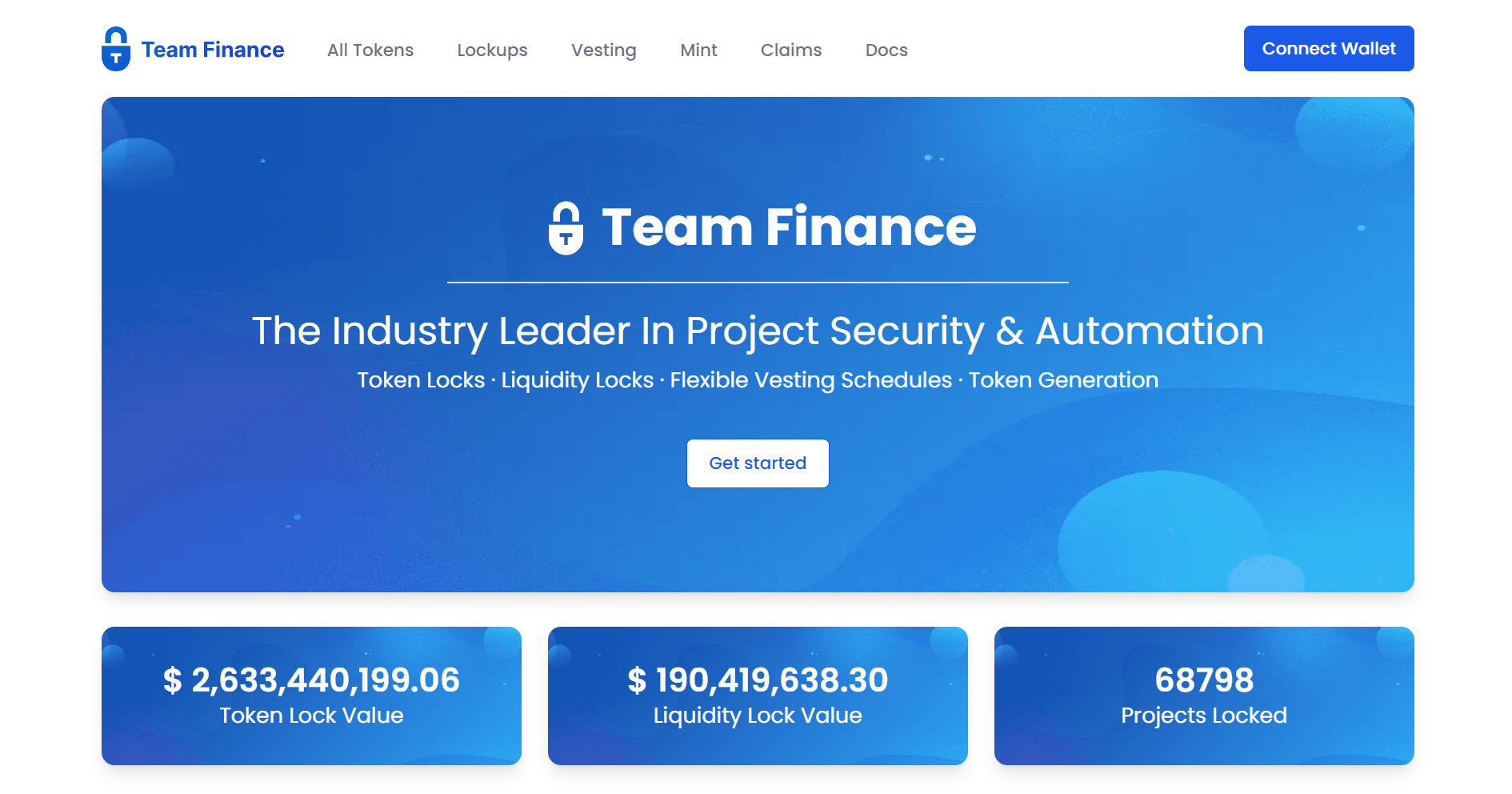

An attacker exploited a vulnerability in Team Finance to transfer blocked liquidity tokens, resulting in losses of up to $ 15.eight million.

On the afternoon of October 27, the Team Finance protocol was hacked by terrible guys, draining all 15.eight million bucks really worth of tokens. The incident impacted four tasks like CAW (A Hunters Dream), Dejitaru Tsuka, Kondux and Feg. In which, CAW suffered the heaviest reduction with $ one.five million.

We just acquired warned about an exploit in Team Finance.

At the second we are uncertain about the specifics.

We invite the exploiter to speak to us for the payment of a bountyWe are doing work to analyze and treatment the predicament suitable now.

More specifics to stick to

– Team Finance (@TeamFinance_) October 27, 2022

DeFi liquidity blocking platform Confirm difficulty, exposing an attacker who exploited a loophole in the migration performance from v2 to audit v3. This vulnerability permitted hackers to manipulate the rate of liquid tokens when they have been moved from v2 to v3. The big difference in rate brought “a lot of money” to the terrible guys.

“We stopped all operations till the difficulty was wholly resolved. The remaining sources on Team Finance are now safe and sound, “announced Team Finance.

According to the “chain police” Shield peckedthe hacker applied one.76 Ethereum ($ two,700) to activate the assault. Address Their portfolios even now hold six.43 million DAI and 880 ETH, equivalent to $ one.36 million.

two / The protocol has a faulty migrate () which is exploited to transfer the serious liquidity of UniswapV2 to a new V3 pair managed by an attacker with a biased rate, resulting in enormous leftovers as a payback for revenue. Also, the authorized sender examine is bypassed by blocking all tokens. pic.twitter.com/G2QVNU7DgU

– PeckShield Inc. (@peckshield) October 27, 2022

Immediately immediately after the unfortunate incident, Team Finance manufactured a concession, urging the hacker to return the income with a effectively-deserved bounty. These This settlement is turning into fairly well-liked in the DeFi area, In the midst of today’s “common” safety incidents,.

Earlier this month, Mango Markets was also hit withdraw $ 114 millionthe attacker then states that it is simply just a “highly profitable trading strategy”.

Synthetic currency 68

Maybe you are interested: