After significantly speculation and speculation, SushiSwap has eventually launched its most up-to-date merchandise: an AMM platform termed “Trident”.

SushiSwap launches the new AMM

At the Ethereum EthCC conference held currently (July twenty), the workforce behind the decentralized exchange SushiSwap (SUSHI) launched a brand new AMM platform termed Trident.

This is SushiSwap’s most up-to-date try to shake off the “label” it is a venture that only understands “fork” the some others. As a end result, Trident is an AMM constructed from the ground up by the SUSHI workforce, with a lot of enhancements that guarantee to be superior and carry a lot more worth to consumers.

07/twenty marks the date we unveil to all our Next Generation AMMs, Trident.

Trident is a new AMM protocol constructed in-property by the Sushi workforce, with functions hardly ever in advance of imagined in DeFi.

We cannot wait to welcome you to SushiSwap “not just a fork”, Trident, coming quickly! pic.twitter.com/RTLiduUVZf

– SushiChef (@SushiSwap) July 20, 2021

The concept of creating Trident came from discussions that the SushiSwap workforce had with Yearn Finance founder Andre Cronje about Deriswap and Mirin: the model of Sushi v2 was produced by this workforce. Therefore, the Trident factor will totally substitute Mirin, which signifies that the growth of this platform will end.

Trident claims to place income movement efficiency and cost volatility safety initially, but nevertheless maintains the consumer interface that consumers are acquainted with.

Improvements to the Trident

Similar to the “three point” trident, Trident will carry 3 significant updates.

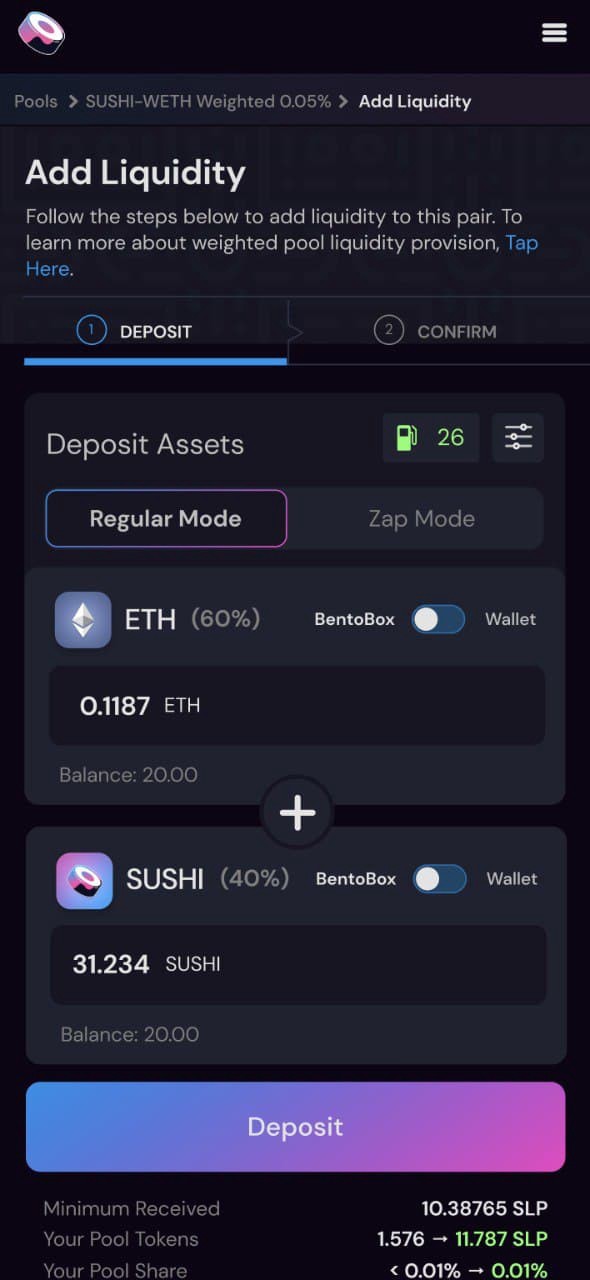

Trident will be a totally BentoBox compatible AMM

BentoBox is SushiSwap’s vault and yield farming platform, which will allow consumers to deposit SUSHI tokens and obtain curiosity on SushiSwap transaction charges, as nicely as SUSHI staking rewards. Thanks to the liquidity acquired by BentoBox, SushiSwap hopes to make Trident the most income-effective AMM in the DeFi market.

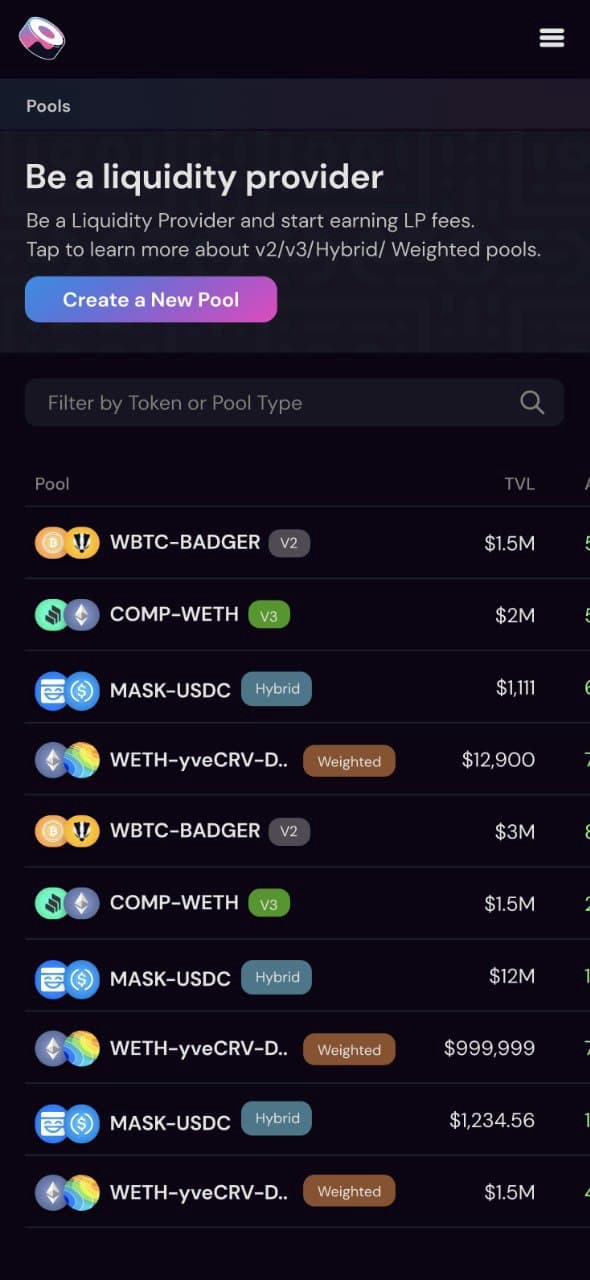

Greater assortment of the style of pool

Trident was designed to help up to four kinds of pools, such as:

– Constant merchandise pool (Fixed Pool): a standard pool construction of the DeFi sector, consisting of two tokens working in accordance to the formula x * y = k. This is the model made use of by a lot of AMMs, such as SushiSwap,

– Hybrid pool (Mixed Pool): Allows up to 32 asset lessons in the pool, built to decrease the affect on token charges all through swaps. This is the very same model as Curve (CRV).

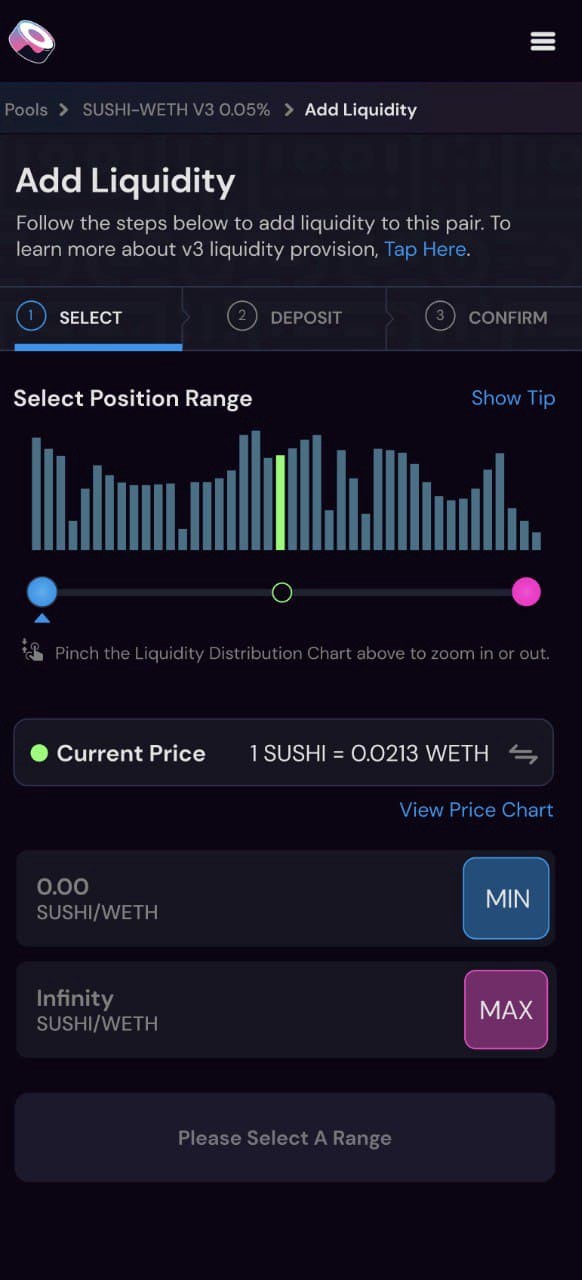

– Concentrated liquidity pool (Centralized Liquidity Pool): A pool that will allow consumers to opt for many liquidity at a provided cost, assisting to resolve the inadequacy of delivering consumers with liquidity that does not transform irrespective of token cost increases. This is the very same model as Uniswap v3.

– Weighted pool (Weighted pool): This is an up to date pool construction in contrast to a fixed pool, which will allow you to transform the proportion of tokens in the pool alternatively of following the formula x * y = k. Trident’s weighted pool supports up to eight tokens. This is the very same model as the Balancer (BAL).

Trident pools will also be represented by ERC-1155 tokens, rather than ERC-721 tokens.

Use of the new routing engine: Tines

Tines is Trident’s routing engine (which can be understood as the matching mechanism), building the AMM consumer working experience a lot more intuitive. Considering variables this kind of as the style of pool, the fuel charges, the affect of the swap cost, the yield curve, and so on., Tines will choose the very best instructions for the allocation of the user’s capital, as nicely as the trading alternatives of the most worthwhile tokens.

Development roadmap

According to SushiSwap Chief Technology Officer Joseph Delong, the venture has not however established an implementation date for the Trident, but at the earliest it will be one month from July twenty and the most up-to-date is right after two months, or common week of September 2021.

In addition to the aforementioned pools, Trident also desires to help an additional style of pool “Franchised swimming pool” – built to meet the KYC needs of stock exchanges and institutional traders. This style of pool really should assist connect liquidity concerning centralized exchanges with decentralized platforms this kind of as SushiSwap, opening up new trading possibilities for consumers.

Additionally, Trident intends to adopt a TWAP two-snapshot charging mechanism, delivering a totally decentralized Oracle charging alternative for all sources.

The SushiSwap ecosystem is slowly finished

With the launch of Trident, the SUSHI ecosystem has extra a new branch to contribute to the all round growth of this suite of DeFi goods.

– SushiSwap: The authentic AMM platform, which will allow decentralized transactions concerning tokens across the pool.

– Onsen: subsidiary that supplies liquidity for SushiSwap.

– BentoBox: are deposits that supply agricultural manufacturing capability.

– Kashi: a lending platform wherever BentoBox liquidity will be reallocated for distinctive functions.

– MISO: launchpad platform (token issuance).

– Trident: Next Generation AMM, the subsequent evolution of SushiSwap.

Synthetic currency 68

Maybe you are interested:

.