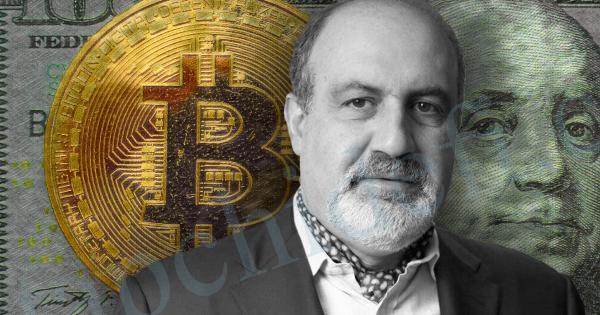

Nassim Nicholas Taleb, an essayist and scholar, finest recognized for his e-book on the intense impression of uncommon and unpredictable occasions, The Black Swan, has launched a brand new paper on Bitcoin (BTC) inflicting plenty of Bitcoiners to leap into the argument with what they take into account to be incorrect.

Taleb Releases New Article On Bitcoin That Caused Much Controversy In Crypto Community

In his article titled ‘Bitcoins, currencies and bubbles’, Taleb, who mentioned in 2018 that BTC is a superb concept, has now acknowledged that bitcoin, in its present model and regardless of the hype, “doesn’t meet the concept of ‘non-government currency’ (it has proven not to be a currency at all),” including that it isn’t a storehouse short-term in addition to long-term worth, it can’t be a dependable hedge towards inflation.

And whereas the writer continues to supply his unfavourable evaluation of the world’s first cryptocurrency, many discover a few of the arguments flawed and or based mostly on inaccuracies.

Judging by the submit shared by crypto podcaster developer Peter McCormack, Taleb shouldn’t be too reluctant to debate his article or hear a counter-opinion.

However, that definitely did not cease the Cryptoverse from indignant and argumentative.

Daniel Brain, a lead engineer on the PayPal Checkout crew, revealed a “short reflection” on Taleb’s evaluation.

He first focuses on the purpose of “when miners go extinct,” saying that so long as transactions and charges survive, so do miners – a certainty assured by block guidelines and the mechanism of motion. Bitcoin problem adjustment.

Bradley Rettler, Assistant Professor of Philosophy on the University of Wyoming (USA), additional argues, that Taleb’s assertion right here – assumes that the worth of BTC goes to zero when there are not any miners, therefore now now it is zero – a standard level of anticipated worth, not an argument towards Bitcoin.

As know-how evolves day by day, Taleb suggests, “items like gold and silver have been shown to be resistant to extinction.” Brain thinks that Taleb has excluded gold from the “technology” record, thus deeming it irreplaceable. “But gold is purely a monetary technology and cannot be substituted,” Brain mentioned. In addition, know-how all the time builds on prime of different know-how.

“Path dependence is a problem” for bitcoin, writes Taleb, whereas gold shouldn’t be path-dependent – which Brain discovered to be false and unproven. While not the rarest or most steady substance, “through the accidents of history, coupled with the diabolical tendency to cause man to suck up shiny metals, gold has indeed accumulated a state of storage.” that worth.”

While Taleb argues that Bitcoin doesn’t act as an inflation hedge, evaluating it to gettoni, an Italian cellphone token, Rettler says that getonni can’t be an inflation hedge due to technological advances — and there is not any argument that it might probably’t be an inflation hedge, or it might probably’t be bitcoin.

“Unfortunately, there seems to be a worse agency problem: a set of insiders holding what they think will be the world currency, so others will have to look to them later to supply,” wrote Taleb, whereas Brain argued that the Bitcoin system that permits anybody to build up it’s a fairer system than the one wherein governments and rulers hoard wealth. by violence and struggle.

Another level that Taleb argues is that, for instance, BTC transactions are “significantly” costlier than wire transfers, and even in different cryptocurrencies, whereas “transaction size is slower compared to standard commercial systems used by credit card companies.” To this, Rettler claims that isn’t the case with on-chain transactions, with wire transfers being rather more costly. Both Rettler and Brain argued that the mere existence of the Lightning Network would nullify this level.

As for Taleb’s argument about bitcoin’s volatility, Brain mentioned that it’s a rapidly-capitalizing asset and that the volatility in its path comes with the territory.

According to Taleb, those that search to cover property from the federal government by Bitcoin’s privateness or anonymity lack monetary literacy, statistical understanding, and customary sense. But in response to Brain, “the existence of privacy or anonymity on the Bitcoin network (aside from the moniker) is not a belief of any serious proponent of Bitcoin.”

Rettler added that Bitcoin doesn’t have an “account,” nor can or not it’s hacked, nor hacked by the FBI in the course of the Colonial Pipeline incident, as beforehand reported. So that is proof that Bitcoin is a protected haven from autocracies. Rettler wrote.

Additionally, “Bitcoin’s exact thesis is that you don’t have to trust any third parties to store and transfer value,” Brain mentioned. “Bitcoin only guarantees that you own the coins you own and that your funds will be sent to the address where you intend to send those coins, and not to anyone else.”

“Overall, the article is a brief discussion of some of the aspects of Bitcoin that Taleb finds problematic,” Rettler mentioned. “But the argument is too thin to justify a firm conclusion.”

Cory Klippsten, CEO of SwanBitcoin, described the newspaper as “a burger” that will shortly be shredded by dozens of Bitcoins. Klippsten writes: Taleb is “very smart,” however “”intelligence” shouldn’t be 1-to-1 correlated with understanding Bitcoin. That’s often a hindrance, in case your intelligence makes you may have a giant ego,” the CEO mentioned.

Who is Nassim Nicholas Taleb?

Nassim Nicholas Taleb (often known as Nessim or Nissim; born 1960) is a Lebanese-American essayist, mathematical statistician, former choices dealer, danger analyst, and linguist. work involving issues of randomness, chance, and uncertainty. His 2007 e-book The Black Swan has been described by The Sunday Times as one of many twelve most influential books for the reason that Second World War.

Taleb is the writer of Incerto, a five-volume philosophical essay on uncertainty revealed between 2001 and 2018 (of which the perfect recognized are The Black Swan and Antifragile). He has served as a professor at a number of universities, because the Distinguished Professor of Risk Engineering at New York University’s Tandon School of Engineering since September 2008. He is co-editor of the educational journal. Risk and choice evaluation since September 2014. He can be a mathematical finance practitioner, a hedge fund supervisor and a derivatives dealer and is presently listed as a scientific advisor. studied at Universa Investments.

In February of this yr, Nassim Nicholas Taleb mentioned ‘eliminate Bitcoin’, it was a failure.”

‘The Black Swan’ writer Nassim Nicholas Taleb mentioned Bitcoin, the cryptocurrency that’s attracting buyers globally, was a ‘failure, at the least for now’.

In a sequence of tweets on February 12, Taleb mentioned he would fully divest from Bitcoin. He cited the unprecedented volatility in its value as the explanation behind the cryptocurrency’s removing.

“A currency is never supposed to be more volatile than what you buy and sell with it,” he mentioned, stating {that a} foreign money “cannot price commodities” in Bitcoin in the meanwhile. .

“In that respect, it’s a failure (at least for now),” Taleb added, including that the cryptocurrency builds attraction on “the basis of some opacity.” In the case of Bitcoin, that attraction is lacking, he steered.

“Black Swan” writer Nassim Taleb agreed together with his view that bitcoin is an open Ponzi scheme and a failed foreign money in a CNBC interview again in April.

“There is no connection between inflation and bitcoin,” Taleb advised CNBC, including that everybody is aware of bitcoin is “a Ponzi.”

Some analysts see the cryptocurrency, generally known as digital gold, as a hedge towards inflation, highlighting its similarities to the dear steel.

“If you want to hedge against inflation, buy a piece of land,” says Taleb. “The best strategy for investors is to own things that generate future returns. In other words, you can get real money from the company.”

Join Facebook Groups and Telegram group of the Coinlive to talk and alternate details about the Crypto Currency market with greater than 10,000 different individuals.

Important Note: All content material on the web site is for informational functions solely and isn’t funding recommendation in any respect. Your cash, the choice is yours.