Following FTX’s $420 million funding round in October 2021, CEO Sam Bankman-Fried offered his stake and raised $300 million.

FTX CEO Sam Bankman-Fried quietly raised $300 million from the sale of FTX stock in the exchange’s $420 million funding round in October 2021, in accordance to FTX sources. Wall Street Journal.

Mr. Sam Bankman-Fried advised traders at the time that the revenue raised would enable FTX broaden and cooperate with regulators, but in actuality a lot of the revenue was made use of to shell out the trader. ‘exchange from Binance .

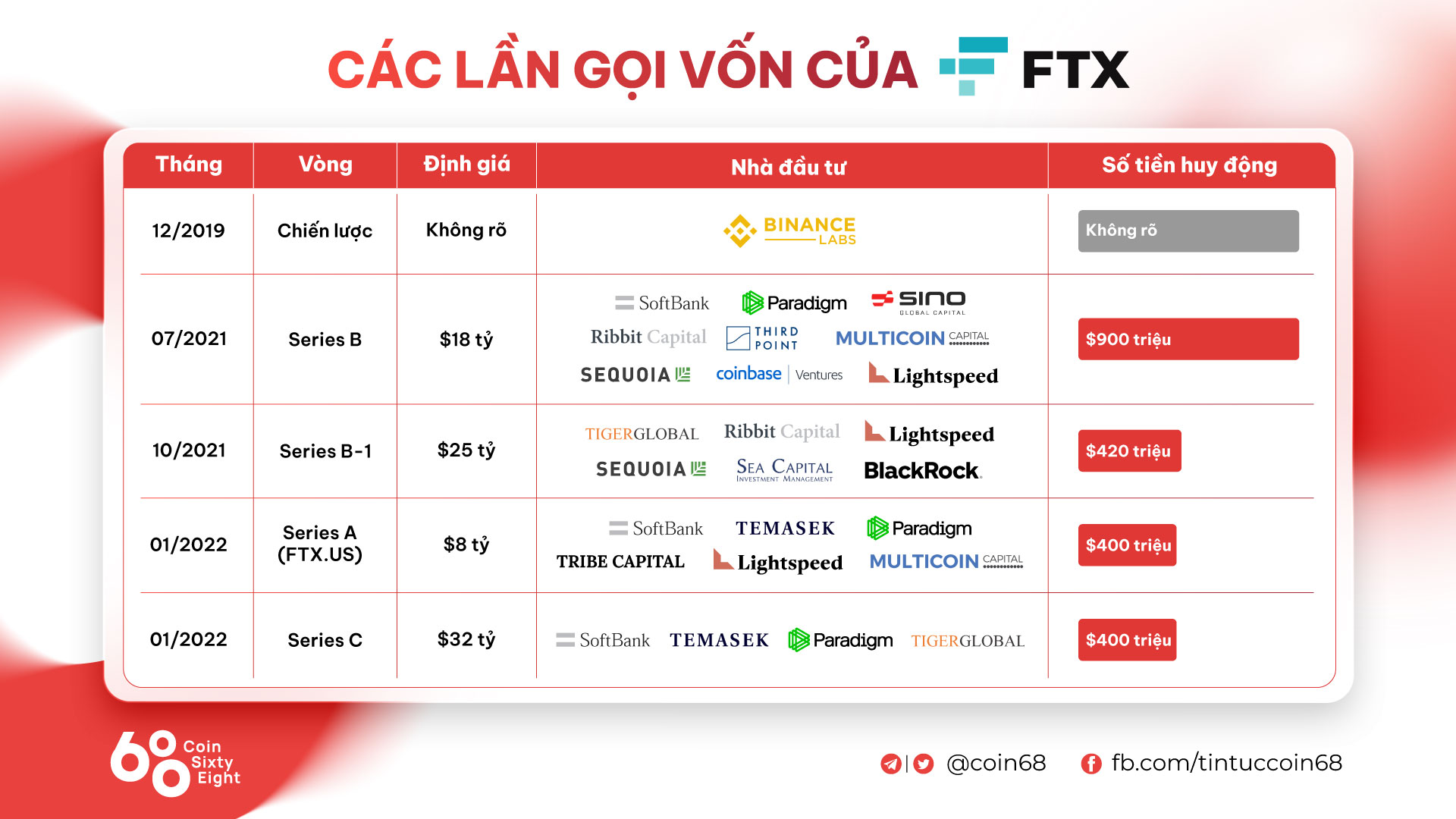

In the following months, FTX continued to increase practically $one.five billion in funding efforts, with participation from several nicely-acknowledged hedge money this kind of as BlackRock, Sequoia Capital and Temasek, with FTX’s valuation getting pushed to $32 billion. bucks.

The Wall Street Journal mentioned it was unclear what CEO Sam Bankman-Fried did with the $300 million, though FTX’s 2021 monetary report says the exchange made use of the revenue to commit on behalf of a associated companion. .

As exposed by Binance CEO Changpeng Zhao in early November, FTX has invested up to $two.one billion to obtain back Binance’s stake in FTX, with $580 million in the type of FTT tokens. Since he no longer believes in the monetary health and fitness of FTX, Mr. Zhao determined to liquidate all these FTTs, building a wave of enormous withdrawals and triggering FTX to go bankrupt just five days later on. The exchange is accused of stealing revenue from consumers at the Alameda Reseach fund and dropping revenue, main to a deficit of up to $eight-ten billion.

Mr. Sam Bankman-Fried later on resigned as CEO of FTX, producing several perplexing statements on Twitter and was observed to be “admitting guilt” right after personal conversations revealing his correct nature had been leaked to the public network.

Synthetic currency68

Maybe you are interested: