Binance and CZ agreed to pay out a fine to settle the lawsuit with the US Department of Justice, as effectively as place an finish to a free of charge-flowing, do-what-you-want cryptocurrency site…

The finish of a “borderless” cryptocurrency.

The finish of a “borderless” cryptocurrency.

On the morning of November 22, 2023, the cryptocurrency industry was shocked by the information that Binance accepted a fine of $four.three billion and founder Changpeng Zhao (CZ) resigned as CEO to shut the investigation of the Ministry of Justice. .

Many individuals see this as a phase backwards for the Binance exchange when it has to pay out a substantial sum of funds and a series of extended legal ordeals. But over all, this can be viewed as the finish of a extended chapter in the historical past of cryptocurrency, the finish of the suitable of “borderless cryptocurrency”.

“Wild West”

Cryptocurrency comes in quite a few shapes and varieties. Transparency, decentralization, progressive technologies, fiscal freedom. And also with no borders.

When you 1st realized about cryptocurrencies, you need to have heard the moment:

“Cryptocurrency has no borders. Regardless of nation. Anyone, anyplace, in any ailment, with no needing a financial institution account can entry cryptocurrency.Just send BTC to Vietnam and individuals in the US will get them in minutes, in contrast to regular financial institution transfers,…”

Indeed, the superiority of cryptocurrencies is additional evident in this cross-border nature. Meanwhile, with regular banking institutions, transferring funds involving nations is incredibly difficult. It is tough for ordinary individuals to transfer funds abroad, but substantial organizations and businesses that want to make transactions have to have additional procedures.

Bitcoin also appeared to be suitable to remedy this problems. Blockchain is so beneficial that fiscal institutions and multinational firms have utilised cryptocurrencies in payment processing, for illustration Coinlive he continually reported.

However, no matter how superior it is, it nevertheless has its disadvantages. Solving the issue of cross-border funds transfers also suggests making the circumstances for criminals to come across means to launder funds.

And ever considering the fact that, the phrases “money laundering” and “crime” have often been related with cryptocurrency.

Black industry web site Silk Road – The Silk Road is a common illustration of this dark side that can not be erased in the historical past of Bitcoin.

Or additional realistically, by hacks in latest many years, criminals normally opt for resources that combine crypto transactions to disperse funds, speedily transfer funds by quite a few clues to erase traces,… Can be in contrast For illustration, Taiwan arrested the greatest ring of crypto funds laundering in historical past, involving 320 million USDT.

Authorities have also constantly recorded efforts to investigate, stop and crack down on criminals in latest many years.

Finally, right after quite a few many years of fishing, the time has come to consider out the net.

When the law comes into perform

The cryptocurrency has extended been in the sights of US officials, a nation viewed as one particular of the most significant markets for cryptocurrency.

The 1st shot was most likely on the ground BitMEX accused of funds laundering and industry manipulation in 2020. Although BitMEX’s mother or father corporation is registered as a legal entity in Seychelles, the exchange is nevertheless legally bound by the US government.

Ultimately, the exchange had to accept a fine of up to $one hundred million, and former CEO Arthur Hayes pleaded guilty in court just before it could be viewed as a “settlement.” But the BitMEX title no longer retains its former glory.

Next is the story of Tornado funds. This trading mixer platform is viewed as a symbol of the spirit of decentralization and anonymity pursued by DeFi. Tornado Cash’s founder and workforce of programmers needed to develop a platform to assistance the neighborhood shield their identities and assets, at a time when private privacy is very easily violated.

But superior intentions in the end have unfortunate endings. Citing why Tornado Cash has been utilised to launder additional than $seven billion in dirty cryptocurrencies considering the fact that 2019, the United States positioned the Tornado Cash web page on its sanctions checklist on August eight, 2023, later on arresting many co-founders. That.

Although the neighborhood is consistently fighting for fairness in direction of the task workforce, other DeFi and CeFi platforms this kind of as Uniswap, Aave and Balancer have to “bit their teeth” to comply with a amount of US rules in buy to deliver companies to customers in this nation. If not, they will probable fall to the very same fate as Tornado Cash.

The most famed just before Binance is most likely FTX. Surely no one particular is quite acquainted with the collapse of FTX/Alameda and former CEO Sam Bankman-Fried (SBF) dealing with trial in court.

FTX was based mostly in Hong Kong, then moved to the Bahamas. Although SBF often needed to penetrate the US industry, by endorsement offers and political donations, hundreds of hundreds of thousands of bucks have been invested just to get a subsidiary of FTX.US that was not also prominent. And in the finish every single hard work gets a zero flip.

Binance also “raises” a youngster, Binance.US, which is very “difficult” when you have to comply with the stringent rules of the US government. Meanwhile, outdoors the US, worldwide exchange Binance is free of charge to “roll around,” permitting customers to move funds anyplace or supplying “very high” ranges of margin and leverage on futures.

For this motive, when the United States 1st sued, Binance even eloquently stated:

“US law can only control companies operating domestically, but not the entire world.”

But then Binance, and not Binance.US, agreed to pay out the fine. And CZ had to fly from Dubai (United Arab Emirates) – a nation that does not have an extradition agreement with the United States – to Seattle to seem and also accept a bond well worth $175 million to be launched on pending bail of the sentence. it is February 23, 2024.

Or it truly is the floor that receives much less focus Bittrex. After obtaining to pay out a $24 million fine and filing for bankruptcy for its US subsidiary, Bittrex Global also had to cease operations. Although the exchange had previously confirmed that it would only withdraw from the US industry and that the international industry would nevertheless perform generally.

American-based mostly cryptocurrency exchanges also like it CoinBase Cute Krakenworking for a extended time and obtaining obtained a license in this nation, even an IPO on the stock exchange, can not stay away from the legal “spear” of the US Securities Commission (SEC).

All these stories have one particular factor in typical: no matter exactly where they register to operate, irrespective of whether it is DeFi or CEX, as extended as they operate in the US industry, they need to accept the country’s management rules. The crypto businesses that dared to “challenge” all had an unfortunate ending.

The previous webpage closes, a new chapter opens

The days of borderless cryptocurrency businesses are above. “Anonymous developers,” who do not reveal their identities, can nevertheless encounter legal judgments as normal.

The mentality of taking benefit of a “hidden” and tough to track crypto industry for private obtain will no longer be probable.

Crypto businesses are now forced to “play by the rules of the game” set by nations, and can not use the excuse of “decentralization, borderlessness and uncontrollability” to justify illicit habits or revenue from traders.

The Binance crash will place an finish to a bleak 2023, as effectively as a “free flight” and “do what you want” chapter of the cryptocurrency industry.

Although it is very unhappy that cryptocurrency is turning into additional and additional equivalent to the regular finance that we the moment criticized, thanks to this the consumer neighborhood is additional protected, generating it tough for criminals to consider benefit of it. ..

Whether superior or lousy, superior or lousy, we need to accept that one particular chapter of the cryptocurrency industry is above. Cryptocurrencies need to accept adjustment in accordance to each and every country’s legal framework to exist and create.

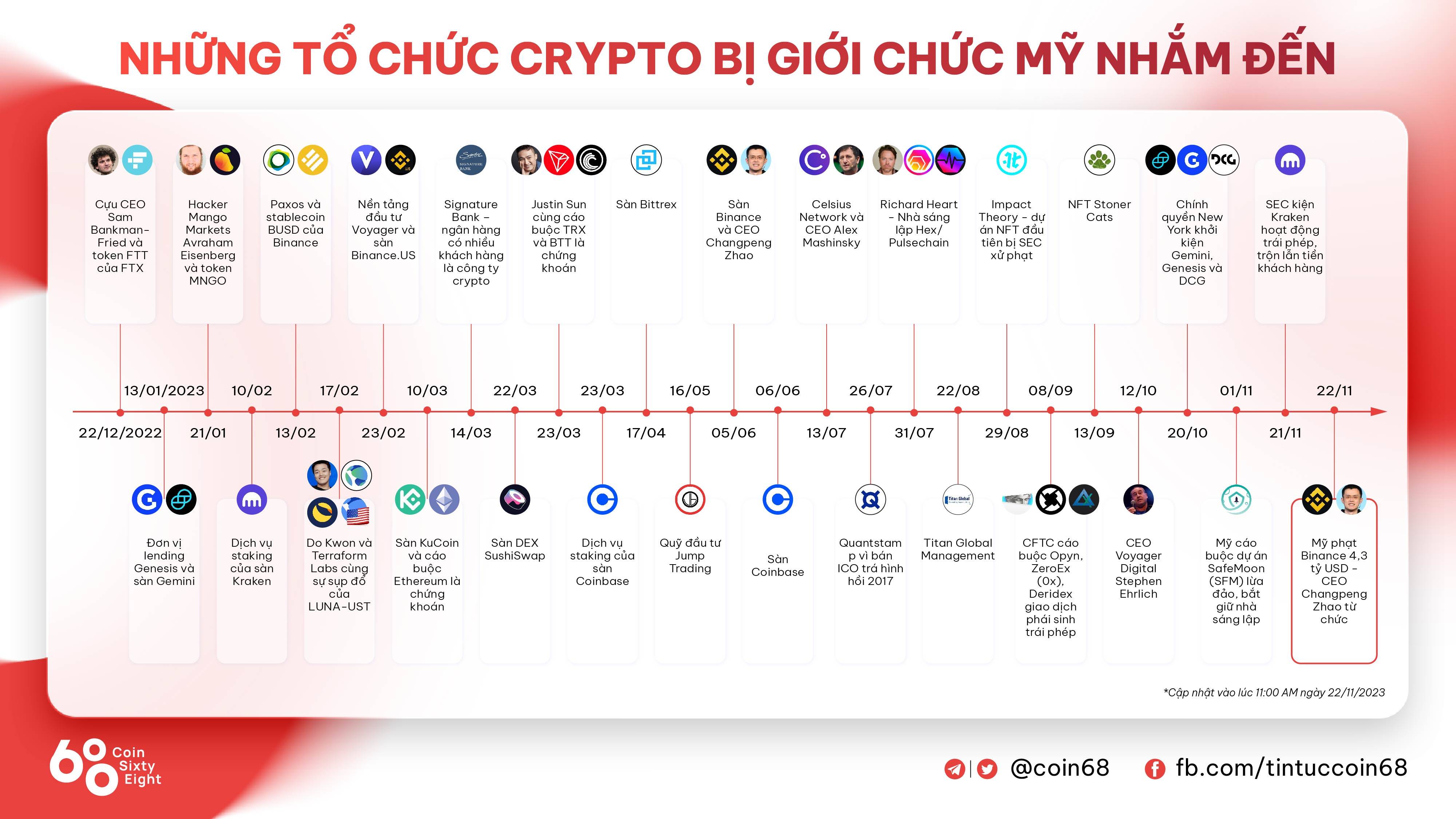

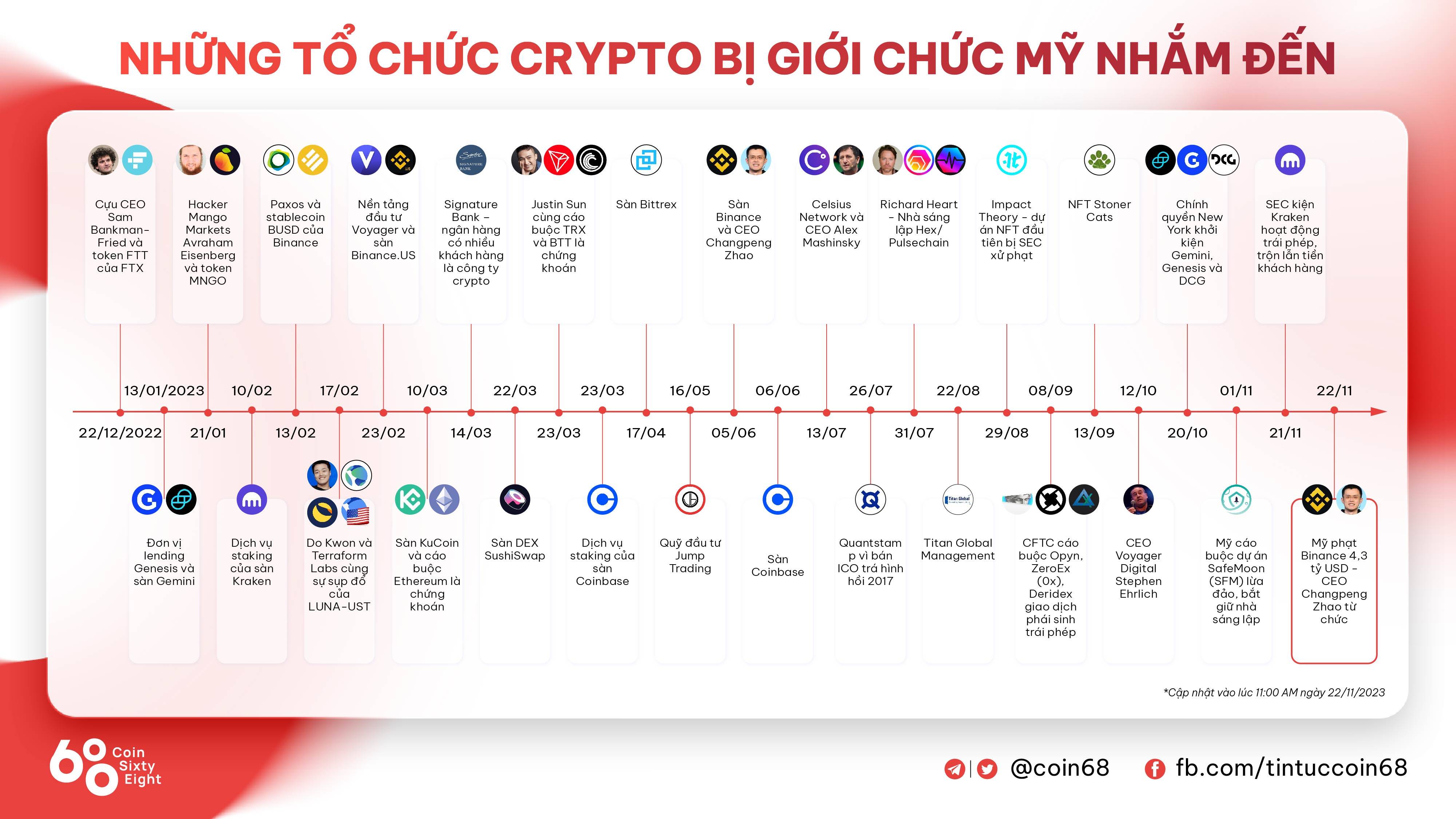

Crypto Organizations Targeted by US Authorities in 2022-2023

Crypto Organizations Targeted by US Authorities in 2022-2023

During the press conference on the $four.three billion fine towards Binance, US Attorney General Merrick B. Garland explained:

“The message given is very clear: the use of new technologies to circumvent the law does not bring any progress. It is still a violation of the law. The Ministry of Justice will not tolerate the guilty.” This phase threatens America’s financial institutions and threatens people’s believe in in individuals institutions. We will prosecute individuals who violate them and revenue from them.”

Jane

Join the discussion on the hottest problems in the DeFi industry in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!

Binance and CZ agreed to pay out a fine to settle the lawsuit with the US Department of Justice, as effectively as place an finish to a free of charge-flowing, do-what-you-want cryptocurrency site…

The finish of a “borderless” cryptocurrency.

The finish of a “borderless” cryptocurrency.

On the morning of November 22, 2023, the cryptocurrency industry was shocked by the information that Binance accepted a fine of $four.three billion and founder Changpeng Zhao (CZ) resigned as CEO to shut the investigation of the Ministry of Justice. .

Many individuals see this as a phase backwards for the Binance exchange when it has to pay out a substantial sum of funds and a series of extended legal ordeals. But over all, this can be viewed as the finish of a extended chapter in the historical past of cryptocurrency, the finish of the suitable of “borderless cryptocurrency”.

“Wild West”

Cryptocurrency comes in quite a few shapes and varieties. Transparency, decentralization, progressive technologies, fiscal freedom. And also with no borders.

When you 1st realized about cryptocurrencies, you need to have heard the moment:

“Cryptocurrency has no borders. Regardless of nation. Anyone, anyplace, in any ailment, with no needing a financial institution account can entry cryptocurrency.Just send BTC to Vietnam and individuals in the US will get them in minutes, in contrast to regular financial institution transfers,…”

Indeed, the superiority of cryptocurrencies is additional evident in this cross-border nature. Meanwhile, with regular banking institutions, transferring funds involving nations is incredibly difficult. It is tough for ordinary individuals to transfer funds abroad, but substantial organizations and businesses that want to make transactions have to have additional procedures.

Bitcoin also appeared to be suitable to remedy this problems. Blockchain is so beneficial that fiscal institutions and multinational firms have utilised cryptocurrencies in payment processing, for illustration Coinlive he continually reported.

However, no matter how superior it is, it nevertheless has its disadvantages. Solving the issue of cross-border funds transfers also suggests making the circumstances for criminals to come across means to launder funds.

And ever considering the fact that, the phrases “money laundering” and “crime” have often been related with cryptocurrency.

Black industry web site Silk Road – The Silk Road is a common illustration of this dark side that can not be erased in the historical past of Bitcoin.

Or additional realistically, by hacks in latest many years, criminals normally opt for resources that combine crypto transactions to disperse funds, speedily transfer funds by quite a few clues to erase traces,… Can be in contrast For illustration, Taiwan arrested the greatest ring of crypto funds laundering in historical past, involving 320 million USDT.

Authorities have also constantly recorded efforts to investigate, stop and crack down on criminals in latest many years.

Finally, right after quite a few many years of fishing, the time has come to consider out the net.

When the law comes into perform

The cryptocurrency has extended been in the sights of US officials, a nation viewed as one particular of the most significant markets for cryptocurrency.

The 1st shot was most likely on the ground BitMEX accused of funds laundering and industry manipulation in 2020. Although BitMEX’s mother or father corporation is registered as a legal entity in Seychelles, the exchange is nevertheless legally bound by the US government.

Ultimately, the exchange had to accept a fine of up to $one hundred million, and former CEO Arthur Hayes pleaded guilty in court just before it could be viewed as a “settlement.” But the BitMEX title no longer retains its former glory.

Next is the story of Tornado funds. This trading mixer platform is viewed as a symbol of the spirit of decentralization and anonymity pursued by DeFi. Tornado Cash’s founder and workforce of programmers needed to develop a platform to assistance the neighborhood shield their identities and assets, at a time when private privacy is very easily violated.

But superior intentions in the end have unfortunate endings. Citing why Tornado Cash has been utilised to launder additional than $seven billion in dirty cryptocurrencies considering the fact that 2019, the United States positioned the Tornado Cash web page on its sanctions checklist on August eight, 2023, later on arresting many co-founders. That.

Although the neighborhood is consistently fighting for fairness in direction of the task workforce, other DeFi and CeFi platforms this kind of as Uniswap, Aave and Balancer have to “bit their teeth” to comply with a amount of US rules in buy to deliver companies to customers in this nation. If not, they will probable fall to the very same fate as Tornado Cash.

The most famed just before Binance is most likely FTX. Surely no one particular is quite acquainted with the collapse of FTX/Alameda and former CEO Sam Bankman-Fried (SBF) dealing with trial in court.

FTX was based mostly in Hong Kong, then moved to the Bahamas. Although SBF often needed to penetrate the US industry, by endorsement offers and political donations, hundreds of hundreds of thousands of bucks have been invested just to get a subsidiary of FTX.US that was not also prominent. And in the finish every single hard work gets a zero flip.

Binance also “raises” a youngster, Binance.US, which is very “difficult” when you have to comply with the stringent rules of the US government. Meanwhile, outdoors the US, worldwide exchange Binance is free of charge to “roll around,” permitting customers to move funds anyplace or supplying “very high” ranges of margin and leverage on futures.

For this motive, when the United States 1st sued, Binance even eloquently stated:

“US law can only control companies operating domestically, but not the entire world.”

But then Binance, and not Binance.US, agreed to pay out the fine. And CZ had to fly from Dubai (United Arab Emirates) – a nation that does not have an extradition agreement with the United States – to Seattle to seem and also accept a bond well worth $175 million to be launched on pending bail of the sentence. it is February 23, 2024.

Or it truly is the floor that receives much less focus Bittrex. After obtaining to pay out a $24 million fine and filing for bankruptcy for its US subsidiary, Bittrex Global also had to cease operations. Although the exchange had previously confirmed that it would only withdraw from the US industry and that the international industry would nevertheless perform generally.

American-based mostly cryptocurrency exchanges also like it CoinBase Cute Krakenworking for a extended time and obtaining obtained a license in this nation, even an IPO on the stock exchange, can not stay away from the legal “spear” of the US Securities Commission (SEC).

All these stories have one particular factor in typical: no matter exactly where they register to operate, irrespective of whether it is DeFi or CEX, as extended as they operate in the US industry, they need to accept the country’s management rules. The crypto businesses that dared to “challenge” all had an unfortunate ending.

The previous webpage closes, a new chapter opens

The days of borderless cryptocurrency businesses are above. “Anonymous developers,” who do not reveal their identities, can nevertheless encounter legal judgments as normal.

The mentality of taking benefit of a “hidden” and tough to track crypto industry for private obtain will no longer be probable.

Crypto businesses are now forced to “play by the rules of the game” set by nations, and can not use the excuse of “decentralization, borderlessness and uncontrollability” to justify illicit habits or revenue from traders.

The Binance crash will place an finish to a bleak 2023, as effectively as a “free flight” and “do what you want” chapter of the cryptocurrency industry.

Although it is very unhappy that cryptocurrency is turning into additional and additional equivalent to the regular finance that we the moment criticized, thanks to this the consumer neighborhood is additional protected, generating it tough for criminals to consider benefit of it. ..

Whether superior or lousy, superior or lousy, we need to accept that one particular chapter of the cryptocurrency industry is above. Cryptocurrencies need to accept adjustment in accordance to each and every country’s legal framework to exist and create.

Crypto Organizations Targeted by US Authorities in 2022-2023

Crypto Organizations Targeted by US Authorities in 2022-2023

During the press conference on the $four.three billion fine towards Binance, US Attorney General Merrick B. Garland explained:

“The message given is very clear: the use of new technologies to circumvent the law does not bring any progress. It is still a violation of the law. The Ministry of Justice will not tolerate the guilty.” This phase threatens America’s financial institutions and threatens people’s believe in in individuals institutions. We will prosecute individuals who violate them and revenue from them.”

Jane

Join the discussion on the hottest problems in the DeFi industry in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!