Circle, the issuer of the USDC stablecoin, is stated to provide shares on the US stock exchange (IPO) in 2024.

Stablecoin business Circle (USDC) is stated to have an IPO in 2024

Stablecoin business Circle (USDC) is stated to have an IPO in 2024

Second Bloombergthe business behind the 2nd greatest stablecoin in the cryptocurrency area, USDC, Circle, strategies to IPO in 2024.

Source Bloomberg confirmed that Circle has been in discussions with advisors about the prospect of an IPO. While it is unclear what the company’s valuation is, in a comparable hard work in 2022, Circle set its valuation at $9 billion.

Stablecoin issuer Circle Internet considers 2024 IPO https://t.co/JUuIQ5iqkN

— Bloomberg Crypto (@crypto) November 7, 2023

Representatives of the club declined to comment on his write-up Bloombergbut he stated turning out to be a publicly traded business on the U.S. stock exchange has prolonged been the company’s strategic purpose.

Circle’s latest traders include things like lots of effectively-recognized names in the US money sector, such as Goldman Sachs, Fidelity and BlackRock. The business also has an agreement to problem USDC and share earnings from holding collateral for the stablecoin with Coinbase, the greatest cryptocurrency exchange in the United States.

Coinbase is also the only notable cryptocurrency business that had an IPO on the US stock exchange in April 2021 with a market place capitalization at the opening of trading of virtually $a hundred billion. However, the exchange was sued by the US Securities Commission (SEC) for allegedly listing cryptocurrencies that the company considers securities.

However, Circle’s business enterprise took a hit when, in March 2023, the business was caught up in the US banking crisis when it locked up $three.three billion in collateral for the USDC stablecoin in Silicon Valley Bank. Although it was later on bailed out by the US government, investor concern in the market place at the time induced the USDC selling price to plummet to $.88, producing widespread consequences all through the cryptocurrency sector.

Since then, USDC’s market place capitalization has fallen from virtually $44 billion to just $24.four billion as of this creating. The downward trend continues regardless of Circle getting pursued a new tactic considering the fact that August, bringing USDC to new blockchains this kind of as Optimism, Base, Polygon PoS, Polkadot, Near and Cosmos, bringing the complete quantity of supported blockchains to 15.

USDC market place capitalization fluctuations from the starting of 2023 to currently. Photo: CoinMarketCap (November eight, 2023)

USDC market place capitalization fluctuations from the starting of 2023 to currently. Photo: CoinMarketCap (November eight, 2023)

Furthermore, there are lots of theories that considering the fact that Circle does not charge any costs to convert USDC into money, lots of USDC organizations and rivals are taking benefit of it as a gateway to withdraw revenue from the cryptocurrency market place.

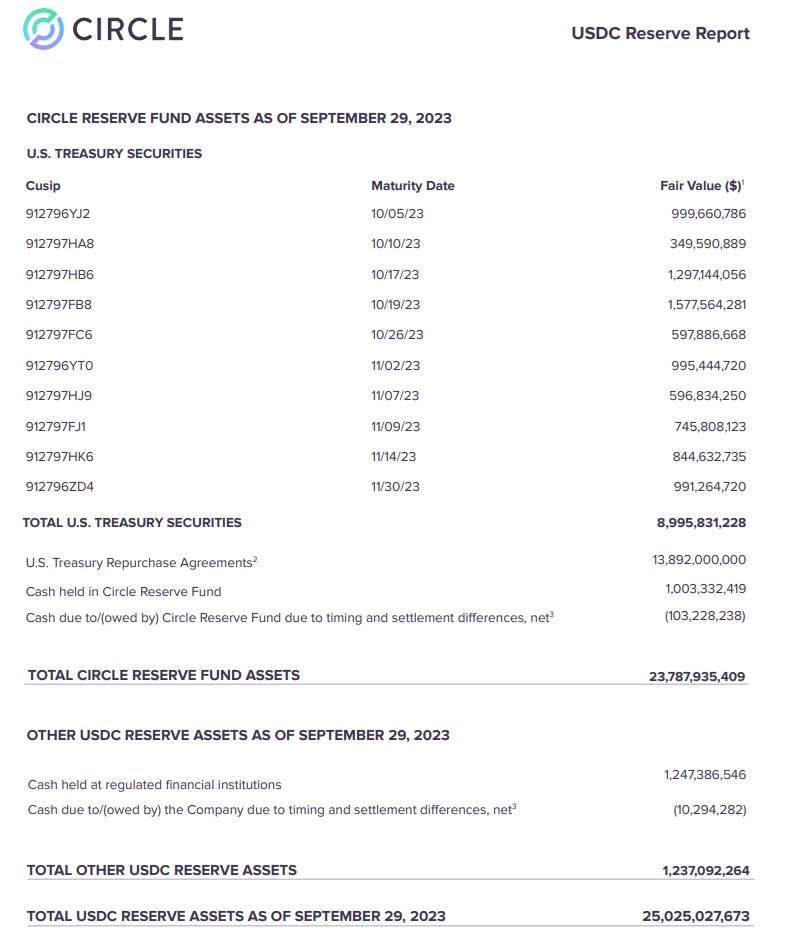

As of the finish of September 2023, Circle holds $25 billion in collateral assets for USDC, of which $22.seven billion is in the kind of U.S. Treasury securities, with the remaining $two.three billion in money.

Circle Sideline Report as of the finish of September 2023. Source: Circle

Coinlive compiled

Join the discussion on the hottest problems in the DeFi market place in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!