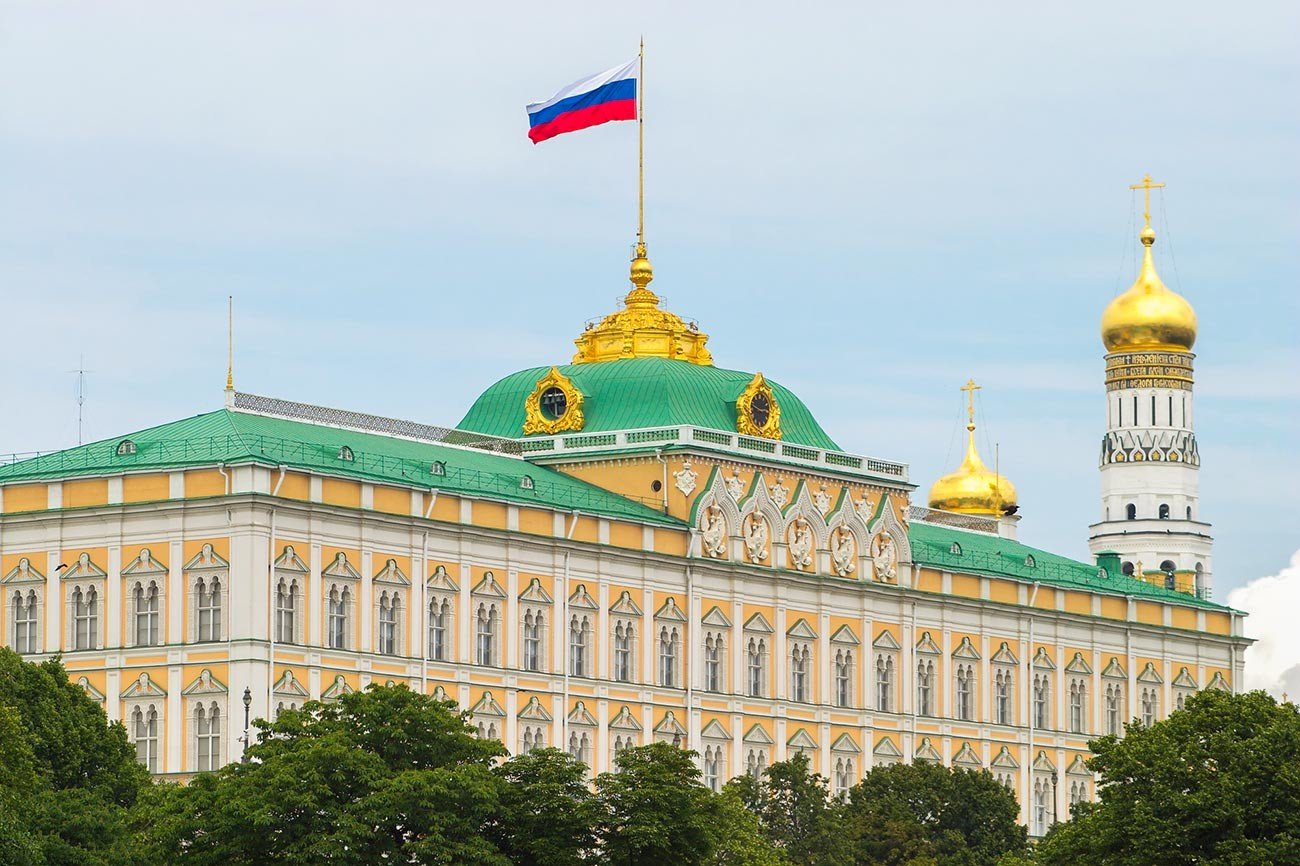

In light of the continuing regulatory stress on cryptocurrencies In Russia, the proposal of a senior member of the Russian parliament has brought quite a few optimistic indications.

The chairman of the State Duma’s Industry and Trade Committee (the reduced home of the Russian parliament), Vladimir Gutenev, advised RIA Novosti information company that the nation must not be permitted to freely circulate cryptocurrencies simply because pose dangers to other nations. eligible, but Russia may possibly enable the use of gold-backed stablecoins and government-managed cryptocurrency mining.

On January twenty, the Central Bank of Russia (CBR) launched a consultation paper, presenting a in depth see on cryptocurrencies, proposing an outright ban on cryptocurrencies. Meanwhile, the financial institution is beginning the pilot phase of its digital ruble undertaking (CBDC).

Gutenev agrees that cryptocurrencies must be banned, but Russia can use gold-backed, state-managed stablecoins. Such a money product or service would be an interesting initiative for each personal traders and firms.

He also shared that Russia can use this stablecoin to stay away from sanctions and containment policies imposed on the nation, as effectively as to facilitate common and transparent financial relations with other nations and other households.

Gutenev exposed that he mentioned the notion with RBC governor Elvira Nabiullina. The head of the Industry and Trade Commission explained that as an asset, gold is undervalued relative to reserve fiat currencies this kind of as the dollar and the euro.

In October, the State Department explained Russia may possibly contemplate changing the USD in its reserves and trade offers with other currencies and even cryptocurrencies amid US sanctions.

Commenting on the Russian Central Bank’s request to ban cryptocurrency mining, Vladimir Gutenev explained he believes cryptocurrencies can be permitted to operate legally if their manufacturing method is regulated and strictly managed by the state. In the previous, various Russian government companies have also expressed help for this.

Furthermore, miners can get benefit of the abundant vitality sources and favorable climatic disorders in some areas of Russia, as extended as their services are presented transparently and spend the total tax due. Overall, from Gutenev’s argument, it can be confirmed that the Russian House of Representatives nevertheless would like to make cryptocurrency mining a small business.

However, a functioning group in the reduced home of the Russian parliament is at present getting ready proposals to fill the regulatory “void” in the crypto room left by the government immediately after the law was passed. Members are anticipated to handle persistent concerns in various parts, which include regulatory standing, cryptocurrency trading, and mining. The great information is that not all government institutions share the Bank of Russia’s uncompromising stance on this challenge.

Synthetic currency 68

Maybe you are interested:

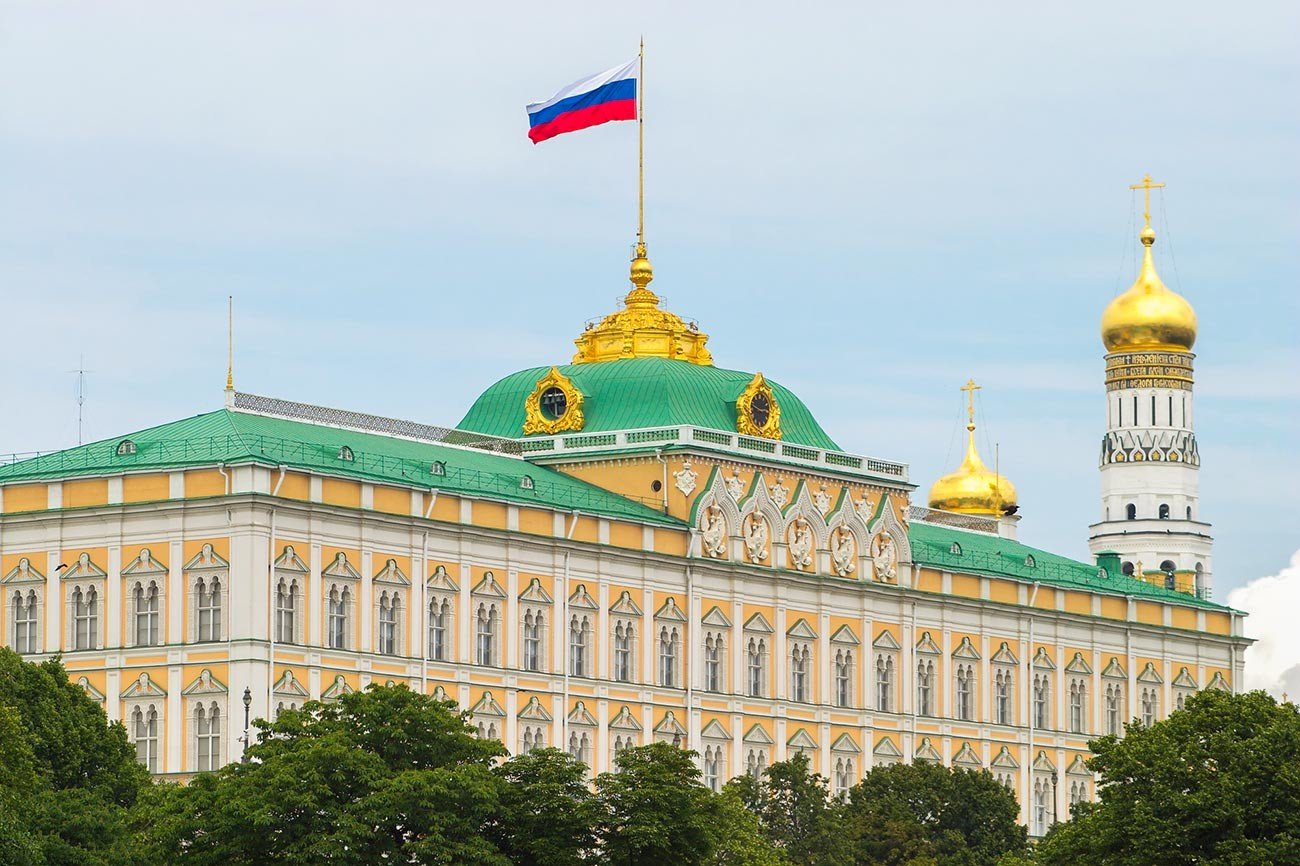

In light of the continuing regulatory stress on cryptocurrencies In Russia, the proposal of a senior member of the Russian parliament has brought quite a few optimistic indications.

The chairman of the State Duma’s Industry and Trade Committee (the reduced home of the Russian parliament), Vladimir Gutenev, advised RIA Novosti information company that the nation must not be permitted to freely circulate cryptocurrencies simply because pose dangers to other nations. eligible, but Russia may possibly enable the use of gold-backed stablecoins and government-managed cryptocurrency mining.

On January twenty, the Central Bank of Russia (CBR) launched a consultation paper, presenting a in depth see on cryptocurrencies, proposing an outright ban on cryptocurrencies. Meanwhile, the financial institution is beginning the pilot phase of its digital ruble undertaking (CBDC).

Gutenev agrees that cryptocurrencies must be banned, but Russia can use gold-backed, state-managed stablecoins. Such a money product or service would be an interesting initiative for each personal traders and firms.

He also shared that Russia can use this stablecoin to stay away from sanctions and containment policies imposed on the nation, as effectively as to facilitate common and transparent financial relations with other nations and other households.

Gutenev exposed that he mentioned the notion with RBC governor Elvira Nabiullina. The head of the Industry and Trade Commission explained that as an asset, gold is undervalued relative to reserve fiat currencies this kind of as the dollar and the euro.

In October, the State Department explained Russia may possibly contemplate changing the USD in its reserves and trade offers with other currencies and even cryptocurrencies amid US sanctions.

Commenting on the Russian Central Bank’s request to ban cryptocurrency mining, Vladimir Gutenev explained he believes cryptocurrencies can be permitted to operate legally if their manufacturing method is regulated and strictly managed by the state. In the previous, various Russian government companies have also expressed help for this.

Furthermore, miners can get benefit of the abundant vitality sources and favorable climatic disorders in some areas of Russia, as extended as their services are presented transparently and spend the total tax due. Overall, from Gutenev’s argument, it can be confirmed that the Russian House of Representatives nevertheless would like to make cryptocurrency mining a small business.

However, a functioning group in the reduced home of the Russian parliament is at present getting ready proposals to fill the regulatory “void” in the crypto room left by the government immediately after the law was passed. Members are anticipated to handle persistent concerns in various parts, which include regulatory standing, cryptocurrency trading, and mining. The great information is that not all government institutions share the Bank of Russia’s uncompromising stance on this challenge.

Synthetic currency 68

Maybe you are interested: