This Singapore pilot is component of Project Guardian’s program to increase the attain and examine the multi-utilities of digital assets, such as payments and wallet management solutions.

Singapore partners with 17 fiscal institutions to trial asset tokenization

Singapore partners with 17 fiscal institutions to trial asset tokenization

According to the announcement of Monetary Authority of Singapore (MAS)this unit is collaborating with 17 key fiscal institutions to examine include additional asset tokenization initiatives and jointly produce platforms to increase the tokenization market place.

This is component of the “Guardian” task program, announced by MAS at the finish of October 2023 by means of cooperation with the nationwide fiscal management companies of Japan, the United Kingdom and Switzerland, aims to improve liquidity, unlock a lot more investment options and boost efficiency of the fiscal market place.

MAS announced that it is functioning with the fiscal market to increase asset tokenization initiatives and produce core abilities to scale tokenized markets.

LIGHT: https://t.co/J1OD1QA83N

—MAS (@MAS_sg) November 15, 2023

Tokenization is the method of digitizing serious-planet assets – Real World Assets (RWA) – luxurious NFT token or kind that can be made use of in DeFi utilizing blockchainIt’s a scorching trend in banking institutions and organizations all around the planet.

17 significant fiscal institutions have been picked by the Singapore Financial Conduct Authority to pilot asset tokenization use situations, featured prominently on the checklist are the following names:

- JP Morgan – The “big” American financial institution

- Asset management firm Loyalty investments

- Group of ants – Fintech giant belonging to the Alibaba group founded by billionaire Jack Ma

- Apollo Global Management – Traditional investment money

- Citi Group – A fiscal empire of more than 200 many years primarily based in Manhattan (New York, USA) and is the financial institution with the 3rd highest asset worth in the United States

- Franklin Templeton – The firm manages assets of virtually one,500 billion bucks

- Standard charter – First financial institution in the United Kingdom

- UBS AG Group – UBS is the greatest multinational fiscal solutions and investment banking management group in Switzerland

- DBS – The greatest financial institution in Singapore

In there:

- Citi, T. Rowe Price Associates, Inc. and Fidelity International will experiment with mechanisms to rate and execute digital asset transactions, then present serious-time publish-trade reporting and evaluation

- BNY Mellon and OCBC Test a safe and interoperable foreign currency cross-border payment resolution across several networks.

- Group of ants will pilot a serious-time treasury management resolution by means of its international treasury center in Singapore, which supports a lot more than forty currencies.

- Franklin Templeton examine issuing a tokenized income market place fund by means of a variable capital firm (VCC) framework, which makes use of a network of digital assets to sustain a registry of the fund’s shares.

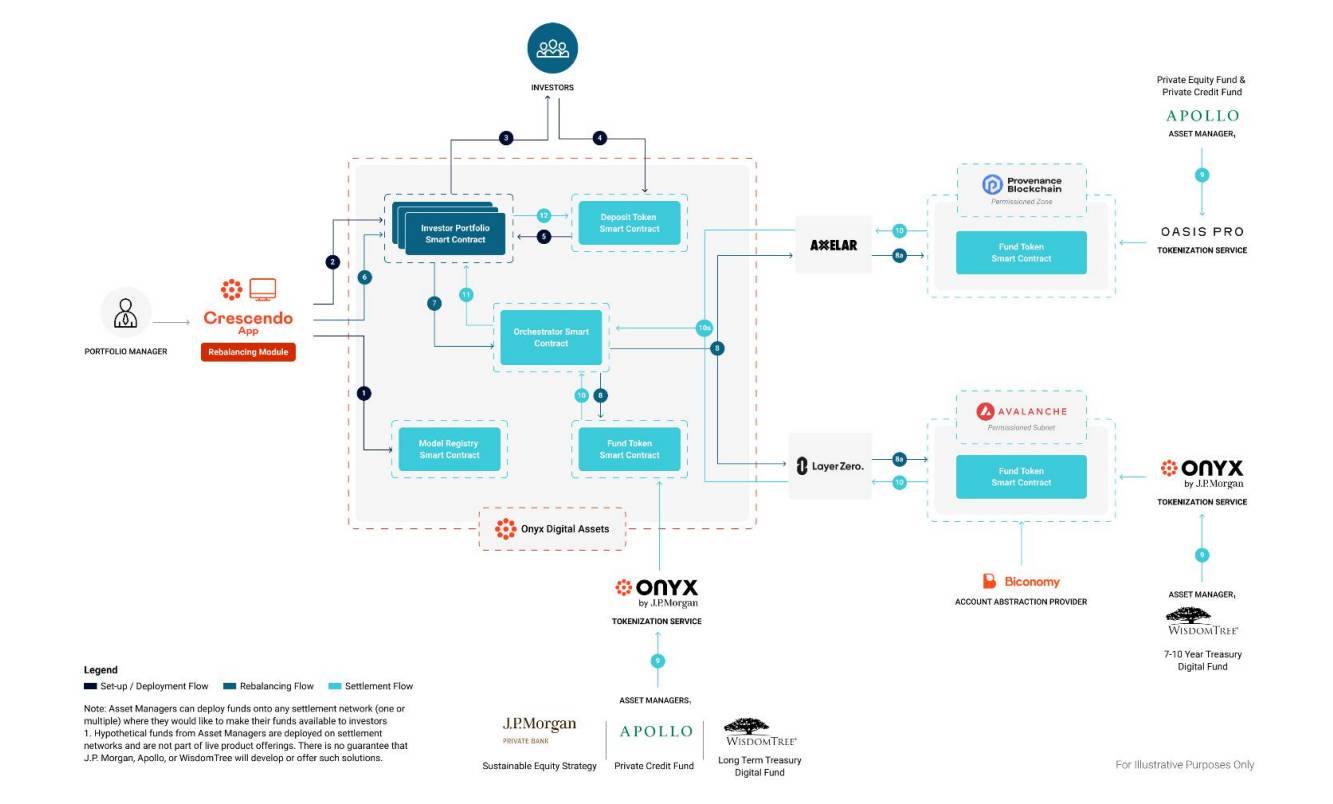

- JP Morgan partners with Apollo pilot Use digital assets to seamlessly control portfolios and option assets at scale. This will assistance conserve time and decrease guide processes.

Asset tokenization method that the Singapore government intends to pilot

Asset tokenization method that the Singapore government intends to pilot

Moreover, MAS will collaborate with Accounting and Corporate Supervision Authority (ACRA) to much better assess the options and hazards deriving from the use of VCC fund units. At the very same time, they intend to style and design a digital infrastructure to retailer encrypted assets and applications Global Level One (GL1)permits cross-border transactions and tradable tokenized assets concerning international liquidity pools, though remaining compliant with all regulatory authorities.

Guardian programs to use Avalanche as the underlying blockchain, Biconomy as the account abstraction resolution, and cross-chain remedies from LayerZero and Axelar.

Real World Asset (RWA) is a single of the achievable remedies, not too long ago examined and formulated by key economies to improve the liquidity of standard assets (bonds, stocks, vehicles, serious estate), serious estate, gold and silver…) to probably boost liquidity for the international fiscal market place. US Federal Reserve (Fed) he also hugely appreciated the advancement likely of serious-existence asset (RWA) tokenization.

Coinlive compiled

Join the discussion on the hottest problems in the DeFi market place in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!