Solace undertaking overview

What is Solace?

Solace is a Decentralized Insurance Protocol undertaking, managed by the Solace DAO. Solace DAO focuses on producing progressive and intuitive insurance coverage solutions to guard consumers when “Skin in the DeFi game”.

The particularity of the Solace undertaking

Simple drawing

Unusual protocols depart the danger evaluation approach to the consumer and force the consumer to insure each place he has opened. Also, this is not a great insurance coverage model for traders and traders.

Solace has created Solace Wallet Coverage as a special characteristic for a greater consumer knowledge. This characteristic operates the very same way as getting a prepaid calling card, reloading the stability and the stability will be charged when it expires, or applying insurance coverage. To get insurance coverage, consumers go via 3 uncomplicated methods: connect their wallet to Solace, set the transaction array restrict and deposit.

Users will not need to have to file a declare to get their funds back and will acquire insurance coverage payments in qualifying reduction occasions inside of a single week.

Exceptional scalability

Solace employs a binding mechanism in which consumers can exchange other tokens in exchange for SOLACE tokens. Additionally, SOLACE tokens can be utilised in staking to earn rewards from insurance coverage revenue and token issuance.

Solace will take the assets from the bond mechanism and areas them in the Underwriting Pool to promote insurance coverage.

Transparency

Solace is the only cryptocurrency safety protocol that publishes its pricing, danger information, and danger model on GitHub and decentralized storage applying IPFS.

Underwriting Pool – The pool is rated for insurance coverage

All money are accumulated in a single a multi-collateral Underwriting Pool owned by Solace. This pool meets all utilization needs and covers monetary losses. Users can pick from the assets in the Subscription Pool to acquire as payment. The alternatives are ETH, WBTC and stablecoin.

Revenues from underwriting routines are mostly distributed to SOLACE token holders (a little commission goes to danger strategists, danger managers and treasury). DAO potential as it grows).

Information on the SOLACE token of the Solace undertaking

SOLACE Token Specifications

- Ticker: SOLACE

- Blockchain: Ethereum

- To contract: 0x501ace9c35e60f03a2af4d484f49f9b1efde9f40

- Token variety: Utility. Government

- Circulating provide: 157.573.056 SOLACE

- Total provide: one.105.183.814 SOLACE

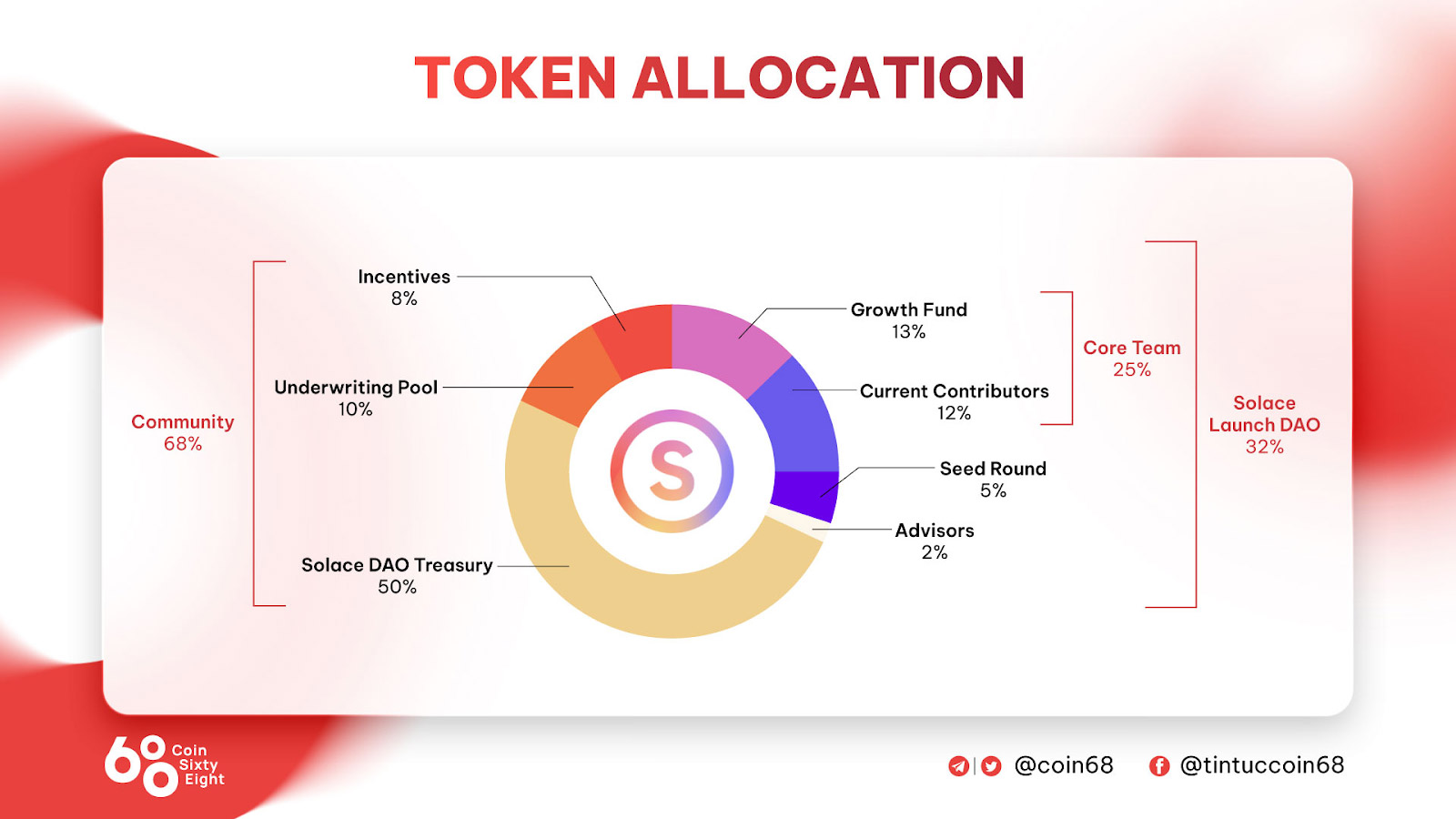

Allocation of SOLACE tokens

- Solace DAO launch: 32%

- Main group: 25%

- Growth Fund: 13%

- Current taxpayers: twelve%

- Round seed: five%

- Consultants: two%

- Community: 68%

- Solace DAO Treasure: 50%

- Subscription pool: ten%

- Incentives: eight%

Uses of the SOLACE token

The key employs of the SOLACE token are:

- Staking: to acquire rewards.

- Governance: vote to make your mind up the issuance fee of SOLACE tokens.

Where to get, promote and keep SOLACE tokens

Currently, the SOLACE token is a token of the Ethereum ecosystem and has been integrated with Aurora Network, so you can get this token on two DEX exchanges: SushiSwap and Trisolaris.

Also, to keep SOLACE tokens, you can use a wallet with Multi-chain or integrate two networks, Aurora Network and Ethereum this kind of as: Metamask, Coin98 Wallet to keep.

Solace undertaking growth roadmap

Fourth quarter – 2021

- SOLACE tokens for sale

- The protocol is owned and managed by the Underwriting Pool.

- Offers a protocol coverage solution

1st quarter – 2022

- Start the DAO-two-DAO management mechanism

- Start Solace Portfolio Hedge (Solace Portfolio Hedge)

- Cross-chain distribution (Aurora, Polygon)

- Development of the V2 staking mechanism and voting rights

Quarter two – 2022

- Cross-chain implementation (BNB, AVAX, …)

- The request mechanism is decentralized

- APY stability for cross staking

- Development of an inflation management model

3rd quarter – 2022

- Implement a non-EVM mechanism

- Development of asset safety equipment for DeFi

- Transfer of management rights to the DAO neighborhood

- Develop on an open platform for solutions

Fourth quarter – 2022

- Expansion to the Close to protocol

- Expansion to Solana

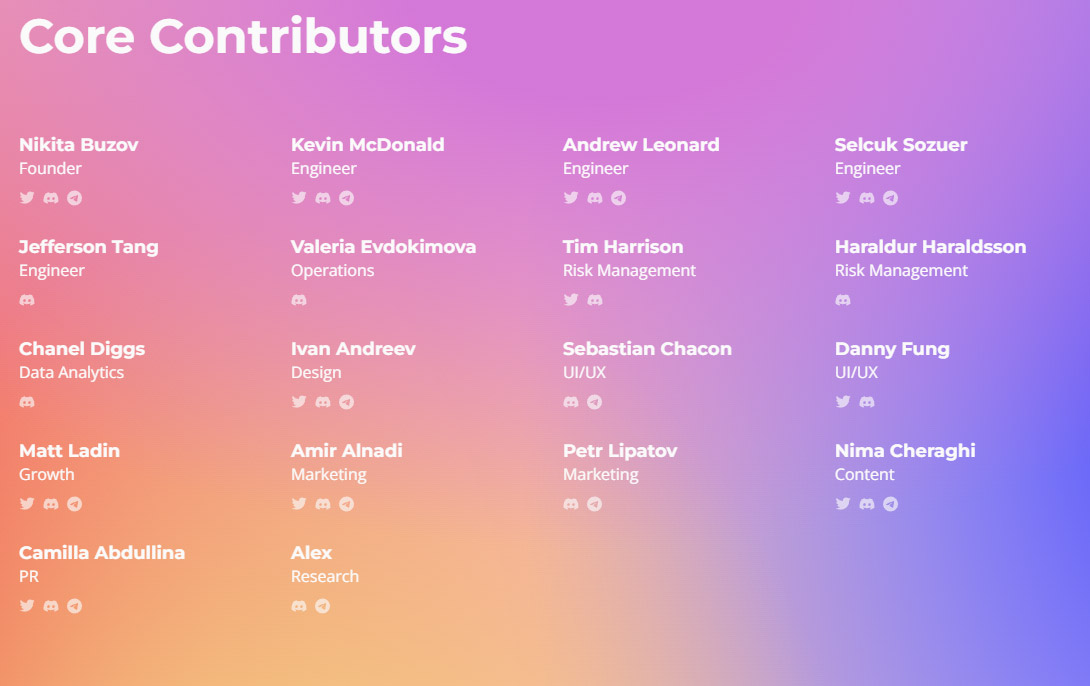

The key growth group of the Solace undertaking

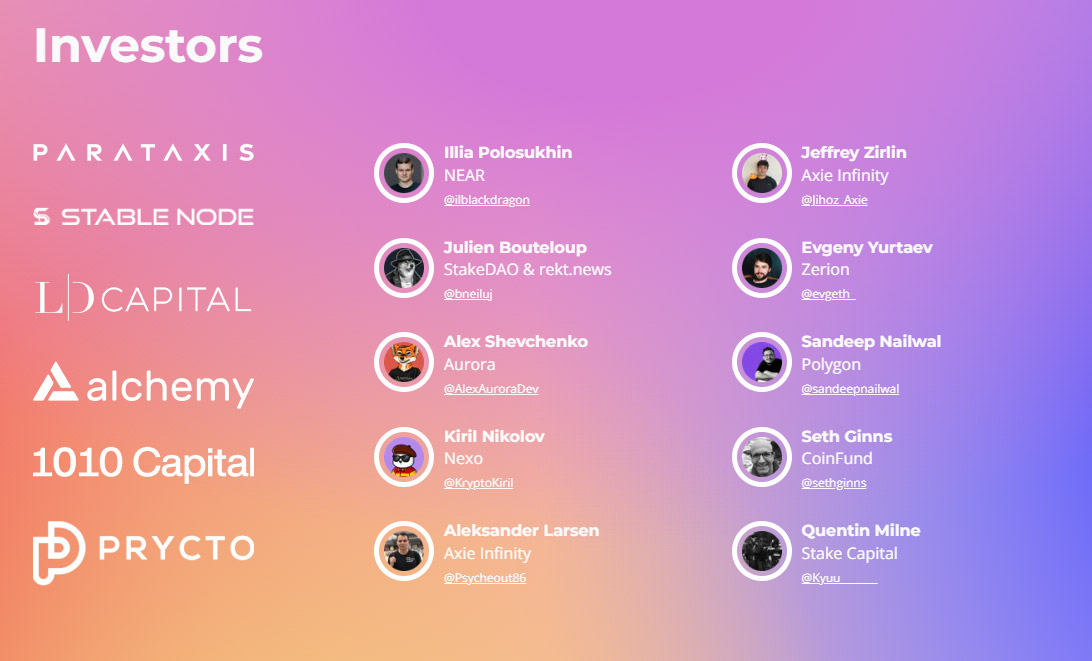

Investors and growth partners of the Solace undertaking

The Solace undertaking has attracted a amount of prominent personalities in the cryptocurrency industry with the participation of:

- Illia Polosukhin: Founder of Near Protocol

- Alex Shevchenko: founder of Aurora

- Jeffrey Zirlin: Co-founder of Axie Infinity

- Julien Bouteloup: Founder of StakeDAO

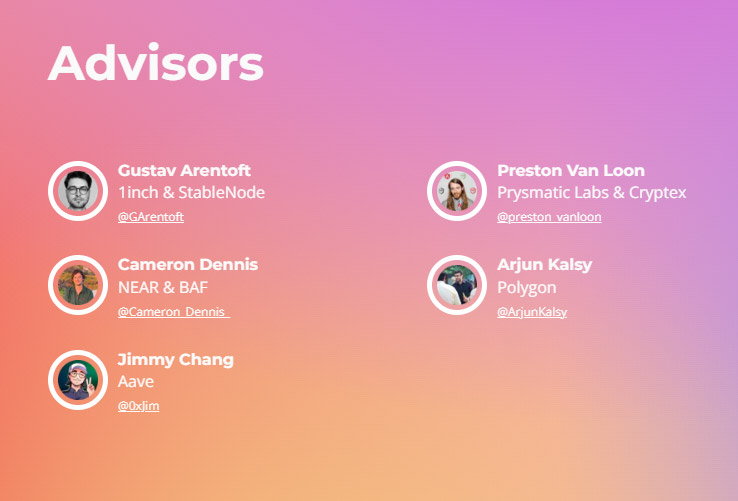

Advisory board members are also growth members of massive tasks this kind of as Close to, Aave, Polygon. This exhibits a favourable degree for the potential growth of the undertaking.

Projections on the Solace undertaking, must I invest in SOLACE tokens?

Insurance is an integral element of the monetary industry in basic and the cryptocurrency industry in specific. However, the insurance coverage niche is nonetheless as well new for the present cryptocurrency industry, there will be sudden dangers for consumers. Solace is a single of the flagship tasks and continues to build in current occasions, but it nonetheless can not steer clear of the industry shaking. Therefore, be cautious with your investment!Through this posting, you have by some means grasped the simple data about the undertaking to make your investment selections. Coinlive is not accountable for any of your investment selections. I want you results and earn a good deal from this likely industry.