The cryptocurrency marketplace rallied strongly immediately after the US inflationary condition returned constructive quick-phrase effects.

The cryptocurrency sector has recovered earlier this week, with Bitcoin (BTC) surpassing $ 24,000, whilst Ethereum (ETH) has also returned to $ one,800 for the to start with time considering the fact that the mid-June dump with momentum.

However, on August 9, the downward strain returned to the marketplace as each BTC and ETH slipped to their outdated amounts. Along with the stock marketplace, the cryptocurrency sector is also “holding its breath” waiting for inflation information from the US.

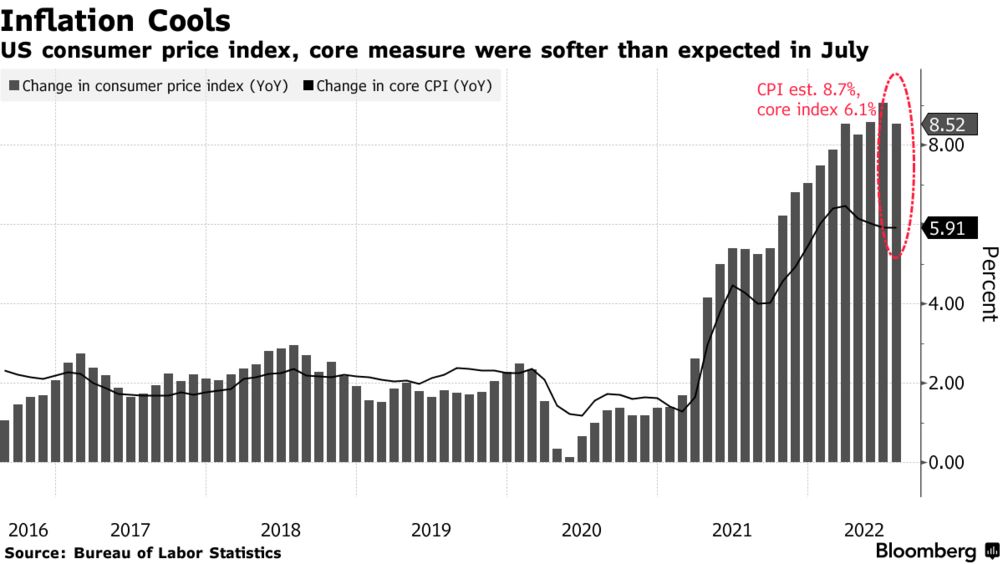

The United States launched information on the buyer rate index (CPI), a measure of the economy’s inflation fee, up to 9.one% in June in contrast to the very same time period final yr, exceeding everyone’s expectations. observers and swinging the money markets. However, the Federal Reserve (Fed) stored the curiosity fee adjustment that month by only .75% mainly because it did not want to overly have an effect on the marketplace.

On the evening of August ten, in accordance to the hottest information, the US CPI for July was eight.five%, reduce than the forecast of eight.seven% manufactured by economists. This demonstrates that inflation in the world’s biggest economic climate, though nevertheless at the highest degree for the previous four decades, has proven indicators of slowing.

Thanks to this, each Bitcoin and Ethereum regained their recovery momentum, even climbing over the outdated peak of the week.

BTC hit $ 24,450 on the morning of August eleven, up practically eight% from its reduced of $ 22,664 on August ten and approaching its large of $ 24,668 on July thirty.

Similarly, Ethereum at the time of the update is up practically twelve% from 24 hrs in the past, getting ready to hit the $ one,900 mark. ETH is presently the leading twenty quickest increasing altcoins.

The remaining main currencies in the leading twenty also recorded a six-ten% recovery.

The mixed cryptocurrency marketplace cap at the time of the update was $ one.150 billion, the highest considering the fact that the 2nd week of June.

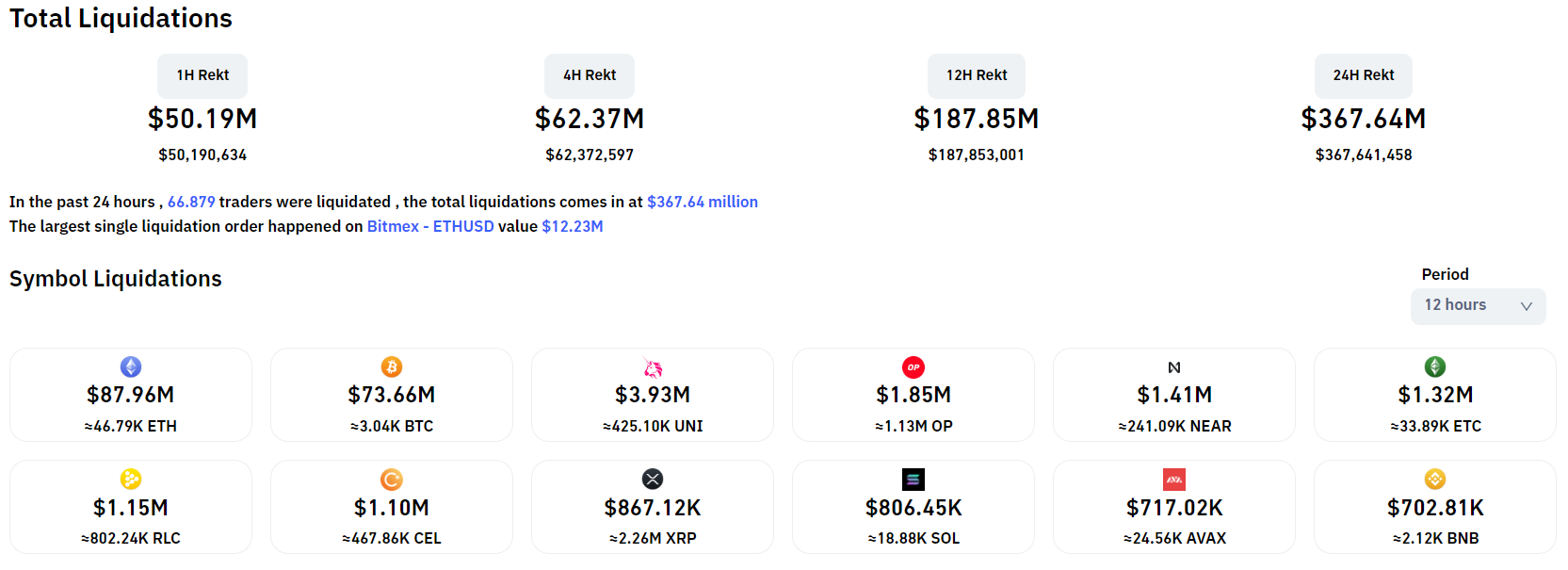

Despite the solid marketplace recovery, the percentage of derivative orders burned in the previous twelve hrs is rather modest with just practically $ 188 million, led by ETH and BTC, of which 61% are quick orders.

Synthetic currency 68

Maybe you are interested: