The world’s biggest stablecoin Tether (USDT) has expanded its exceptional providing following almost 3 months of constant decline, which could be a signal that the cryptocurrency market place is gradually recovering.

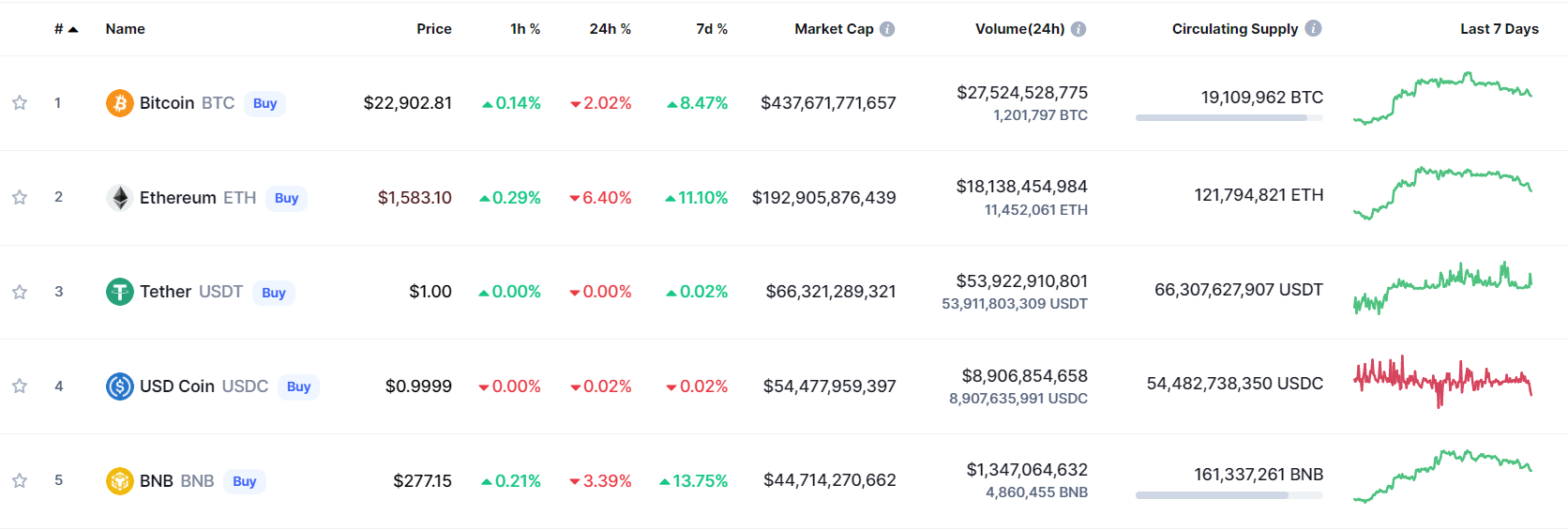

As of July 28, Tether started possessing USDT “injections” into the market place, rising USDT’s capitalization by .seven%, about more than USD 500 million. There are presently 66.three billion USDT in circulation. This provides Tether a complete market place share of all around 43% in the marketplace.

Tether’s providing reached an all-time higher in early May 2022 with a market place capitalization of up to $ 83 billion. However, following the collapse of the Earth ecosystem, coupled with the widespread liquidity crisis that brought about a amount of cryptocurrency corporations to go bankrupt in the lending arena, Tether’s provide has dropped 21% to its recent degree, commencing at 65. , eight billion at the finish of July 2022.

It is for this similar cause that in the previous it has as soon as once more “triggered” the legal issues and “shady” organization actions of Tether, a lot of investment money are mentioned to have lately enhanced their bets on Tether, their brief place in USDT. .

This permitted rival enterprise Circle to maximize its USDC stablecoin market place share, which presently accounts for 36% with a market place capitalization of $ 54.five billion.

Last month, USDC volume on Ethereum basically surpassed USDT throughout a time period of time in which Circle continually manufactured surprising developments, this kind of as its willingness to publish a thorough USDC margin report following the “FUD” storm, USDC distributes to Polygon for payments and Web3 stablecoin launches backed by the euro.

Furthermore, excellent information appeared more than the weekend when, referring to the stablecoin sector, Binance CEO Changpeng Zhao commented on the problem in which recent traders are prepared to re-enter the market place, with the following statement:

“3 of the prime ten cryptocurrencies are stablecoins, which suggests a whole lot of fiat is waiting for traders to come back. If people today want to get out of the marketplace, they will not retain stablecoins for nothing at all. “

Indeed, a value of residing crisis brought about by increasing international inflation may well have held back cryptocurrency investments and speculation between retail traders.

However, people today residing in nations with spikes in inflation, this kind of as Argentina, have utilised stablecoins as a “bailout” answer for their nationwide currency. The evidence is that there has just been a transfer of football gamers traded in USDC in between an Argentine and a Brazilian staff.

Synthetic currency 68

Maybe you are interested: