Following the choice to get rid of it from Solana, the neighborhood proposes that Lido end working on Polygon due to its meager income.

The neighborhood has proposed that Lido Finance end supplying providers on Polygon

The neighborhood has proposed that Lido Finance end supplying providers on Polygon

October 17th, a single o’clock propose consulted on the elimination of the Lido Finance liquid staking protocol from the Polygon blockchain, citing quite a few causes this kind of as income, procedure, roadmap and amount of protocol staking on the network, particularly:

- Low income: Over the previous twelve months, Lido invested at least LDO2,138,000 ($three,421,600) on returns and incentives to earn just $166,683, the proposal states.

- Technical issue: Lido on Polygon underwent an update, but a vulnerability appeared that induced withdrawals to be suspended for 25 days. While not topic to FUD, this place the track record of a protocol holding $15 billion at threat.

- The roadmap is unclear: The proposal cited Polygon’s uncertain roadmap as the blockchain undergoing a radical multi-yr technical overhaul, with Lido also needing to make substantial modifications in response to the network, it continued, could trigger hazards for the brand.

- Lack of liquid staking companies: Stader Labs is Lido’s sole liquidity supplier on Polygon. It demonstrates the lack of attractiveness of this market place on Polygon.

The proposed answer is for Lido Finance to target on supplying providers on Ethereum and restrict threat taking from other networks with smaller sized TVLs.

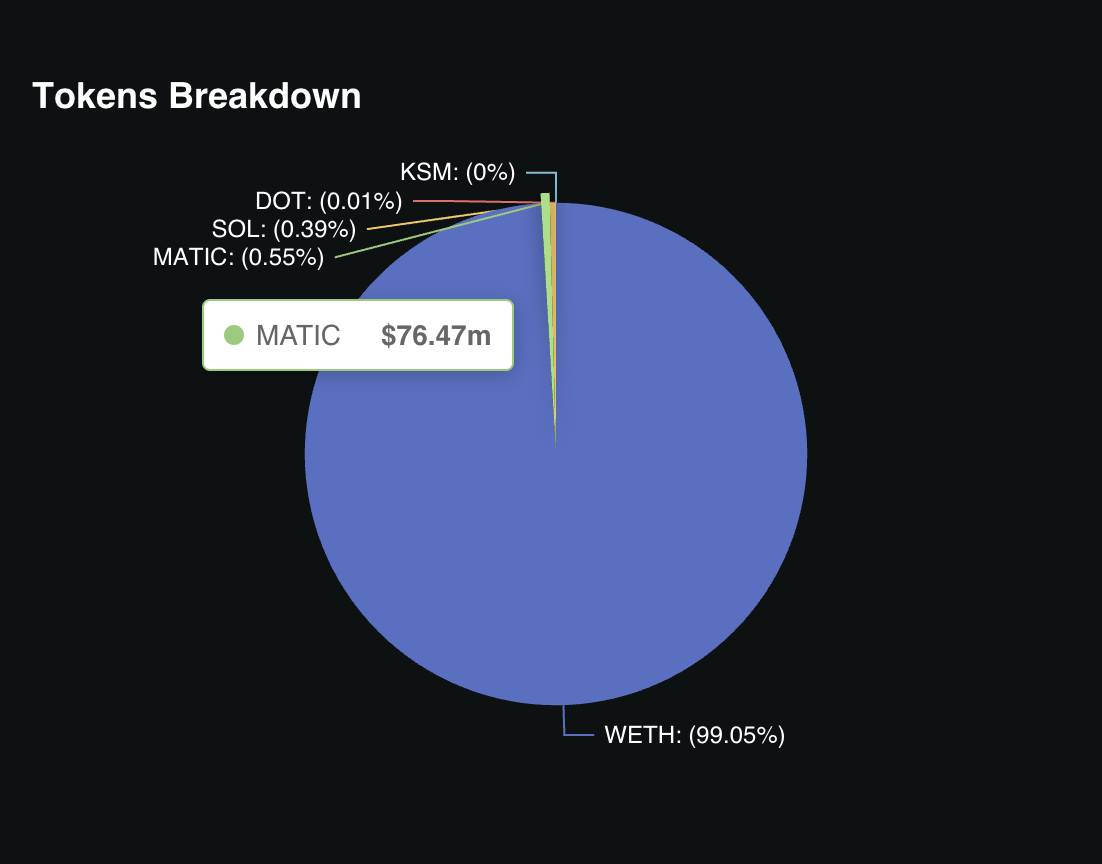

Currently, this proposal could influence somewhere around $76.four million in MATIC worth staked on Polygon.

MATIC staking quantity on Lido Finance. Source: DefiLlama

MATIC staking quantity on Lido Finance. Source: DefiLlama

Before Polygon, other blockchains Polka dots, Kusama AND Solana they have been also evaluated and, as a outcome, they all agreed to end supporting.

Coinlive compiled

Join the discussion on the hottest problems in the DeFi market place in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!