The flash lending assault brought on the Platypus Finance stablecoin to drop by additional than 52%. The estimated reduction from the protection incident is about $eight.five million, in accordance to CertiK.

On the evening of February sixteen, the Platypus Finance DeFi protocol was hacked flash loan with ~$eight.five million in damages, blockchain protection company CertiK is reporting the incident.

We are seeing you #flash loan stick on @Platypusdefi resulting in a likely reduction of ~$eight.five million.

Tx AVAX: 0x1266a937c2ccd970e5d7929021eed3ec593a95c68a99b4920c2efa226679b430

Stay frosty! pic.twitter.com/AM2HOM5M2r

— CertiK Alert (@CertiKAlert) February 16, 2023

The infiltration system utilized by the criminals is flash lending, i.e. scorching borrowing a massive sum of funds from lending platforms, then employing them to manipulate the selling price distinction and revenue.

According to the undertaking announcement, The attacker took benefit of a vulnerability in the USP payment mechanism. Song, hCurrently all pursuits are suspended until finally Platypus full the survey.

Dear Community,

We regret to inform you that our protocol was not too long ago breached and the attacker took benefit of a flaw in our USP credit score rating mechanism. They utilized a flash loan to exploit a logical flaw in the USP’s credit score test mechanism in the contract that held the collateral.— Platypus (🦆+🦦+🦫) (@Platypusdefi) February 17, 2023

After the assault, the selling price of Platypus USD (USP), the protocol’s stablecoin, quickly dropped from the USD one peg to USD .48 and showed no indications of recovery.

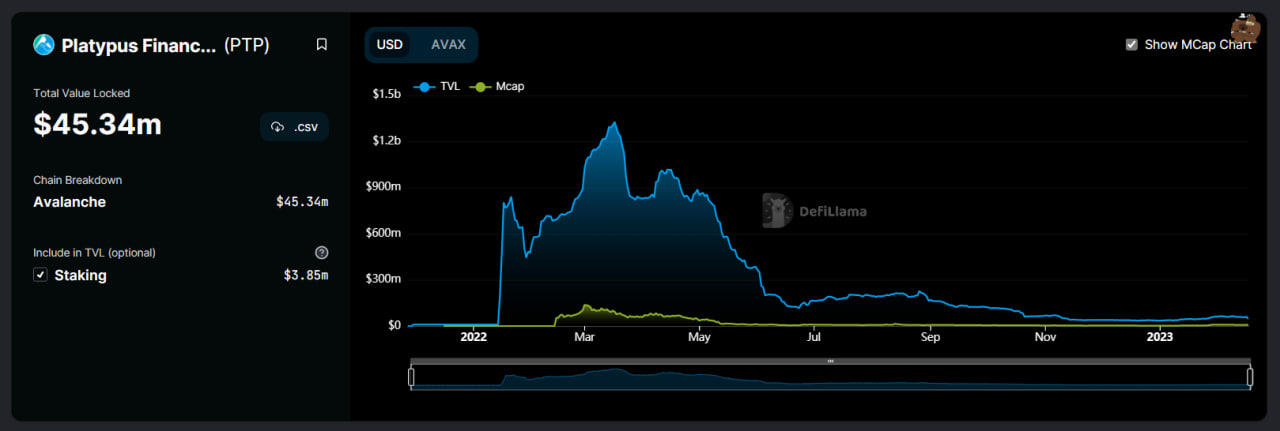

Platypus is an automated market place maker on Avalanche. There is at the moment an estimated $45.three million in Asset Freeze (TVL) on the protocol. At its peak in March 2022, Platypus Finance noticed $one.two billion in TVL, in accordance to DeFiLlama.

Synthetic currency68

Maybe you are interested: