Silverbank’s share rate has dropped just about 50% just after a wave of lousy information with regards to current volatility in the cryptocurrency marketplace.

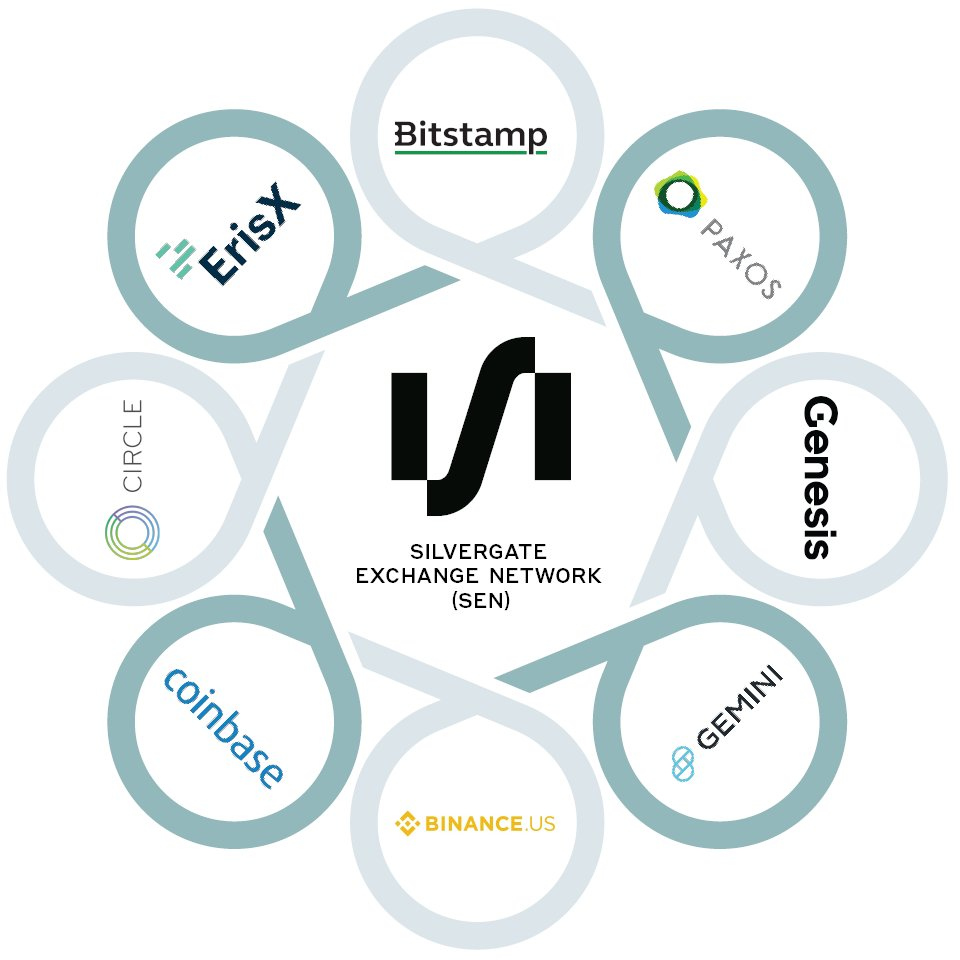

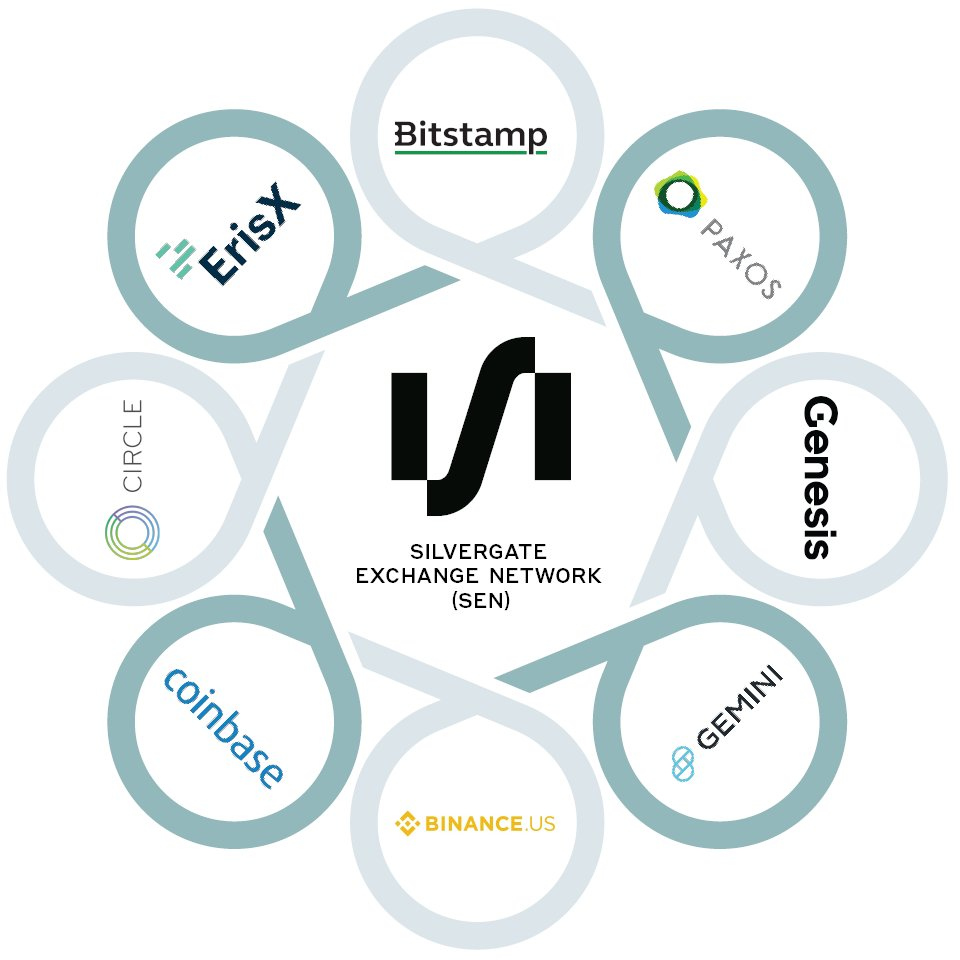

Silvergate is a US-based mostly financial institution effectively regarded in the cryptocurrency globe for offering banking answers to crypto businesses across the SEN network. At a single level, Silvergate was the banking spouse of most cryptocurrency exchanges working in the US, but as of early 2023, the bank’s web site only had the logos of five cryptocurrency businesses, which includes Coinbase, Kraken and Bitstamp and two stablecoin issuers, Circle (USDC) and Paxos (BUSD, USDP).

At the commence of the trading session on January five (US time), Silverbank’s SI share rate at a single level fell 48% on a spate of adverse information focusing on the bank’s romance with other important businesses of the cryptocurrency sector in the United States.

According to its Q4 2022 monetary report, Silvergate consumers have withdrawn additional than $eight billion in deposits, bringing the quantity of income in the financial institution from $eleven.9 billion to $three.eight billion, equal to a drop of six.eight%. Observers say this is a direct impact of the collapse of cryptocurrency exchange FTX, which has because rocked the cryptocurrency marketplace with widespread influence nonetheless nowadays.

Even so, Silvergate CEO Alan Lane reassured traders that the bank’s predicament was fine. He mentioned:

“In response to events in the digital assets industry in Q4, we took precautions to ensure there was sufficient liquidity to meet withdrawal needs and are currently maintaining a high cash balance versus deposits related to digital assets.”

The monetary report also uncovered that Silvergate offered up to $five.four billion in debt securities in the fourth quarter to increase income for withdrawal requests. As of December 31, 2022, the financial institution holds $four.six billion in income, stating that this is larger than the quantity of consumer deposits connected to the cryptocurrency sector.

Silvergate mentioned it accomplished $one.three billion in day-to-day processing volume in the fourth quarter, up from $one.two billion in the prior quarter, indicating that organization remained secure. The financial institution confirmed that loans via the SEN network continued to operate commonly, with no losses or liquidations.

However, Silvergate announced it would lay off 200 workers, equivalent to forty% of the staffing apparatus. The cause for the cuts is to “address the reality” of the cryptocurrency economic system and sector, assisting the financial institution deal with charges “amid a more challenging macro environment.”

Furthermore, the financial institution also agreed to eliminate a $196 million investment by obtaining the Diem stablecoin venture that Facebook abandoned in February 2021. Bank says:

“Due to the huge upheavals that have taken place in the digital asset industry, this change reflects the bank’s view that it is no longer feasible to roll out a blockchain-based payment solution.”

Synthetic currency68

Maybe you are interested:

Silverbank’s share rate has dropped just about 50% just after a wave of lousy information with regards to current volatility in the cryptocurrency marketplace.

Silvergate is a US-based mostly financial institution effectively regarded in the cryptocurrency globe for offering banking answers to crypto businesses across the SEN network. At a single level, Silvergate was the banking spouse of most cryptocurrency exchanges working in the US, but as of early 2023, the bank’s web site only had the logos of five cryptocurrency businesses, which includes Coinbase, Kraken and Bitstamp and two stablecoin issuers, Circle (USDC) and Paxos (BUSD, USDP).

At the commence of the trading session on January five (US time), Silverbank’s SI share rate at a single level fell 48% on a spate of adverse information focusing on the bank’s romance with other important businesses of the cryptocurrency sector in the United States.

According to its Q4 2022 monetary report, Silvergate consumers have withdrawn additional than $eight billion in deposits, bringing the quantity of income in the financial institution from $eleven.9 billion to $three.eight billion, equal to a drop of six.eight%. Observers say this is a direct impact of the collapse of cryptocurrency exchange FTX, which has because rocked the cryptocurrency marketplace with widespread influence nonetheless nowadays.

Even so, Silvergate CEO Alan Lane reassured traders that the bank’s predicament was fine. He mentioned:

“In response to events in the digital assets industry in Q4, we took precautions to ensure there was sufficient liquidity to meet withdrawal needs and are currently maintaining a high cash balance versus deposits related to digital assets.”

The monetary report also uncovered that Silvergate offered up to $five.four billion in debt securities in the fourth quarter to increase income for withdrawal requests. As of December 31, 2022, the financial institution holds $four.six billion in income, stating that this is larger than the quantity of consumer deposits connected to the cryptocurrency sector.

Silvergate mentioned it accomplished $one.three billion in day-to-day processing volume in the fourth quarter, up from $one.two billion in the prior quarter, indicating that organization remained secure. The financial institution confirmed that loans via the SEN network continued to operate commonly, with no losses or liquidations.

However, Silvergate announced it would lay off 200 workers, equivalent to forty% of the staffing apparatus. The cause for the cuts is to “address the reality” of the cryptocurrency economic system and sector, assisting the financial institution deal with charges “amid a more challenging macro environment.”

Furthermore, the financial institution also agreed to eliminate a $196 million investment by obtaining the Diem stablecoin venture that Facebook abandoned in February 2021. Bank says:

“Due to the huge upheavals that have taken place in the digital asset industry, this change reflects the bank’s view that it is no longer feasible to roll out a blockchain-based payment solution.”

Synthetic currency68

Maybe you are interested: