Cryptocurrency costs plummeted amid a stock marketplace slump. Concerns about the new virus variant led lots of traders to pour dollars into safer assets.

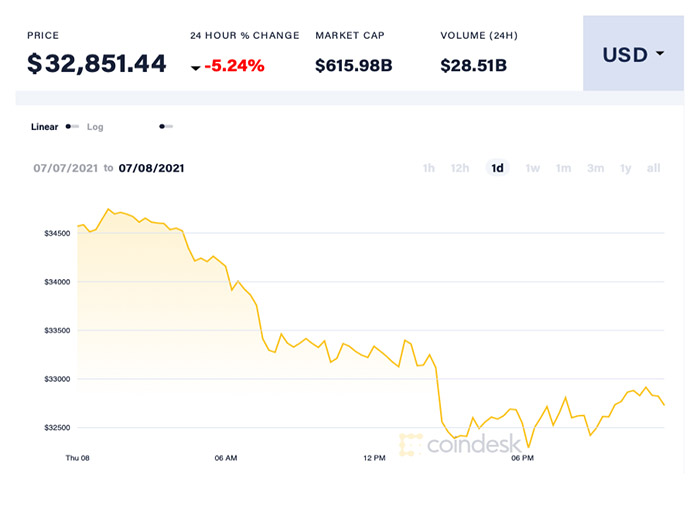

According to Coin Desk information on July eight (Vietnam time), the selling price of Bitcoin at 1 stage fell to $ 32,000, down six% from the prior day. As of the finish of the day, the world’s greatest cryptocurrency was trading at $32,851, down five.24%.

The marketplace capitalization of Bitcoin reaches additional than 615 billion USD. The boost given that the starting of the 12 months also narrowed to only twelve.76%.

In addition to Bitcoin, other cryptocurrencies also plummeted. Ether – the 2nd greatest cryptocurrency – noticed a selling price drop of eight.29% to $two,159. XRP and Cardano costs also fell five.28% and four.two%, respectively. Dogecoin – the coin that has recorded a phenomenal selling price boost this 12 months – plunged seven.six% to $.21.

According to CoinMarketCap information, the complete capitalization of the crypto marketplace is down six.13% from 24 hrs earlier to $one.380 billion.

Simultaneously plunge

Edward Moya, an professional at consulting company Oanda (based mostly in the US), thinks that the selling price of cryptocurrencies has fallen amid the stock marketplace slump.

In the trading session on July eight, the principal US stock indexes concurrently plunged. The Dow Jones, S&P 500 and NASDAQ fell .73%, .75% and .64%, respectively. Concerns about the new virus variant led lots of traders to flip to safer asset courses.

On July eight, Japan declared a state of emergency for the city of Tokyo to stop the spread of the Covid-19 epidemic, powerful for the duration of the Olympic Games and lasting until finally August 22.

The Bitcoin selling price has been caught in the $thirty,000-forty,000 assortment for the previous numerous weeks, following falling from a peak of just about $65,000 (set on April 14). “Bitcoin will need progress in moving mining out of China, as well as addressing environmental concerns, to break through the $30,000-40,000 price range,” Moya stated.

According to him, the greater handle by the Chinese government will weigh on investor sentiment. “China has declared war on cryptocurrencies. It’s like aspect of the cold war and we’re nonetheless staying impacted steadily,” Mike Novogratz, CEO of Galaxy Digital informed CNBC on July eight.

On July six, the People’s Bank of China (PBOC) and the money regulator in Beijing ordered a application maker to shut down due to suspicious cryptocurrency transactions. Accordingly, the Chinese application enterprise was forced to halt functioning due to the alleged provision of application solutions for cryptocurrency trading.

In a statement, the Chinese regulator emphasized that the move is needed “to prevent and control speculative risks in cryptocurrency transactions, and at the same time protect people’s assets.”

The marketplace is gloomy

Regulatory hazards stay a important obstacle to Bitcoin’s upside momentum. In a letter to US Securities and Exchange Commission (SEC) Chairman Gary Gensler, US Democratic Senator Elizabeth Warren warned of the rising hazards that the crypto marketplace is “ambiguous.” and volatile” to people and money markets.

She previously criticized cryptocurrencies as “not a good way to buy, sell, invest and an environmental disaster.”

However, gurus say that the tightening of regulation by regulators on the cryptocurrency marketplace can have a good affect in the extended run.

For instance, lots of miners fled China following Beijing cracked down on Bitcoin mining and trading.

According to Moya at consulting company Oanda, the departure of Bitcoin miners from China will assistance the system of decentralization of mining operations, even though marketing the development of environmentally pleasant mining services. marketplace, therefore supporting the Bitcoin selling price in the extended phrase.

“I still believe the Bitcoin price will rise in the long term, but it may take time,” stated Moya. “Bitcoin price could reach $50,000/dong by the end of this year. However, the world’s largest cryptocurrency will hardly return to the threshold of 65,000 USD/dong until the second half of 2022,” the professional forecast.

Despite the warning about China’s declaration of war on cryptocurrencies, Mr. Mike Novogratz – head of Galaxy Digital – is nonetheless a major supporter of Bitcoin.

“China is looking for ways to crack down on Bitcoin. They ban mining, ban leverage, and ban Bitcoin in some places. And Bitcoin still exists. The coin has survived,” stated Novogratz.

Maybe you are interested:

Join our channel to update the most handy information and expertise at:

According to Zingnews

Compiled by ToiYeuBitcoin

.