The sudoswap protocol is finding a whole lot of local community interest just lately due to a new alternative termed sudoAMM. This is a alternative to enhance NFT liquidity and guarantees to probably open the summer season for the “JPEG” market place. So how does this alternative get the job done? Let’s obtain out with the AANC staff in today’s write-up.

Summary (TLDR)

- AMM versions that operate with the x * y = k pricing mechanism when utilized to NFT will produce big slippage

- sudoAMM assists enhance slippage by separating the cost and reserves of tokens in the liquidity pool, permitting liquidity companies to freely pick out the fee of cost alter

- SudoAMM’s alternative has enhanced pricing accuracy and liquidity, which will enhance the working of the NFT loan market place.

Why not the normal AMMs?

To recognize how sudoAMM performs, let us initial consider a seem at how a typical Automated Market Maker (AMM) performs in cryptography. Currently, most AMMs this kind of as Uniswap, Sushiwap, Pancakeswap, and so on. have a pricing mechanism x * y = k. There is no denying that this mechanism has fueled DeFi’s powerful development by supplying customers with a straightforward on-chain transaction strategy. However, this mechanism includes some limitations. x * y = k will have a big slip if the liquidity in the pool is very low and most of the liquidity in the pool is not working effectively.

NFTX – a platform that enables you to convert NFT into ERC-twenty tokens (aka fungible tokens) and then customers can right exchange this token in exchange for income. This is a kind of offering NFTs instantly, not listing NFTs on the markets and waiting for persons to obtain. This is a very good plan and assists customers obtain / promote NFTs quicker. However, due to the x * y = k trade and constrained provide and the indivisible token nature of the NFT, trading will outcome in big slippage.

Assuming you have a liquidity pool consisting of ten ETH and ten NFT, the cost of one NFT = one ETH. When somebody buys / sells on this pool, the cost and slippage will take place as proven beneath.

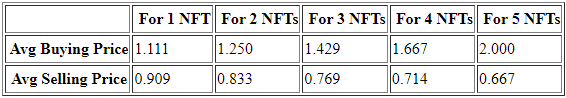

We can see that when customers make NFT purchases with ETH, the slippage in the pool increases. This will trigger the cost to fluctuate with a powerful assortment. Take a seem at the table beneath, which demonstrates the typical cost for getting / offering a particular amount of NFTs in the pool.

Initially the cost of one NFT = one ETH, but if we obtain five NFT at the similar time, the typical cost for one NFT will be two ETH, which indicates that the cost has greater to a hundred%. Conversely, the cost drops by 33.three% if we promote five NFTs at the similar time.

But can we offer much more liquidity to lessen slippage? Yes, but if the pool is a hundred ETH and a hundred NFT, the slippage is nevertheless big in contrast to regular transactions. This produces a adverse impact not only for traders but also for individuals supplying liquidity as the short-term reduction is also big.

sudoAMM recognizes this difficulty and has created a alternative that lowers slippage, as a result building rates significantly less volatile.

How sudoAMM performs

In basic, sudoAMM enables customers to obtain / promote by means of liquidity pool, customers do not need to have to convert NFT to a representative ERC-twenty token like NFTX but can trade right from NFT to ERC-twenty token. In terms of consumer expertise, there will be similarities with other AMMs. However, the underlying layout mechanism includes several variations.

To recognize how sudoAMM performs, let us consider a seem from the viewpoint of an LP, a liquidity supplier.

The liquidity supplier will have three selections on sudoAMM:

– Buy NFT with tokens: You will need to have to deposit an sum of ETH and set the cost to obtain NFT. Then other people will promote you NFTs as a result of this pool.

– Sell NFTs with tokens: In contrast to the pool over, you will deposit an sum of NFTs and set the cost to promote NFTs. Users will make NFT purchases primarily based on this pool.

– Do each and earn trading charges: This pattern is very similar to regular AMMs, you will need to have to deposit a pair in the pool consisting of a particular sum of NFT and ETH. Buyers / Sellers can all join this pool and you will obtain transaction charges in this model.

Basically, the two pools “Buy NFT with token” and “Sell NFT with token” are not really unique from present NFT markets this kind of as Opensea or Magic Eden. We are in essence NFTs / provides on NFT lists and count on acceptors to obtain / promote at set rates. Mechanism amount three has a reasonably very similar model to traditional AMMs. So why is sudoAMM ready to support enhance prices for traders?

Although it is an exchange, sudoAMM’s pool amount three (Do each and earn trading charges) does not get the job done with the x * y = k mechanism. The protocol, on the other hand, wholly separates the romantic relationship among cost and amount of tokens in reserve in the pool. sudoAMM enables liquidity companies to specify precisely how a great deal the cost improvements when somebody tends to make a obtain / promote in their pool. It is this mechanism that has drastically decreased the cost slippage.

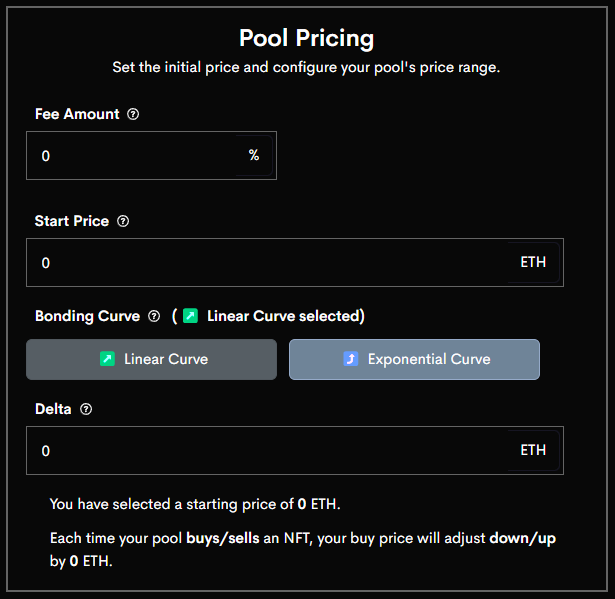

As proven over, the liquidity supplier will be ready to make a decision some data this kind of as the commission sum (transaction charge), the first cost (first cost), the delta (cost alter).

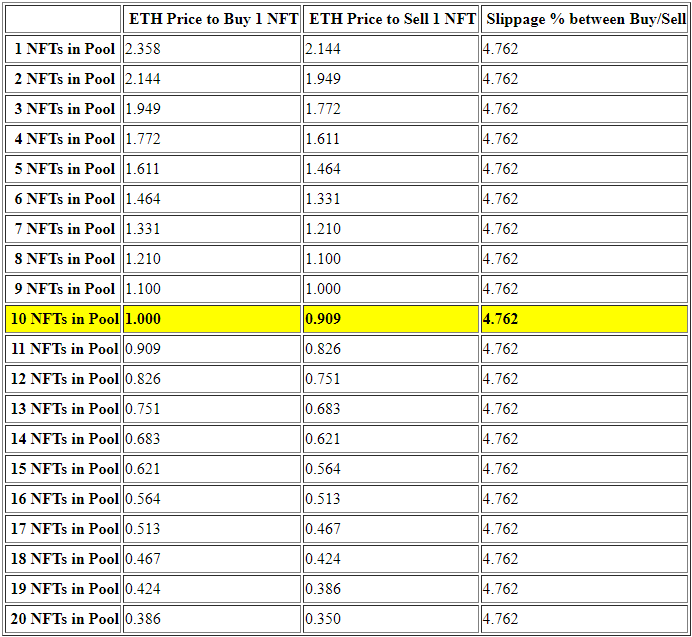

Let’s go back to the instance we have a liquidity pool consisting of ten NFT and ten ETH, one NFT = one ETH. As a liquidity supplier on sudoAMM, we will have the energy to make a decision how the cost improvements when somebody buys / sells in our pool. In this instance we will define the cost alter as one.one, this indicates that when somebody buys / sells NFT, the cost will alter one.one instances the enhance / lessen. As a outcome, the cost and slippage will fluctuate as proven in the table beneath.

Therefore, with this mechanism, slippage was substantially decreased in contrast to the x * y = k mechanism and slippage was also corrected in all situations. Slippage can also lessen even more based on the cost alter we have set.

The outcome of cost motion when building NFT obtain / promote on sudoAMM happens as beneath screenshot proven.

Therefore, when getting five NFTs at the similar time, the typical cost for one NFT is one,221 ETH, a great deal significantly less than two ETH in the x * y = k model.

Therefore, by wholly decoupling the romantic relationship among cost and token reserves in the liquidity pool collectively with the means to regulate cost improvements, sudoAMM delivers a trading model that substantially lowers slippage.

Also, a variation in sudoAMM is that for a token pair (ex. BAYC / ETH) there will be several unique liquidity pools from several LPs, every single LP has the proper to pick out how to offer liquidity in accordance to the three choice over, it has the proper to set the first cost and the degree of cost alter for every single transaction. On the purchaser / vendor interface side, all these pools will be aggregated into one particular big pool, traders will not have to get worried about liquidity from which pool.

How will sudoAMM support the NFT market place?

Sudo’s alternative focuses on resolving NFT market place liquidity, how to produce a way to obtain / promote NFTs immediately with smaller cost fluctuations. Therefore, sudoAMM has offered NFT traders with a hassle-free and immediate way to obtain / promote. It also minimizes the threat of short-term reduction of liquidity companies.

However, sudoAMM’s alternative solves a whole lot much more. This is most likely to be a door that will open powerful growth for the NFT loan market place. sudoAMM has enhanced pricing accuracy and liquidity, which will be an really crucial database for lending platforms. For instance, when a lending platform desires to know the worth of the collateral, it can match the sudoAMM cost.

Why reconcile by means of sudoAMM and not OpenSea? Since the cost on sudoAMM is the cost at which you can immediately convert an NFT into income, when in contrast to Opensea’s minimal cost, it is only the lowest cost and it is unlikely that any individual will obtain instantly at that cost.

For any economic market place wanting to expand, leverage is an indispensable instrument and lending platforms are the primary gamers. Therefore, several opinions feel that sudoAMM will make the NFT market place “go to the moon” by unlocking lending platforms.

Personal viewpoint of the writer

From the writer’s level of see, the sudoAMM model is not fundamentally unique from an NFT market place like OpenSea or Magic Eden. However, some of these smaller improvements have undeniably made a much more effective working model for each traders and liquidity companies.

The possible sudoAMM brings in the long term is fairly clear. However, sudoAMM will encounter terrific competitors from currently well-liked and effortless-to-use NFT market place platforms this kind of as Opensea or Magic Eden if they develop very similar performance in the long term. That would be a really tough difficulty that sudoAMM would have to fix.

On the other hand, sudoAMM is not a smaller competitor as Uniswap just lately uncovered that it will integrate sudoswap alternative into its personal platform. This can be noticed that, sudoAMM is owning powerful assistance behind it.

It will be a really fascinating race.

About AntiAntiNFTs Club (AANC)

AntiAntiNFTs Club (AANC) is a local community of NFT collectors and traders in Vietnam. Born out of enjoy for NFT, AANC usually desires to spread that enjoy to anyone by setting up a high-quality local community, a spot real to our slogan …