After the initial day of non-jury testimony, former FTX CEO Sam Bankman-Fried was ultimately in a position to defend himself.

Sam Bankman-Fried took the oath of workplace on the witness stand. Photo: Jane Rosenberg/Reuters

Sam Bankman-Fried took the oath of workplace on the witness stand. Photo: Jane Rosenberg/Reuters

As Coinlive reported, Sam Bankman-Fried’s defense lawyer chose the risky approach of calling the former FTX CEO himself as a witness in his trial.

However, the presiding judge was cautious when, on the initial day of testimony, Sam Bankman-Fried had to solution issues with out the presence of the jury, which would have reached a collective verdict. CEO of FTX.

However, on the 2nd day of testimony, Sam Bankman-Fried was in a position to defend himself to the jury.

The starting of Alameda and FTX

At the starting of the defense attorney’s solution to the query, Sam Bankman-Fried stated that FTX was a cryptocurrency derivatives exchange, but it collapsed and went bankrupt. Even so, former CEO he denied defrauding everyone or taking cash from clients.

Sam mentioned:

“I made a number of big and small mistakes. For example, FTX does not have its own team responsible for risk management, as well as oversight of employee activities.”

The defense lawyer then asked Sam Bankman-Fried about his background, from functioning for the Jane Street investment fund, to later on meeting with partners like Gary Wang, Nishad Singh and Caroline Ellison to uncovered Alameda Research and FTX.

After realizing the terrific demand for cryptocurrency trading and the chance to revenue from selling price distinctions, Alameda has produced quite a few effective transactions with yearly revenue of 50% to one hundred%. The fund then moved its headquarters from Berkeley (Alameda County, California, USA) to Hong Kong to seek out much more options and finally founded the FTX exchange. Sam also stated that the cause he chose Hong Kong was mainly because it is legally much more open to cryptocurrencies. Cryptocurrency Investment Fund Alameda Research Adds Market Making Features to FTX.

Notably, Sam Bankman-Fried mentioned that at this time he intends to resell FTX to Binance, as previously exposed that the former CEO of FTX provided $forty million for the exchange but was rejected by Changpeng Zhao. This is a single of the causes why Sam Bankman-Fried made the decision to establish FTX himself to turn into a competitor to Binance. However, Binance was an early investor in FTX, investing $80 million in the type of BNB.

Sam Bankman-Fried mentioned he imposed a recovery mechanism on FTX, which simply just suggests that when a futures trading consumer suffers a reduction, the quantity of injury past FTX’s capability to fix will be divided equally amid all customers. When an account is liquidated, FTX will promote the collateral to offset the trading place. However, Sam Bankman-Fried mentioned that in the occasion that a massive account like Alameda was liquidated, the consequences for FTX could be particularly massive.

Therefore, Sam advised Chief Technology Officer Gary Wang that there will have to be a mechanism to avert this, and then discovered that Gary Wang and Nishad Singh had made the “allow negatives” characteristic, making it possible for Alameda Research to sustain a damaging account on FTX. Sam Bankman-Fried claims he was reported by Wang and Singh for repairing the issue, but I never know exclusively what they did.

Now, just after hearing testimony from Gary Wang and Nishad Singh, Sam Bankman-Fried understands that the mechanism makes it possible for Alameda Research to area trading orders on FTX with out mortgaging assets, making it possible for damaging assets with out worrying about getting liquidated. Meanwhile, Gary Wang and Nishad Singh mentioned it was Sam in 2020 who ordered them to impose a damaging consensus to avert Alameda from dropping much more cash.

Subsequently, Alameda started borrowing cash from FTX, with a credit score quantity in the billions of bucks. Sam Bankman-Fried talked about the matter with Gary Wang and Nishad Singh and uncovered that the cash was sent to Alameda’s financial institution account and recorded as fund debt on FTX.

The defense lawyer then asked Sam Bankman-Fried for details FTT token of the FTX exchange, as very well as the mechanism for getting and burning exchange tokens to obtain them back as transaction charges. FTT tokens are also traded on other exchanges this kind of as Binance, and Binance when planned to promote all of its FTT holdings. The former CEO of FTX mentioned that FTT is created similarly to the BNB model on Binance.

When asked what “market manipulation” is, Sam Bankman-Fried described it in Jane Street terms, “a bad trading order that leads to price fluctuations.”

Cohen: Is there a time when Binance made the decision to promote its FTT?

SBF: Yes. We had a meeting with Sam Trabucco and Caroline Ellison.

Cohen: What is market place manipulation?

SBF: At Jane Street they say that these are incorrect operations to transform the selling price of an asset— Inner City Press (@innercitypress) October 27, 2023

Sam Bankman-Fried says he typically will work up to twelve hrs a day, even up to 22 hrs on the busiest events. He typically has up to 60,000 unread emails and participates in hundreds of chat groups on the messaging app Signal.

In the total 12 months of 2019, FTX’s income was only $twenty million, but by 2021 the exchange was earning up to $three million per day.

FTX grows, investments and sponsorships

When the time came to really feel the have to have to target on the growth of FTX, Sam Bankman-Fried made the decision to hand more than management of Alameda Research to Sam Trabucco and Caroline Ellison at the finish of 2021. These are talented folks, whilst So, Sam commented that Caroline Ellison is a superior researcher but does not have sufficient encounter in threat management.

In August 2022 Sam Trabucco resigned mainly because he desired to rest. Sam proposed to Caroline that they discover a new co-CEO but she refused.

In the summertime of 2021, FTX made the decision to depart Hong Kong and move its headquarters to the Bahamas in the Caribbean. Sam Bankman-Fried mentioned that the cause for the over choice is mainly because the legal setting of cryptocurrencies in Asia has modified, as has the scenario of the COVID-19 epidemic.

Subsequently, FTX started investing heavily on sponsorship discounts to market the stadium, like investing hundreds of hundreds of thousands of bucks to get back the naming rights to the Miami Heat basketball team’s stadium.

Sam Bankman-Fried also prospects FTX and Alameda’s investment operations, participating in the evaluation of several tasks, like Solana (SOL). The CEO admitted it Start getting SOL for as small as $.two, applying revenue Alameda earned and borrowed cash. In early 2021, Sam Bankman-Fried grew to become popular for getting concerned in a dispute with yet another investor, which led to the statement that he would get back all of Solana that this man or woman held for three USD, a selling price larger than the market place selling price in that second.

I’ll get all the SOL you have, ideal now, for $three.

Sell me anything at all you want.

Then go fuck your self.

— SBF (@SBF_FTX) January 9, 2021

In the Bahamas, FTX invested tens of hundreds of thousands of bucks shopping for properties to meet the residential requires of its staff to persuade them to move right here. Sam Bankman-Fried also grew to become the “face” of FTX just after his interviews made quite a few favourable impressions in the media.

The defense lawyer then questioned Sam Bankman-Fried about investments in K5 Global, an investment fund with ties to quite a few celebrities, as very well as political donations to lobby to assistance FTX have a say in making the cryptocurrency regulatory framework in the United States. The donation was produced by Sam Bankman-Fried and other FTX managers like Nishad Singh and Ryan Salame with cash borrowed from Alameda. However, the former CEO denied directing Singh and Salame to make donations.

Sam Bankman-Fried has also been invited to testify 3 occasions to US Congressional committees, most notably on the proposed regulation of the cryptocurrency business by the Asset Futures Trading Commission (CFTC).

Sam Bankman-Fried admitted that he intentionally pushed FTX’s income to $one billion by adjusting the exchange’s Serum (SRM) transactions, mainly because it would assistance “hit round numbers.”

The liquidity crisis of summertime 2022

After the collapse of LUNA – USDT in May 2022, the cryptocurrency market place suffered a sturdy liquidity shock, placing quite a few primary providers in issues.

Alameda’s asset worth dropped from $forty billion to just $ten billion in June alone. Sam Bankman-Fried spoke to Caroline Ellison and uncovered that the fund had no hedged investments. The former FTX CEO mentioned Ellison came to him to report that there was a probability of Alameda going bankrupt, then was informed by Nishad Singh of an accounting error that induced Alameda’s debt to FTX was $eight billion larger than it truly was. Sam Bankman-Fried then demanded that the loophole be closed and advised Alameda to repay his debt.

Sam Bankman-Fried mentioned he had no recollection of instructing Caroline Ellison to put together 7 separate fiscal statements to hide Alameda Research’s debt and asset shortfall to send to creditors to borrow much more cash.

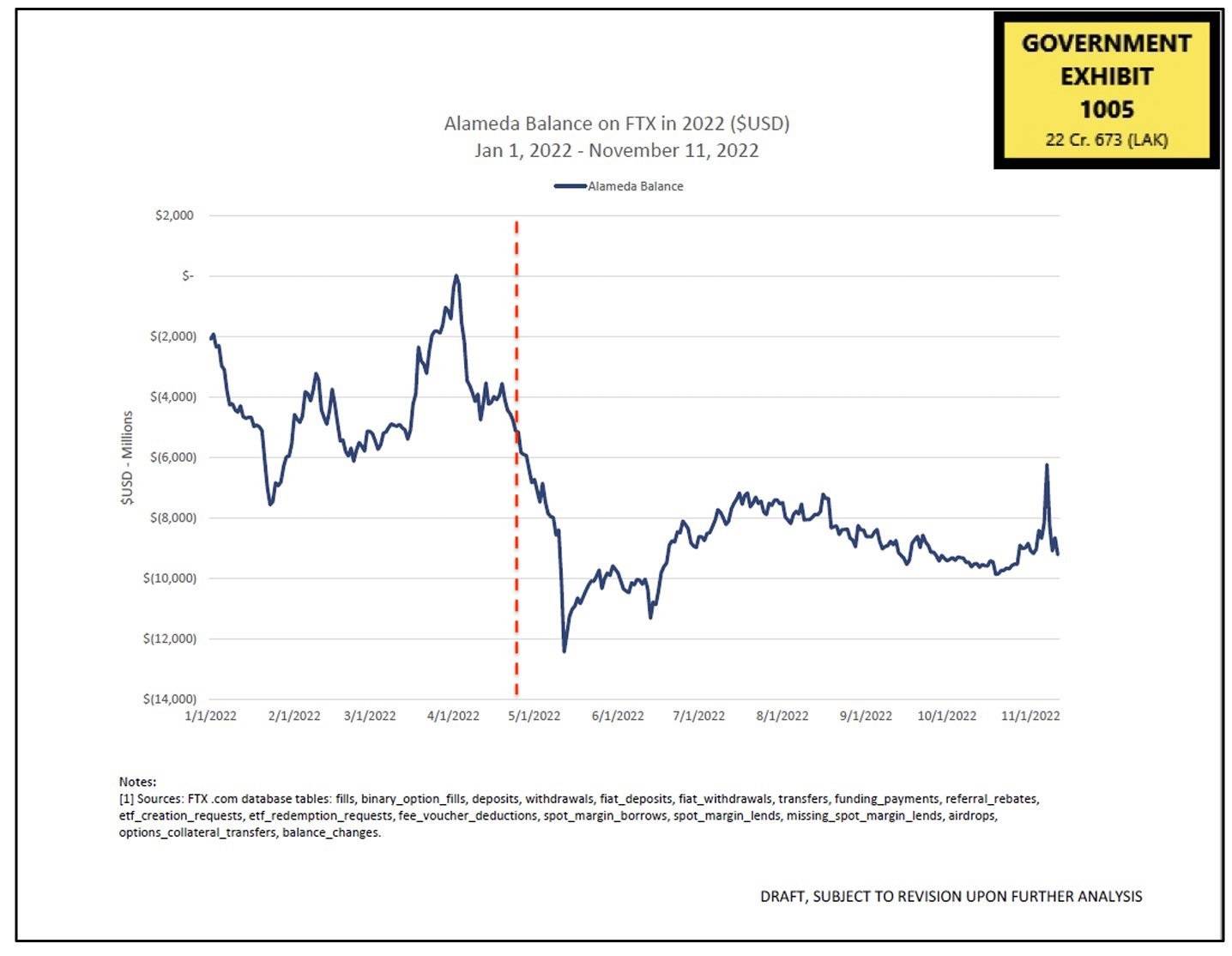

Evidence filed in court, displaying the worth of Alameda Research’s assets just before and just after the collapse of LUNA-UST

Evidence filed in court, displaying the worth of Alameda Research’s assets just before and just after the collapse of LUNA-UST

The former FTX CEO also mentioned he was contacted by quite a few providers that have been struggling to request for liquidity at the time, like DCG’s Genesis lending unit, Celsius, BlockFi and Voyager. Sam Bankman-Fried later on emerged as a “tycoon” reaching out to conserve the market place and has been in contrast to the “JP Morgan of the cryptocurrency industry,” even arguing with Binance CEO Changpeng Zhao on this difficulty.

Of these, FTX only agreed to conserve BlockFi by an acquisition deal really worth just about half a billion bucks. However, following FTX’s bankruptcy in November, BlockFi also filed for bankruptcy a number of weeks later on. Voyager announced bankruptcy in July, comparable to Celsius, when Genesis announced bankruptcy in January 2023.

The attorney then asked the former FTX CEO about the conversations he had with other FTX managers this kind of as Nishad Singh and CEO Alameda about the exchange scenario, evaluating them with their testimonies.

The trial then concluded and will resume on Monday (October thirty) with the cross-examination of Sam Bankman-Fried by the US Department of Justice prosecutor.

Coinlive compiled

Join the discussion on the hottest concerns in the DeFi market place in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!