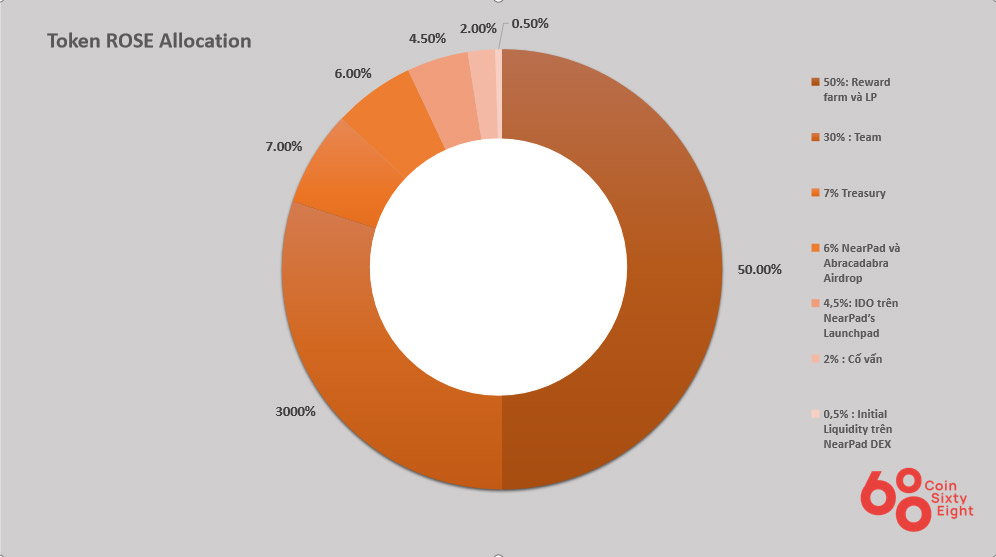

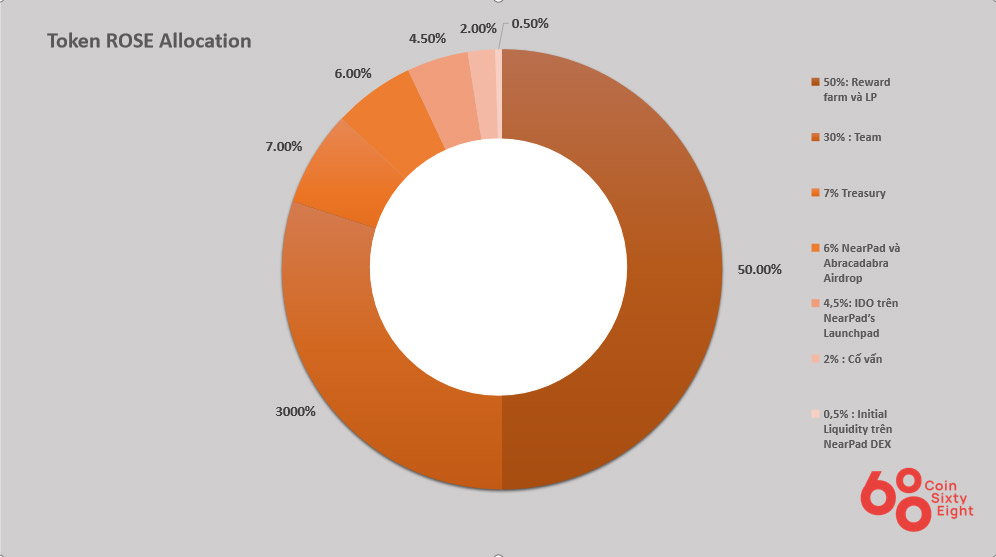

ROSE Token Allocation

- 50% (500m PINK): Encourage mining per farm and LP, halved for ten many years

- thirty% (300 million ROSEs): Team assignment – two many years: 66.seven% to start with 12 months and 33.three% 2nd 12 months

- seven% (70 million ROSEs): Funds: Used for marketing and advertising, probable group members, probable fundraisers, operations, strategic partnerships, proposals manufactured by the DAO

- six% (60 million ROSEs): NearPad and Abracadabra Airdrop – five% assigned to NearPad to be distributed to NearPad token stakeholders for two many years and one% airdrop to Abracadabra Spell holders

- four.five% (45 million ROSEs): IDO on NearPad Launchpad – Fundraising is utilized to produce original liquidity on NearPad dex and the rest is utilized for protocol operations

- two% (twenty million ROSE): Mentoring – maturation two many years: 66.seven% to start with 12 months and 33.three% 2nd 12 months

- .five% (five million ROSEs): Initial liquidity pool on NearPad DEX

Token use situation

Solid

You can stake and lock your ROSE to get strOSE applying the staking dashboard. The ROSE in staking has a blocking time of 24 hrs for assortment.

stroSE has three key functions:

- Earn 63% of the income produced by the protocol

- Vote on governance proposals

- Use as collateral to borrow RUSD

The stroSE tokens are constantly compounded. When you unsubscribe, you will get all ROSE tokens initially deposited plus any more ROSE earned from commissions.

RUSD – steady pegged currency

The Rose Dollar (RUSD) token is a USD-pegged stablecoin backed by curiosity-bearing tokens, primarily strOSE, and later on other SLP tokens from stableswap pools.

RUSD will depend on arbitrage to hold the fee at ~ $ one.

- A consumer who holds a debt, in RUSD, may well discover that RUSD is trading on some markets for significantly less than one USD and choose to invest in some RUSD at this price reduction to repay some of their debt. This obtain of RUSD will have a bullish impact relative to their volume.

- Users who hold legitimate collateral may well discover that the RUSD is trading in some markets over one USD and choose to promote the borrowed RUSD for use elsewhere. This trade will have the impact of reducing their costs relative to their volume.

- Users who hold other cryptocurrencies, (stablecoin or not) can see RUSD trading in a different way on two of the aforementioned markets and choose to invest in RUSD on a marketplace that prices significantly less than one USD and offered on one more marketplace for one USD or extra. . This can also come about in reverse.

In most instances, significantly of the marketplace-to-marketplace arbitrage is finished by automated bots that continually check pools for possibilities to capitalize on these arbitrages. This has the benefit that the pegs are adjusted relatively speedily.

Where to shop and invest in ROSE Tokens

Place to invest in and promote

You can totally invest in Rose Tokens on Rose.fi’s DEX right here: https://app.rose.fi/

Storage spot

Currently you can use Metamask, Coin98 Wallet to shop ROSE tokens as these two wallets help integration with Aurora blockchain, or you can transfer ROSE tokens to Near Wallet applying Rainbow Bridge.

RoseFi undertaking advancement roadmap

Updating…

RoseFi’s key advancement group

Updating…

RoseFi Investors / Supporters

Updating….

Evaluation of the RoseFi undertaking, do I have to invest in ROSE Token?

Overview, RoseFi undertaking is really a probable undertaking on the Aurora ecosystem, it can be stated that RoseFi is a steady swap and the to start with steady coin supplier on Aurora, in addition to the Mortgage function. Can speak RoseFi really related to the undertaking Aracadabra on the avalanche. However, this is not investment suggestions and the Defi danger is normally inevitable, you will need to cautiously think about ahead of building an investment determination.

This short article is not investment suggestions, you should really cautiously think about ahead of building selections when applying your funds. Coinlive is not accountable for any of your investment selections. I want you results and earn a great deal from this probable marketplace.

As funds flows are pouring into the Close to method suitable now, as degree two of Close to and the EVM engine utilized as a bridge for Ethereum, AURORA can act as an intermediary of the funds movement concerning Ethereum and Close to, therefore investment capital for AURORA in the long term it can develop even extra.

RoseFi undertaking the two a DEX exchange mixed with the Loan and Loan functions and entered the area of Stable Coin. When you mix three significant locations in DEFI collectively, maybe RoseFi will be a probable undertaking in the long term. So let us study Coinlive collectively RoseFi undertaking for a far better overview of this undertaking.

RoseFi undertaking overview

What is the RoseFi undertaking?

Rose.fi is a liquidity protocol on Aurora which consists of an exchange of stablecoins and asset wrapping and a collateralized stablecoin (CDP) that utilizes curiosity-bearing tokens as collateral.

Rose’s to start with merchandise, which is also a vital merchandise, is Stablecoin swap, which makes it possible for you to trade steady coins with extremely lower slippage, followed by Farms and Stake.

Particularities of the RoseFi undertaking

Stablecoin Exchange – Exchange steady coins with super lower slippage

The to start with merchandise is stables wap, the to start with decentralized Automated Market Maker (AMM) exchange on Aurora to trade fixed assets this kind of as stablecoins and assets with slip restrict and lower transaction charges.

Farm

Similar to other DEXs, you can leverage liquidity for revenue, to start with you will need to include assets

Pole

stRose will be utilized as collateral or as a share of the swap income. You can bet Rose tokens to get stRose

Vay – Borrow

Users can bet with Altcoins or other steady assets to borrow RUSD

Earn funds from RoseFi

Rose earns protocol charges in two approaches: swap charges and curiosity on borrowed RUSDs.

The Rose DAO decides this commission.

As liquidity companies will be heavily subsidized by incentive schemes, the income produced from the swap / gross charges and curiosity from borrowed RUSD will be distributed to stroSE and protocol holders in the following part. :

- 63% of the protocol income will be utilized to obtain ROSEs on the secondary marketplace for distribution to strOSE holders.

- 37% of the protocol income will go to the treasury and the group

- After the token is distributed, thirty% of the income will go to the Rose group, which will serve as a developer fund to incentivize development and extended-phrase financing following two many years of vesting.

- seven% of the income will go to the treasury managed by the DAO

Basic information and facts about the ROSE token of the RoseFi undertaking

The RoseFi undertaking has three styles of tokens

- PINK: use to inspire customers

- Solid: governance token, income share earned by staking ROSE and can be utilized to borrow RUSD

- USD: stablecoin, priced at one USD

Key metrics of the ROSE token

- Token title: Pink

- Ticker: PINK

- Blockchain: AURORA

- Token normal: AURORA

- Contract: 0xdcd6d4e2b3e1d1e1e6fa8c21c8a323dcbecff970

- Token kind: Government

- Total provide: 408.665.849

- Maximum provide: one,000,000,000

- Circulating provide: 48.725.779

ROSE Token Allocation

- 50% (500m PINK): Encourage mining per farm and LP, halved for ten many years

- thirty% (300 million ROSEs): Team assignment – two many years: 66.seven% to start with 12 months and 33.three% 2nd 12 months

- seven% (70 million ROSEs): Funds: Used for marketing and advertising, probable group members, probable fundraisers, operations, strategic partnerships, proposals manufactured by the DAO

- six% (60 million ROSEs): NearPad and Abracadabra Airdrop – five% assigned to NearPad to be distributed to NearPad token stakeholders for two many years and one% airdrop to Abracadabra Spell holders

- four.five% (45 million ROSEs): IDO on NearPad Launchpad – Fundraising is utilized to produce original liquidity on NearPad dex and the rest is utilized for protocol operations

- two% (twenty million ROSE): Mentoring – maturation two many years: 66.seven% to start with 12 months and 33.three% 2nd 12 months

- .five% (five million ROSEs): Initial liquidity pool on NearPad DEX

Token use situation

Solid

You can stake and lock your ROSE to get strOSE applying the staking dashboard. The ROSE in staking has a blocking time of 24 hrs for assortment.

stroSE has three key functions:

- Earn 63% of the income produced by the protocol

- Vote on governance proposals

- Use as collateral to borrow RUSD

The stroSE tokens are constantly compounded. When you unsubscribe, you will get all ROSE tokens initially deposited plus any more ROSE earned from commissions.

RUSD – steady pegged currency

The Rose Dollar (RUSD) token is a USD-pegged stablecoin backed by curiosity-bearing tokens, primarily strOSE, and later on other SLP tokens from stableswap pools.

RUSD will depend on arbitrage to hold the fee at ~ $ one.

- A consumer who holds a debt, in RUSD, may well discover that RUSD is trading on some markets for significantly less than one USD and choose to invest in some RUSD at this price reduction to repay some of their debt. This obtain of RUSD will have a bullish impact relative to their volume.

- Users who hold legitimate collateral may well discover that the RUSD is trading in some markets over one USD and choose to promote the borrowed RUSD for use elsewhere. This trade will have the impact of reducing their costs relative to their volume.

- Users who hold other cryptocurrencies, (stablecoin or not) can see RUSD trading in a different way on two of the aforementioned markets and choose to invest in RUSD on a marketplace that prices significantly less than one USD and offered on one more marketplace for one USD or extra. . This can also come about in reverse.

In most instances, significantly of the marketplace-to-marketplace arbitrage is finished by automated bots that continually check pools for possibilities to capitalize on these arbitrages. This has the benefit that the pegs are adjusted relatively speedily.

Where to shop and invest in ROSE Tokens

Place to invest in and promote

You can totally invest in Rose Tokens on Rose.fi’s DEX right here: https://app.rose.fi/

Storage spot

Currently you can use Metamask, Coin98 Wallet to shop ROSE tokens as these two wallets help integration with Aurora blockchain, or you can transfer ROSE tokens to Near Wallet applying Rainbow Bridge.

RoseFi undertaking advancement roadmap

Updating…

RoseFi’s key advancement group

Updating…

RoseFi Investors / Supporters

Updating….

Evaluation of the RoseFi undertaking, do I have to invest in ROSE Token?

Overview, RoseFi undertaking is really a probable undertaking on the Aurora ecosystem, it can be stated that RoseFi is a steady swap and the to start with steady coin supplier on Aurora, in addition to the Mortgage function. Can speak RoseFi really related to the undertaking Aracadabra on the avalanche. However, this is not investment suggestions and the Defi danger is normally inevitable, you will need to cautiously think about ahead of building an investment determination.

This short article is not investment suggestions, you should really cautiously think about ahead of building selections when applying your funds. Coinlive is not accountable for any of your investment selections. I want you results and earn a great deal from this probable marketplace.