Activity decreased, the volume of charges applied was not substantial, once more triggering an inflation of the Ethereum network.

The Ethereum Network Is Experiencing “Reverse Deflation”

The Ethereum Network Is Experiencing “Reverse Deflation”

As Coinlive explained, Ethereum follows The merger moved to Proof-of-Stake mechanism and staking consensus, lowering the volume of new coins developed by up to 90% in contrast to the outdated Proof-of-Work mechanism and mining routines. At the exact same time, mixed with updates EIP-1559 it assists burn up a portion of ETH’s transaction charges, which could produce deflationary strain on the world’s 2nd-biggest cryptocurrency.

When it was a Proof-of-Work blockchain, the ETH inflation price was commonly three.15% per 12 months. Net reached deflation for the very first time on November 9, thanks to a sudden raise in business demand resulting from the occasion FTX collapsed. However, what is occurring lately appears to go towards this trend, the volume of new provide of ETH has enhanced substantially once more.

Comparing the provide development of Ethereum Proof-of-Work (dotted line), Bitcoin (orange line), and Ethereum Proof-of-Stake (blue line). Screenshot of Ultrasound.funds at 09:00 on October 9, 2023

Comparing the provide development of Ethereum Proof-of-Work (dotted line), Bitcoin (orange line), and Ethereum Proof-of-Stake (blue line). Screenshot of Ultrasound.funds at 09:00 on October 9, 2023

In the final thirty days alone, the worldwide provide of ETH has enhanced by virtually thirty,000 ETH, or around $47.9 million, in accordance to the information aggregator. ultrasound.funds. The motive for this is due to a notable reduce in exercise on the Ethereum network, with each NFT and DeFi trading drying up.

ETH provide development more than the previous month. Screenshot of Ultrasound.funds at 09:00 on October 9, 2023

ETH provide development more than the previous month. Screenshot of Ultrasound.funds at 09:00 on October 9, 2023

Since 2021, Ethereum has been working with a charge burning mechanism, which indicates that the extra visitors on the network, the increased the fuel charges wanted to total on-chain transactions. And after fuel charges rise drastically, it indicates extra ETH is burned from the network, or in other phrases, completely eliminated from circulation.

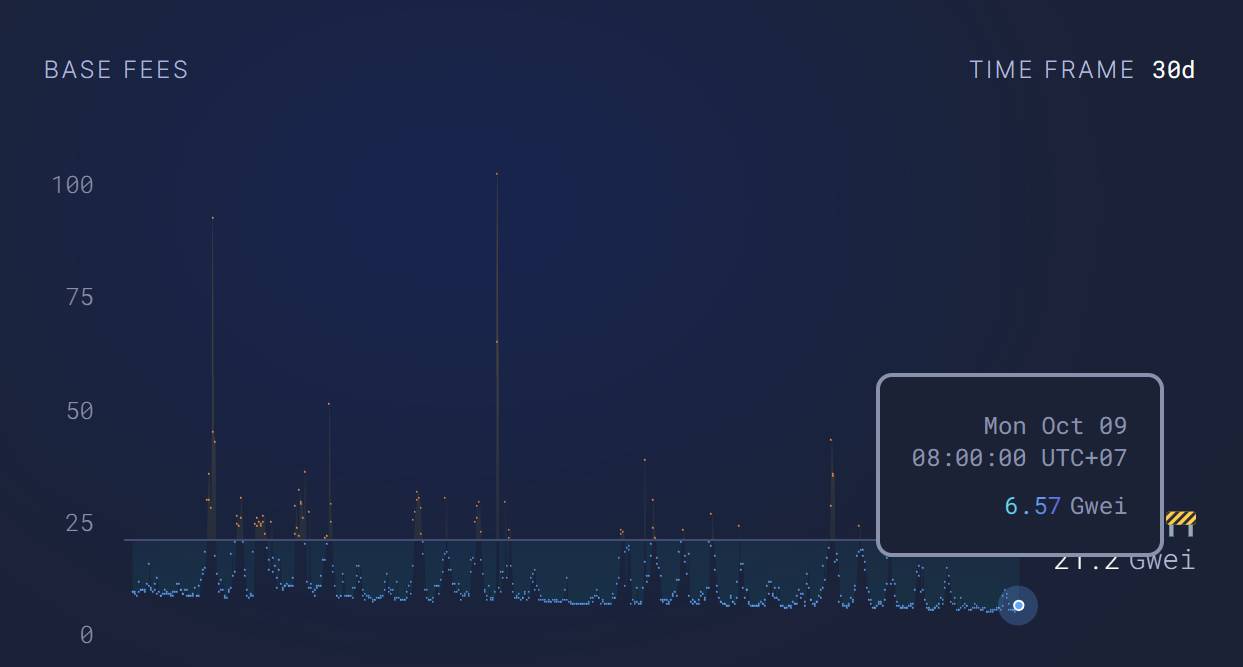

Ethereum fuel charges have lately dropped substantially, averaging all over seven gwei, just $.24. An normal transaction on the OpenSea NFT marketplace expenses significantly less than $one. While just more than a 12 months in the past, throughout Yuga Labs’ Otherside Collection sale in May, customers burned extra than $157 million in ETH just to mint fifty five,000 NFT plenty, the normal individual invested up to $two,854 to pay out for fuel for a transaction.

Average fuel costs more than the final thirty days. Source: Ultrasound.funds

Average fuel costs more than the final thirty days. Source: Ultrasound.funds

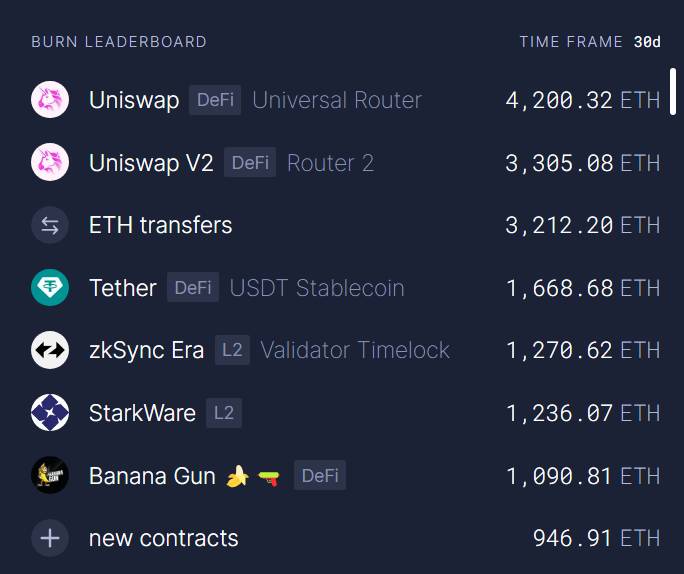

TOver the previous thirty days, extra than 38,360 ETH has been burned in transaction charges, largely coming from transfers of ETH and USDT, DEX Uniswap and layer-two stablecoins like zkSync Era…

Ethereum applications have burned the most charges in the final thirty days. Screenshot of Ultrasound.funds at 09:00 on October 9, 2023

Ethereum applications have burned the most charges in the final thirty days. Screenshot of Ultrasound.funds at 09:00 on October 9, 2023

As a consumer, practically absolutely everyone likes lower fuel charges, but hunting at the large image, this is a indicator that it is pushing the worldwide provide of ETH as a result of the roof, triggering this coin to inflate after once more. the prolonged-phrase fiscal well being of the network.

Is Ethereum Getting Inflationary Again?

Yes, it is, and which is mainly because Ethereum charges, which are supposed to burn up ether, are all over the place but on Ethereum: its L2s (Arbitrum, Polygon, and so forth.) and EVM rivals (BNB, Avalanche C, and so forth.)

L1 limitation dooms cryptocurrencies. pic.twitter.com/cE82gwUbZR

— Nikita Zhavoronkov (@nikzh) September 23, 2023

The important challenge with Ethereum is that its long term provide is unknown, unpredictable, and probably inflationary.

For Ethereum to be deflationary, tx charges ought to be substantial, which means it ought to not be ready to develop, and tx volume ought to not move to other crypto stocks like Solana. pic.twitter.com/dITZ7RfSf6

— Joe Burnett (🔑)³ (@IIICapital) October 2, 2023

The staff behind Ethereum does not appear to location as well considerably emphasis on this difficulty. Micah Zoltu, an Ethereum core programmer, shares with Decipher:

“I don’t think anyone on the development team cares about this story. If you look at the bigger picture, it’s insignificant.”

Danno Ferrin, a different Ethereum representative, also shares Zoltu’s view:

“ETH supply remains below all-time highs. And Ethereum’s short-term inflation is much lower than other chains and the broader economy.”

The cost of Ethereum also dropped drastically right after The Merge.

1D chart of the ETH/USDT pair on Binance at 09:ten on October 9, 2023

1D chart of the ETH/USDT pair on Binance at 09:ten on October 9, 2023

Coinlive compiled

Join the discussion on the hottest concerns in the DeFi industry in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!