You will see a whole lot of wars emerging recently – battles for voting rights on DeFi platforms. The most standard is Curve Wars, Solana we have Saber Wars, Avax is Platypus Wars and the final a single will be Solidly Wars. So what is exciting about fight in Solidly? Let’s consider a appear at some of the important components of Solidly Wars!

Curve Wars overview

Note, the following short article is predefined for the reader who has an overview of Curved finance, a devoted DEX for stablecoins. If you are interested, you can read through a lot more about this key phrase!

>> See a lot more: What is Curve Finance (CRV)? Find out comprehensive data about the Curve Finance undertaking and the CRV token

First of all, you need to have to fully grasp Curved Wars what? Because Curve is ruled by copper veCRV (to personal veCRV, consumer should lock CRV on the platform), so the CRV token is sought immediately after by numerous tasks. The principal goal of these tasks is to obtain voting electrical power, consequently producing lucrative proposals, providing numerous agricultural rewards to their funds pools.

With Convex financewill incentivize consumers to enter CRVs on Convex’s platform, then return a token it represents cvxCRV. With the voting rights acquired by attracting CRVs, Convex will gather a lot more transaction charges on Curve, consequently assisting consumers to stake tokens on Convex’s platform. have a greater APY curiosity is to target immediately on Curve Finance.

Also, the specials on Cost of the transaction obtained, the airplane launch for CRV holders they will all be redistributed by Convex to supporters of their merchandise.

If you happen to be interested, we have developed a podcast discussing this challenge beneath!

>> Listen now: DeFi Discussion Ep. 27: Curve Wars – the secret key phrase behind the CRV rate hike

Solidly wars

Basically, there are two principal opponents Solidex And 0xDAO. In addition, just about every competitor will have their personal way of mobilizing sources from their Partners. As for the companion record, I will be precise when speaking about just about every competitor.

Another undertaking is also concerned in Solidly Wars, but the model is very diverse from the two names over Iron financial institution. He will also communicate by means of some data on Iron Bank. However, as pointed out, this war at the moment only focuses on two key names, Solidex and 0xDAO.

Solidex

With Solidex, I pointed out in the Solidly Projects overview short article beneath.

> See Also: Projects Built Around Solidly You May Not Know About

In this short article, I will delve into how Solidex performs so that it is less difficult to visualize.

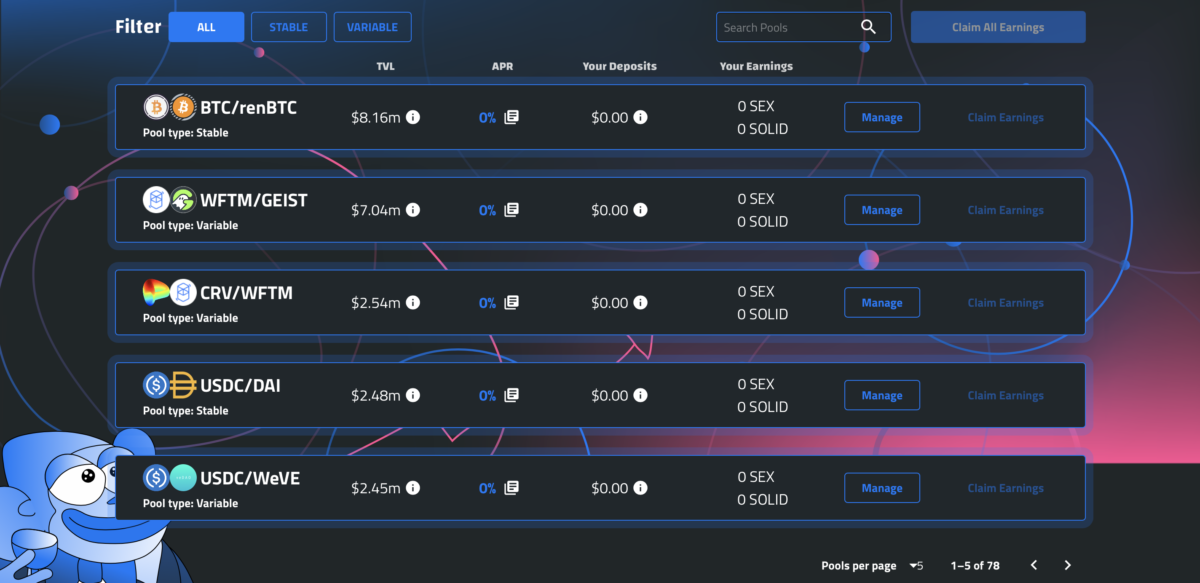

First issues the Liquidity pool. On the Solidex interface, you will see that there are two sorts of pools: Stable And Variable. These two sorts of pools will also correspond to two sorts of pools on Solidly.

When you offer liquidity on Solidly, you will acquire LP tokens representing just about every form of pool. Then place these LP tokens into perform in Solidex. At this stage, you not only take pleasure in the tokens Strong but also tokens Intercourse (Token Solidex).

Second point I want to mention, that is SOLIDsex token. This is a token that represents a one: one ratio if you block veSOLID in Solidex.

Note: The part of veSOLID will also be the exact same as that of veCRV, a joint board of directors with voting rights for AMM exchange proposals.

And like these that offer liquidity, veSOLID blocking man or woman also in Solidex receiving the reward is Strong And Intercourse.

The ultimate is a Intercourse token, as pointed out in the earlier two factors, this is the Solidex governance token. Therefore, if Solidex is profitable and has solid management above Solidly (related to what Convex did with Curve), it is probably that Intercourse will be sought immediately after by numerous tasks to indirectly control Solidly by means of the hands of Solidex. Currently, Solidex has not announced the Intercourse Token Lockout rewards.

And to have sufficient management, definitely Solidex will need to have to have partners, together with numerous tasks that have won the major 25 snapshots on Fantom. There are at the moment only eight tasks committed to blocking their NFTs in Solidex, inclusive Multichain, Geist, Curve, Ren, Yearn, veDAO, Saddle And Abracadabra (SYLLABLE).

0xDAO

Later I will speak about 0xDAO. Originally, 0xDAO was born with the goal of attacking veDAO vampires. However, just lately tokennomic V2 undertaking announced. You can master about the veDAO stage of the 0xDAO vampire assault in the short article beneath!

See a lot more: Update the newest “Ghost Wars” occasions

Preparation for launch V2 https://t.co/wj3seyVjvw

– 0xDAO (@ 0xDAO_fi) February 18, 2022

First I will also speak about pursuits offer liquidity. Unlike Solidex, as a substitute of delivering LP in Solidly and then betting on the Solidex platform, 0xDAO will inquire consumers to offer liquidity on its platform, then deliver this liquidity to compete with Optimized on Solidly.

Second, as a substitute of prompting the consumer to form veSOLID as Solidex, 0xDAO nonetheless call for consumers to stake Strong immediately in its merchandise. From there 0xDAO will return a one: one representation token of 0x Strong.

Similar to owning SOLIDsex, 0xSOLID consumers will also acquire% Strong, transaction charges, kickbacks and airdrops for veSOLID owners. All the over cash flow will be obtained by optimizing the yield from 0xDAO.

In addition, 0xSOLID holders will also acquire a component of the OXD (0xDAO administrative token).

Another idea is vlOXDso it will be a lot more or significantly less like vlCVX (Convex’s vote blocking token on Ethereum). Owner of vlOXD will be entitledmanagement voting rights on 0xDAO. However, as a substitute of voting, vlOXD is also for consumers take pleasure in some yield developed by this platform. vlOXD is created by blocking OXD on the 0xDAO platform.

0xDAO partners consist of SpookySwap, Tomb Finance, SCREAM, Reaper Farm, Beethoven X, Liquid Driver And Tarot.

Iron financial institution

Another competitor but not immediately concerned is Iron Bank. I wrote an short article about this undertaking when they launched a governance token identified as IB. If you are interested, you can come across some short data about this undertaking.

> See also: Iron Bank Launches IB Token – An Expected Start for Yearn Finance in 2022?

Many siblings wonder why the IB token has skyrocketed just lately, and due to the fact their undertaking announced it will challenge Strong tokens to these who hold IB tokens.

Therefore, in my viewpoint, the playground on Iron Bank is very risky, partly due to the fact the information broke out, partly due to the fact this model isn’t going to have numerous sustainable incentives for IB tokens.

Typically with companion Cream Finance (the undertaking announced by Iron Bank that will give IB awards to CREAM holders). Having had extraordinary first momentum, CREAM also declined quickly and no longer rebounded thanks to IB’s airdrop data.

With Iron Bank, I consider there are not also numerous pursuits you can securely participate in Solidly Wars.

Personal viewpoint

With Solidly Wars, there are a handful of facts beneath that you really should look at.

Liquidity is the initial point you need to have to look at if you want to join Solidly Wars. This is a merchandise on Fantom and liquidity on DEX is not that fantastic ideal now. Price slippage when executing transactions (even among Stablecoins) is probable, particularly for siblings trading huge orders that could have an impact on it.

The following difficulty is an error in the merchandise code. Typically with Solidex this morning, they had a difficulty with the voting contract. This error brings about numerous liquidity pools not to acquire votes, consequently not acquiring the% of transaction charges to share with liquidity companies on Solidex.

Finally, there is the query of trading on Fantom. This network is at the moment overdue due to Solidly Wars. One tip is that you really should boost the throttle about one-one.five FTM. Obviously, in contrast to ETH, this is an acceptable charge, but there are nonetheless instances wherever the transaction regularly fails and brings about pretty unpleasant experiences when participating in Add liquidity to the pool.

Note, all of the over articles is for informational functions only and really should not be viewed as investment assistance!

Synthetic currency 68

Maybe you are interested: