The subject mentioned by the cryptocurrency neighborhood on Sunday is the chance of an Ethereum fork continuing to use Proof-of-Work immediately after The Merge.

Over a weekend of very little information, curiosity in the crypto neighborhood on Twitter turned into a heated debate from a growing figure on Ethereum and The Merge.

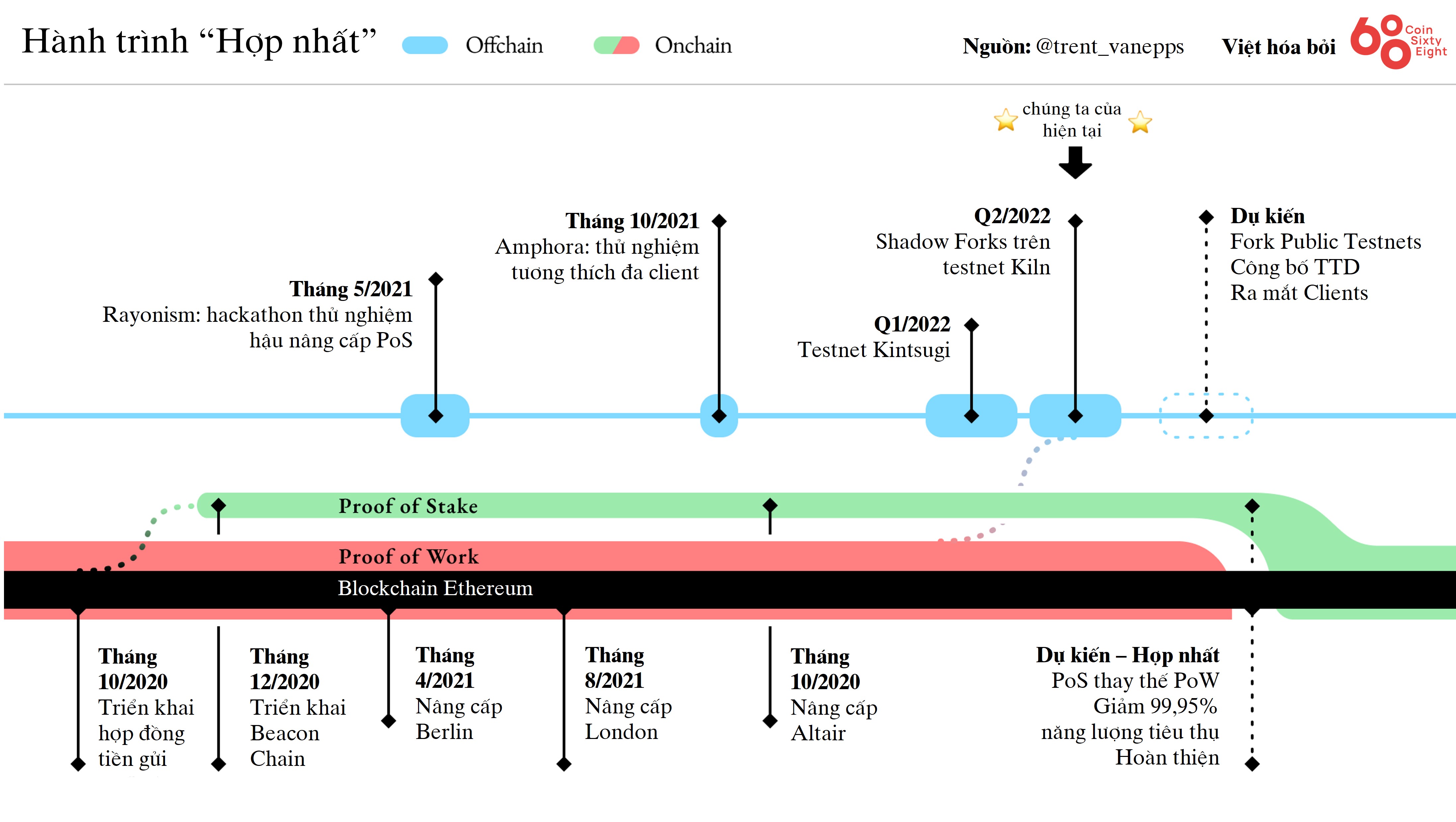

Summary of The Merge

As explained by Coinlive,The merger is the title that refers to the “unification” occasion of two blockchains Ethereum one. (working with Proof-of-Work to mine coins) and Ethereum two. (working with Proof-of-Stake and staking ETH to make new coins). This can be deemed the most essential milestone in Ethereum’s seven-yr historical past and a cornerstone for the task to put into action numerous options to scale the network primarily based on Proof-of-Stake and, at the exact same time, decrease the affect. on the setting by getting rid of mining.

As unveiled by the most current developers, The Merge will be distributed on the principal Ethereum network amongst 19 and twenty September as a result of a really hard fork occasion, which needs updating all parts of the network or the blockchain fork. The update was effectively rolled out on two important ETH testnets, Ropsten and Sepholia in June and July, and is about to be examined on the ultimate testnet, Goerli, in August.

The Merge is the important engine behind ETH’s recovery in the previous, followed by relevant tasks this kind of as Ethereum Classic (And so on) “twin”, Lido staking protocol (LDO) and Layer-two Optimism (OP) resolution.

The situation of And so on alone is very fascinating, mainly because Ethereum is really a fork of Ethereum Classic immediately after The DAO Hack 2016. In the situation of Ethereum effectively implementing The Merge and switching to Proof-of-Stake, numerous people today assume that the latest ETH miners will switch to And so on mining as an alternative of promoting the miners, primary to sturdy And so on selling price development in the previous. The July And so on hashrate also reached a new degree, indicating that a quantity of ETH miners have started off moving right here.

Vitalik: “If you like PoW, use Ethereum Classic, it’s an absolutely fine chain”

+ Support existing for Antpool / Bitmain

= And so on hashrate teleportation to ATHs pic.twitter.com/amNvOuixi3

– Hsaka (@HsakaTrades) July 29, 2022

Debate “ETH1” – “ETH2”.

On July 28, Twitter account Galois CapitalThe investment fund that emerged from the LUNA-UST crash immediately after warning about it right up until 2021 and which is mentioned to have created a good deal of income brief of these two coins, has raised an argument concerning the long term of Ethereum (ETH) and the approaching update occasion The Merge.

However, Galois Capital isn’t going to assume so. This account thinks that, equivalent to the 2017 Bitcoin fork occasion for Bitcoin Cash, there will be numerous other persons / organizations that will develop “copies” of the Ethereum and Proof-of-Work chain for other functions collectively.

Bitcoin’s 2017 really hard fork to Bitcoin Cash due to the block dimension controversy led to numerous other “fake” chains, this kind of as Bitcoin Gold, Bitcoin SV, Bitcoin God, Bitcoin Red, Bitcoin Silver, and so forth., with quite a few improvement paths and indications. These tasks attempt to entice customers by flipping coins to BTC / BCH holders, but eventually they do not final prolonged and die.

Assuming that there will absolutely be a celebration that will perform a fork of Ethereum to preserve the Proof-of-Work for miners, to which Galois offers its title ETH1 to compete with the edition of Ethereum which is sophisticated working with Proof-of-Stake referred to as ETH2Galois Capital asked the following inquiries:

Question one: what takes place for the duration of the merge? If selection two or three move on to inquiries two-five.

– Galois Capital (@Galois_Capital) July 27, 2022

- If The Merge goes smoothly, ETH switches to PoS or there will be two chains ETH1 (continues to use PoW) and ETH2 (employs PoS) Or will there be three chains: ETH1, ETH2 and a PoW chain that nonetheless maintains the bomb trouble?

- What coins do miners mine immediately after The Merge: And so on or ETH1 without having trouble bombs?

- Is there any probability that USDT will select to help ETH1 as an alternative of ETH2?

- How will exchanges deal with the ETH1-ETH2 situation?

- What will come about to stETH (Lido’s ETH staking item)?

- If each ETH1 and ETH2 are existing, will their complete worth be higher than, equal to or significantly less than the latest worth of the ETH chain?

Community view

Questions from Galois Capital have produced mixed views more than the previous couple of days. However, most views of the crypto neighborhood at the moment think that the ETH1 situation will be unlikely, mainly because:

– The Ethereum neighborhood has prolonged agreed to switch to Proof-of-Stake, so it is unlikely that any one will be in a position to divide up the chain to serve the interests of the miners.

– Ethereum has created into a multi-application cryptocurrency ecosystem, total of trends from DeFi, layer-two, GameFi to NFT, so tasks will value stability and adhere to route. Ethereum group leader.

– To date, no unit has announced programs to fork Ethereum and entice neighborhood help, as mentioned by Coinlive.

Nevertheless, the factors reported by Galois Capital are also noteworthy, mainly because it touches the place of exchanges and issuers of stablecoins this kind of as Tether (USDT), a cryptocurrency that is mentioned to be the most essential pillar of the complete crypto ecosystem. So far, no exchanges have announced that they help The Merge, but as Ethereum has not set the actual time, it will have to wait for the check success on Georli’s testnet.

However, Tether CTO Paolo Ardoino commented on the following to reassure the neighborhood:[USDT] will help ETH2 smoothly. “

It is not about what I / we favor amongst PoW / PoS.

Stablecoins must act responsibly and keep away from disruption to customers. Especially for DeFi it is actually delicate.—Paolo Ardoino (@paoloardoino) July 31, 2022

Ardoino also promised to release information of Tether’s area in the coming days.

“We will not select amongst PoW or PoS. Stablecoin issuers must act responsibly and keep away from disruption to customers. Especially with DeFi, which is a incredibly “fragile” spot.

Ethereum founder Vitalik Buterin himself was concerned in the debate. In response to a different publish asking the Ethereum Foundation to employ Galois Capital to advise on resolving the ETH1-ETH2 problem, Vitalik Buterin sarcastically:

Wait I have go through the over and am baffled. Why Twitter says so numerous people today I know adhere to @Galois_Capitale ? Is it a popular parody tale?

– vitalik.eth (@VitalikButerin) July 30, 2022

“I go through the publish over and discovered it a bit puzzling. Why do so numerous people today I adhere to on Twitter also adhere to Galois Capital? Is he a popular comedian? “

Synthetic currency 68

Maybe you are interested: