Following criticism of discrimination in between the two exchanges Binance and FTX, the Singapore official explained the two scenarios are “completely different”.

The collapse of FTX has relatively impacted the macroeconomy of lots of nations, particularly Singapore. To observe WuBlockchain, Singaporean customers account for five.26% of all customers. But authorities right here have been accused of previously focusing on Binance, leaving men and women with no selection but to flip to the exchange behind it, FTX.

The apparent distinction is that though Binance has been “trying to lure” Singaporean customers as a result of lots of approaches this kind of as providing trading incentives, aggressive promoting, even listing the Singapore dollar. Then, on the other side, FTX did not care about these factors.

The Monetary Authority of Singapore (MAS) explained: Binance is on the “alert” record., since the exchange violated the Payment Services Act by giving crypto solutions with no a license to operate, resulting in a significant “suppression” by the Singapore government. Receiving complaints from January to August final yr, Binance did not final prolonged choosing withdraw the application for intervention and declare closure in February 2022.

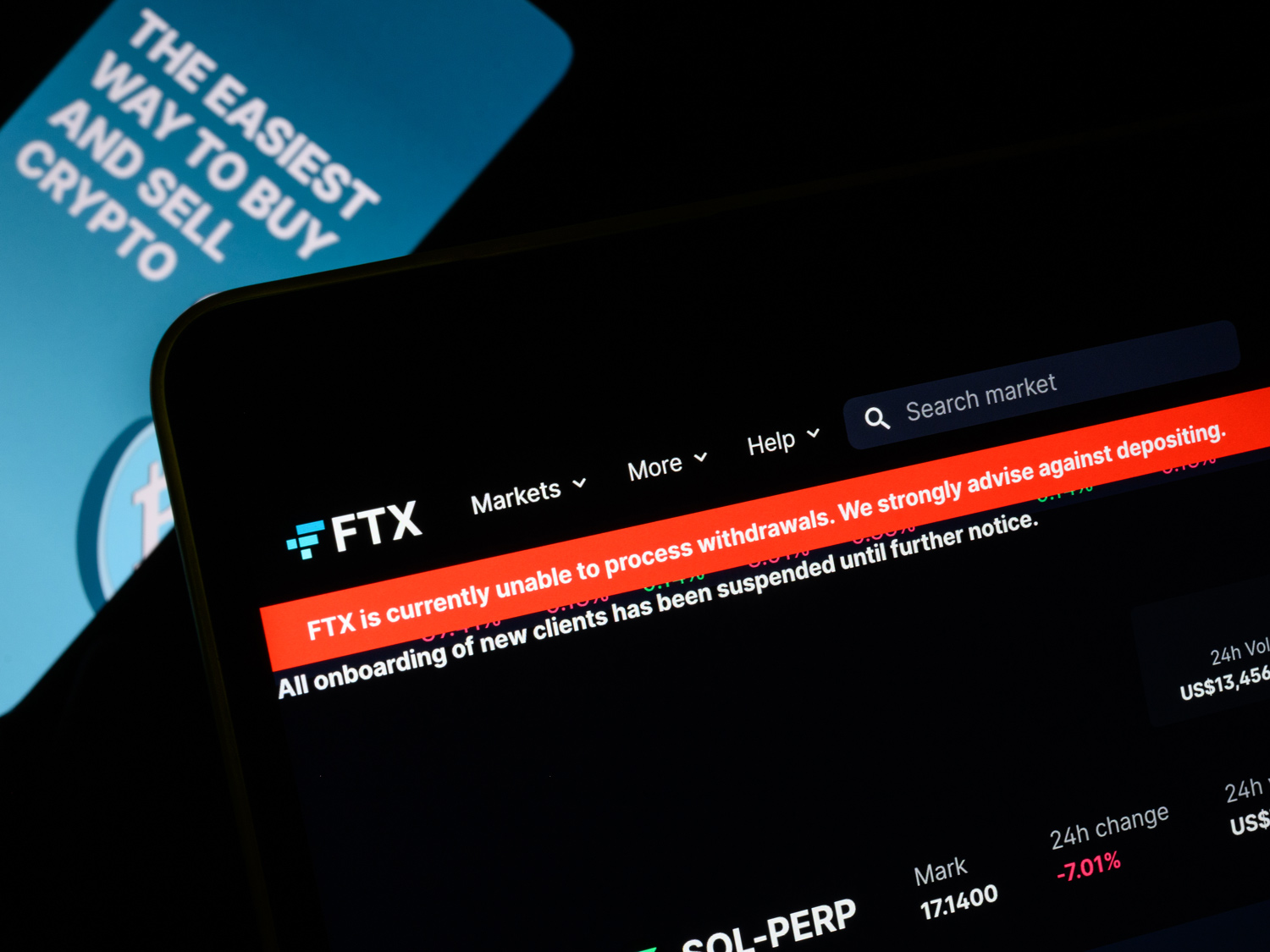

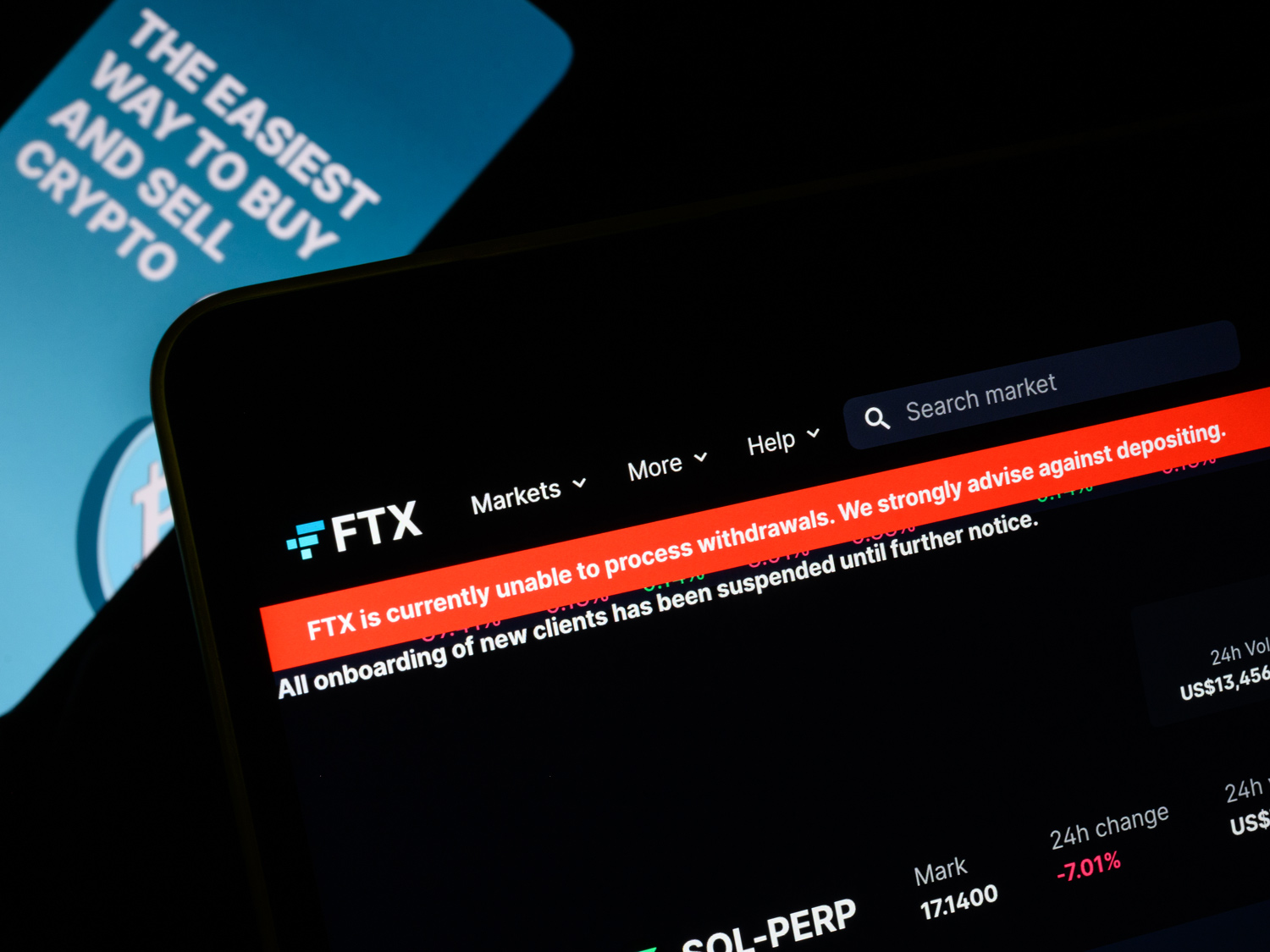

Meanwhile, immediately after the FTX situation was exposed, MAS had to reiterate that “FTX has never been licensed in Singapore” and the government has no cause to end men and women from working with the platform. However, they have repeatedly warned men and women about the dangers of dealing with unapproved organizations.

MAS draws the following conclusions:

“The most essential lesson from the FTX failure is that trading in any cryptocurrency, on any platform, is all risky. There are no safeguards for these who pick out to trade cryptocurrencies. They could eliminate all their funds.”

Synthetic currency68

Maybe you are interested:

Following criticism of discrimination in between the two exchanges Binance and FTX, the Singapore official explained the two scenarios are “completely different”.

The collapse of FTX has relatively impacted the macroeconomy of lots of nations, particularly Singapore. To observe WuBlockchain, Singaporean customers account for five.26% of all customers. But authorities right here have been accused of previously focusing on Binance, leaving men and women with no selection but to flip to the exchange behind it, FTX.

The apparent distinction is that though Binance has been “trying to lure” Singaporean customers as a result of lots of approaches this kind of as providing trading incentives, aggressive promoting, even listing the Singapore dollar. Then, on the other side, FTX did not care about these factors.

The Monetary Authority of Singapore (MAS) explained: Binance is on the “alert” record., since the exchange violated the Payment Services Act by giving crypto solutions with no a license to operate, resulting in a significant “suppression” by the Singapore government. Receiving complaints from January to August final yr, Binance did not final prolonged choosing withdraw the application for intervention and declare closure in February 2022.

Meanwhile, immediately after the FTX situation was exposed, MAS had to reiterate that “FTX has never been licensed in Singapore” and the government has no cause to end men and women from working with the platform. However, they have repeatedly warned men and women about the dangers of dealing with unapproved organizations.

MAS draws the following conclusions:

“The most essential lesson from the FTX failure is that trading in any cryptocurrency, on any platform, is all risky. There are no safeguards for these who pick out to trade cryptocurrencies. They could eliminate all their funds.”

Synthetic currency68

Maybe you are interested: