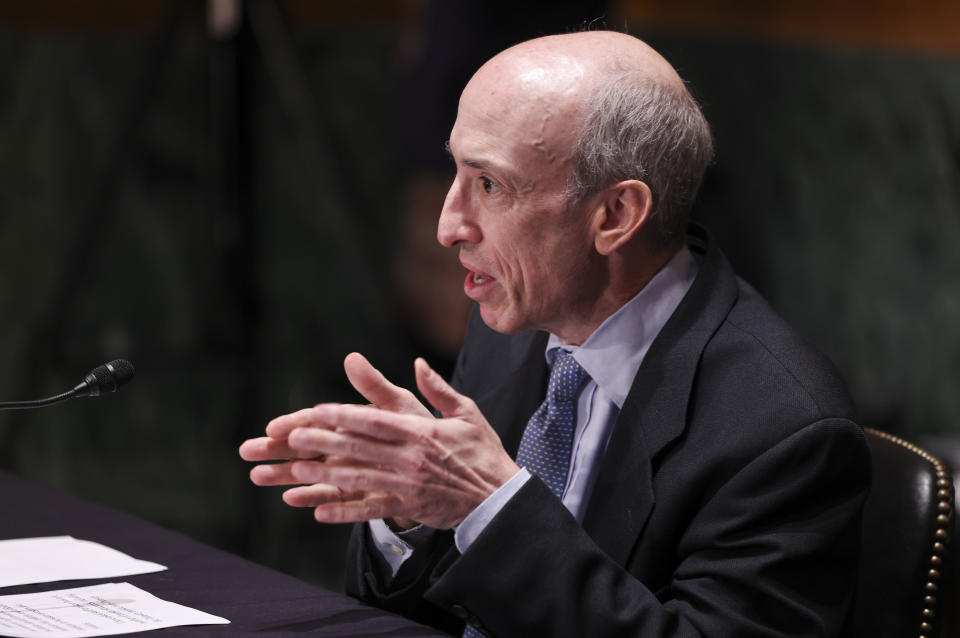

During a hearing that took spot at dawn this morning (Vietnam time), SEC Chairman Gary Gensler explained his company will not ban cryptocurrencies.

US Securities and Exchange Commission (SEC) Chairman Gary Gensler informed the US House of Representatives that the cryptocurrency will not be banned by the SEC, as it is outdoors its jurisdiction.

Asked by Congressman Ted Budd of the Congressional Blockchain Research Group if the SEC intends to comply with in the footsteps of China’s latest cryptocurrency ban, Gensler replied:

SEC Chairman: No curiosity in cryptocurrency ban pic.twitter.com/0nKClodhu0

– Mr. Whale (@CryptoWhale) October 5, 2021

“No, this is completely up to Congress.

As this kind of, the SEC chairman requires a equivalent stance to Federal Reserve Chairman Jerome Powell, who testified just before the House of Representatives final week that he would not ban cryptocurrencies, as previously reported.

Additionally, Mr. Gensler was asked several a lot more queries by MPs relating to cryptocurrencies, most notably the SEC regulation relating to cryptocurrency exchanges, the two centralized (CEX) and decentralized (DEX). ) stablecoin sector and the nature of cryptocurrency securities.

The SEC chief went on to reiterate his former stance that cryptocurrency exchanges should register with the SEC to be topic to clear regulation. He explained:

“Decentralized cryptocurrency platforms, aka DeFi, are also essentially centralized protocols. Even if they don’t hold the same currencies as traditional exchanges, in my opinion both are subject to the same regulation ”.

Gensler also pointed out the fiscal hazards that stablecoins can deliver, even further likening them to “poker money paper” and requiring a lot more regulation to handle them, saying “most of the people there are”. “Cryptocurrencies now belong to the” securities “group.

“The stablecoin section with a industry cap of $ 125 billion is like a card on the poker table correct now. I consider if they carry on to increase as they are, developing ten instances in worth final 12 months, it could signify a massive-scale systemic threat. “

US lawmakers are also placing stablecoins on the table, with the Treasury Department and the White House expressing a wish to thoroughly investigate the field to pave the way for regulation.

The SEC a short while ago unveiled that it is opening an investigation into Circle, the 2nd greatest stablecoin issuer in the cryptocurrency industry, USDC. In addition, the company also investigated the greatest US cryptocurrency exchange Coinbase and the top DeFi DEX platform Uniswap. The SEC is also filing a lawsuit towards Ripple, arguing that XRP is really “security in disguise”.

One subject that was not covered at the hearing was the bill to “relax” the laws for crypto tasks, providing them 3 many years to difficulty tokens devoid of registering for the sale of securities, offered it demands to be decentralized and thoroughly disclosed in the course of this time period. The new bill stems from a proposal from a senior SEC official with a professional-crypto stance.

Synthetic Currency 68

Maybe you are interested: