The US Securities Commission (SEC) needs to clarify the function of the Jump Crypto fund and president Kanav Kariya in the 1st depeg in 2021.

Cryptocurrency President Kanav Kariya Skips. Photo: CoinDesk

Cryptocurrency President Kanav Kariya Skips. Photo: CoinDesk

According to a short while ago published details, the US Securities and Exchange Commission (SEC) questioned the head of Jump Crypto, Kanav Kariya, about the function of this fund in the 1st depeg of the stablecoin UST in 2021. Previously, there had been allegations in accordance which Jump invested its very own income to get UST on the marketplace to enable this stablecoin return to the worth of one USD, then was compensated by Terraform Labs by transferring LUNA.

LUNA-UST in the end collapsed in May 2022, wiping out $60 billion from the cryptocurrency sector.

The SEC has begun investigating no matter if former Jump Crypto CEO Kanav Kariya entered into a secret deal with Do Kwon of Terraform Labs for the duration of the collapse of the TerraUSD stablecoin, in which Jump will enable restore UST’s peg by buying the tokens . https://t.co/MqwX5OLmn2

— Wu Blockchain (@WuBlockchain) November 9, 2023

This is element of a greater SEC investigation focusing on Terraform Labs and CEO Do Kwon, alleging that LUNA and UST are securities. Mr. Do Kwon is in prison in Montenegro for working with a fake passport and is nevertheless fighting extradition by the United States and South Korea.

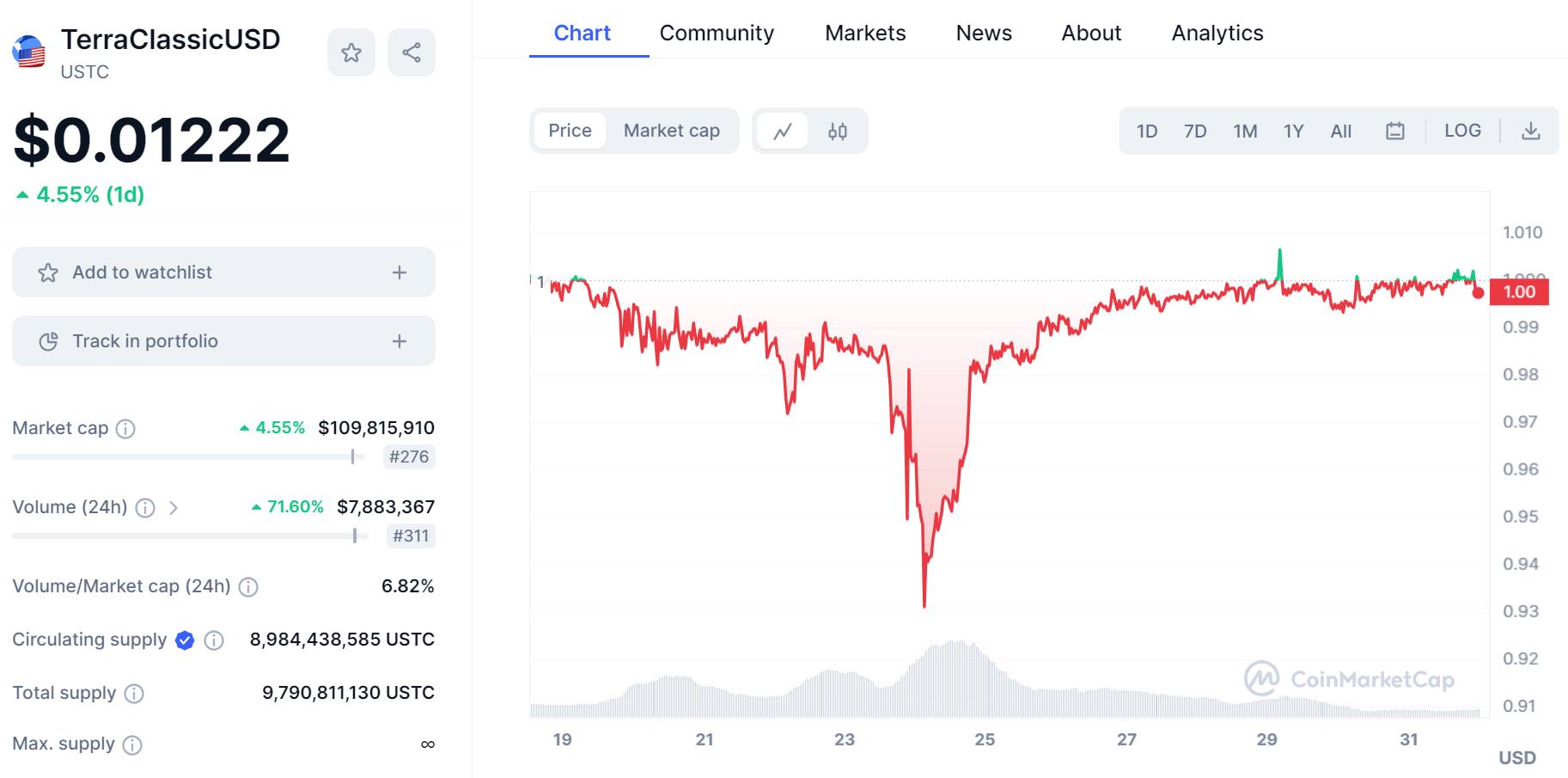

Specifically, the SEC claims that in May 2021 Terraform Labs and Jump Crypto reached a secret agreement to conserve the cost of UST when this stablecoin fell to $.92. As a end result, Jump will shell out income to get UST in the marketplace to lower provide, as a result assisting UST return to the $one mark a handful of days later on.

– Detail: The SEC confirms that Jump Trading is the “mysterious investment fund” that manipulated the cost of LUNA-UST

The 1st depeg of the UST stablecoin in May 2021. Source: CoinMarketCap

The 1st depeg of the UST stablecoin in May 2021. Source: CoinMarketCap

In exchange, Terraform Labs will amend the terms of Jump’s LUNA loan agreement, making it possible for the fund to unlock the tokens sooner. The volume traded was 61.four million LUNA, with a promoting cost 99% decrease than the marketplace cost at the time, the SEC stated. Jump is stated to have earned as considerably as $one.three billion from unlocking LUNA early.

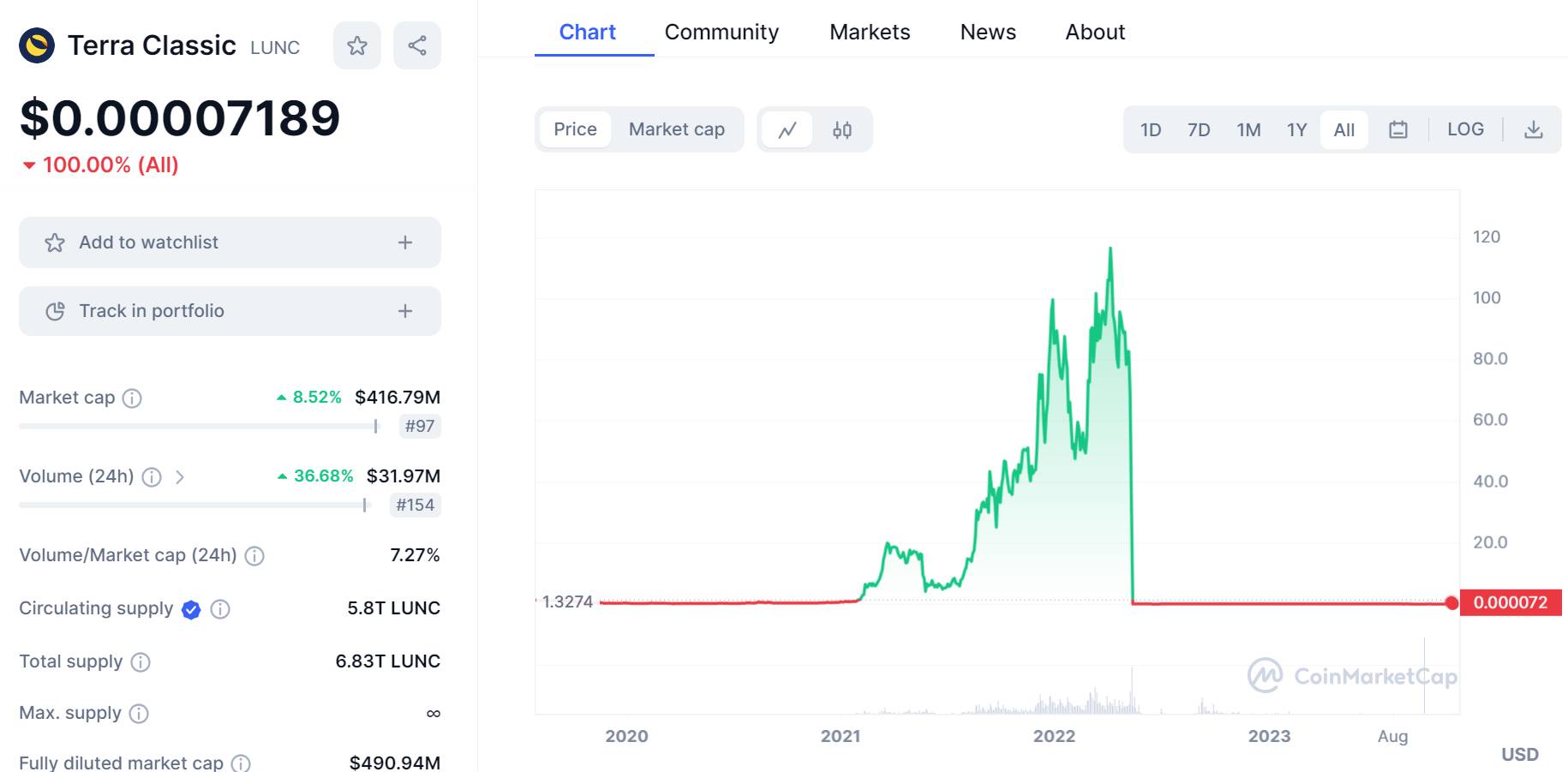

Terraform Labs and Do Kwon later on stated that UST’s re-pegging was evidence of the effectiveness of the stablecoin algorithmic model, attracting much more men and women to think in the task. The cost of LUNA went from $six at the finish of May 2021 to a peak of $116 in April 2022, just a month ahead of almost everything collapsed.

LUNA cost fluctuations in excess of its working background from 2019 to 2023. Source: CoinMarketCap

LUNA cost fluctuations in excess of its working background from 2019 to 2023. Source: CoinMarketCap

During the interrogation, Mr Kanav Kariya refused 9 occasions to solution inquiries from the SEC, as a result triggering the Fifth Amendment, which will allow American citizens to retain details except if questioned in the presence of a jury in court.

In a deposition with the SEC, Jump Crypto’s Kanav Kariya was asked right, beneath oath, no matter if Jump had promised to bail out Do Kwon and restore the UST peg in exchange for a LUNA bribe.

He invoked the fifth. pic.twitter.com/5iQK0skk4P

— FatMan (@FatManTerra) November 8, 2023

As exposed by writer Michael Lewis in the guide To infinity Referring to the collapse of FTX, Jump Crypto and its mother or father corporation, Jump Trading, misplaced much more than $200 million, creating them amid the exchange’s major 50 greatest creditors.

Terraform Labs, at the similar time, experimented with to blame the collapse of LUNA-UST on the famed Wall Street investment fund Citadel Securities, but this fund denied it.

Coinlive compiled

Join the discussion on the hottest concerns in the DeFi marketplace in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!