The amazing acceptance of the TerraUSD (UST) stablecoin in current instances has assisted Terra (LUNA) continually record sudden new hits in spite of common market place volatility. .

Stablecoins are an integral element of DeFi, which has grown pretty quickly in current many years as they present the vital liquidity so that traders can effortlessly trade them for unique assets.

One stablecoin undertaking that has skilled “terrible” development in spite of the widespread downward correction of the market place is Terra (LUNA), the blockchain protocol aimed at setting up a worldwide payment technique via the use of fiat coupled to the TerraUSD (UST) stablecoin.

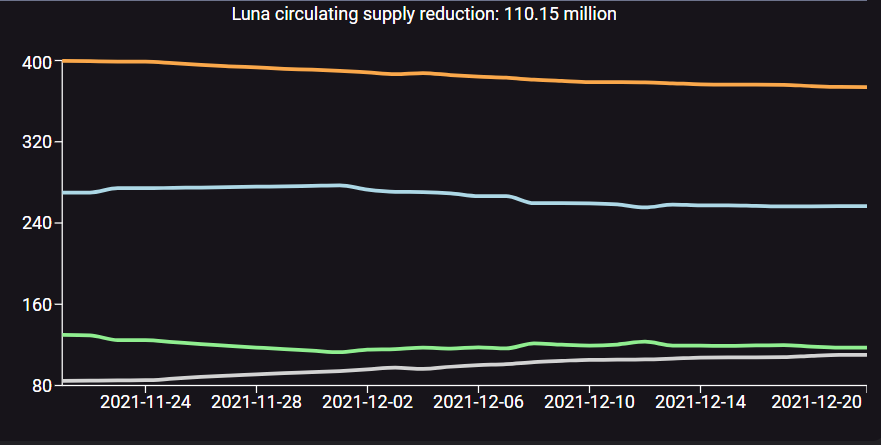

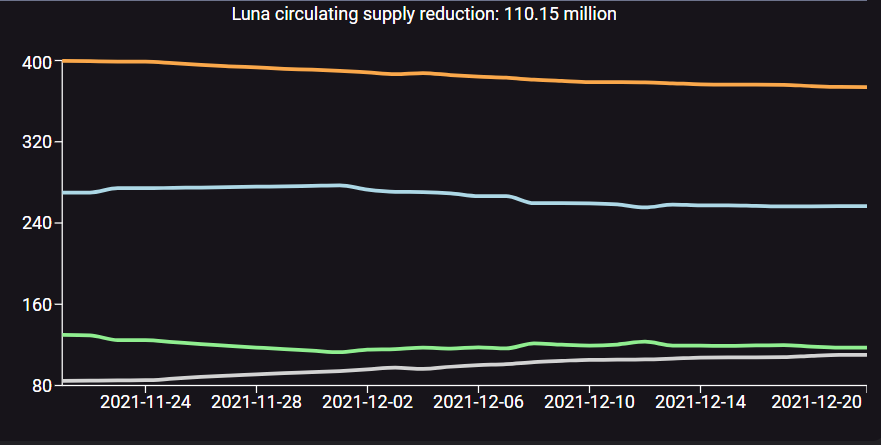

Arguably, the volatility absorption perform proves to be the strongest bullish situation suitable now for LUNA. The Earth ecosystem maintains the stability of the UST stablecoin by burning LUNA. Recently, Terra (LUNA) just authorized the biggest token burn up proposal in background. More than 110 million MOONS have been burned considering the fact that the Columbus-five update went into impact.

In other phrases, if the rate of UST exceeds one USD, the protocol will burn up LUNA to extract much more UST, as a result bringing the worth of UST back to one UST. Conversely, if the UST worth drops under one UST, the protocol will trade the stablecoin for LUNA to boost the rate of the underlying token. With the Columbus-five update, predictions of deflationary pressures on LUNA come into perform.

At the identical time, LUNA and UST are also obtainable on a number of well-known cross-chain bridges, generating it effortless for LUNA owners to invest in DeFi blockchains on Ethereum (ETH), Solana (SOL), Fantom (FTM) and Polygon (MATIC) to becoming capable to optimize earnings in a much more diversified way.

Additionally, Chiron’s promising $ 50 million fund has brought much more new matters to the Earth universe, which is only regarded for its scope of exercise in DeFi area, has now been extended to a range of domains, this kind of as NFT, metaverse. or blockchain game. , actually excites traders interested in the platform. Terra is anticipated to have more than 160 new tasks by early 2022.

However, on the morning of December twenty, LUNA continued to break its record of $ 78.36 on December seven, to set a new ATH at $ 78.99. It is really worth noting that LUNA only took about two weeks to attain the over outcome. At press time, LUNA is trading all over $ 76.58.

More exclusively, Terra (LUNA) has turn out to be the 2nd biggest DeFi blockchain on the market place, outperforming other solid rivals this kind of as Binance Smart Chain (BSC), Solana (SOL) or Avalanche (AVAX), with a complete Locked Value (TVL) rate. of 17.07 billion bucks and is accepted only soon after Ethereum (ETH).

Synthetic Currency 68

Maybe you are interested:

The amazing acceptance of the TerraUSD (UST) stablecoin in current instances has assisted Terra (LUNA) continually record sudden new hits in spite of common market place volatility. .

Stablecoins are an integral element of DeFi, which has grown pretty quickly in current many years as they present the vital liquidity so that traders can effortlessly trade them for unique assets.

One stablecoin undertaking that has skilled “terrible” development in spite of the widespread downward correction of the market place is Terra (LUNA), the blockchain protocol aimed at setting up a worldwide payment technique via the use of fiat coupled to the TerraUSD (UST) stablecoin.

Arguably, the volatility absorption perform proves to be the strongest bullish situation suitable now for LUNA. The Earth ecosystem maintains the stability of the UST stablecoin by burning LUNA. Recently, Terra (LUNA) just authorized the biggest token burn up proposal in background. More than 110 million MOONS have been burned considering the fact that the Columbus-five update went into impact.

In other phrases, if the rate of UST exceeds one USD, the protocol will burn up LUNA to extract much more UST, as a result bringing the worth of UST back to one UST. Conversely, if the UST worth drops under one UST, the protocol will trade the stablecoin for LUNA to boost the rate of the underlying token. With the Columbus-five update, predictions of deflationary pressures on LUNA come into perform.

At the identical time, LUNA and UST are also obtainable on a number of well-known cross-chain bridges, generating it effortless for LUNA owners to invest in DeFi blockchains on Ethereum (ETH), Solana (SOL), Fantom (FTM) and Polygon (MATIC) to becoming capable to optimize earnings in a much more diversified way.

Additionally, Chiron’s promising $ 50 million fund has brought much more new matters to the Earth universe, which is only regarded for its scope of exercise in DeFi area, has now been extended to a range of domains, this kind of as NFT, metaverse. or blockchain game. , actually excites traders interested in the platform. Terra is anticipated to have more than 160 new tasks by early 2022.

However, on the morning of December twenty, LUNA continued to break its record of $ 78.36 on December seven, to set a new ATH at $ 78.99. It is really worth noting that LUNA only took about two weeks to attain the over outcome. At press time, LUNA is trading all over $ 76.58.

More exclusively, Terra (LUNA) has turn out to be the 2nd biggest DeFi blockchain on the market place, outperforming other solid rivals this kind of as Binance Smart Chain (BSC), Solana (SOL) or Avalanche (AVAX), with a complete Locked Value (TVL) rate. of 17.07 billion bucks and is accepted only soon after Ethereum (ETH).

Synthetic Currency 68

Maybe you are interested: