Recently, Aave (AAVE) announced the launch of a new merchandise: the GHO stablecoin. According to the undertaking, this merchandise is nevertheless awaiting the vote of the DAO, but is in essence “built”. In today’s report we will study about the style and design and mechanism of operation of GHO.

General introduction

According to Aave, GHO is a decentralized stablecoinstotally securitized (a hundred%), originating from AAVE and backed by many assets (numerous asset lessons).

two / GHO will be:

Decentralized

💪 Over-secured by assets that carry on to make returns

✨ Supported by many kinds of ensures offered on the Aave Protocol

⚖️ Ruled by the Aave neighborhoodWith neighborhood help, GHO can lengthen the abilities of the Aave ecosystem!

– Aave (@AaveAave) July 7, 2022

How GHO functions

GHO is designed by customers (aka borrowers) by committing assets into the protocol and “minting” (borrowing) a selected sum of GHO stablecoins. The romantic relationship concerning the collateral and the loan will be intended to safe the protocol. When loan repayment (lively) or liquidation (passive, due to unsecured collateral charge), the user’s GHO will be “burned”, acquiring collateral.

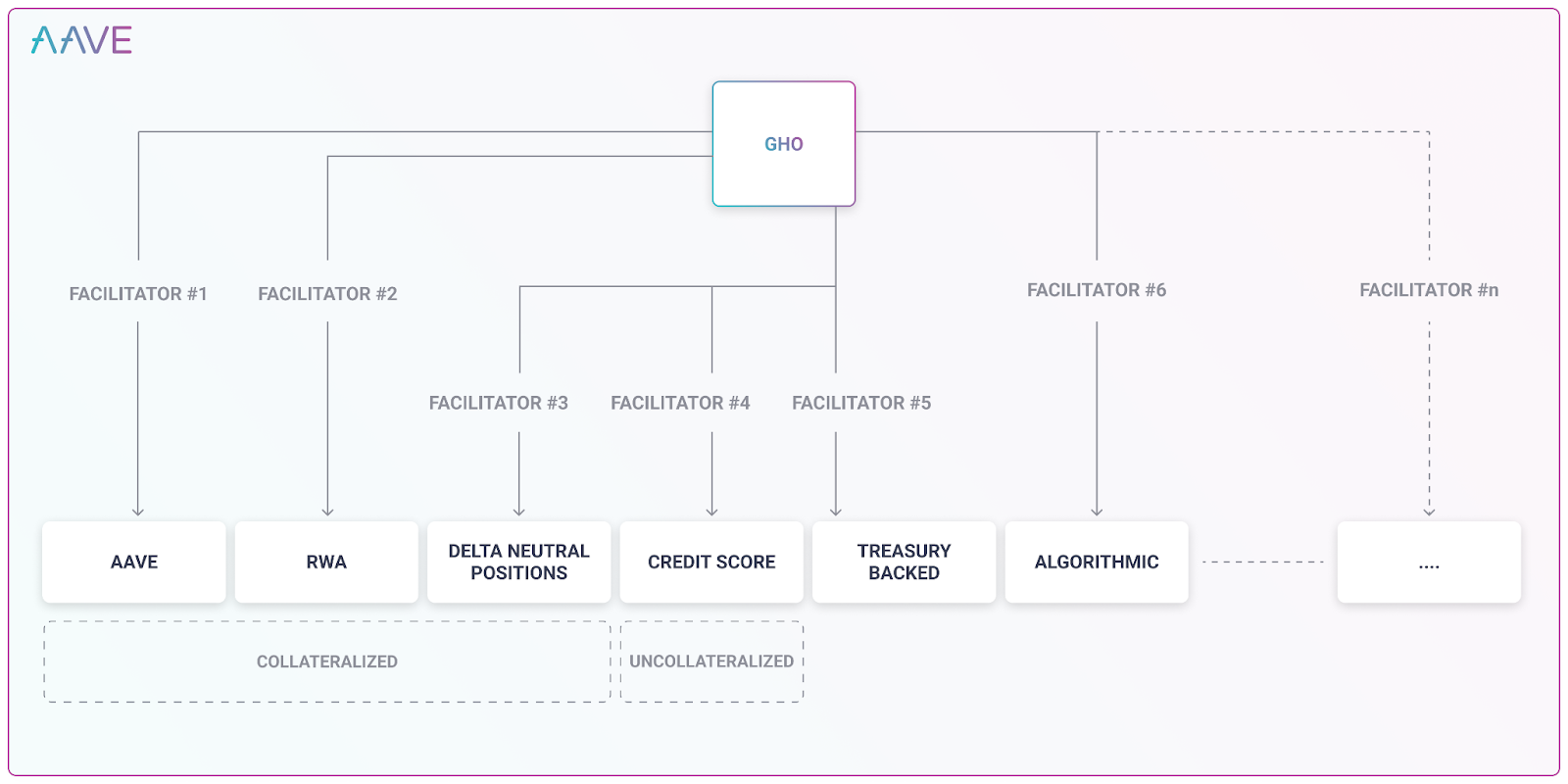

In addition, Aave also introduces a new notion: Facilitator (3 translations: loan promoter). The facilitator is a particular person who has the capability to participate in loans / loan repayments by GHO. Each Facilitator will have their very own method to lend or burn up GHO (as proven in the picture over, you can see Facilitator # one functions through AAVE, even though # two through RWA, # four comes from credit score score. Use …)

The facilitator will be accepted by the Aave DAO. Based on the Loan and Loan Recovery Mechanism, Aave’s DAO will approve a selected sum of GHO that the Facilitator is authorized to lend. For instance, Facilitators who lend with the credit score scoring mechanism will be ready to “repay” the loan with a reduced sum.

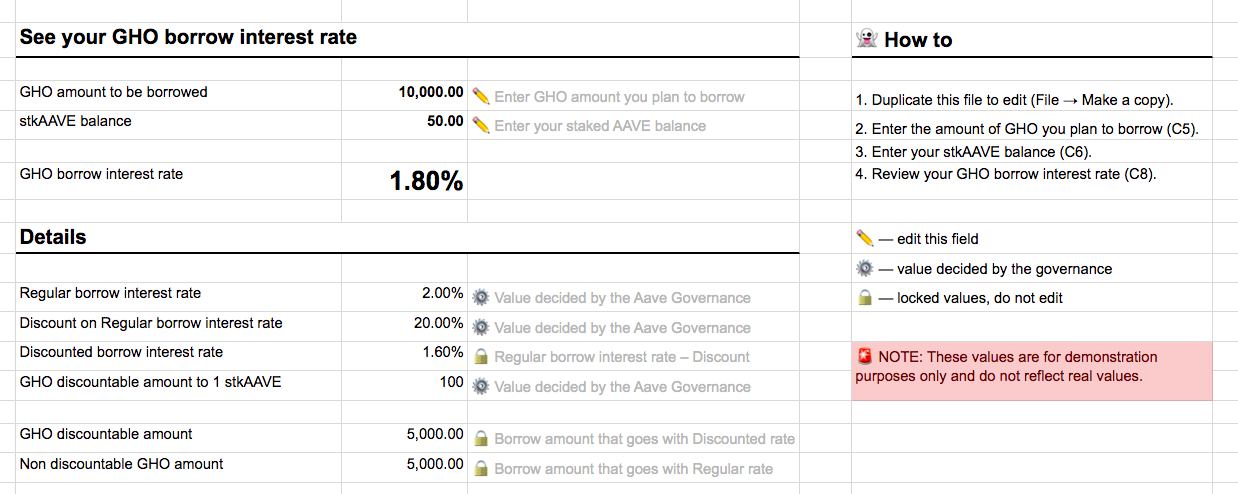

Interest charge: The curiosity charge will be made a decision by the AAVE DAO, which can be adjusted in accordance to market place fluctuations.

Discount mechanism: AAVE lets holders of stkAAVE in the wallet to get a price reduction ( to a hundred%) at the time of the loan, the% price reduction will be made a decision by the AAVE DAO.

Turnover

With GHO, Aave expects to make a huge sum of income and place it into the DAO treasury. This income improve is utilized to help continued undertaking development, primarily through a market place downturn, as properly as to help the neighborhood and governance participants.

Additionally, AAVE staking participants will get stkAAVE. As talked about over, stkAAVE lets you to borrow GHOs at a price reduction charge, i.e. with a reduced curiosity charge.

Therefore, by GHO, AAVE holders will have two other means to earn new earnings: joining the administrative DAO or turning to AAVE to get a loan with a reduced curiosity charge.

Strategies for bringing GHO to market place

To make GHO extra preferred on the market place and utilized by extra persons, AAVE strategically employs incentives, grants and hackathons, as properly as by minimal-price Layer-two to create routines for customers.

Review and evaluation

Basic, the model of the GHO stablecoin is related to that of the DAI stablecoin issued by Maker, i.e. customers will home loan the assets to borrow GHO. The adjust in curiosity prices, the approval of the Facilitators or the choice to use the charges will be made a decision by Aave DAO.

With the over working model, GHO will have the qualities of becoming decentralized, totally secured and protected by many assets.

However, GHO’s new level is that it not only lets stablecoins to trade below the over loan and loan mechanism, but can also Authorize Facilitators to “customize” the method. It will be a novelty, as properly as a chance. To check out the safety of the GHO, the AAVE DAO plays a pretty vital function in the Facilitator’s approval approach as properly as that Facilitator’s GHO loan restrict.

GHO is the merchandise that demonstrates The Aave staff is nevertheless operating really hard to produce through a market place downturn. The orientation of placing the taxes collected by GHO into the DAO Treasury showed Aave’s wish for extra revenue to keep and produce the undertaking. However, in essence, the aforementioned revenue will be utilized at the discretion of the Aave DAO, i.e. at the choice of the staff and some whales and investment money (which hold a good deal of AAVE). Therefore, we have to keep track of the use of this revenue by the AAVE staff.

Furthermore, in accordance to GHO’s working model, we will have a bullcase for AAVE token: GHO is utilized extra => commissions collected => AAVE stakers and AAVE holders who participate in governance get a greater share of income => will need to invest in and accumulate AAVE.

Therefore, what we will need to do is get care of the improvement of GHO and use the commissions collected to take into account the positive aspects of owning AAVE.

finish

As a multi-chain improvement protocol, AAVE will have some positive aspects when implementing GHO in bulk. However, stablecoin is at the moment a niche with some massive rivals, if GHO can produce and capture market place share it isn’t going to will need time to show it any longer. What’s your get on this AAVE move? Leave a comment to talk about with us!

Poseidon

See other articles or blog posts by the writer of Poseidon: