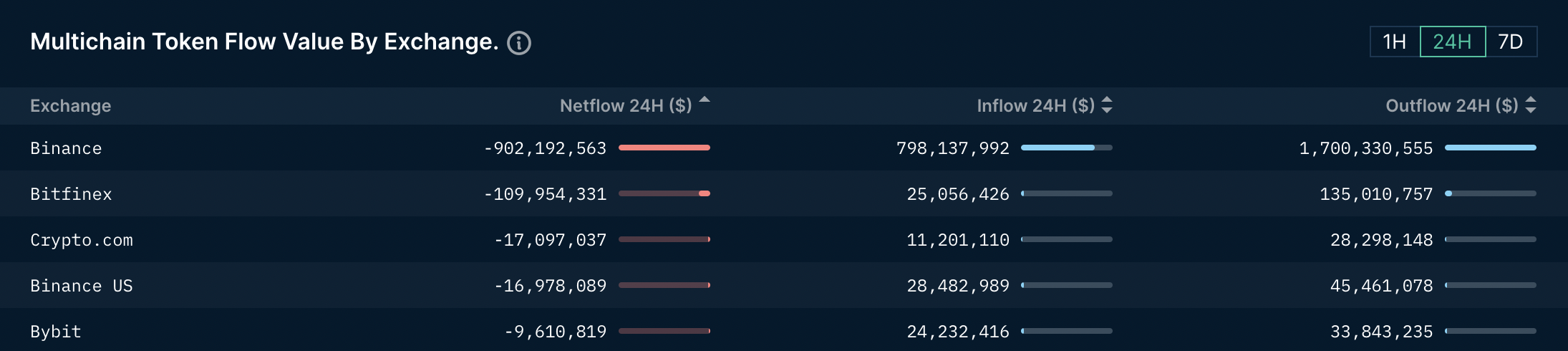

Up to USD 902 million in net inflows flowed out of the Binance exchange in the previous 24 hrs, in accordance to nansen.

Binance, the world’s biggest cryptocurrency exchange by trading volume, is going through a surge in withdrawals amid the FUD siege.

Netflow, which is calculated as the distinction in between the volume of assets getting into/depositing (Inflow) and leaving/withdrawing (Outflow) from the exchange, reached USD 902 million in the final 24 hrs, in accordance to Cointelegraph statistics . platform nansen.

This amount is even increased than the sum of all other centralized exchanges on the identical benchmark frame and 9 occasions increased than Bitfinex, which has the 2nd highest deposit and withdrawal spread in the statistical checklist.

Withdrawal from Binance is the record considering that eleven/13, two days later on FTX file for failure safetyTo comply with Arkham intelligence.

Still, the outflow “doesn’t look too unusual or severe,” Arkham analyst Henry Fisher wrote in Telegram, evaluating the outflows to $64 billion in assets more than Binanza.

Notably, Jump Trading and Wintermute are the two names that have quietly transferred the biggest volume of income from Binance more than the previous seven days.

Jump has net outflows from Binance exceeding $146 million for the week and no inflows

If Binance’s books look totally drained of all liquidity, the release of probably the biggest MM is possibly a fantastic purpose why

Source: https://t.co/aasol67vsX https://t.co/GbeXfXqwce pic.twitter.com/yLYXgBEsSW

— Andrew T (@Blockanalia) December 12, 2022

Specifically, Jump produced a net withdrawal of USD 146 million, of which BUSD 102 million, USDT 14 million, ETH ten million, and a number of hrs in the past it traded close to BUSD thirty million from Paxos. Meanwhile, Wintermute has withdrawn eight.five million wBTC and five.five million USDC.

The wave of substantial withdrawals came immediately after a amount of Binance-connected suspicions have been broadly reported in the media, the facts are welcome to study much more in the up coming part.

Criminal costs towards Binance

As reported by CoinliveBinance has been suspected of violating sanctions and anti-income laundering laws considering that 2018. Theo ReutersSeveral prosecutors filed criminal costs towards twelve Binance executives, together with CZ. However, numerous other prosecutors are trying to find even more proof towards Binance.

This yr, the information company Reuters has carried out a lot of independent investigations into Binance, the exchange claims weak anti-income launderingnever ever cover your eyes for a big volume of dirty income up to two.35 billion bucks And disclosure of information and facts to Russian authorities. In July, Binance also aided Iranians set up accounts and trade on the exchange, bypassing the US embargo.

Also on the evening of December twelve, Binance confirmed that the Reuters report was totally fabricated and counterfeit. The exchange says it continues to make improvements to its technologies to make improvements to its anti-income laundering operations. CZ also posted a tweet that meant “cheating” the media and urged the neighborhood to “ignore FUD.”

smh, some media are nevertheless functioning for…

—CZ Binance (@cz_binance) December 12, 2022

By the finish of final week, Binance is condemned by the neighborhood made a decision to block a user’s account due to “absurd” allegations. how block withdrawals from accounts that unexpectedly advantage from it from the fluctuations of the Sun Token, Ardor, Osmosis, Pleasurable and Golem coins on the exchange.

Not only that, even if it was announced Proof of Reserves (PoR) authentication on blockchain And licensed by audit unit to hold 101% Bitcoin, Binance has but to meet media demands. Sheet Wall Street Journal pointed out that Binance’s capital buffer report omits inner fiscal controls and is relatively shady.

Synthetic currency68

Maybe you are interested: