The cryptocurrency industry has taken a main hit following continued reviews of a US crackdown on staking and stablecoin legislation.

On the morning of February ten, the cryptocurrency industry underwent one more correction, sending the value charts into the red.

Bitcoin (BTC) fell almost five% from $22,500 to $21,688, just before recovering somewhat to $21,850 at the time of the update.

Ethereum (ETH) misplaced additional than six% of its worth 24 hrs in the past, falling from $one,620 to $one,524.

The finest altcoins are “red floors” from seven-twelve%.

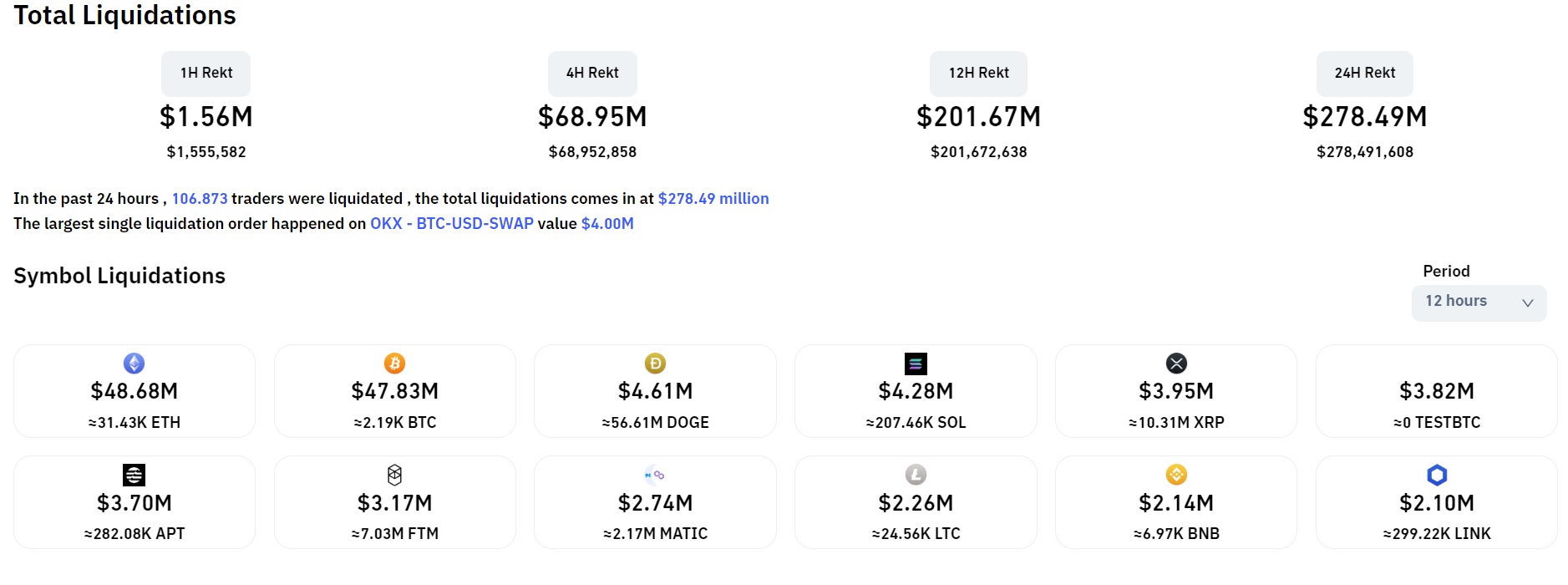

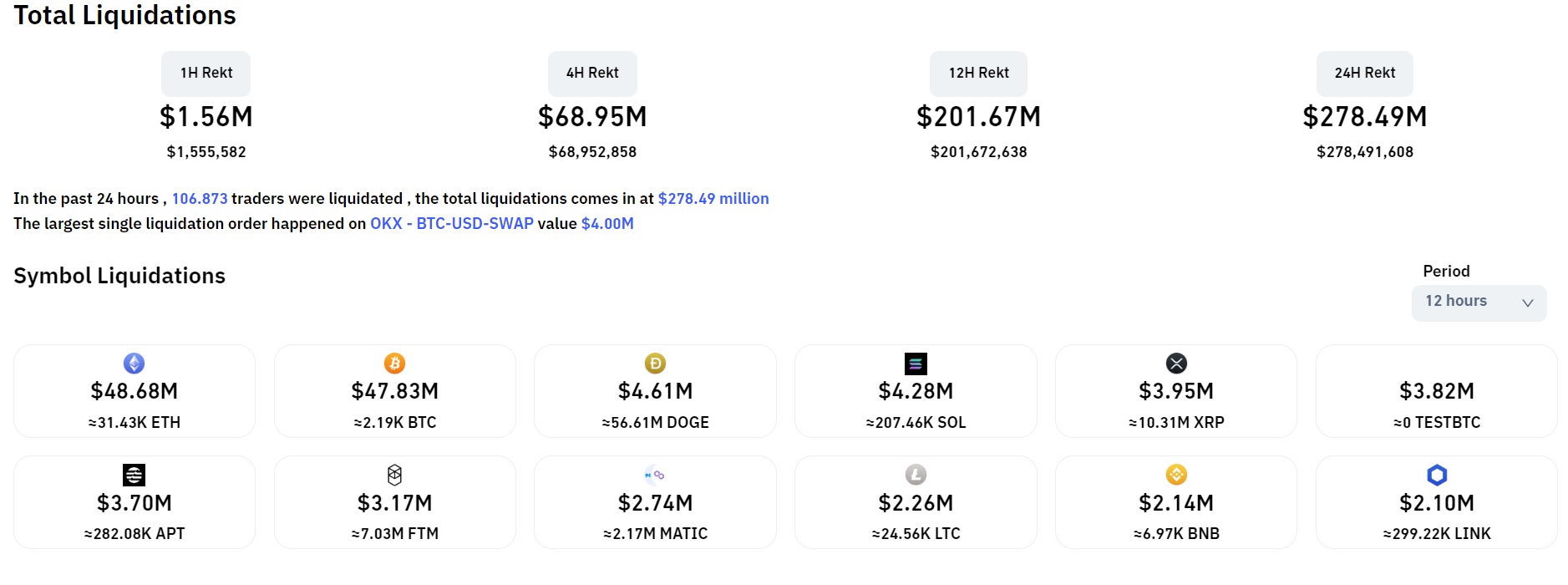

In the previous twelve hrs, the amount of derivatives orders cleared was USD 201 million, with the sum of lengthy orders exceeding 92%.

The motive for the decline came from a series of legal information from the United States. Specifically, the Kraken exchange has been charged by the US Securities and Exchange Commission (SEC) for failing to register its staking support with this company. Instead of deciding upon to battle legally, Kraken made the decision to shell out a $thirty million fine to the SEC and finish staking support for all previously supported coins except ETH.

Just on Feb. 9, Coinbase CEO Brian Armstrong exposed that the SEC is hunting to ban cryptocurrency staking outright since it sees it as a kind of disguised safety. With the most recent developments, it can be viewed that Mr. Armstrong was mindful of the SEC’s crackdown on Kraken.

Next, the BUSD stablecoin issuer for Binance, Paxos, was investigated by the New York government. While that information and facts has not been confirmed and the scope of the investigation is unknown, it nevertheless resonates with Paxos getting asked by the US Office of the Comptroller of the Currency (OCC) to withdraw its banking license.

Even so, cryptocurrencies representing decentralized/liquid staking tasks are on the upswing, notably Rocket Pool (RPL) surging in excess of 25% to $56.33 – RPL’s new ATH peak on Binance. Meanwhile, the latest #one liquid staking venture, Lido (LDO), has immediately recovered from the industry fall.

Another title that was hit challenging is Optimism (OP) when this tier two venture abruptly announced its most recent airdrop, releasing one more eleven.seven million OPs to additional than 300,000 consumer wallet addresses.

Synthetic currency68

Maybe you are interested:

The cryptocurrency industry has taken a main hit following continued reviews of a US crackdown on staking and stablecoin legislation.

On the morning of February ten, the cryptocurrency industry underwent one more correction, sending the value charts into the red.

Bitcoin (BTC) fell almost five% from $22,500 to $21,688, just before recovering somewhat to $21,850 at the time of the update.

Ethereum (ETH) misplaced additional than six% of its worth 24 hrs in the past, falling from $one,620 to $one,524.

The finest altcoins are “red floors” from seven-twelve%.

In the previous twelve hrs, the amount of derivatives orders cleared was USD 201 million, with the sum of lengthy orders exceeding 92%.

The motive for the decline came from a series of legal information from the United States. Specifically, the Kraken exchange has been charged by the US Securities and Exchange Commission (SEC) for failing to register its staking support with this company. Instead of deciding upon to battle legally, Kraken made the decision to shell out a $thirty million fine to the SEC and finish staking support for all previously supported coins except ETH.

Just on Feb. 9, Coinbase CEO Brian Armstrong exposed that the SEC is hunting to ban cryptocurrency staking outright since it sees it as a kind of disguised safety. With the most recent developments, it can be viewed that Mr. Armstrong was mindful of the SEC’s crackdown on Kraken.

Next, the BUSD stablecoin issuer for Binance, Paxos, was investigated by the New York government. While that information and facts has not been confirmed and the scope of the investigation is unknown, it nevertheless resonates with Paxos getting asked by the US Office of the Comptroller of the Currency (OCC) to withdraw its banking license.

Even so, cryptocurrencies representing decentralized/liquid staking tasks are on the upswing, notably Rocket Pool (RPL) surging in excess of 25% to $56.33 – RPL’s new ATH peak on Binance. Meanwhile, the latest #one liquid staking venture, Lido (LDO), has immediately recovered from the industry fall.

Another title that was hit challenging is Optimism (OP) when this tier two venture abruptly announced its most recent airdrop, releasing one more eleven.seven million OPs to additional than 300,000 consumer wallet addresses.

Synthetic currency68

Maybe you are interested: