CEO of BitGo Mike Belshe launched an “unpleasant” statement amid the wave named spot Bitcoin ETFs in the United States.

In one particular interview lately with the information company BloombergBitGo CEO Mike Belshe believes the US Securities Commission (SEC) will reject a amount of applications to register Bitcoin spot ETFs, in spite of significantly optimistic speculation present in the marketplace.

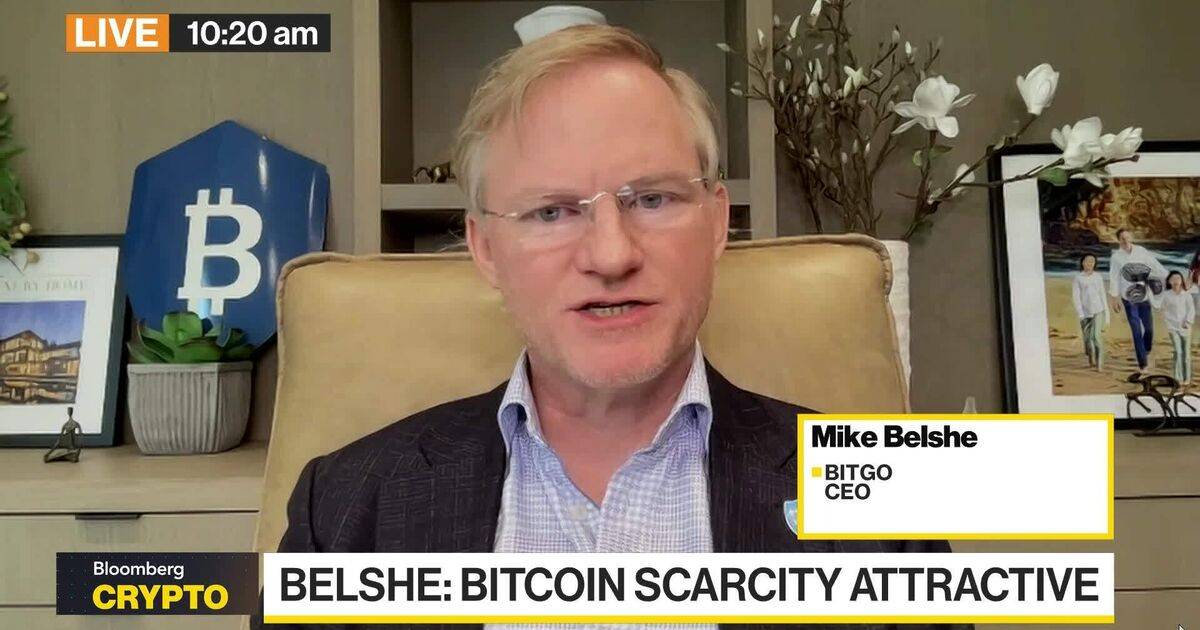

“Bitcoin in particular has this element of scarcity. Which seems pretty attractive to investors,” says Mike Belshe, CEO of cryptocurrency marketplace BitGo. https://t.co/roMhtrRo6Q pic.twitter.com/sO13UPLHXv

— Bloomberg Crypto (@crypto) November 15, 2023

While he does not suggest to extinguish hope or deny the beneficial developments relating to the Bitcoin spot ETF as of late, Mike Belshe stated that the marketplace requires to strengthen its construction for the SEC to make an official choice.

“It is very likely that we will continue to see another rejection before we get the final good news.”

According to Belshe, paperwork submitted to the SEC – typically selecting Coinbase as the ETF’s custodian companion – are nevertheless ambiguous among the exchange and supervisory unit ideas. Belshe stated:

“There are a lot of risks that need to be addressed with Coinbase. I think the SEC can absolutely say no until institutions can separate the exchange from custody and improve the market structure first.”

The BitGo director’s remarks came at a time when the cryptocurrency marketplace was extremely fired up about the run-up of Bitcoin spot ETFs, when analysts had been Increase the SEC approval charge for this kind of solution to 90%.

Over the many years, although green light for the futures kindthe US securities regulator has so far not accepted any spot ETF proposals, for the reason that it believes this marketplace possible dangers of manipulation and fraud. However, the plaintiffs argued that the agency’s issues had been unfounded provided what the SEC had accepted for the Bitcoin futures ETF.

There are now twelve asset management giants awaiting a “ruling” from the SEC above their set of ETF filings. In which BlackRock is pioneering on this track, along with VanEck, Bitwise, WisdomTree, Valkyrie, Fidelity, Invesco, ARK Invest, Global X, HashdexAND Franklin Templeton. The Securities Commission also arrived in the early morning of November sixteen made the decision to delay two recommendations Hashdex Bitcoin Spot ETF AND Grayscale Ethereum Futures ETF.

ETF fever additional momentum Bitcoin (BTC) continually sets new highs in 2023. The highest achievement this genuine coin has accomplished due to the fact then Collapse of the LUNA-UST is the threshold of $37,980. Only from now BlackRock initiates ETF filing with SECBitcoin also enhanced by 45%.

Coinlive compiled

Join the discussion on the hottest challenges in the DeFi marketplace in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!