The “steaming” conflicts inside of SushiSwap have last but not least erupted violently in a way that couple of persons anticipated.

In a series of Twitter posts on December five, Mr. Joseph Delong, CTO of the well-liked AMM / DEX SushiSwap (SUSHI) undertaking, confirmed that he will depart the undertaking except if the growth group is provided additional employer autonomy and increase wages.

The CTO wrote:

I will ship Trident and if you never give us the autonomy to proceed operations, the capability to type leadership and maximize compensation in common, I will depart.

– Joseph Delong (@josephdelong) December 5, 2021

“I will excellent Trident and if the neighborhood no longer has the autonomy to proceed working and the capability to lead and maximize the salary of the growth group, I will depart the undertaking.

The supply of the dispute

SushiSwap is a decentralized exchange (DEX) launched in mid-2020, which copies the working model of the pioneering platform in the DEX array on Ethereum, Uniswap and even Uniswap “bloodsucking attack” rewarding consumers with tokens to entice liquidity.

In September 2020, SushiSwap founder, then Chef Nomi, carried out a “pass”, took management of the project’s money and offered SUSHI tokens for 38,000 ETH (really worth $ 14 million at the time. ). However, underneath fantastic strain from the neighborhood, Chef Nomi was forced to return the revenue and depart the undertaking, offering management of the undertaking to FTX exchange CEO Sam Bankman-Fried. Soon right after, the management of SushiSwap was entrusted to an anonymous developer named 0xMaki.

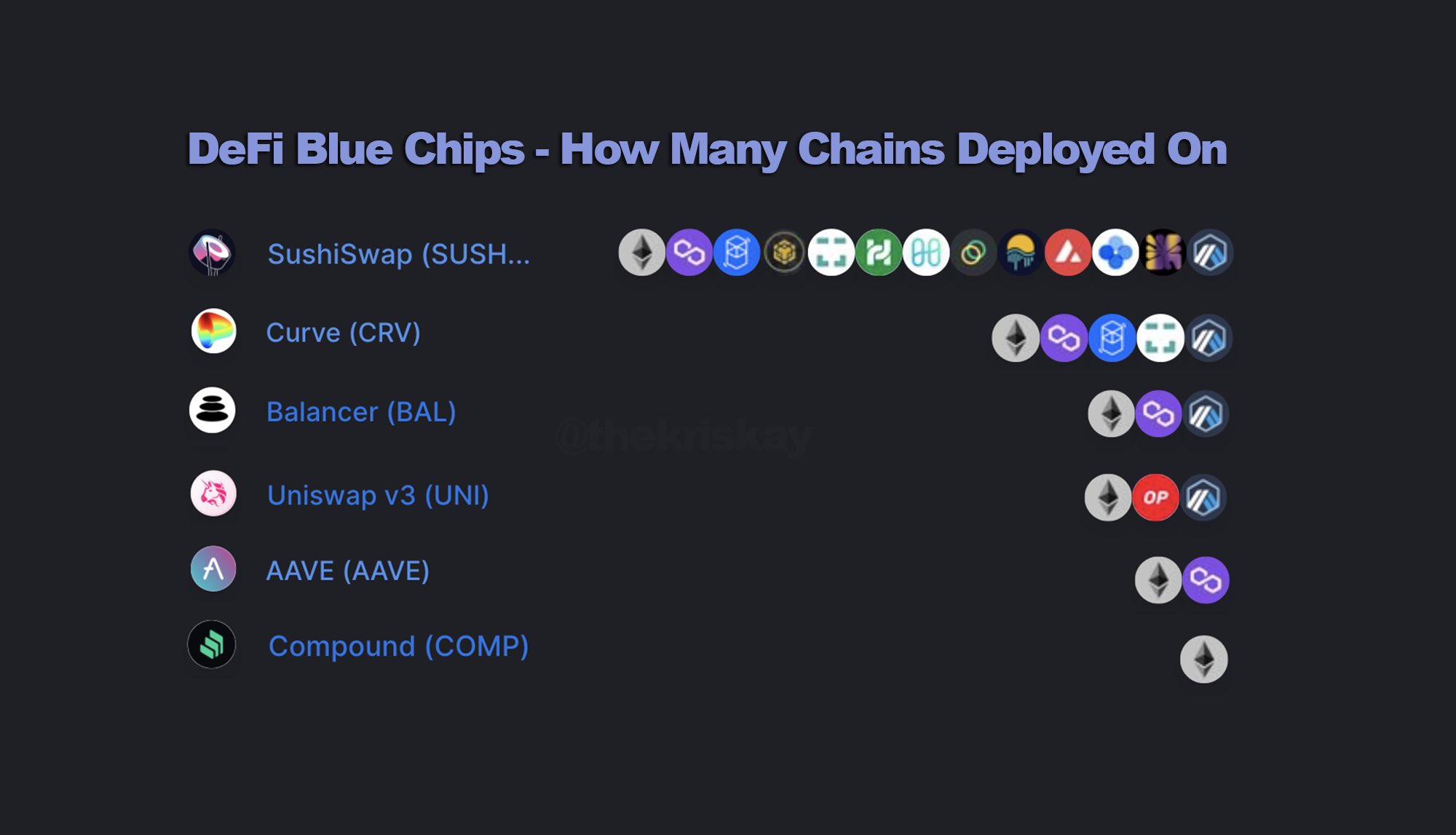

Under the leadership of 0xMaki, SushiSwap has progressively regained its picture in the eyes of the crypto neighborhood and has continually grown to develop into a primary DEX / AMM platform on Ethereum and deployed on a lot of other blockchains.

In 2021, SushiSwap even types a DeFi ecosystem, which include:

– SushiSwap: The unique AMM platform, which makes it possible for decentralized transactions involving tokens across the pool.

– Onsen: subsidiary that offers liquidity for SushiSwap.

– BentoBox: are deposits that deliver agricultural manufacturing capability.

– Kashi: a lending platform the place BentoBox liquidity will be reallocated for diverse functions.

– MISO: launchpad platform (token issuance).

– Trident: Next Generation AMM, the following evolution of SushiSwap.

– Shoyu: NFT platform.

– Meowshi: “animal system” token.

However, back in September, when 0xMaki had just turned one yr in energy at SushiSwap, this developer “seriously baffled” the neighborhood when he announced he was stepping down and returning to the consultancy place. The cause provided by 0xMaki is for the reason that the time invested making Sushi negatively impacted his wellness. However, shortly thereafter this particular person moved to operate for one more DeFi undertaking, Tokemak (TOKE).

The conflict has broken out

It is due to the sudden departure of “princess” 0xMaki, as nicely as the leak of an picture of an inner SushiSwap vote, for which CTO Joseph Delong asked 0xMaki to depart the growth group and return to the long lasting place. up to 91%. This data led a lot of persons in the SushiSwap neighborhood to conclude that there was a conflict of curiosity inside of the Sushi group, primary to a “divisive” predicament and as a outcome 0xMaki had to depart.

Should we request? @ 0xMaki come back to @SushiSwap central group? pic.twitter.com/cgE4jUiL6l

– WeWantMakiBack (@makibacknow) November 23, 2021

Later, he extra photographs of a deleted submit on the SushiSwap forum stating that 0xMaki had been fired, as nicely as accusing growth group members of asking for positive aspects to avail without the need of as a result of neighborhood feedback. The submit even further states that Mr. Delong has not contributed to the undertaking given that turning into CTO.

The finish photograph. Everything right here is accurate. pic.twitter.com/Ot3Km0DXO7

– WeWantMakiBack (@makibacknow) November 25, 2021

The similar former SushiSwap developers have also confirmed that the undertaking is in turmoil internally. BoringCrypto, a developer who was portion of the Sushi group, has been with Sushi given that Chef Nomi was even now there, tweeting:

With the $ SUHI by now lower cost anyway, time for a small thread on the behind-the-scenes Sushi ripoffs. @ 0xMaki was kicked out. Most of the fantastic developers are gone. It would seem that greed has sadly taken above the neighborhood. A wire:

– BoringCrypto (@Noioso_Crypto) December 4, 2021

“Since the cost of SUSHI is dropping anyway, it really should be honest to reveal the contradictions behind Sushi. 0xMaki has been deposed. Most of the growth group also left the undertaking. It is unhappy that greed has taken above this neighborhood. “

According to BoringCrypto, SushiSwap’s talented developers which include Keno, LevX, and Mudit Gupta have all left the undertaking. BoringCrypto also attacked Joseph Delong, claiming he was just tweeting all day and not assisting the undertaking.

CTO Joseph Delong “responds”

Due to ongoing criticism in the previous, CTO Joseph Delong has last but not least come out towards what he referred to as “ridiculous libel.”

My concentrate comes from Sushi (at the direct request of @ 0xMaki ) was to professionalize and downsize the organization.

The brutal actuality of that aim is that Sushi desired to get near to a Uniswap Labs-type model.

– Joseph Delong (@josephdelong) December 5, 2021

Mr. Delong stated that at the direct request of 0xMaki himself, his job was to professionalize the style apparatus and switch to an working model equivalent to Uniswap. However, as SushiSwap is heavily neighborhood primarily based, this is not an uncomplicated task, requiring you to set up a legal entity to be ready to open a financial institution account and indicator contracts with services suppliers. , be certain compliance with the law. Since the legal entity model inevitably prospects to a split of responsibilities, SushiSwap are not able to depend on the neighborhood to make all choices in a timely method.

The CTO then refuted BoringCrypto’s allegations. He claims to have expertise programming customers for Eth2 and this can enable him develop into SushiSwap’s Chief Technology Officer. Additionally, he also stated that his purpose as CTO is no longer to routine just about every undertaking, but to deliver advice, programs and roadmaps and then oversee the implementation to be certain SushiSwap is even now ongoing. Joseph Delong mentioned he was “hurt” when the neighborhood trusted BoringCrypto yet again, which utilised the project’s assets to create its very own merchandise and then resell it to one more undertaking.

Mr. Delong mentioned that with the workload and strain he is underneath, it is not adequate to be paid just $ 300,000 in 2021. He thus does not rule out the chance of leaving SushiSwap when the contract expires in January 2022.

So here is what I’m going to do, we’re in the middle of the Trident expedition proper now (our fifth merchandise this yr) and this neighborhood is performing its greatest to tinker with the challenging operate of the core group.

– Joseph Delong (@josephdelong) December 5, 2021

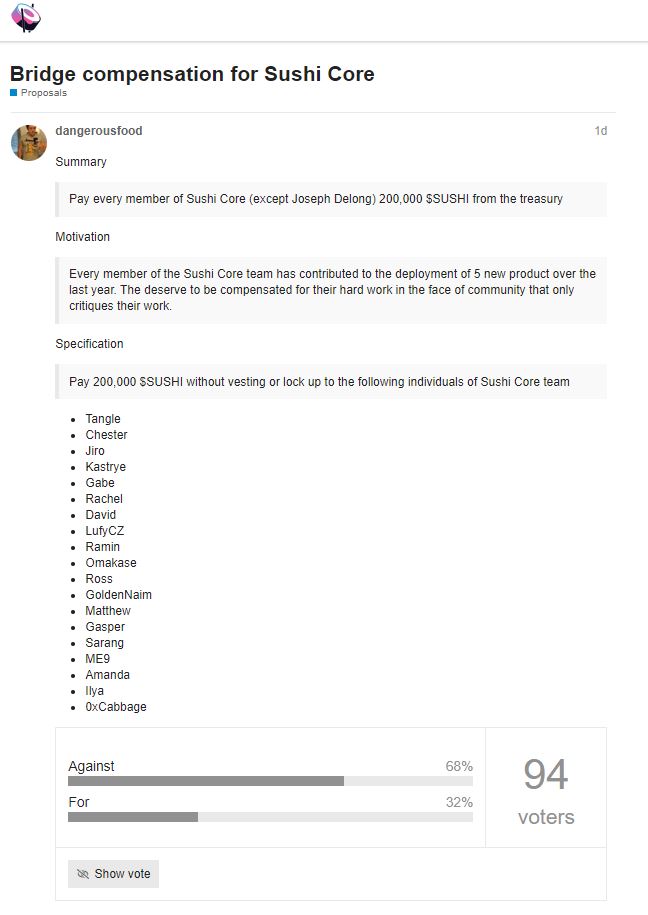

Mr. Delong then designed a proposal on the SushiSwap neighborhood, asking for a reward of 200,000 SUSHI from 19 members of the growth group (except him) without the need of blocking the token. This quantity at the time of creating is really worth up to $ 23.three million. However, at 2pm on seven December, the proposal obtained 94 votes, of which 68% opposed.

I designed a new proposal for Sushi Corehttps://t.co/Cpurasqc74

– Joseph Delong (@josephdelong) December 5, 2021

The SUSHI neighborhood “turns to the olive branch”

In the encounter of these developments, some folks in the neighborhood have been actively functioning to mediate conflicts. On the morning of seven December, the representative of the Arca investment fund presented a proposal to the SushiSwap neighborhood to restructure the Sushi apparatus and maximize transparency in operations.

Clearly, there have been inner issues a $ SUHI. Today @ark is releasing a Sushi-Core restructuring proposal to deal with this problem and lack of transparency, so that SUSHI can scale and proceed to ship planet-class neighborhood-owned DeFi items.

– Jeff Dorman, CFA (@ jdorman81) December 7, 2021

Therefore, the goals of this proposal are:

– Establishment of a new legal entity for SushiSwap as a result of neighborhood approval.

– Establish a new multisig management mechanism for the money of this legal entity.

– Establish a new framework for the project’s DAO mechanism, guaranteeing that Sushi often has ample assets to create.

– Establish a monitoring mechanism involving the Sushi neighborhood and the tasks underneath growth underneath the title of Sushi.

– Establish mechanisms to be certain that the neighborhood stays on best and defines the vision of the undertaking.

five) Our proposal accomplishes this as a result of restructuring $ SUHI Core with new Product Teams for just about every of the following items:

Trident

Shoyu

Miso

Kashi

Multi-chain growth pic.twitter.com/LTAbJLZEaF– Jeff Dorman, CFA (@ jdorman81) December 7, 2021

The new proposal over is underneath discussion in the Sushi neighborhood and is getting a substantial approval rating. However, due to the complexity and the will need for intensive reform, the neighborhood will take additional time to analyze the pros / cons of the proposal to arrive at the most beneficial path.

SushiSwap is more and more shedding its place

The consequence of the SushiSwap conflict involving the neighborhood and the growth group is evident in the truth that the cost of the SUSHI token from mid-September until finally now has from time to time split four instances in worth throughout the decline on December 4th, earlier when it returned. at $ six.one at the time of creating. However, in contrast to the ATH’s peak at $ 22.five on May 18, 2021, the existing cost is even now a great deal decrease.

According to DeFi Llama, SushiSwap’s lock-in worth (TVL) is even now on a regular upward trend, at the moment at $ five.89 billion. SushiSwap is the 11th greatest DeFi TVL protocol in the planet …