As a veteran blockchain platform, Cardano is nonetheless standing immediately after the several occasions of final 2022.

2022 is a tumultuous yr for the cryptocurrency marketplace, following a series of Terra/Three Arrows Capital/FTX “black swan” crashes. Many men and women in the local community are thinking if, immediately after what occurred, what this ecosystem will seem like and if there are other brilliant “jewels”.

As a veteran blockchain venture, Cardano is nonetheless standing immediately after the over occasions. Moving into 2023, Cardano continues to pursue important milestones as it grows its ecosystem. Here are some of the most crucial occasions for Cardano in 2022, from the point of view of Adaverse, a important accelerator of this ecosystem.

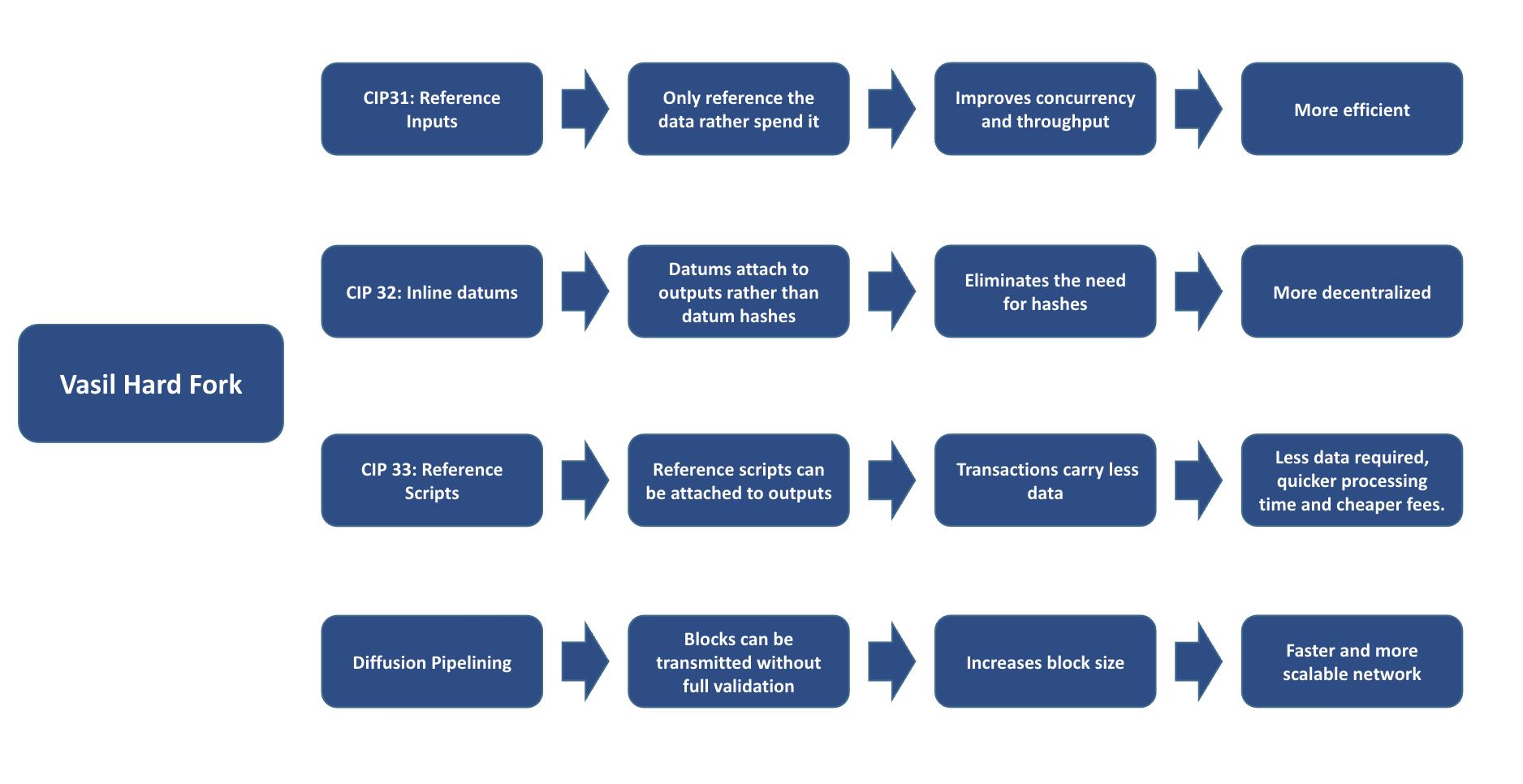

Vasil tricky fork update

According to Cardano founder Charles Hoskinson, Vasil is “the hardest upgrade we’ve ever done” due to the fact it will involve practically every single element of the Cardano network’s technical layers.

The Vasil tricky fork is element of the Basho era of Cardano’s advancement roadmap which focuses on optimization, scalability and interoperability on the blockchain network. This is also a consequence of the relentless collaborative efforts amongst the core advancement crew at Cardano, IOG, Emurgo, and the total Cardano local community via Cardano Improvement Proposals.

Finally, the Vasil update was officially activated at Epoch 365 with no concerns at 04:44am on September 23rd (Vietnam Time).

One of the most crucial modifications immediately after the Vasil update is that transaction costs on Cardano will be decreased. Block aggregation and transaction validation will also be simplified with out sacrificing process safety, therefore lowering transaction processing instances for customers. Also, the modifications in Plutus (the programming language on Cardano) will assistance make improvements to the operate expertise of programmers in the local community of this blockchain.

dApp ecosystem

Since Cardano entered the wise contract era final September, the infrastructure of the Cardano ecosystem has steadily enhanced in latest months, attracting marketplace interest and capital flows, and is steadily catching up Looking at developing a wise contract platform.

It has now been practically 6 months and Cardano has steadily formed an ecosystem model dominated by DEX and NFT tasks. Other DEXs, launchpads, stablecoins, and other DeFi sectors have also emerged, and the Cardano DApp ecosystem matrix is starting to get form.

Indigo Protocol

Back in 2021, with the speedy advancement of the Ethereum DeFi notion, derivatives (futures, selections, asset synthesis…) have been thought of the most promising discipline for the long term. However, two many years have passed and the trend of the derivative layout nonetheless appears to be at a standstill.

However, considering that the rise of the Terra ecosystem, the relative benefit of the public chain has been demonstrated on the race for synthetic assets. This is a purely natural benefit for Cardano:

- On the a single hand, with the price and effectiveness positive aspects of Cardano, several of the use scenarios restricted by Ethereum can be steadily implemented in the genuine globe.

- On the other hand, the complete marketplace worth of Cardano stays as large as $13.seven billion (CoinGecko information as of Feb. 22), 2nd only to Bitcoin, Ethereum, BNB, and XRP in the ranking minus stablecoins. This suggests that, as the underlying asset, ADA can supply enough mass assistance for the synthetic asset ecosystem.

In November 2021, Indigo Protocol, a synthetic asset protocol in the Cardano ecosystem, launched the iUSD stablecoin, making it possible for customers to mint stablecoins by staking ADA.

And in the final month alone, Indigo has witnessed a whopping 50% development, creating it the third greatest DeFi protocol on Cardano in terms of TVL (practically $20M). The rush for synthetic assets in the Cardano ecosystem is accelerating and is anticipated to kick off an additional “DeFi summer” for Cardano in the marketplace.

Djed steady coin

Djed, the 1st degree one Cardano algorithmic stablecoin, has officially entered the mainnet on January 31 of final yr, After much more than a yr of incubation and advancement.

Djed was jointly made by the COTI Level one platform and the Cardano core advancement crew. Djed is pegged one:one to USD, is in excess of-collateralized with ADA (comparable to DAI) and makes use of SHEN as reserve currency. DJED is backed by ADA and demands a reserve ratio of 400-80% to lessen the chance of impairment.

Djed will be utilized on prime of DeFi protocols in the Cardano ecosystem as a steady option. COTI uncovered to include much more coins as wrapped bitcoins (WBTC) and wrapped ETH (WETH) as collateral to mint Djed on Cardano.

The venture ideas to integrate this algorithmic stablecoin into forty Cardano applications. Many decentralized exchanges this kind of as MinSwap, Winggriders and MuesliSwap has started off supporting this stablecoin. Coti after shared that they strategy to launch DjedPay out, a support for Djed payments at the very same time.

USDA steady currency

Recent incidents with BUSD and other stablecoins testifying to stablecoin competitors in 2023 could encounter significant regulatory hurdles.

Asylum EMURGUS di Cardano also ready himself for this squeeze when ideas to launch a stablecoin solely for the ADA ecosystem.

The new stablecoin, dubbed USDA, will be one hundred% supported and get regulatory approval. According to the announcement, USDA will be launched on the Anzens platform in Q1 2023, making it possible for customers to convert USD to USDA from regular fiscal channels this kind of as credit score cards, debit cards, financial institution transfers. Of program, customers can also convert ADA to USDA.

NFTs

A notable trend in the Cardano ecosystem in 2022 is the speedy development of the NFT circuit. After the Vasil update in September 2022, Cardano’s NFT trading volume reached $19 million, 2nd only to Ethereum and Solana.

This trend is steadily having more powerful. According to the most current information from CryptoSlamthe everyday NFT trading volume is all-around USD 250,000, as of September 2022.

April 2022, Legendary rapper Snoop Dogg, a popular KOL in the NFT discipline I steadily flip my interest to Cardano for the most current twist by launching their personal assortment of NFTs on ADA. On the other hand, Cardano’s NFT section is forming a robust local community.

Additionally, Input Output Global (IOG), a single of the builders of Cardano, has also partnered with the University of Edinburgh in the United kingdom to produce the 1st ever “Edinburgh Decentralization Index” (EDI) for the blockchain marketplace. This index aims to measure the effectiveness of blockchain decentralization, to improve transparency and inclusiveness across the total decentralized technological innovation sector.

All in all, all through the previous wave of crises, Cardano quietly designed its platform.

About Adaverse

Adaverse is a Cardano ecosystem accelerator connecting startups, strategists and platform builders in Africa and Asia. This is a collaborative initiative amongst EMURGO and Everest Ventures Group to assistance the founders of Web3 globally.

Find out much more about the venture: Website | Chirping | medium

Note: This is sponsored content material, Coinlive does not straight endorse any data from the over post and does not promise the veracity of the post. Readers should really do their personal study just before creating choices about themselves or their corporations and be ready to get accountability for their alternatives. The over post should really not be witnessed as investment tips.