The amount of Ethereum addresses with values below .01 and .one ETH has improved given that the latest cost correction.

Ethereum (ETH) fell far more than 18% immediately after setting an all-time large at $ four,867 on November ten. However, the collapse did not prevent ETH retail traders in little quantities from including worth. . At press time, ETH is trading close to $ three,814.49.

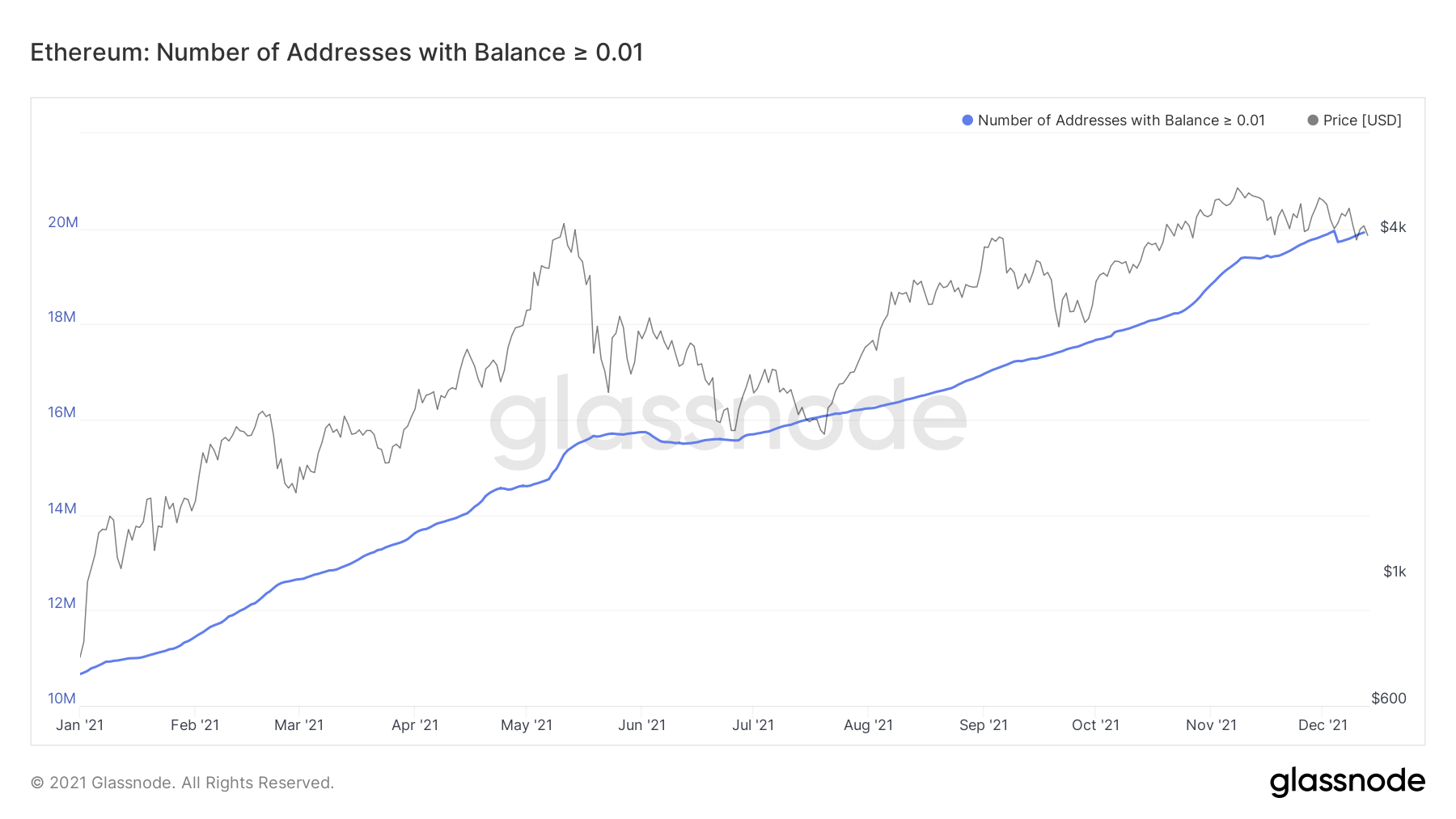

Based on information from Glassnode, a well known blockchain analytics platform, the amount of Ether addresses with .01 ETH or significantly less hit a record 19.95 million on December four, the day ETH dropped to $ three,575. .

Meanwhile, the amount of Ethereum wallets with a stability of at least .one ETH also continued to rise regardless of Ether’s correction from $ four,867 to $ three,575, lastly reaching a new ATH of six.37 million in December. As a outcome, the complete amount of non-zero ETH portfolios also hit a new large of almost 70 million.

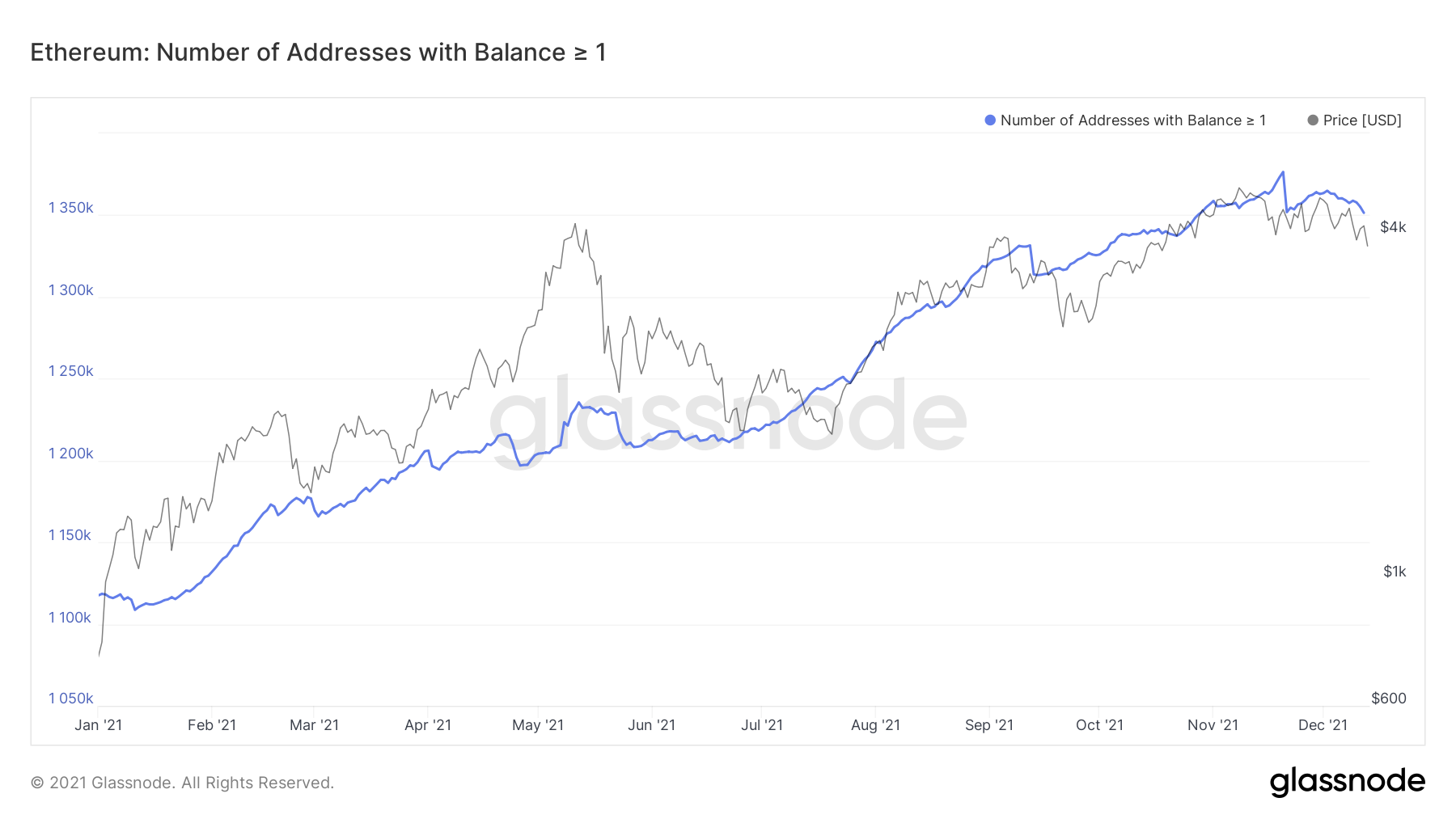

Conversely, addresses holding significantly less than or equal to one ETH have declined along with ETH cost developments in the industry, suggesting that most reasonable traders have minor curiosity in the latest “buying bottom”. .

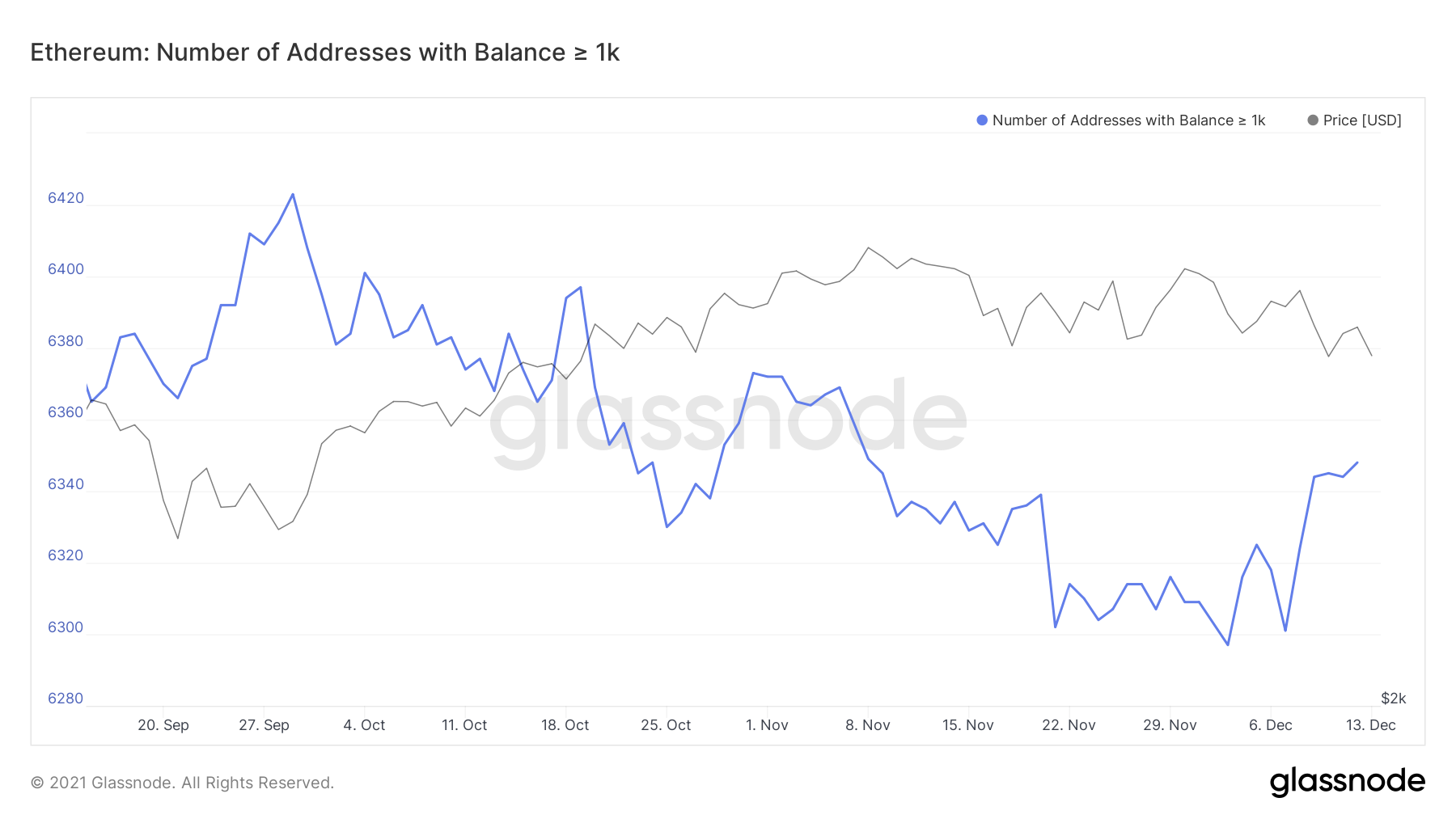

Furthermore, ETH whales seem to be in a relatively contradictory course. The slight choose-up in ETH construct-up of portfolios with balances of at least one,000 ETH was evident for the duration of the most up-to-date downturn. Overall, having said that, their amount of portfolios dropped from almost seven,200 to significantly less than six,350 in 2021 alone.

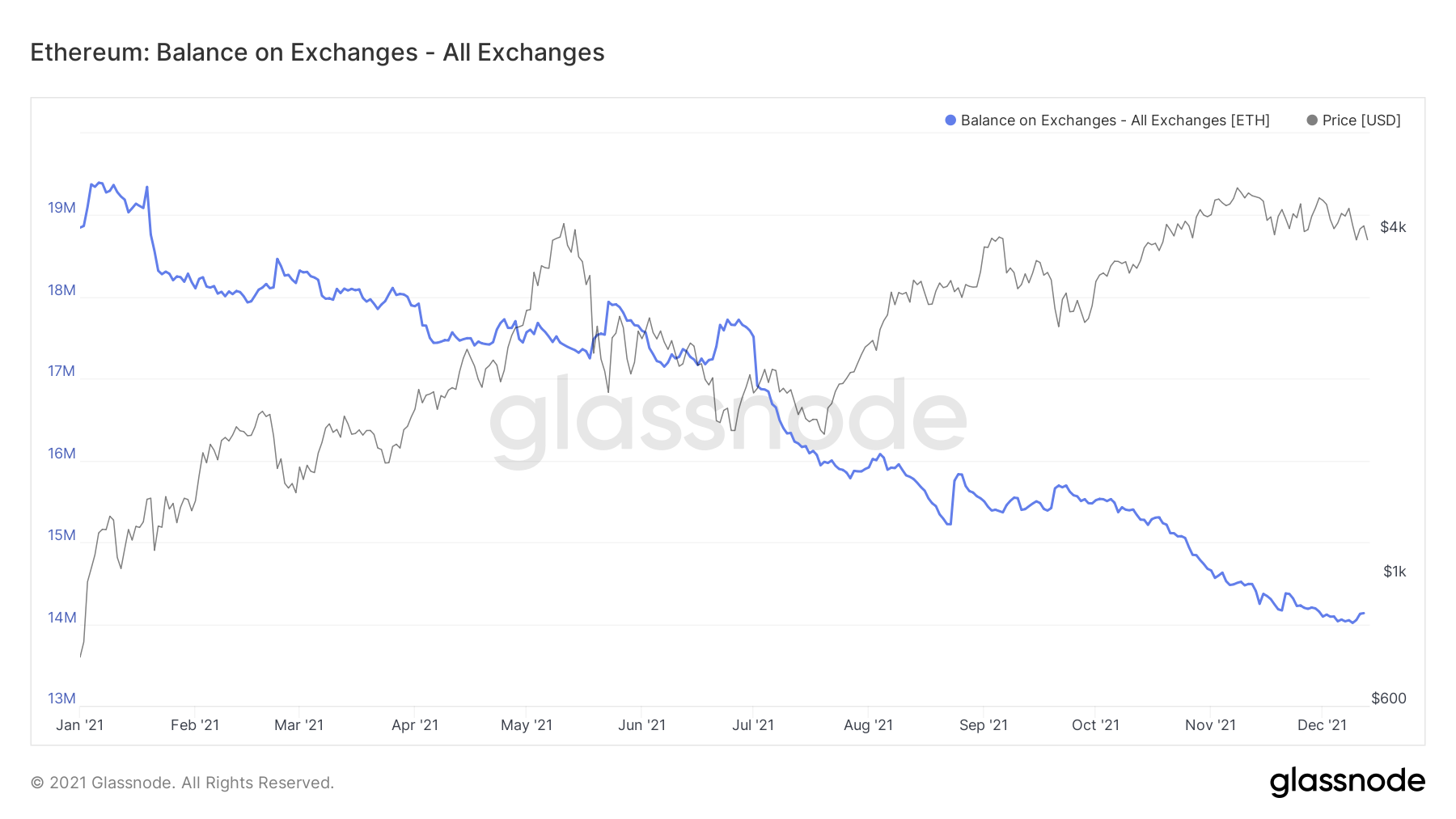

Many bullish signals come from Ethereum’s dwindling reserves across all cryptocurrency exchanges. The amount of coins held by exchanges has gone from almost 14 million ETH to 14.13 million ETH given that December 9, coinciding with a almost ten.five% drop in ETH more than the exact same time frame, but the trend to extended-phrase is nonetheless skewed to the downside.

The reduce amount of ETH on exchanges confirms that traders are actively obtaining ETH to serve a broad assortment of solutions in the DeFi variety to maximize earnings alternatively of building normal purchases on the spot industry.

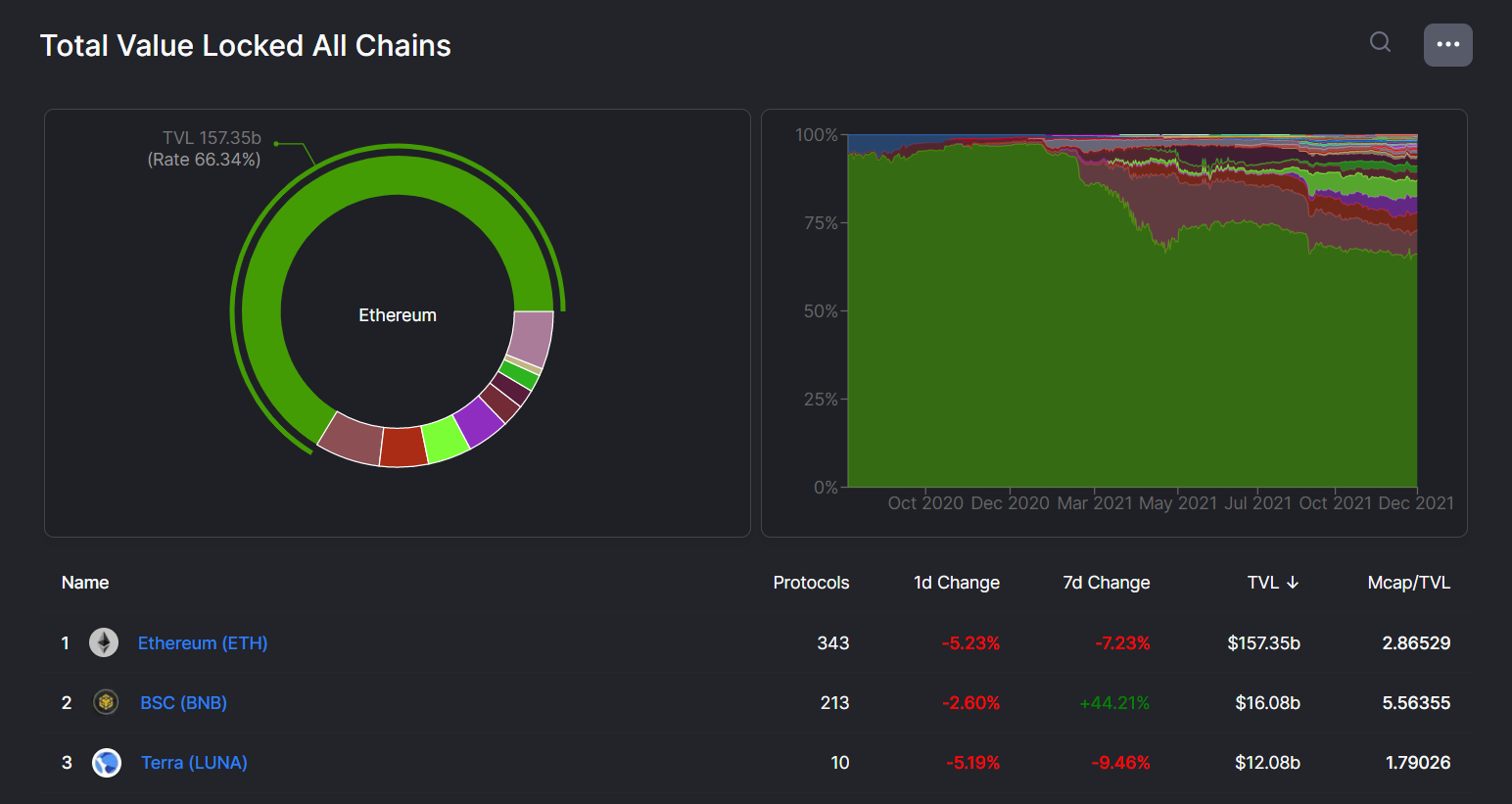

Although gasoline tariffs are nonetheless the largest obstacle for ETH, there is no denying Ether’s close to-absolute coverage in the DeFi room. If the complete blocked worth (TVL) of the complete sector is $ 237 billion, then ETH has $ 157.35 billion, or 66.34%. Therefore, customers have nearly no selection but to get ETH for gasoline taxes other than the very simple investment move.

– See far more: Ethereum (ETH) – The place of “blockchain hegemony” is reflected in the degree of reception of substantial firms

However, Ethereum also recognizes the over issue and is striving to fix it to supply optimum comfort to traders. The improve of the EIP-1559 with a Layer two option that minimizes gasoline charges “100 times” is the ideal evidence of this. To date, Ethereum has reached one million ETH burned thanks to EIP-1559.

There was also a time when burnt Ethereum was surpassing the produced amount, assisting ETH scarcity peak. Many of the world’s main monetary institutions are also pretty supportive of the platform’s extended-phrase probable as a result of good predictions with large hopes for the heart of the Ethereum two. Beacon Chain.

Synthetic Currency 68

Maybe you are interested: