Tether (USDT), the top stableoin in the cryptocurrency market place, continues to strengthen its place all through the latest rally with the issuance of an further four billion USDT in significantly less than a month.

Tether (USDT) market place capitalization elevated by $four billion in three weeks. Photo: information.bitcoin.com

Tether (USDT) market place capitalization elevated by $four billion in three weeks. Photo: information.bitcoin.com

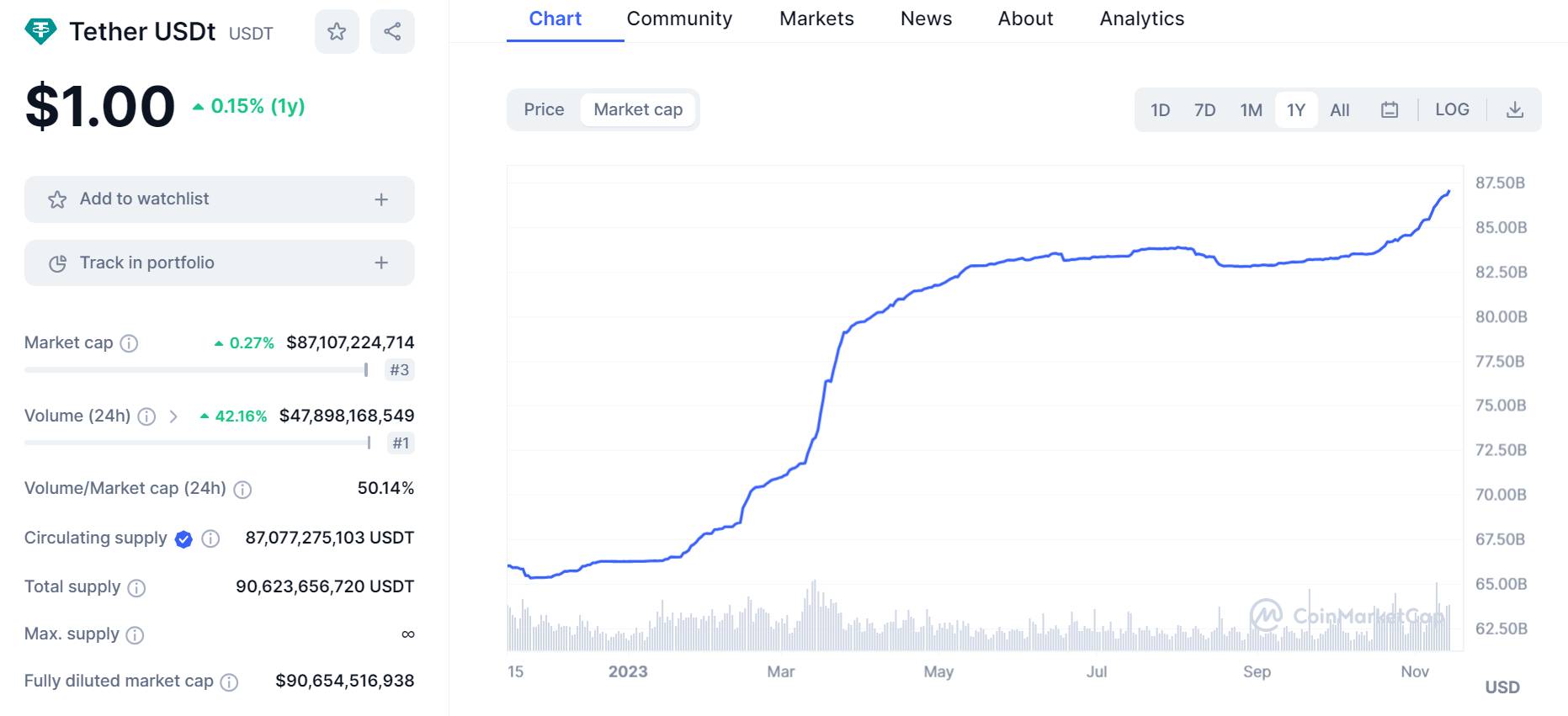

As a consequence, following practically five months of hovering all-around the $83 billion capitalization degree, the quantity of Tether (USDT) in circulation has elevated once more considering the fact that mid-October, just as Bitcoin acquired extra traction from ETF momentum .

Whale Alert information displays that Tether has issued four instances one billion USDT considering the fact that October twenty, bringing the stablecoin’s capitalization to in excess of USD 87 billion for the very first time in historical past.

Tether’s new USDT challenges in the final three weeks. Source: Whale Alert on X (Twitter)

USDT capitalization fluctuation in the most current 12 months. Source: CoinMarketCap (November 14, 2023)

USDT capitalization fluctuation in the most current 12 months. Source: CoinMarketCap (November 14, 2023)

Some observers stage out that the final time Tether’s capitalization rose so strongly was in March 2023, when rival USDC suffered a big setback since it was caught with collateral at Silicon Valley Bank.

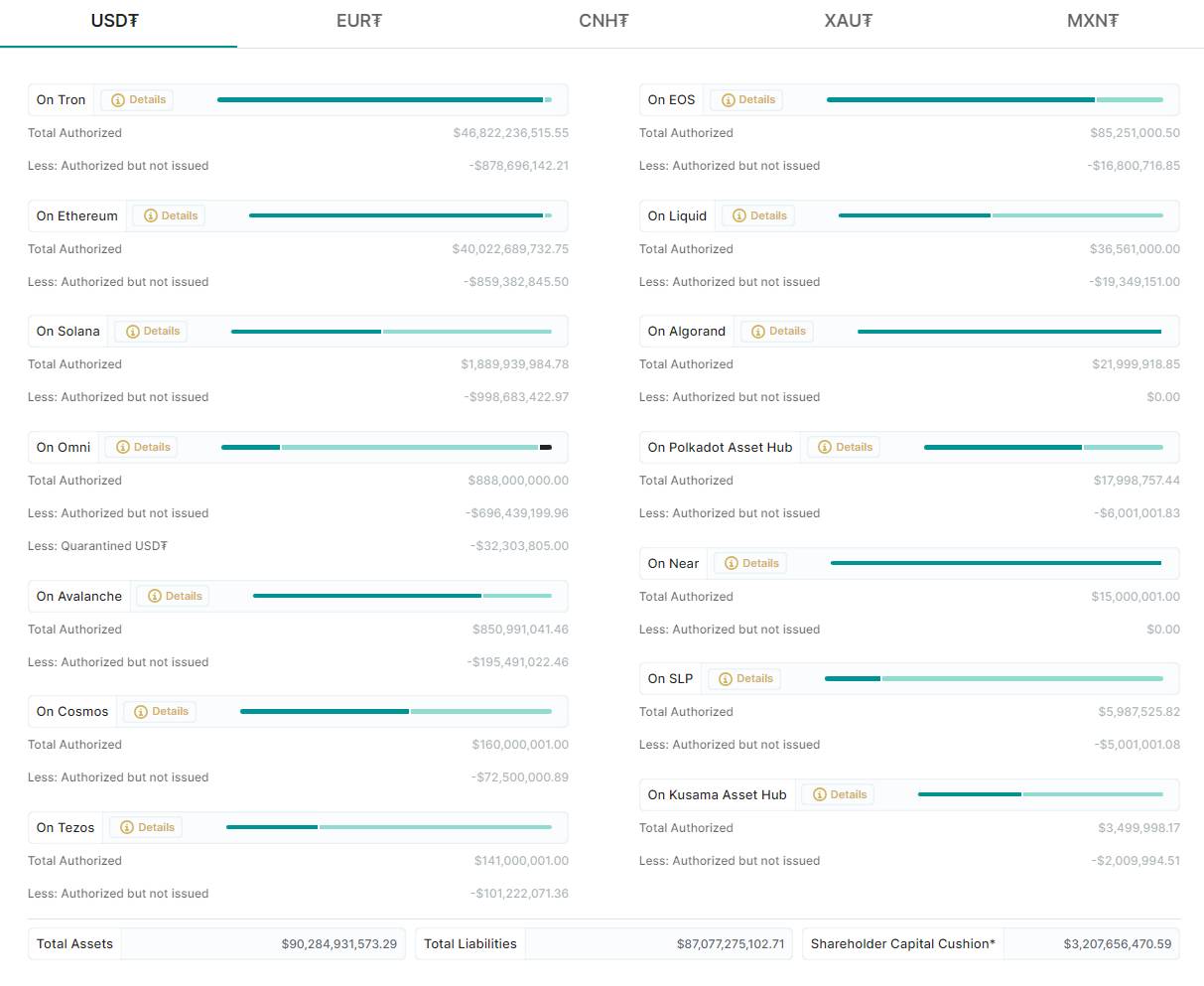

The sum of newly issued USDT in current weeks represents 18% of the complete Tether stablecoins produced in 2023. Specifically, the organization has issued 22.75 billion USDT this 12 months, of which 13 billion USD is on the internet. billions of bucks are on Ethereum. TRON and Ethereum are also two blockchains that presently focus practically all of the USDT, with a provide of $46 billion and $forty billion respectively.

Allocation of USDT among blockchains. Source: Tether (November 14, 2023)

Allocation of USDT among blockchains. Source: Tether (November 14, 2023)

The occasion was also announced by the new Tether CEO Paolo Ardoino on Twitter on the morning of November 14th.

87B $USDt

— Paolo Ardoino 🍐 (@paoloardoino) November 13, 2023

This suggests that Tether’s market place share in the US dollar-pegged stablecoin section elevated to 68%, whilst other rivals did not practical experience an improvement in capitalization.

In its Q3 2023 asset report, the stablecoin issuer explained it nevertheless holds the bulk of USDT-backing assets in the kind of quick-phrase U.S. Treasuries, whilst expanding investments in new merchandise.

Ardoino “hinted” that Tether will launch up to five new merchandise in 2024, assuring that “these are things that users really need.” Tether is acknowledged to be investing a whole lot of revenue in Bitcoin mining, as effectively as building the RGB protocol to employ wise contracts on the Bitcoin network.

We’re fairly shut to incorporating an additional exceptionally effective piece of the puzzle @Tether_to ecosystem.

A complete of five thoughts-blowing tasks (and counting) for 2024.

A couple of these could completely wipe out some common centralized Web2 companies.Pure true-globe ecosystem, aka “Things…”

— Paolo Ardoino 🍐 (@paoloardoino) November 12, 2023

The capitalization of Tether’s USDT stablecoin has set a new record, mixed with good indicators in current instances this kind of as the boost in investment capital in the cryptocurrency sector and the recovery of spot trading volume, top several persons to think that the latest surge in development of Bitcoin and other cryptocurrencies is effectively founded and could reverse the two-12 months downward trend cycle.

Coinlive compiled

Join the discussion on the hottest challenges in the DeFi market place in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!