[ad_1]

Stablecoin inflows into exchanges are dwindling as buyers transfer cautiously in direction of Bitcoin.

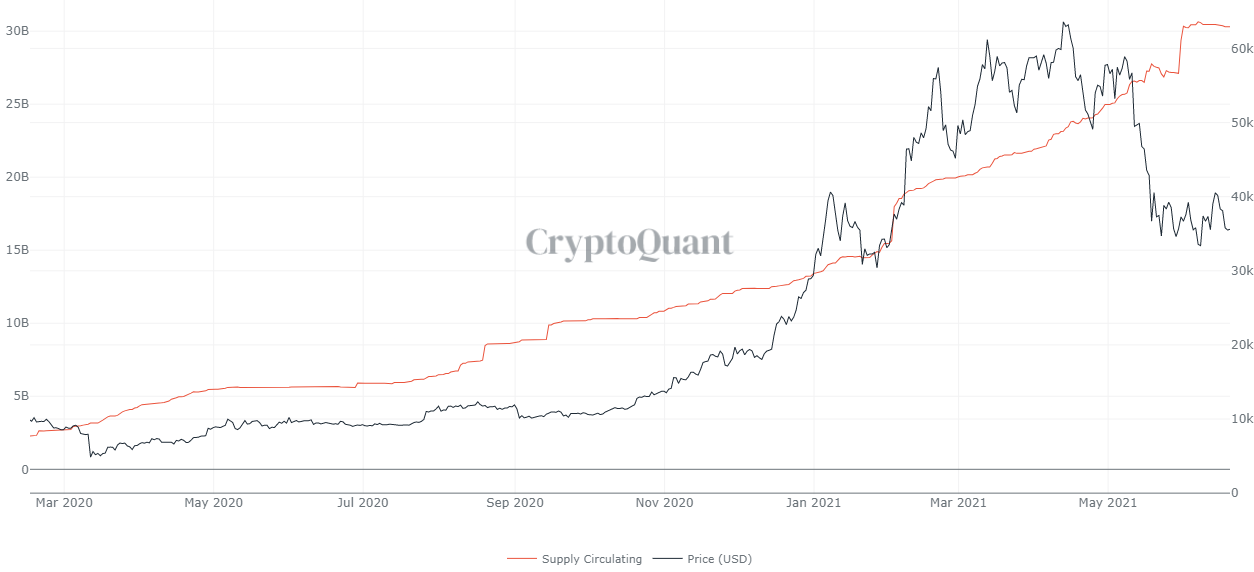

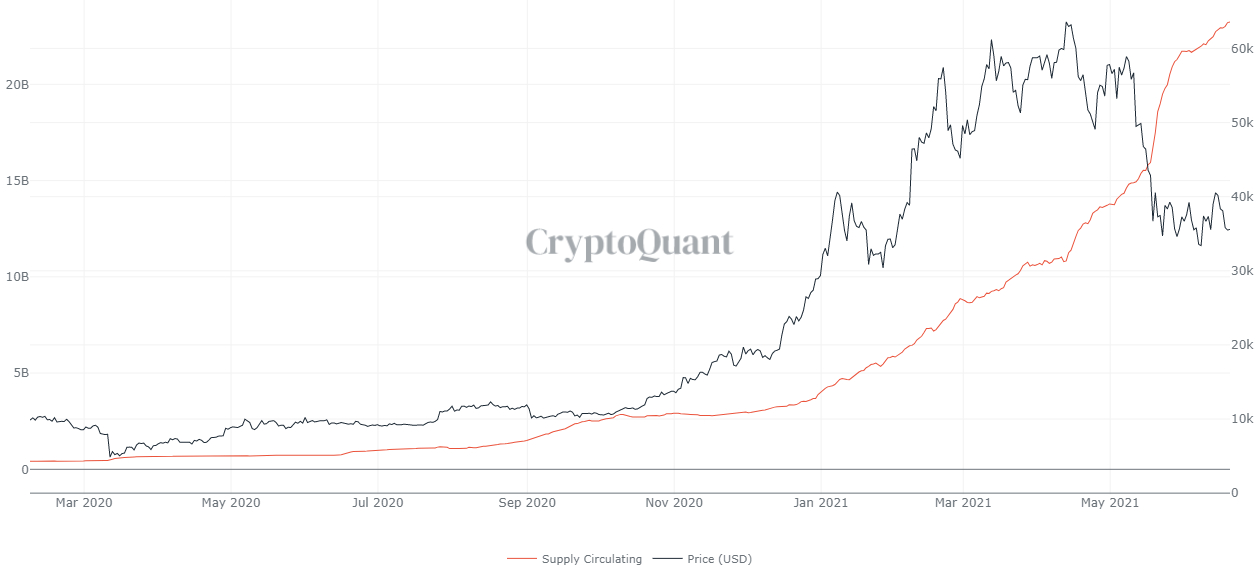

The information offered by CryptoQuant signifies {that a} change in share within the construction of the stablecoin market could also be forming as USDT issuance has begun to stagnate whereas the circulating provide of rivals like USD Coin (USDC) has continued its uptrend in comparison with final week.

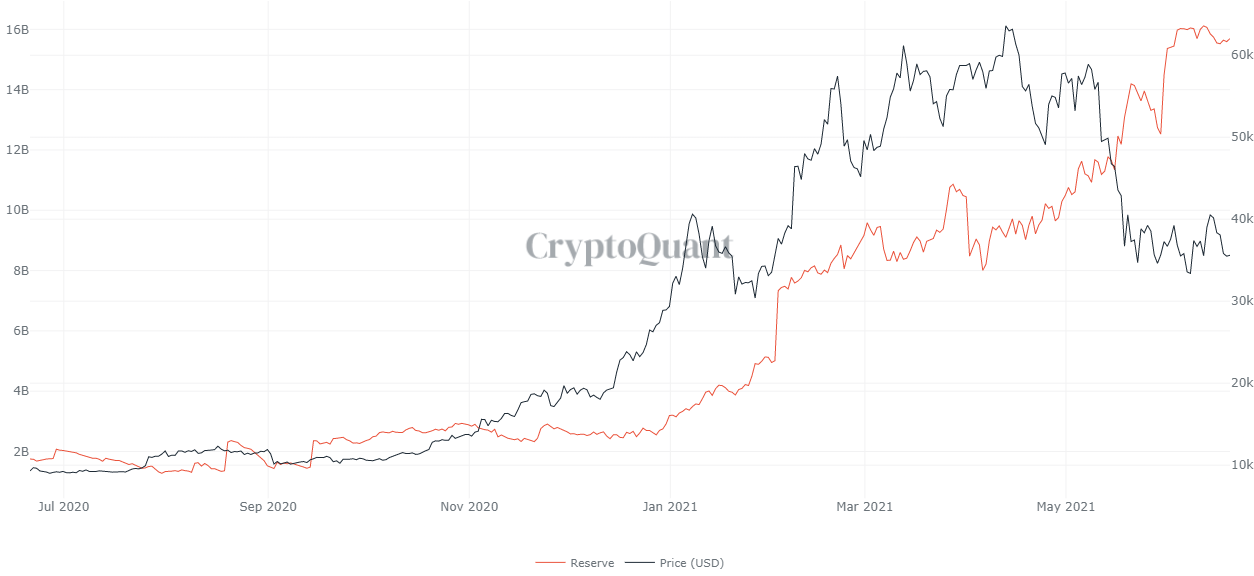

When trying on the change flows and reserves of particular person stablecoins, there has truly been a rise in USDC deposited on exchanges whereas a lower in USDT, leading to a stabilization within the complete stablecoin reserve held on flooring.

This is critical as a result of printing Tether (USDT) has traditionally been the driving force of main market strikes, however ongoing regulatory challenges and questions relating to the reserve asset have making USDT holdings extra annoying as regulators more and more repress the character of the cryptocurrency market.

See extra: The provide of Tether hasn’t elevated because the starting of June and this is why

As seen on the chart above, whereas the circulating provide of stablecoins was steadily rising within the first 5 months of 2021 and accelerated considerably because the market offered off in May, issuance stalled initially of the yr. June within the context of the downtrend that dominated the market.

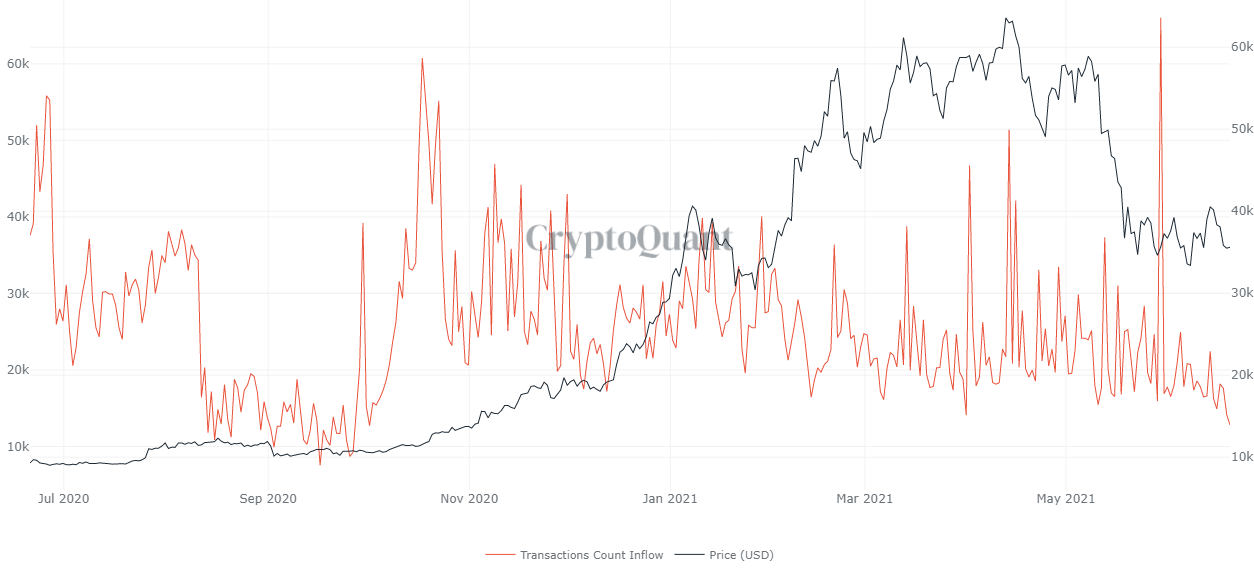

There was additionally a spike within the variety of stablecoin cash-flow transactions that occurred on May 29. When stablecoin provide was peaking, it was adopted by a fast rise in BTC worth to $40,000 earlier than one other one. Another wave of sell-offs pushed costs again under $34,000 and eliminated any impetus.

This information serves as a warning that not all stablecoin issuances are predictors of Bitcoin worth will increase as there are a number of different components that may be defined similar to institutional buyers. purchase stablecoins for future reserve and even DeFi protocols put together to combine pairs with stablecoins.

Synthetic

Maybe you have an interest:

.

[ad_2]