Stellar (XLM) price has increased 34% in the past seven days, demonstrating strong upward momentum. The coin is trading between key levels, with resistance at $0.47 and support at $0.41, while investors await its next move.

Although the recent rallies were fueled by the “Golden Cross” formation, signals from the CMF and DMI suggest the trend may be losing momentum. If XLM can clear the $0.47 resistance, it could aim for $0.51 or even $0.60, but if it fails to hold the $0.41 support, something could happen. strong adjustment.

XLM Still In Uptrend, But Sellers May Take Control

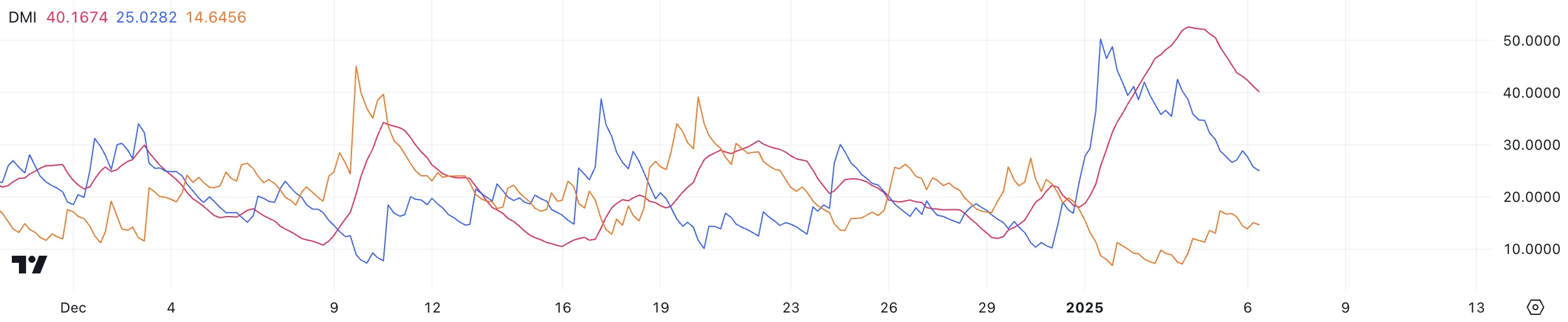

XLM’s Average Trend Direction (ADX) index currently stands at 40.1, reflecting a strong trend, albeit down from 52.6 two days ago. ADX measures trend strength on a scale of 0 to 100, with values above 25 indicating a strong trend and below 20 signaling weak or non-existent momentum.

Despite the decline, ADX remains firmly above 25, confirming that Stellar remains in an uptrend, although momentum appears to be fading.

The +DI index, which represents buying pressure, has fallen from 40.3 to 25 in the previous two days, while the -DI, which tracks selling pressure, has increased from 7.9 to 14.6.

This change shows that while buyers are still in control, their control is weakening as sellers gradually take over. If this trend continues, the XLM uptrend could weaken further, possibly leading to a stall or reversal unless buying momentum strengthens.

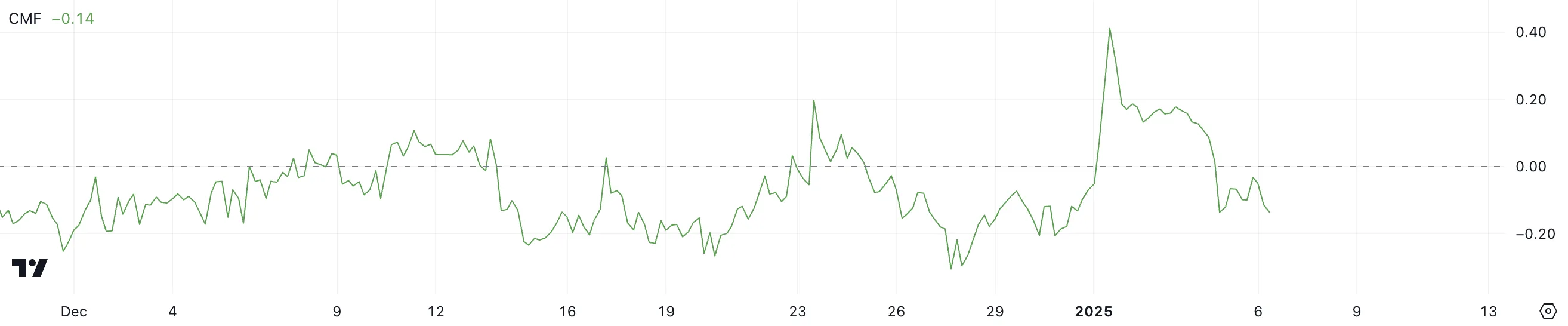

Stellar CMF Drops From One-Year High Value

XLM’s Chaikin Money Flow (CMF) index is currently at -0.14, marking a significant turnaround from a peak of 0.41 on January 1, its highest value in a year. CMF measures the flow of money into and out of an asset based on price and volume, with values above zero indicating net buying pressure and values below zero indicating net selling pressure.

Stellar’s move into negative territory highlights the shift from strong inflows to increased outflows, signaling a change in market sentiment.

This decline shows that selling pressure has overcome buying activity, which could affect XLM’s price in the short term. With CMF falling from 0.17 to current levels in just two days, the trend points to a loss of investor confidence.

If CMF remains negative or continues to decline, XLM price could face further downward pressure. However, a recovery back into positive territory could indicate renewed interest and a potential stabilization or lift in prices.

XLM Price Prediction: Can Stellar Hit $0.60 in January?

XLM’s EMAs have featured a “Golden Cross” formed on January 1, which has fueled the recent price increase. Currently, XLM is trading between the $0.47 resistance and $0.41 support, with the resistance having been a barrier in previous attempts.

If it breaks the $0.47 resistance, Stellar’s price could rally to $0.51 and potentially even test the $0.60 level if the upside momentum is strong.

However, signals from CMF and DMI suggest that the uptrend may be weakening. If the $0.41 support fails to hold, XLM price could face a sharp decline, potentially dropping to $0.35 or even $0.31.