For the first time since November 2021, the price of Solana (SOL) tested the $220 level. This sparked many predictions that altcoins could reach new highs in the future.

Notably, SOL charts across multiple timeframes support this prediction. Here’s a closer look at the key indicators that support this statement.

Solana Forms a Rising Flag, Aiming for a Big Increase

On November 13, the price of the altcoin returned to the $200 level. However, Solana’s important breakthrough to $220 in the past 24 hours comes from Robinhood’s decision to relist this Token.

Following this event, Solana broke out of a bullish flag on the weekly chart. A bullish flag is a pattern characterized by two upward rallies, with a short period of consolidation in between. This pattern begins with a sharp price rise (the so-called “flag bar”) as buyers overwhelm sellers, followed by a correction that creates parallel upper and lower resistance levels, forming a “leaf flag”.

As seen below, SOL broke out of a bull flag and touched $220 before falling to $217.52 recently. If the technical pattern holds, Solana’s price could surpass its all-time high of $260, with a possible mid-term target of $320.83.

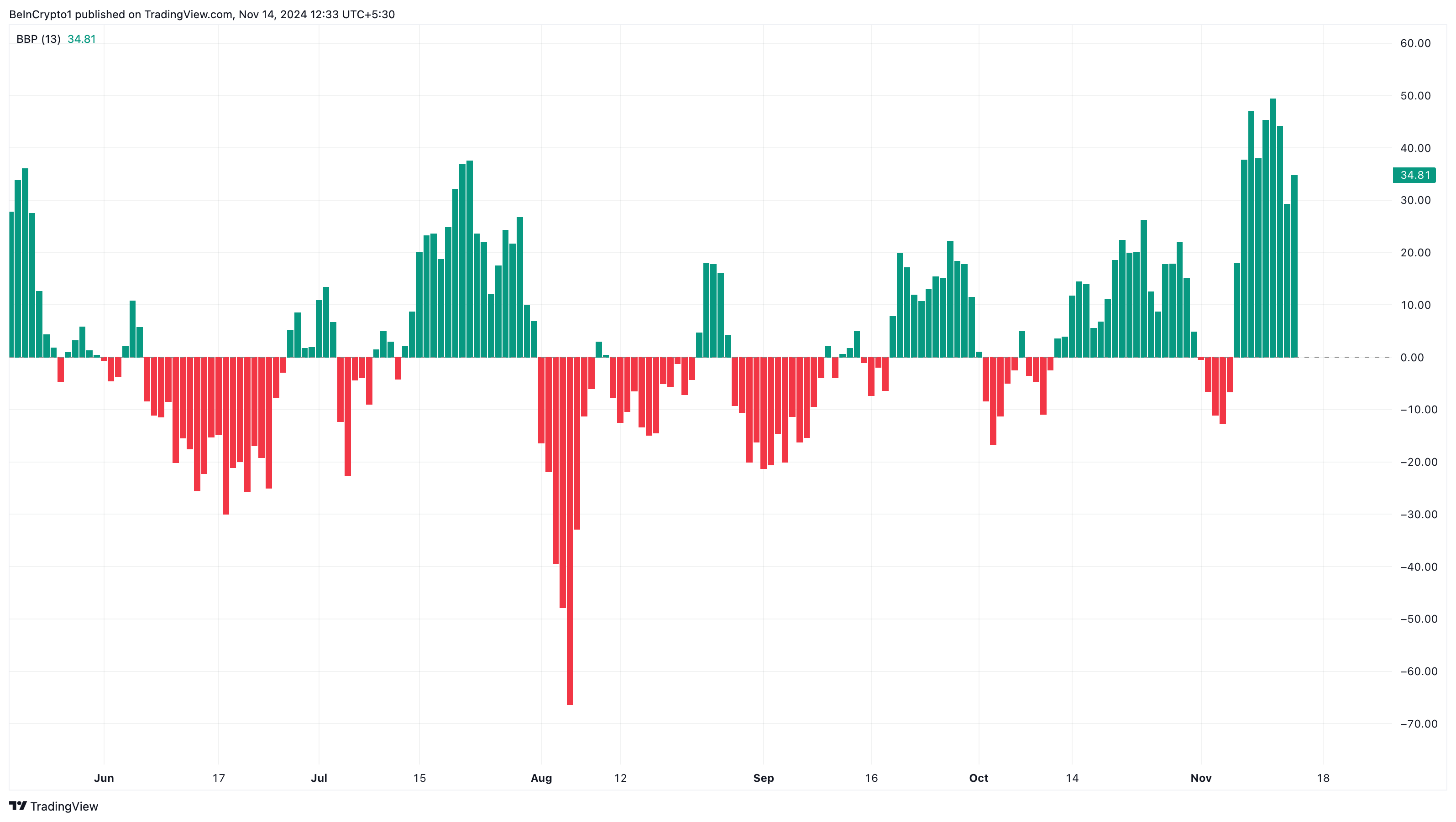

Furthermore, daily chart analysis also supports this prediction, especially due to the current state of the Bull Bear Power (BBP) indicator.

The BBP indicator evaluates the strength of buyers (bulls) relative to sellers (bears) by measuring the difference between the highest price and the 13-period Exponential Moving Average (EMA). When the Bulls Power indicator is above zero, it shows that buyers have held the price above the EMA, indicating positive momentum.

However, if it is the opposite, it indicates that the sellers have pushed the price below the EMA, i.e. the trend is down. Therefore, the current state of the indicator, as shown below, suggests that buyers may continue to push Solana price higher.

SOL Price Prediction: Possible Doubles

Meanwhile, another look at the daily chart shows that Solana’s breakout is likely to continue. The Parabolic Stop and Reverse (SAR) indicator also gives this signal.

The Parabolic SAR indicator helps traders identify the direction of a trend as well as possible price reversals. When the indicator places dots above or below the price, it suggests a downtrend. But in this case, it is below the SOL price, suggesting a possible continuation of the uptrend.

Typically, when this happens, Solana’s price tends to go higher. For example, as shown below, altcoins almost always record double digit gains when they occur. Therefore, if history repeats itself, SOL could rise to $260 within a few days.

If confirmed, this could prompt a rally to $320.83, as mentioned above. Conversely, if the dotted lines of the parabolic SAR cross above the price of the SOL, this prediction can be invalidated. In that situation, the price could drop below $200.