A new venture capital fund referred to as “Protagonist” constructed jointly by Saber Labs has officially launched with a spending budget of $ one hundred million.

Founders include things like Dylan Macalinao and Ian Macalinao of Saber Labs, the “team” behind the decentralized cross-chain exchange on Solana, which has just produced a $ one hundred million improvement fund.

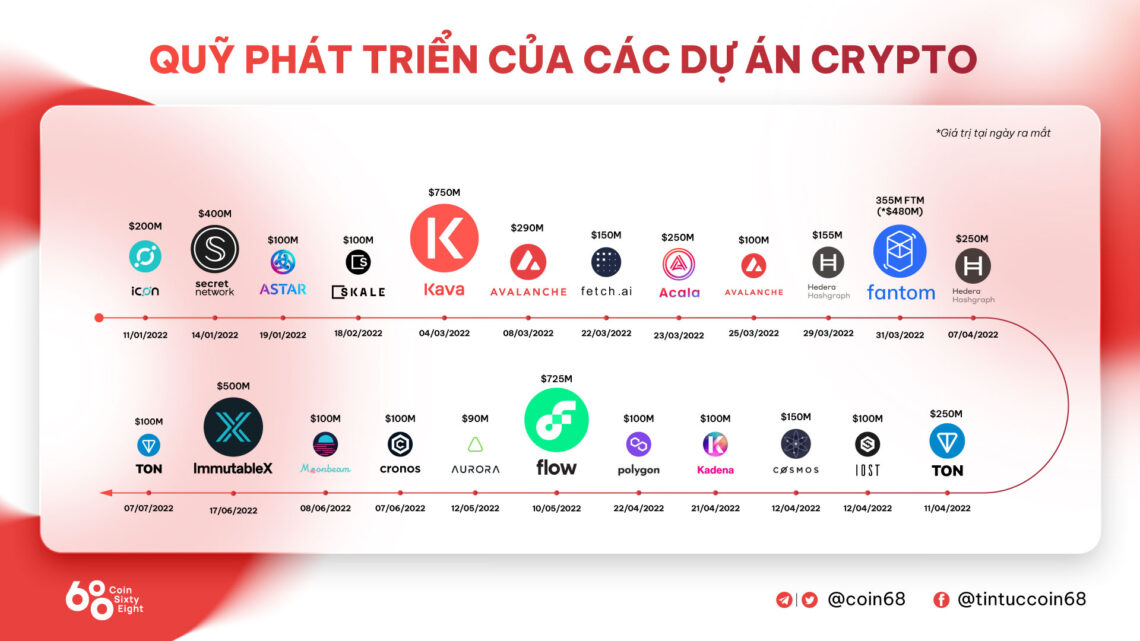

Headquartered in Miami, Protagonist ideas to invest and incubate early-stage Web3 protocols and startups targeted on gaming, infrastructure, safety and privacy. Recently, the basis funded Aptos, a new degree one blockchain Cardinal, an NFT utility protocol on Solana and Cogni, a digital banking platform. Furthermore, Protagonist is also establishing and incubating our personal protocols.

Macalinao stated in a statement:

“Protagonist is targeted on the investment and incubation of basic protocols that help the emerging Web3 ecosystem. More blockchains will proceed to thrive as just about every network varieties its personal application niche and in excess of the following twenty many years we are enthusiastic to perform an significant function in supporting these networks. “

The fund was jointly founded by two angelic entrepreneurs and traders George Bousis and Harry Hurst. Bousis is the founder and CEO of Raise and Slide, a business that presents payment answers, present cards and loyalty applications. Hurst is the co-founder and CEO of Pipe, a recurring income trading platform.

It is not clear who is behind the Protagonist and the fund does not reveal its traders. For Saber Labs – the business raised $ seven.seven million final 12 months from Chamath Palihapitiya’s Social Capital, Multicoin Capital and Jump Capital. Saber is at this time the 11th biggest Solana protocol in terms of TVL, with somewhere around $ 95 million in assets locked onto the platform, in accordance to information flowing from DeFi blade.

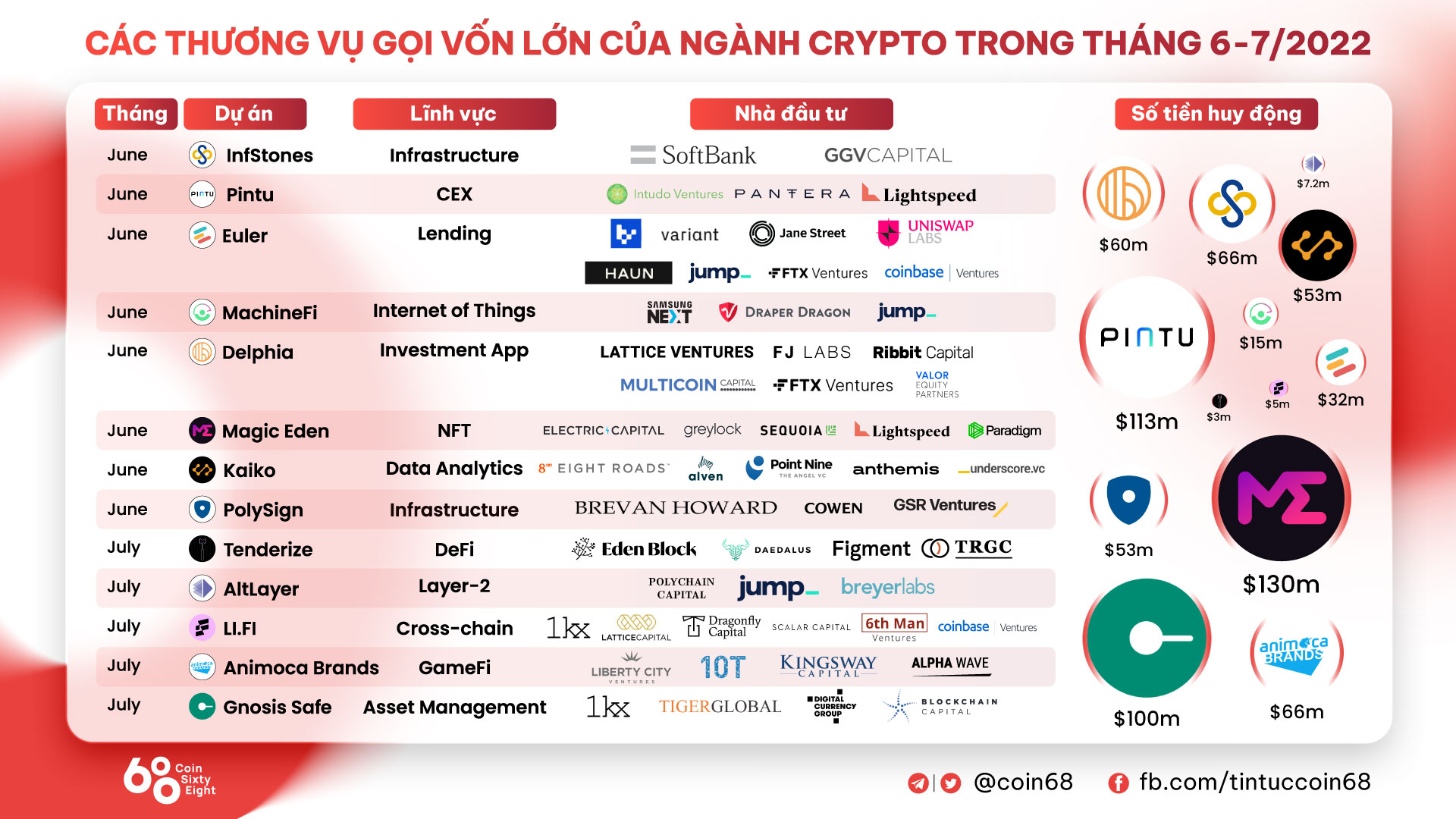

This move has positioned Saber amid the couple of big businesses that have produced an ecosystem improvement fund in the midst of a struggling market place. Just tonight, the market place seems to be “peppered” with a slew of information calling for capital to set up a improvement fund of hundreds of hundreds of thousands of bucks. The newest is the giant Animoca Brands which has raised $ 75 million to carry the company’s valuation to $ five.9 billion and the asset management platform by means of clever contract Gnosis Safe has also closed a round of financing of one hundred million. bucks. Veteran investment fund Multicoin Capital was also “named” minutes in the past when it just launched a third venture fund really worth $ 430 million.

Synthetic currency 68

Maybe you are interested: