Tether’s most current wealth report exhibits that the ratio of money reserves to money equivalents has improved to its highest degree ever.

Tether Releases Q3 2023 Asset Report. Photo: CCN

Tether Releases Q3 2023 Asset Report. Photo: CCN

Tether, the world’s greatest stablecoin issuer, USDT, launched its most current asset certification report on the evening of October 31, summarizing the third quarter of 2023.

Tether’s Q3 Statement Reveals Highest Percentage of Cash and Cash Equivalent Reserves, Over $330 Million Reduction in Secured Lending, and Maintains $72.six Billion Exposure in U.S. Treasuries

Read a lot more 🔽: https://t.co/CNJujkh4oZ—Tether (@Tether_to) October 31, 2023

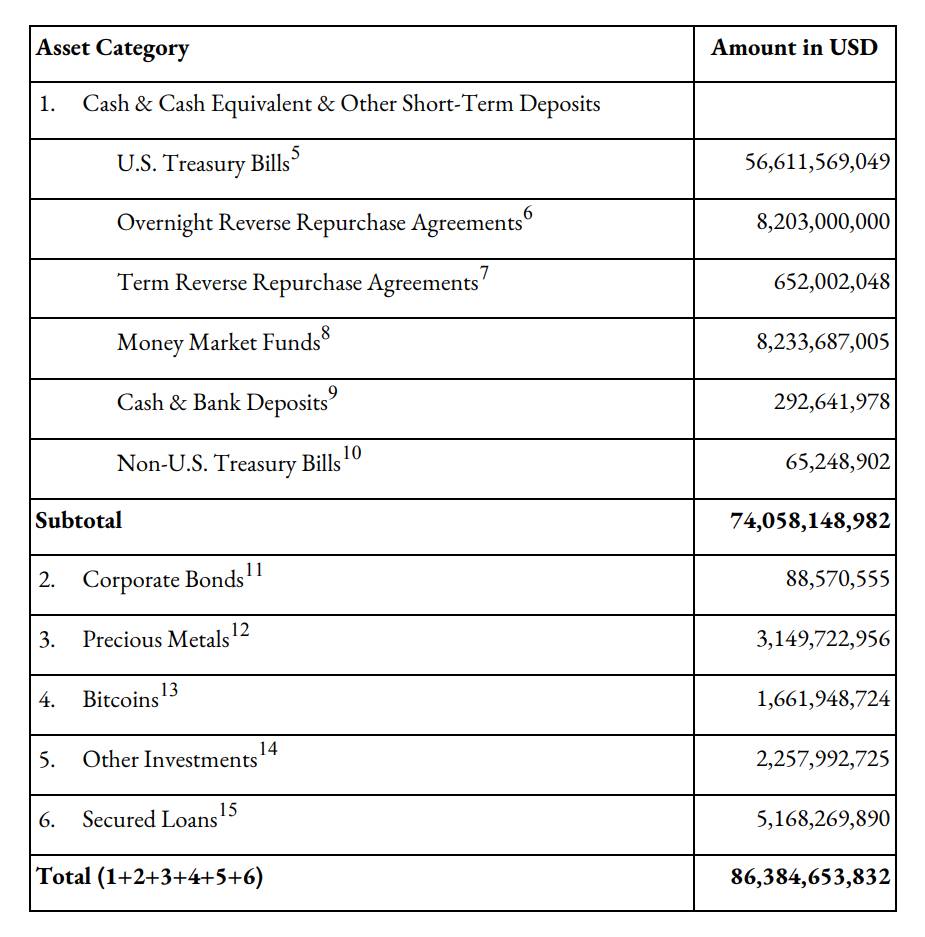

Accordingly, as of September thirty, 2023, Tether is holds assets of 86.three billion bucksvouch for 83.one billion USDT issued industry.

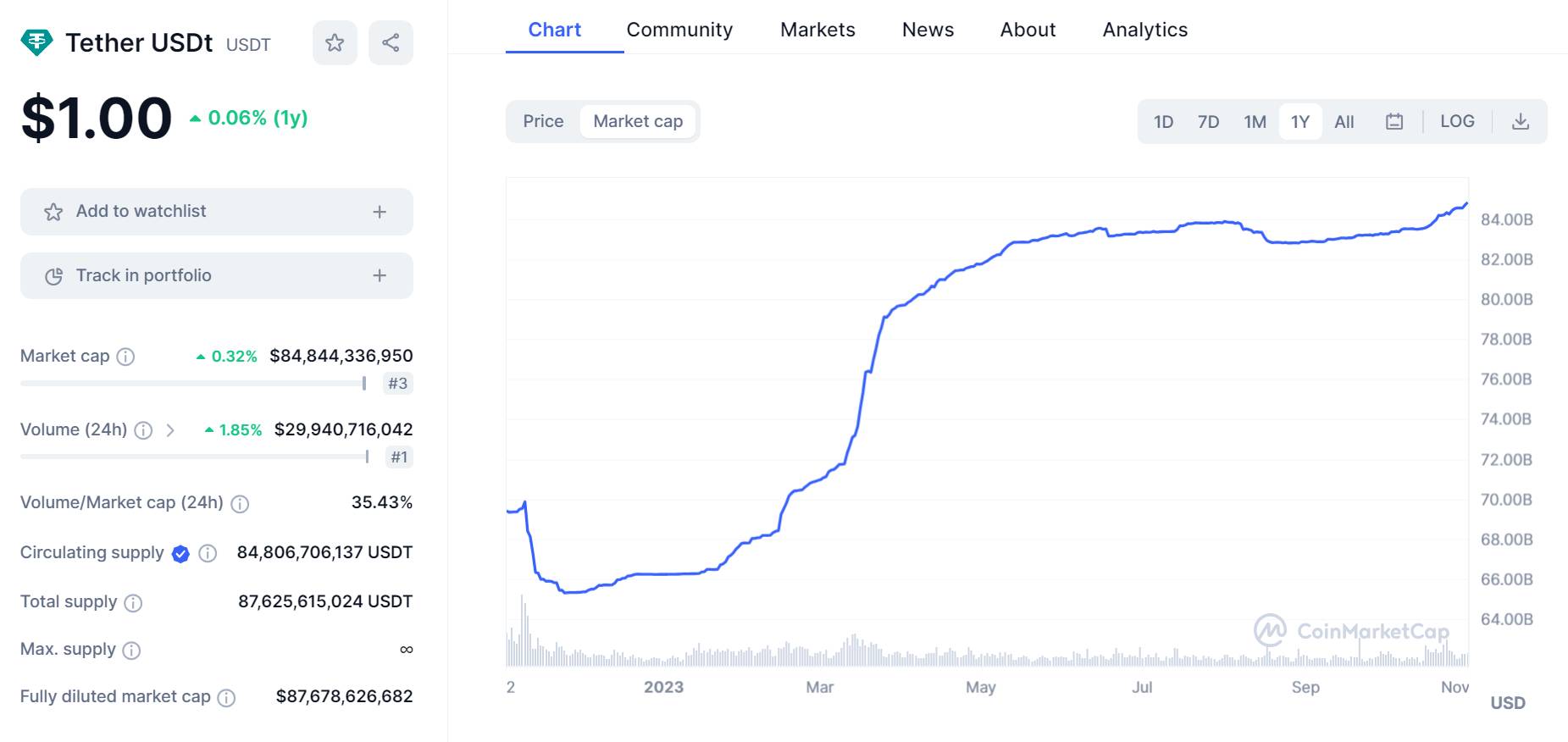

However, in accordance to existing information as of October 31, USDT’s industry capitalization has reached $84.eight billion, the highest mark in historical past. This aids Tether carry on to sustain its place as the greatest stablecoin in the cryptocurrency industry, with a industry share of more than 67%.

USDT industry capitalization fluctuation more than the most latest 12 months. Source: CoinMarketCap (November one, 2023)

USDT industry capitalization fluctuation more than the most latest 12 months. Source: CoinMarketCap (November one, 2023)

Of the complete $86.three billion in collateral assets, the greatest share is nonetheless created up of US Treasury securities (T-payments), with a worth of $56.six billion, up somewhat from $fifty five.eight billion 2nd quarter bucks. to a variety of other monetary instruments invoice of the tbringing the complete worth to 72.six billion bucks.

From this investment in Treasury Bonds, revenue earned in Tether’s third quarter once again reached around $one billionequal to the 2nd quarter figure and only missing the record of one.five billion bucks in the 1st quarter of 2023.

The organization has invested 670 million bucks for “research and development”, bringing the complete volume allotted in 2023 for this function to $800 million. Because of these bills, capital surplus fund of the organization stays the very same around approx three.two billion bucks.

Assets held by Tether as of September thirty, 2023. Source: Tether

Assets held by Tether as of September thirty, 2023. Source: Tether

Another noteworthy level is that Tether’s money reserves and financial institution deposits have improved from $90 million three months in the past to $292 million.

Therefore, the ratio of money to money-equivalent assets (such as Treasury payments) represents 85.seven% of Tether’s reserve fund. According to new CEO Paolo Ardoino, this is the 1st time in Tether’s 9-12 months historical past of operations that it has reached this kind of a substantial variety.

Other asset classes this kind of as corporate bonds, treasured metals (gold) and Bitcoin investments and other investments did not fluctuate substantially. However, the organization mentioned that it decreased the variety of external borrowings by an additional $330 million.

The solid price tag development of Bitcoin and gold in October 2023 was not reflected in this asset report. According to Ardoino, if calculated primarily based on the price tag of BTC on October 31, the volume of BTC and gold held by the organization will raise to $two.one billion and $three.four billion respectively, and the asset surplus fund will broaden radically . four.three billion bucks.

Tether currently releases its attestation for the third quarter of 2023. The money and money equivalents share of reserves is at an all-time substantial at 85.seven%, with a yield of around $one billion

– Exposure (direct and indirect) to US Treasury Bonds at $72.six billion

– reduction in assured loans by $330 million

– investments in vitality, bitcoin mining and P2P technological innovation… https://t.co/PXQ1H5gqUX pic.twitter.com/ibKJRPlBAg— Paolo Ardoino 🍐 (@paoloardoino) October 31, 2023

Tether had a quieter third quarter of 2023 in contrast to the prior half-12 months, which noticed a good deal of information that had each beneficial and damaging impacts on the organization and the USDT coin.

In addition to naming longtime Chief Technology Officer Paolo Ardoino as CEO, Tether announced that it will cease supporting USDT on 3 blockchains such as Kusama, Omni (Bitcoin), and Bitcoin Cash due to declining demand. However, the stablecoin growth unit is hectic focusing its efforts on creating the RGB protocol to help wise contracts on Bitcoin, quickly bringing USDT back into the world’s greatest cryptocurrency network.

In light of the political circumstance, Tether mentioned it supported blocking wallet addresses believed to be linked to organizations concerned in conflicts in Israel and Ukraine. However, the organization is nonetheless accused by US officials of aiding and abetting terrorist financing.

In 2024, Tether announced that it will offer authentic-time USDT reserve information, even more rising operational transparency.

Coinlive compiled

Join the discussion on the hottest challenges in the DeFi industry in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!