The Bitcoin network is dealing with congestion with more than 460,000 pending transactions, resulting in higher fluctuations in transaction charges.

The Bitcoin network is “overloaded” with more than 460,000 pending transactions

The Bitcoin network is “overloaded” with more than 460,000 pending transactions

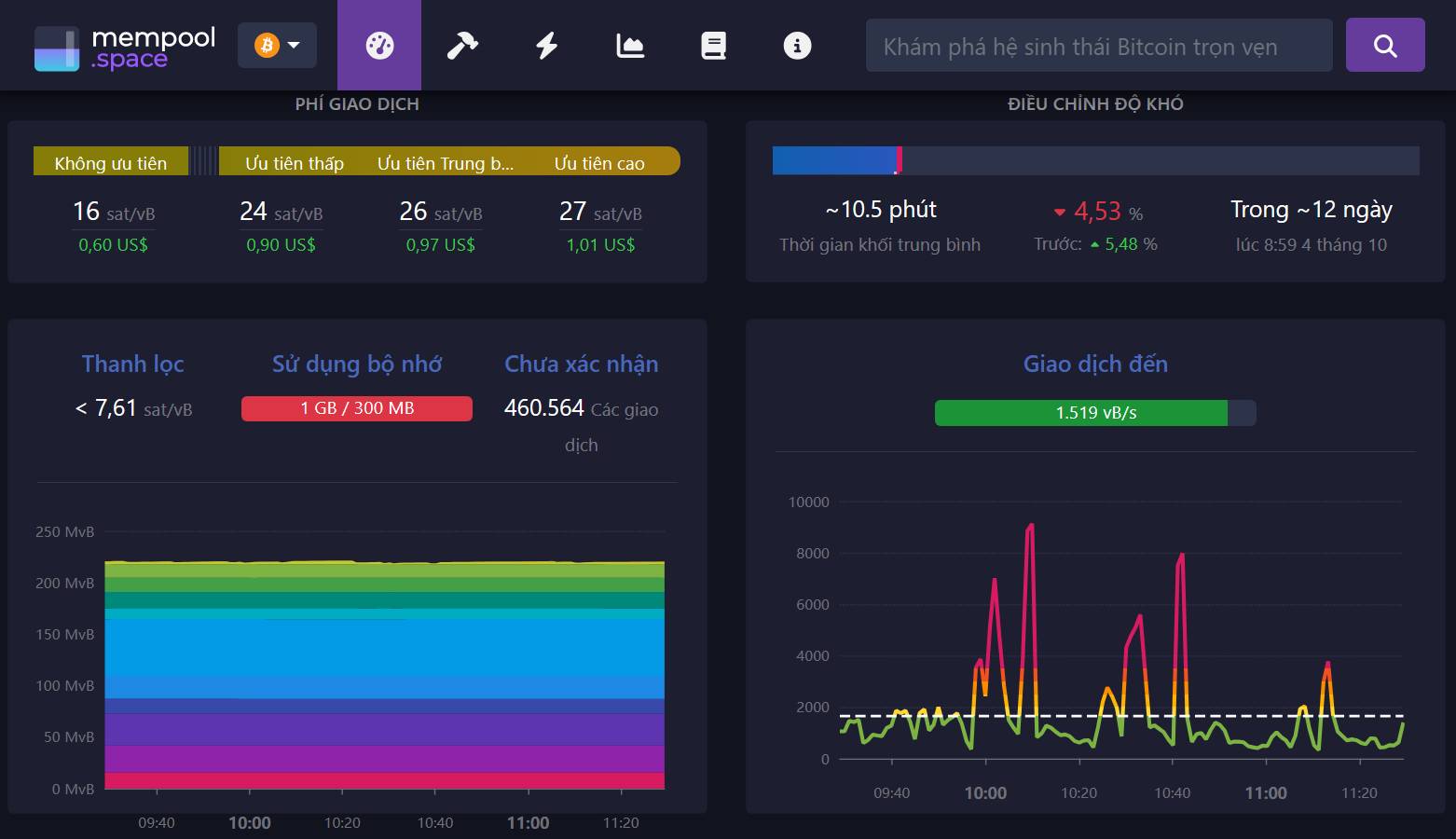

According to information collected by Bitcoin’s Mempool, the world’s biggest cryptocurrency network is going through the longest “overload” in background with more than 460,000 pending transactions. This displays that the network is struggling to take care of growing transaction volume, main to greater transaction charges and slower confirmation instances.

The Bitcoin network is going through the longest complete block time period in background, Mempool information displays there are now additional than 458,000 pending transactions, which means continued congestion on the Bitcoin network will even further have an impact on the confirmation of minimal-worth blocks …

— Wu Blockchain (@WuBlockchain) September 21, 2023

The mempool serves as a short-term record of all Bitcoin transactions, which will have to be validated by miners and are then additional to the subsequent block on the blockchain. Each node in the Bitcoin network temporarily retailers this Mempool. Transactions in Mempool will be periodically cleared anytime a new block is additional to the blockchain.

At the time of creating, Mempool information data up to 460,564 transactions awaiting confirmation to be processed. However, pending transactions in the Mempool are only processed and confirmed when they meet the minimal transaction charge. Transactions with reduced charges will have to wait additional than 1 block till they are processed and confirmed.

The information recorded up to 460,564 transactions awaiting confirmation to be processed. Photo: Mempool at eleven:31 am on September 22, 2023

The information recorded up to 460,564 transactions awaiting confirmation to be processed. Photo: Mempool at eleven:31 am on September 22, 2023

During instances of network congestion, miners have a tendency to prioritize processing higher-charge transactions, main to a backlog of minimal-charge transactions. As a consequence, end users who want to promptly verify transactions have to shell out greater charges, main to an boost in common transaction charges on the Bitcoin network.

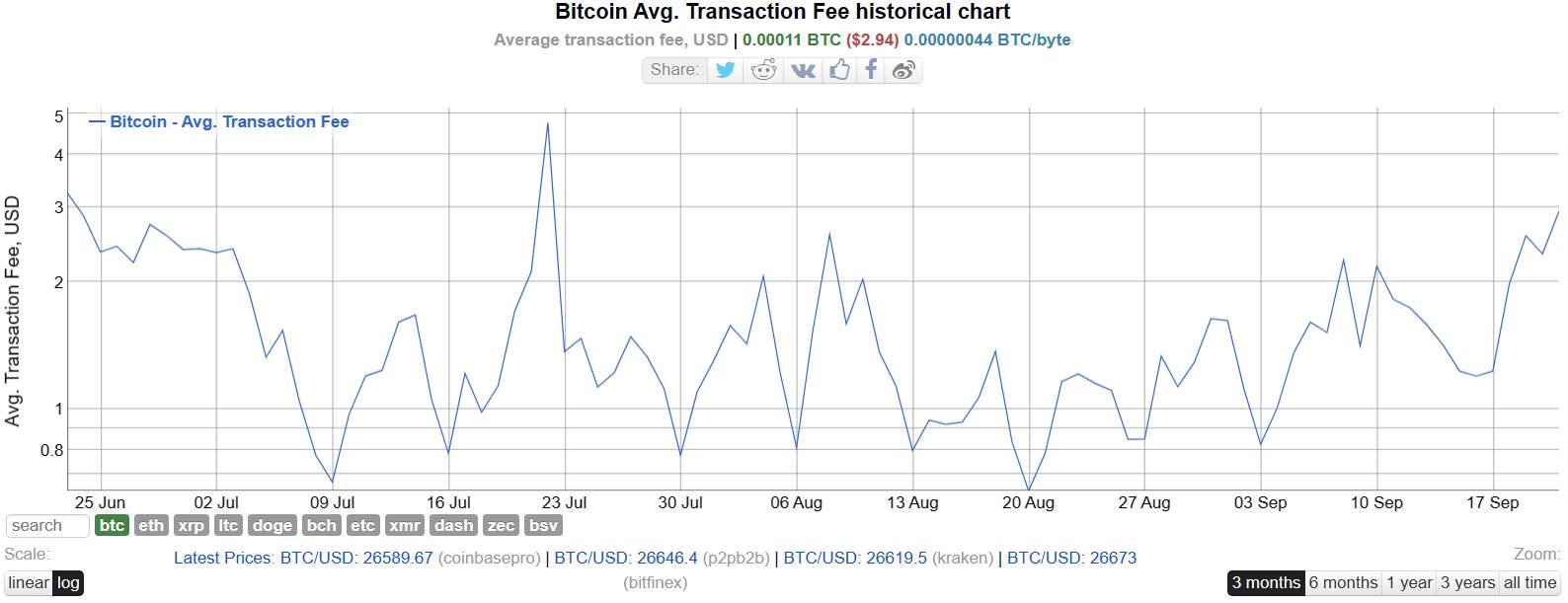

Data from bitinfocharts also displays that the common Bitcoin transaction charge is $two.94, the highest because July 2023. With a charge of $one,021 recorded on the identical day a yr in the past, this usually means that the common Bitcoin transaction charge has elevated by all over 188% in the final yr.

DThe chart displays common transaction charges on the Bitcoin network from June 23 to September 22, 2023. Photo taken at eleven:43 am on September 22, 2023

DThe chart displays common transaction charges on the Bitcoin network from June 23 to September 22, 2023. Photo taken at eleven:43 am on September 22, 2023

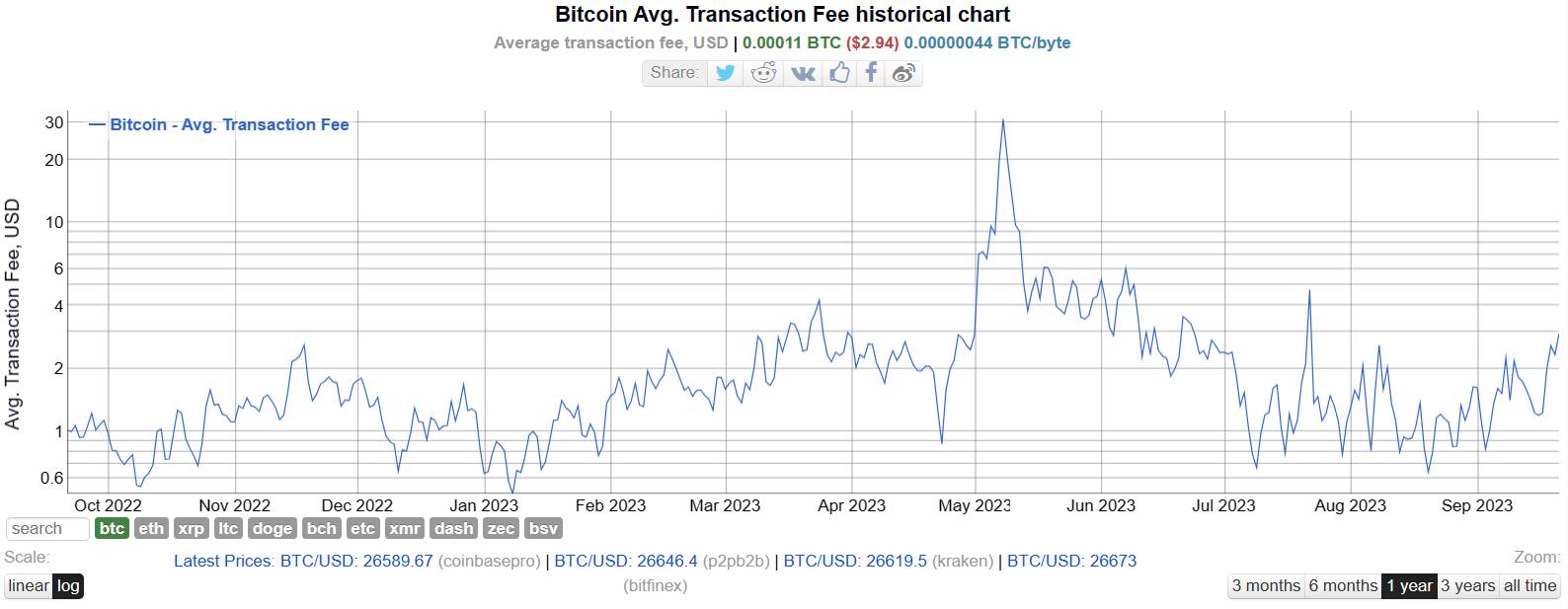

This is not the initial time Bitcoin has faced congestion problems. In May 2023, the network also professional a related transaction “overload,” resulting in common transaction charges to skyrocket to more than $19, peaking at $31.one on May eight, 2023.

Chart displaying common transaction charges on the Bitcoin network from September 22, 2022 to September 22, 2023. Photo taken at eleven:45 pm on September 22, 2023

Chart displaying common transaction charges on the Bitcoin network from September 22, 2022 to September 22, 2023. Photo taken at eleven:45 pm on September 22, 2023

As reported by Coinlive, this congestion is mostly due to the emergence of the Bitcoin Ordinals protocol and BRC-twenty tokens, which have elevated the variety of signups, contributing to a sharp boost in transaction charges on the Bitcoin blockchain.

Bitcoin Ordinals (also identified as Bitcoin NFTs) have been when viewed as 1 of the Top stories in Q1 2023. The emergence of Ordinals has brought to light the prolonged-standing background of NFTs and wise contracts on the Bitcoin blockchain. During its heyday, Bitcoin Ordinals trading volume elevated steadily and peaked at $452 million in May 2023.

However, additional than 80% of the signups at the time of the “hype” have been primarily memecoins, and when by the hypethe market place promptly moved on to other trends, main to a extreme decline in focus to the Bitcoin NFT section.

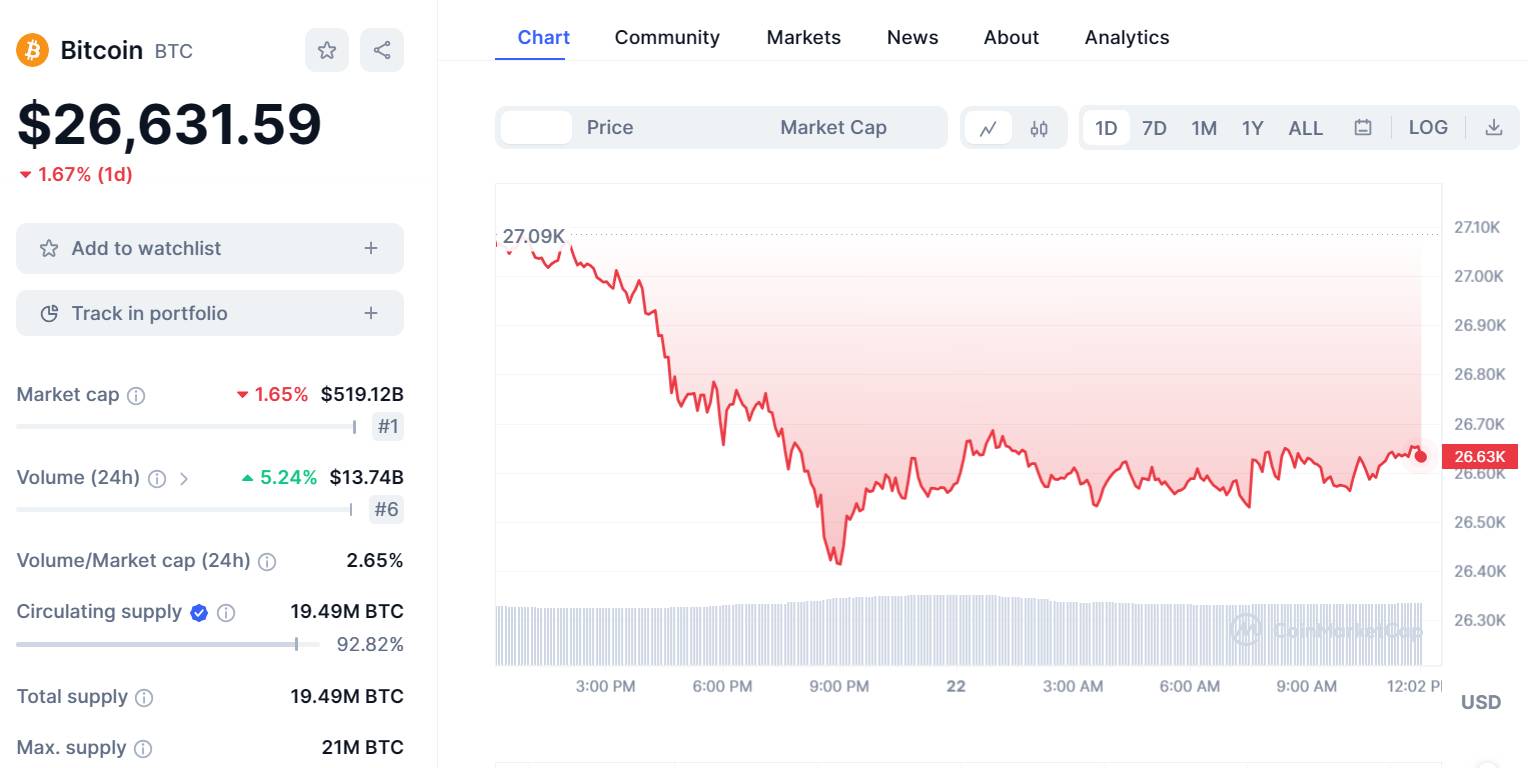

Therefore, the present transaction congestion difficulty has not had a important affect on the cost of BTC. At the time of creating, BTC was trading at $26,631 with slight fluctuations.

Bitcoin cost on Coinmarketcap 1D chart. Photo taken at twelve.05pm on September 22, 2023

Bitcoin cost on Coinmarketcap 1D chart. Photo taken at twelve.05pm on September 22, 2023

Coinlive compiled

Join the discussion on the hottest problems in the DeFi market place in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!