The “steaming” conflicts inside SushiSwap have ultimately erupted violently in a way that couple of individuals anticipated.

In a series of Twitter posts on December five, Mr. Joseph Delong, CTO of the well-known AMM / DEX SushiSwap (SUSHI) undertaking, confirmed that he will depart the undertaking except if the improvement group is offered a lot more employer autonomy and increase wages.

The CTO wrote:

I will ship Trident and if you do not give us the autonomy to carry on operations, the skill to type leadership and raise compensation in standard, I will depart.

– Joseph Delong (@josephdelong) December 5, 2021

“I will fantastic Trident and if the neighborhood no longer has the autonomy to carry on working and the skill to lead and raise the salary of the improvement group, I will depart the undertaking.

The supply of the dispute

SushiSwap is a decentralized exchange (DEX) launched in mid-2020, which copies the working model of the pioneering platform in the DEX array on Ethereum, Uniswap and even Uniswap “bloodsucking attack” rewarding customers with tokens to appeal to liquidity.

In September 2020, SushiSwap founder, then Chef Nomi, carried out a “pass”, took management of the project’s money and offered SUSHI tokens for 38,000 ETH (well worth $ 14 million at the time. ). However, underneath good stress from the neighborhood, Chef Nomi was forced to return the revenue and depart the undertaking, offering management of the undertaking to FTX exchange CEO Sam Bankman-Fried. Soon immediately after, the management of SushiSwap was entrusted to an anonymous developer named 0xMaki.

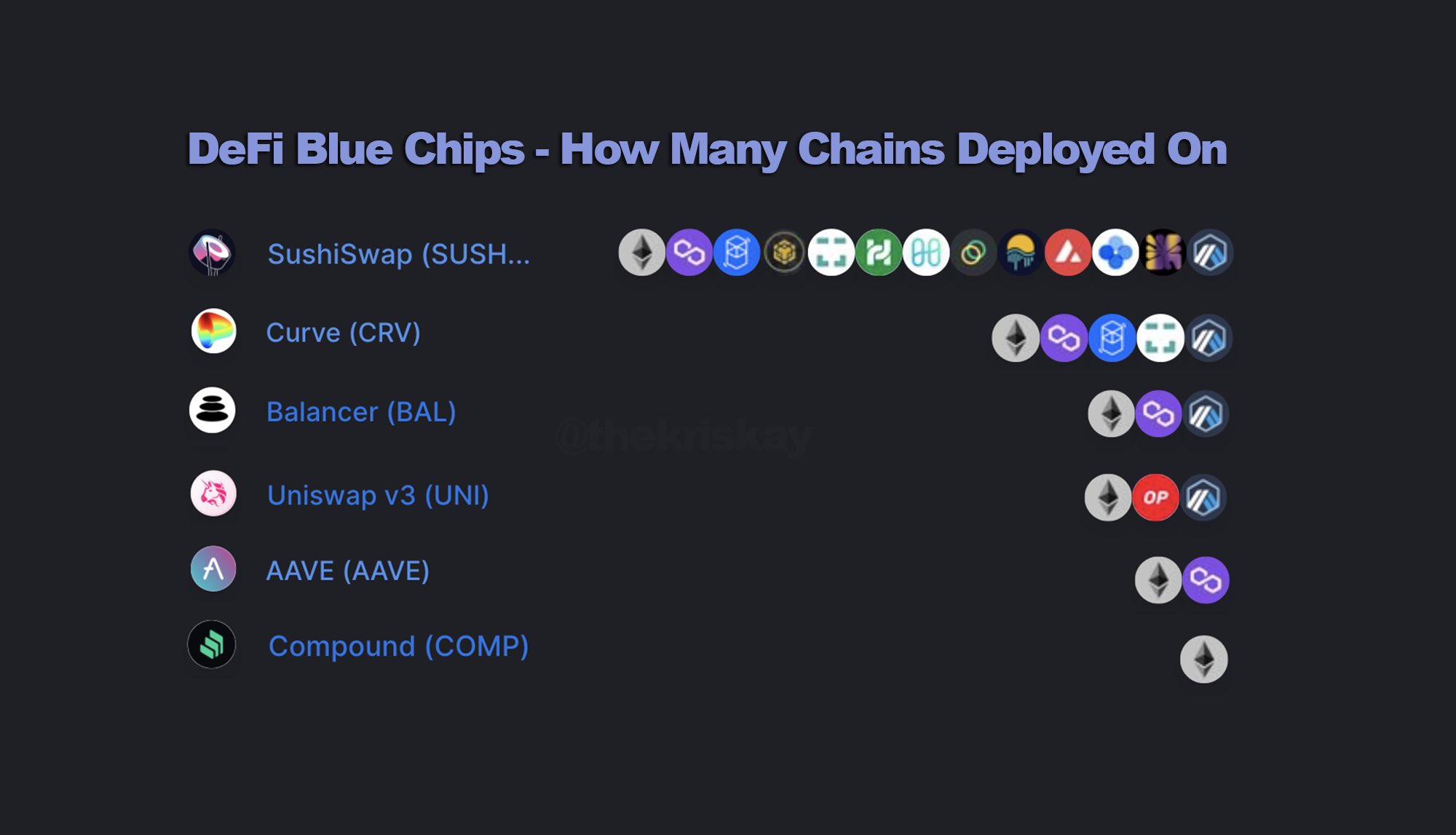

Under the leadership of 0xMaki, SushiSwap has progressively regained its picture in the eyes of the crypto neighborhood and has continually grown to develop into a main DEX / AMM platform on Ethereum and deployed on numerous other blockchains.

In 2021, SushiSwap even kinds a DeFi ecosystem, which includes:

– SushiSwap: The authentic AMM platform, which will allow decentralized transactions amongst tokens across the pool.

– Onsen: subsidiary that delivers liquidity for SushiSwap.

– BentoBox: are deposits that deliver agricultural manufacturing capability.

– Kashi: a lending platform wherever BentoBox liquidity will be reallocated for distinct functions.

– MISO: launchpad platform (token issuance).

– Trident: Next Generation AMM, the upcoming evolution of SushiSwap.

– Shoyu: NFT platform.

– Meowshi: “animal system” token.

However, back in September, when 0xMaki had just turned one 12 months in electrical power at SushiSwap, this developer “seriously baffled” the neighborhood when he announced he was stepping down and returning to the consultancy place. The cause offered by 0xMaki is mainly because the time invested creating Sushi negatively impacted his wellbeing. However, shortly thereafter this particular person moved to perform for a different DeFi undertaking, Tokemak (TOKE).

The conflict has broken out

It is due to the sudden departure of “princess” 0xMaki, as very well as the leak of an picture of an inner SushiSwap vote, for which CTO Joseph Delong asked 0xMaki to depart the improvement group and return to the long lasting place. up to 91%. This data led numerous individuals in the SushiSwap neighborhood to conclude that there was a conflict of curiosity inside the Sushi group, main to a “divisive” predicament and as a consequence 0xMaki had to depart.

Should we inquire? @ 0xMaki come back to @SushiSwap central group? pic.twitter.com/cgE4jUiL6l

– WeWantMakiBack (@makibacknow) November 23, 2021

Later, he additional photos of a deleted publish on the SushiSwap forum stating that 0xMaki had been fired, as very well as accusing improvement group members of asking for rewards to avail with no by means of neighborhood feedback. The publish more states that Mr. Delong has not contributed to the undertaking due to the fact starting to be CTO.

The comprehensive photograph. Everything right here is real. pic.twitter.com/Ot3Km0DXO7

– WeWantMakiBack (@makibacknow) November 25, 2021

The similar former SushiSwap developers have also confirmed that the undertaking is in turmoil internally. BoringCrypto, a developer who was element of the Sushi group, has been with Sushi due to the fact Chef Nomi was nevertheless there, tweeting:

With the $ SUHI presently very low rate anyway, time for a very little thread on the behind-the-scenes Sushi ripoffs. @ 0xMaki was kicked out. Most of the fantastic developers are gone. It would seem that greed has sadly taken more than the neighborhood. A wire:

– BoringCrypto (@Noioso_Crypto) December 4, 2021

“Since the rate of SUSHI is dropping anyway, it ought to be honest to reveal the contradictions behind Sushi. 0xMaki has been deposed. Most of the improvement group also left the undertaking. It is unhappy that greed has taken more than this neighborhood. “

According to BoringCrypto, SushiSwap’s talented developers which includes Keno, LevX, and Mudit Gupta have all left the undertaking. BoringCrypto also attacked Joseph Delong, claiming he was just tweeting all day and not assisting the undertaking.

CTO Joseph Delong “responds”

Due to ongoing criticism in the previous, CTO Joseph Delong has ultimately come out towards what he known as “ridiculous libel.”

My concentrate comes from Sushi (at the direct request of @ 0xMaki ) was to professionalize and downsize the organization.

The brutal actuality of that purpose is that Sushi desired to get shut to a Uniswap Labs-type model.

– Joseph Delong (@josephdelong) December 5, 2021

Mr. Delong stated that at the direct request of 0xMaki himself, his undertaking was to professionalize the style and design apparatus and switch to an working model equivalent to Uniswap. However, as SushiSwap is heavily neighborhood based mostly, this is not an quick career, requiring you to set up a legal entity to be ready to open a financial institution account and signal contracts with support suppliers. , make certain compliance with the law. Since the legal entity model inevitably prospects to a split of responsibilities, SushiSwap can’t depend on the neighborhood to make all choices in a timely method.

The CTO then refuted BoringCrypto’s allegations. He claims to have working experience programming clientele for Eth2 and this can enable him develop into SushiSwap’s Chief Technology Officer. Additionally, he also stated that his function as CTO is no longer to routine every single undertaking, but to deliver advice, strategies and roadmaps and then oversee the implementation to make certain SushiSwap is nevertheless ongoing. Joseph Delong mentioned he was “hurt” when the neighborhood trusted BoringCrypto once again, which utilised the project’s sources to create its very own merchandise and then resell it to a different undertaking.

Mr. Delong mentioned that with the workload and stress he is underneath, it is not adequate to be paid just $ 300,000 in 2021. He for that reason does not rule out the likelihood of leaving SushiSwap when the contract expires in January 2022.

So here is what I’m going to do, we’re in the middle of the Trident expedition ideal now (our fifth merchandise this 12 months) and this neighborhood is executing its finest to tinker with the really hard perform of the core group.

– Joseph Delong (@josephdelong) December 5, 2021

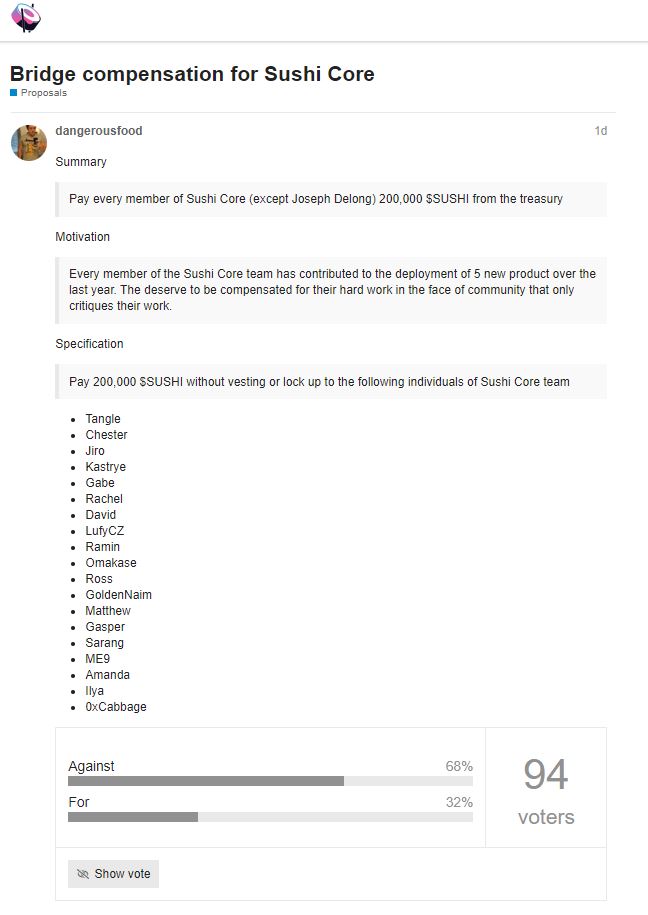

Mr. Delong then produced a proposal on the SushiSwap neighborhood, asking for a reward of 200,000 SUSHI from 19 members of the improvement group (except him) with no blocking the token. This volume at the time of creating is well worth up to $ 23.three million. However, at 2pm on seven December, the proposal acquired 94 votes, of which 68% opposed.

I produced a new proposal for Sushi Corehttps://t.co/Cpurasqc74

– Joseph Delong (@josephdelong) December 5, 2021

The SUSHI neighborhood “turns to the olive branch”

In the encounter of these developments, some men and women in the neighborhood have been actively functioning to mediate conflicts. On the morning of seven December, the representative of the Arca investment fund presented a proposal to the SushiSwap neighborhood to restructure the Sushi apparatus and raise transparency in operations.

Clearly, there have been inner complications a $ SUHI. Today @ark is releasing a Sushi-Core restructuring proposal to handle this difficulty and lack of transparency, so that SUSHI can scale and carry on to ship planet-class neighborhood-owned DeFi items.

– Jeff Dorman, CFA (@ jdorman81) December 7, 2021

Therefore, the goals of this proposal are:

– Establishment of a new legal entity for SushiSwap by means of neighborhood approval.

– Establish a new multisig management mechanism for the money of this legal entity.

– Establish a new framework for the project’s DAO mechanism, making certain that Sushi often has ample sources to create.

– Establish a monitoring mechanism amongst the Sushi neighborhood and the tasks underneath improvement underneath the identify of Sushi.

– Establish mechanisms to make certain that the neighborhood stays on top rated and defines the vision of the undertaking.

five) Our proposal accomplishes this by means of restructuring $ SUHI Core with new Product Teams for every single of the following items:

Trident

Shoyu

Miso

Kashi

Multi-chain growth pic.twitter.com/LTAbJLZEaF– Jeff Dorman, CFA (@ jdorman81) December 7, 2021

The new proposal over is underneath discussion in the Sushi neighborhood and is acquiring a substantial approval rating. However, due to the complexity and the want for intensive reform, the neighborhood requires a lot more time to analyze the pros / cons of the proposal to arrive at the most beneficial path.

SushiSwap is more and more shedding its place

The consequence of the SushiSwap conflict amongst the neighborhood and the improvement group is evident in the reality that the rate of the SUSHI token from mid-September until finally now has from time to time split four instances in worth throughout the decline on December 4th, earlier when it returned. at $ six.one at the time of creating. However, in contrast to the ATH’s peak at $ 22.five on May 18, 2021, the recent rate is nevertheless a lot reduce.

According to DeFi Llama, SushiSwap’s lock-in worth (TVL) is nevertheless on a regular upward trend, at present at $ five.89 billion. SushiSwap is the 11th biggest DeFi TVL protocol in the planet …