What are the Tarot (TAROT)?

Tarot is a decentralized lending protocol, created to maximize the possible potential crop in the Fantom ecosystem.

Liquidity companies can borrow working with their automated industry maker (AMM) LP token as collateral. Lenders can deposit their person tokens into the Tarot Protocol loan pools to supply loans.

The task facilitates quite a few new use situations:

- Borrow Leveraged Yield Farming Tokens, exactly where the loan is additional to a liquidity pool for numerous LP tokens.

- Use the borrowed tokens to put into action a short-term reduction hedging system.

- Lending person tokens for revenue, indirectly delivering liquidity to AMMs with no the danger of short-term losses.

- Get the very same leverage as choice DeFi lending protocols with significantly less danger.

How does the Tarot get the job done?

Settlement model

The LP token worth is often backed by 50-50 by the underlying tokens in the token pair. To decide the volume of collateral needed to borrow and make sure that borrowers can’t borrow much more than their collateral worth, the Tarot Protocol ought to determine the worth of the LP token.

The model of ensures in the Tarot determines the required ensures for a loan, based mostly on the security margin and the parameters that favor the liquidation of the loan pool.

These parameters of the security margin and the liquidation incentive get the job done to make sure that even soon after fluctuations in the value of the underlying tokens, there will often be adequate collateral to repay the loan and pay out the liquidator in the occasion of a liquidation.

Liquidation

Almost all decentralized lending protocols, which include the Tarot Protocol, depend on swift and timely settlement to make sure loan stability. If a borrower’s loan is not entirely secured, relative to the volume borrowed, a protocol normally sells component of the underlying collateral and repays the loan.

Liquidation incentive bonus

Tarot provides liquidators a liquidation incentive bonus (at present four%) in exchange for liquidating or repaying risky loans. Anyone can turn out to be a liquidator as prolonged as they supply the required tokens to repay the loan. In return, they acquire a percentage of the borrowed volume, which is deducted from the borrower’s authentic collateral.

borrower

Borrowers ought to periodically keep track of their latest leverage and liquidation value for leverage pending positions to make sure they are entirely secured.

Liquidation does not always suggest a reduction of a hundred% of the authentic ensure. When a borrower’s place is liquidated, the borrower pays a liquidation incentive in addition to the volume borrowed, deducted from the authentic collateral. After liquidation, the borrower keeps all remaining collateral. This method aids make sure that borrowers retain their positions entirely secured to keep away from penalties.

Vault of the Tarot

Many well-liked DEXs provide supplemental rewards to incentivize LPs to supply liquidity for unique token pairs. Liquidity companies can stake their energetic LP tokens in a staking or farming pool to earn these supplemental rewards in addition to transaction costs.

Tarot manages this method immediately with Tarot Vaults. Any Tarot Vault-enabled Loan Fund will acquire and reinvest these rewards. Rewards are accrued for any one who deposits or utilizes their collateral (LP token) in the loan pool and will periodically reinvest to invest in much more LP tokens on their behalf.

Interest price model

The adaptive curiosity price model in the Tarot defines the loan APR and the provide for every loan pool. All loan pools are separate, and every loan pool utilizes its very own curiosity price model that operates independently of all other loan pools.

Similar to protocols like Aave and Compound, Tarot utilizes a folding curiosity price model with a single adjustment parameter (kinkUtilizationRate, ranging from 70% to 90%) that can be adjusted by management.

Oracle value

Tarot utilizes Oracle’s Tarot Price to reliably determine the worth of LP tokens and decide the volume of collateral essential to borrow and leverage.

Tarot Price Oracle will work with any Uniswap V2 compatible token pair, which is normally supported by a DEX. Calculate the time common value (TWAP) working with the pair’s developed-in value accumulator, in excess of a time period of at least one,200 seconds (twenty minutes). This is performed working with the pair’s latest value and the previously observed value (stored in Oracle’s contract) from at least twenty minutes in the past.

Basic facts about the TAROT token

- Token identify: Tarot

- Ticker: TAROT

- Blockchain: Ghost

- Token typical: FRC-twenty

- To contract: 0xc5e2b037d30a390e62180970b3aa4e91868764cd

- Token kind: Utility, Governance

- Total provide: a hundred,000,000 TAROT

- Circulating provide: twenty.889.245 TAROT

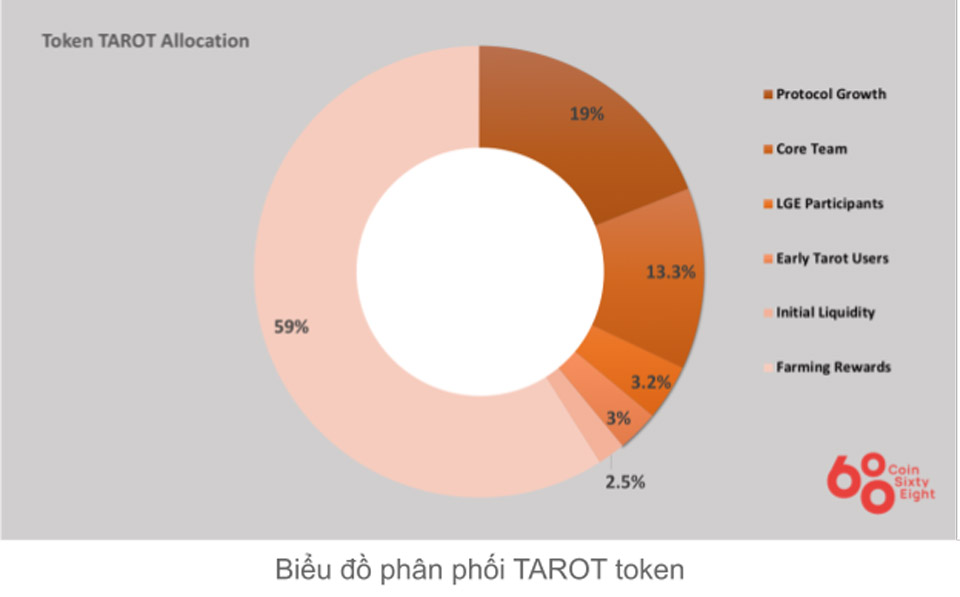

Token allocation

- Protocol growth: 19%

- Key workforce: 13.three%

- LGE Participants: three.two%

- Tarot consumers in the early phases: three%

- Initial liquidity: two.five%

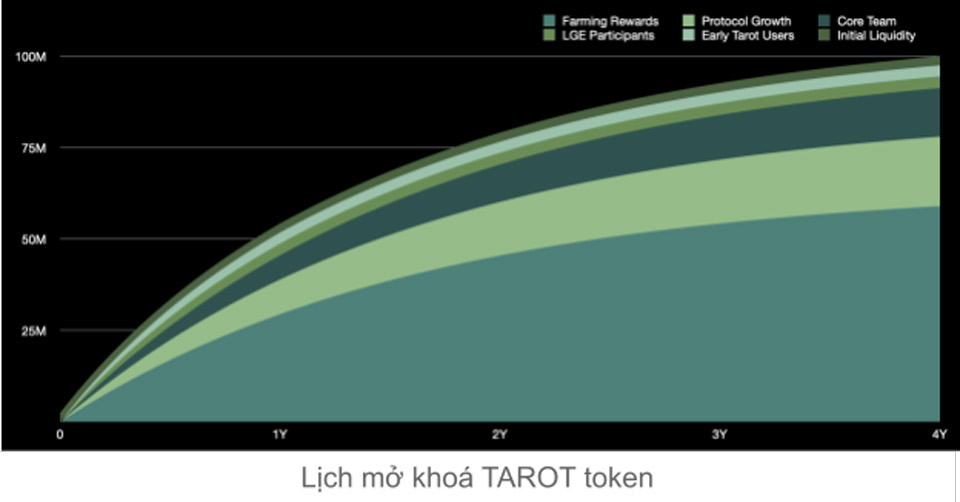

Token release system

What is the TAROT token for?

Administration

Wallet for TAROT tokens

You can retailer this token on wallets: Metamask, Fantom, Coin98 Wallet.

How to earn and very own TAROT tokens

Buy immediately on the stock exchange

Where to purchase and promote TAROT tokens?

TAROT is at present traded on four exchanges Spookyswap, Spiritswap, OpenOcean and Beethoven X with a complete each day trading volume of around $ one.six million.

Roadmap

Updating

What is the potential of the Tarot task, ought to I invest in TAROT tokens?

Tarot is a lending protocol created on Fantom, with the very same working model as other main lending protocols on Ethereum this kind of as Aave, Alpha Finance. Through this report, you ought to have by some means grasped the essential facts about the task to make your investment choices. Coinlive is not accountable for any of your investment choices. I want you results and earn a great deal from this possible industry.

What are the Tarot (TAROT)?

Tarot is a decentralized lending protocol, created to maximize the possible potential crop in the Fantom ecosystem.

Liquidity companies can borrow working with their automated industry maker (AMM) LP token as collateral. Lenders can deposit their person tokens into the Tarot Protocol loan pools to supply loans.

The task facilitates quite a few new use situations:

- Borrow Leveraged Yield Farming Tokens, exactly where the loan is additional to a liquidity pool for numerous LP tokens.

- Use the borrowed tokens to put into action a short-term reduction hedging system.

- Lending person tokens for revenue, indirectly delivering liquidity to AMMs with no the danger of short-term losses.

- Get the very same leverage as choice DeFi lending protocols with significantly less danger.

How does the Tarot get the job done?

Settlement model

The LP token worth is often backed by 50-50 by the underlying tokens in the token pair. To decide the volume of collateral needed to borrow and make sure that borrowers can’t borrow much more than their collateral worth, the Tarot Protocol ought to determine the worth of the LP token.

The model of ensures in the Tarot determines the required ensures for a loan, based mostly on the security margin and the parameters that favor the liquidation of the loan pool.

These parameters of the security margin and the liquidation incentive get the job done to make sure that even soon after fluctuations in the value of the underlying tokens, there will often be adequate collateral to repay the loan and pay out the liquidator in the occasion of a liquidation.

Liquidation

Almost all decentralized lending protocols, which include the Tarot Protocol, depend on swift and timely settlement to make sure loan stability. If a borrower’s loan is not entirely secured, relative to the volume borrowed, a protocol normally sells component of the underlying collateral and repays the loan.

Liquidation incentive bonus

Tarot provides liquidators a liquidation incentive bonus (at present four%) in exchange for liquidating or repaying risky loans. Anyone can turn out to be a liquidator as prolonged as they supply the required tokens to repay the loan. In return, they acquire a percentage of the borrowed volume, which is deducted from the borrower’s authentic collateral.

borrower

Borrowers ought to periodically keep track of their latest leverage and liquidation value for leverage pending positions to make sure they are entirely secured.

Liquidation does not always suggest a reduction of a hundred% of the authentic ensure. When a borrower’s place is liquidated, the borrower pays a liquidation incentive in addition to the volume borrowed, deducted from the authentic collateral. After liquidation, the borrower keeps all remaining collateral. This method aids make sure that borrowers retain their positions entirely secured to keep away from penalties.

Vault of the Tarot

Many well-liked DEXs provide supplemental rewards to incentivize LPs to supply liquidity for unique token pairs. Liquidity companies can stake their energetic LP tokens in a staking or farming pool to earn these supplemental rewards in addition to transaction costs.

Tarot manages this method immediately with Tarot Vaults. Any Tarot Vault-enabled Loan Fund will acquire and reinvest these rewards. Rewards are accrued for any one who deposits or utilizes their collateral (LP token) in the loan pool and will periodically reinvest to invest in much more LP tokens on their behalf.

Interest price model

The adaptive curiosity price model in the Tarot defines the loan APR and the provide for every loan pool. All loan pools are separate, and every loan pool utilizes its very own curiosity price model that operates independently of all other loan pools.

Similar to protocols like Aave and Compound, Tarot utilizes a folding curiosity price model with a single adjustment parameter (kinkUtilizationRate, ranging from 70% to 90%) that can be adjusted by management.

Oracle value

Tarot utilizes Oracle’s Tarot Price to reliably determine the worth of LP tokens and decide the volume of collateral essential to borrow and leverage.

Tarot Price Oracle will work with any Uniswap V2 compatible token pair, which is normally supported by a DEX. Calculate the time common value (TWAP) working with the pair’s developed-in value accumulator, in excess of a time period of at least one,200 seconds (twenty minutes). This is performed working with the pair’s latest value and the previously observed value (stored in Oracle’s contract) from at least twenty minutes in the past.

Basic facts about the TAROT token

- Token identify: Tarot

- Ticker: TAROT

- Blockchain: Ghost

- Token typical: FRC-twenty

- To contract: 0xc5e2b037d30a390e62180970b3aa4e91868764cd

- Token kind: Utility, Governance

- Total provide: a hundred,000,000 TAROT

- Circulating provide: twenty.889.245 TAROT

Token allocation

- Protocol growth: 19%

- Key workforce: 13.three%

- LGE Participants: three.two%

- Tarot consumers in the early phases: three%

- Initial liquidity: two.five%

Token release system

What is the TAROT token for?

Administration

Wallet for TAROT tokens

You can retailer this token on wallets: Metamask, Fantom, Coin98 Wallet.

How to earn and very own TAROT tokens

Buy immediately on the stock exchange

Where to purchase and promote TAROT tokens?

TAROT is at present traded on four exchanges Spookyswap, Spiritswap, OpenOcean and Beethoven X with a complete each day trading volume of around $ one.six million.

Roadmap

Updating

What is the potential of the Tarot task, ought to I invest in TAROT tokens?

Tarot is a lending protocol created on Fantom, with the very same working model as other main lending protocols on Ethereum this kind of as Aave, Alpha Finance. Through this report, you ought to have by some means grasped the essential facts about the task to make your investment choices. Coinlive is not accountable for any of your investment choices. I want you results and earn a great deal from this possible industry.