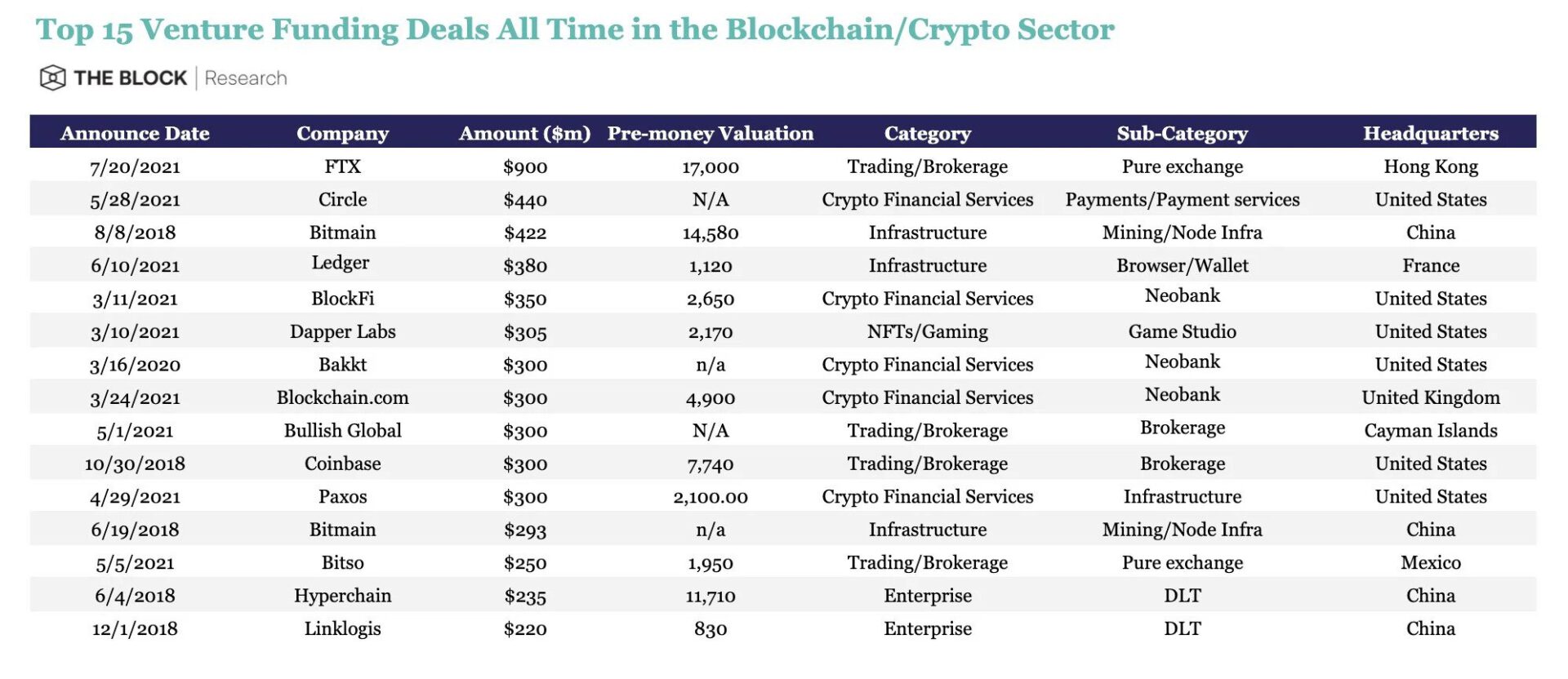

FTX has just finished the greatest ever funding round in the cryptocurrency business, effectively raising up to $ 900 million and becoming valued at $ 18 billion from investment money.

FTX involves $ 900 million of capital, well worth $ 18 billion

On July twenty, cryptocurrency exchange FTX announced that it has $ 900 million effectively raised from extra than 60 significant and compact investment money all around the planet. The listing of investment money consists of significant names like Paradigm, Sequoia Capital, Ribbit Capital, Third Point, Lightspeed Venture Partners, Coinbase Ventures, Softbank, Sino Global Capital, Multicoin Capital, Paul Tudor Jones household, VanEck, Circle and person traders Izzy Englander and Alan Howard. With a $ 900 million fund, FTX has come to be the greatest cryptocurrency company in the industry’s twelve-yr historical past.

In addition, FTX also receives is valued at up to USD 18 billion, which is up 15 occasions from $ one.two billion a yr in the past offered the quick development of this cryptocurrency trading platform just after the bull marketplace time period of late 2020 and early 2021.

Last month, the magazine Forbes estimated the complete wealth of FTX CEO Sam Bankman-Fried, who holds a 58% stake in the corporation, to be somewhere around $ eight.three billion. However, just after confirming the good funding of $ 900 million and raising the minimal valuation to $ 18 billion, Forbes launched a new evaluation variety for FTX Chief Resources, namely up to $ sixteen.two billion.

When asked about its intention to come to be a public corporation by going public, which was accomplished by the greatest cryptocurrency exchange in the United States, Coinbase, in April or quickly, the bullish exchange produced by EOS with a capital variety of 9 billion. bucks, Sam commented:

“This is an choice we are thinking about, but a ultimate selection has not nevertheless been produced. We want to place ourselves in a place to have the room and time to do it as we please. We are not below stress to get the discipline straight away. “

The FTX technique behind the “huge” fundraising deal

Sam Bankman-Fried, CEO of FTX, shared the strategy to use the newly raised income as follows:

“Our principal function in this funding round is to obtain strategic partners who can assist FTX establish its brand, but the proceeds will be utilized mostly for mergers and acquisitions. We will take into account obtaining enterprises that are not in the cryptocurrency business, or trading units, even NFT platforms – any component we assume can deliver worth to FTX or assist complement the equipment we have produced.

Indeed, FTX’s technique of rising brand recognition by means of mergers and acquisitions has been evident from mid-2020 to the current. Last August, FTX stated it acquired the Blockfolio cryptocurrency monitoring app for $ 150 million, then produced it into a complete-fledged trading app and targeted the US marketplace.

Additionally, in 2021, FTX also has surprising promoting and sponsorship offers, mostly aimed at the sports activities business in the United States. In April, the exchange signed a contract to get the rights to the team’s basketball court title Miami Heat for 19 many years with worth 135 million bucks. Until June, FTX continues to shell out right up until 210 million bucks come to be an official companion of the Esports organization TSM, renamed this group to TSM FTX. Just a number of weeks later on, the exchange continues to come to be the cryptocurrency companion of the whole American Baseball League (MLB). FTX has also teamed up with soccer legend Tom Brady and his wife, supermodel Gisele Bundchen, creating them the two its ambassadors to the United States.

It can be witnessed that FTX is paying a great deal of assets on brand promotion in the US, obviously displaying its ambition to capture marketplace share from the two most well-known cryptocurrency trading platforms right here, Coinbase and Robinhood.

Even CEO Sam Bankman-Fried uncovered that up to 50% Users surveyed “learn about FTX through sponsorship deals” over, displaying a higher degree of effectiveness of this technique.

“Surprise” with the title absent

If you get a seem at the FTX investor listing at the top rated of the write-up, people following the cryptocurrency business considering that 2019 will be shocked to obtain the missing title. Binance – the variety one cryptocurrency exchange in the planet currently. As reported by Coinlive, in December 2019, Binance announced an undisclosed strategic investment in FTX. This is a conciliatory move involving the two sides when a month earlier, Binance filed a lawsuit towards FTX attacking the Futures platform with an quantity of up to $ 150 million.

Answer the interview ForbesBinance CEO Changpeng Zhao stated the explanation Binance is no longer on the FTX investor listing is due to the fact the corporation lately divested all of its shares in FTX. He stated:

“We have witnessed them increase at an extraordinary price, we are content about it, but we have entirely terminated the investment partnership. The explanation is just due to the fact of the regular investment cycle. Both sides are nevertheless buddies, but they no longer have a participation partnership “.

This is probable to deepen the “no good rice, no sweet soup” competitors involving FTX and Binance. As reported by Coinlive in the exclusive write-up celebrating the 2nd anniversary of the establishment of FTX, a feud that is tricky to reconcile has existed for some time involving FTX and Binance. The principal starting up level was the incident exactly where Binance accused FTX of manipulating its Futures trading platform in 2019, followed by Binance supporting FTX’s leveraged token, only to abruptly eliminate it from the listing due to the fact he considered it was worthless. of the token with leverage.

The latest scenario also displays a conflicting image involving these two trading platforms. While FTX has persistently attained accomplishment and elevated its status in the previous, Binance has encountered a variety of legal troubles all around the planet, even getting to halt its personal protection token trading services, a product or service also derived from FTX itself. .

To understand extra about the education and growth path, behind the scenes and the FTX ecosystem currently, never miss the exclusive write-up “E-Magazine: FTX and the 2-year journey of non-stop innovation“by Coinlive.

Synthetic currency 68

Maybe you are interested:

.