Temasek, Singapore’s nationwide investment fund, mentioned it accepted the reduction of $275 million that had been invested in FTX.

According to the announcement launched on the morning of November 17, Temasek – the state-owned investment fund of Singapore – will record the worth of the investment of $275 million in FTX and FTX US as zero on its stability sheet.

Our Statement on FTX. https://t.co/pok0EfNEwq

— Temasek (@Temasek) November 17, 2022

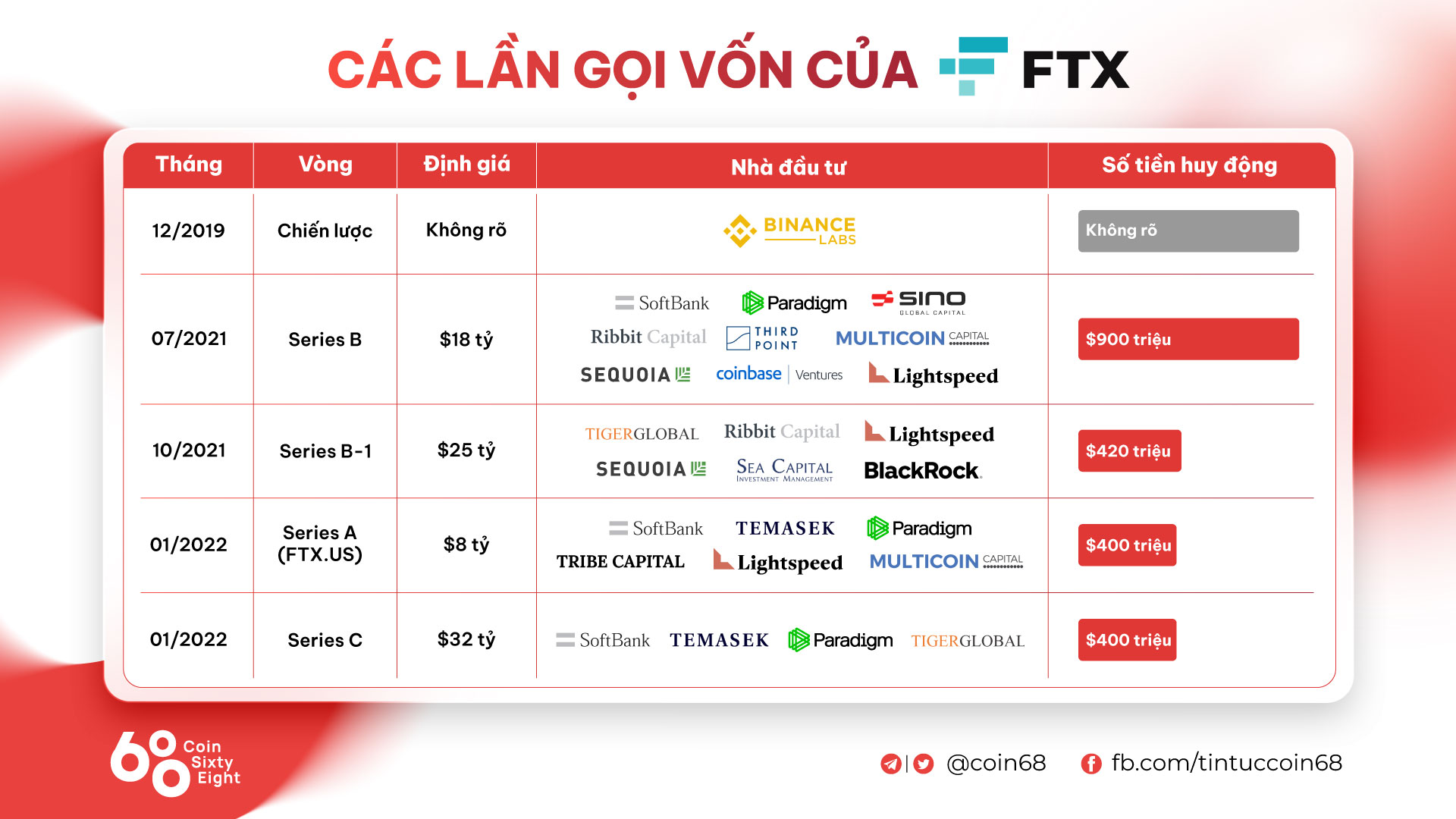

Previously, Temasek invested $210 million for a one% stake in FTX and $65 million for a one.five% stake in FTX US. The over two investment rounds have been produced earlier this yr, as FTX and FTX raised capital with a complete valuation of up to $32 billion.

Temasek confirmed that the $275 million in damages amounted to just .09 % of the fund’s $294 billion complete assets beneath management as of March 31, 2022.

The Fund also claims that it performed substantial due diligence of FTX prior to producing an investment choice, which for the time period February to October 2021 reviewed all monetary statements supplied by FTX, per The organization is nonetheless successful and has a model of sustainable business enterprise. Temasek also evaluates each the monetary hazards that come up from the crypto and regulatory industries (licensing, anti-funds laundering rules, KYC) and FTX’s safety background.

Temasek mentioned that it has obtained lots of reviews of misuse of FTX consumer assets. The Foundation says that if these allegations are correct, it would be a major fraud and scam by FTX.

Due to the existing problem, Temasek has determined to zero investment in FTX and mentioned that it will draw lots of lessons from the FTX situation.

Prior to that, when FTX was located to be in difficulties, Temasek experimented with to get in touch with the exchange for assistance.

In addition to Temasek, a number of other investment money/crypto organizations have announced losses due to FTX, such as: Genesis Trading ($175M, withdrawals blocked), Galois Capital ($40M), Multicoin Capital (~ten% of assets ). , BlockFi (heavily broken, in the method of failing), Sequoia ($213 million). Paradigm ($290 million),…

The Singaporean government has stated that it does not regulate FTX, even though end users from this nation signify a massive percentage of registered accounts on the exchange.

Synthetic currency68

Maybe you are interested: